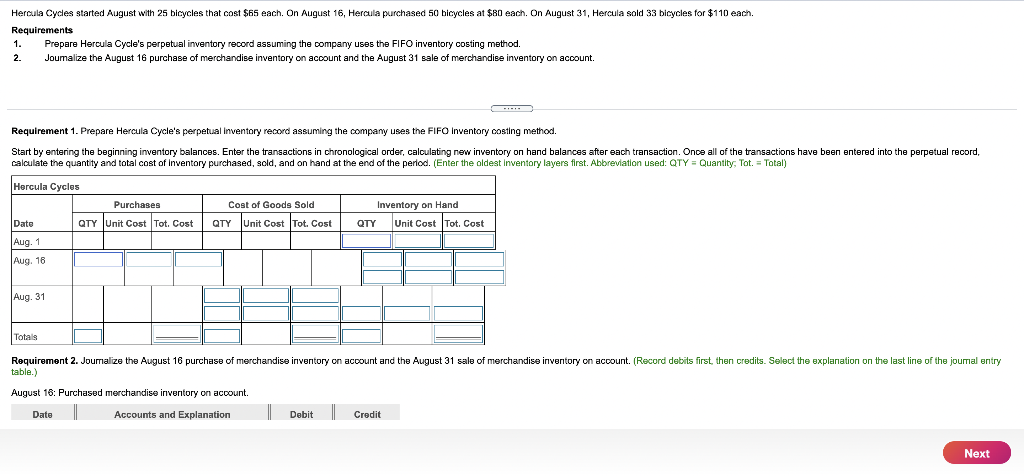

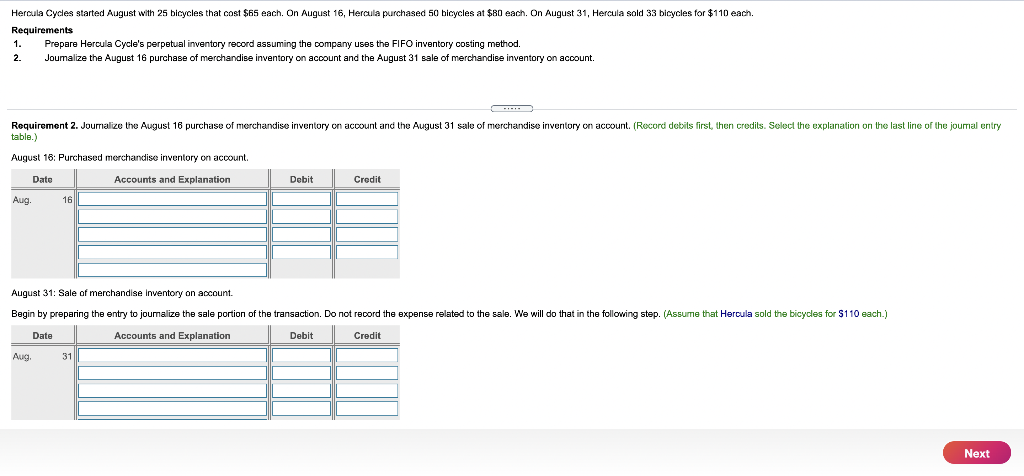

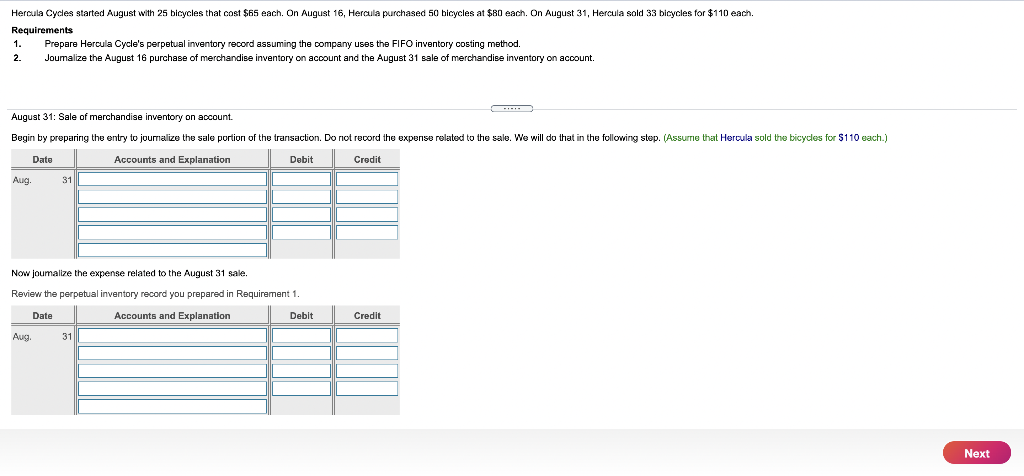

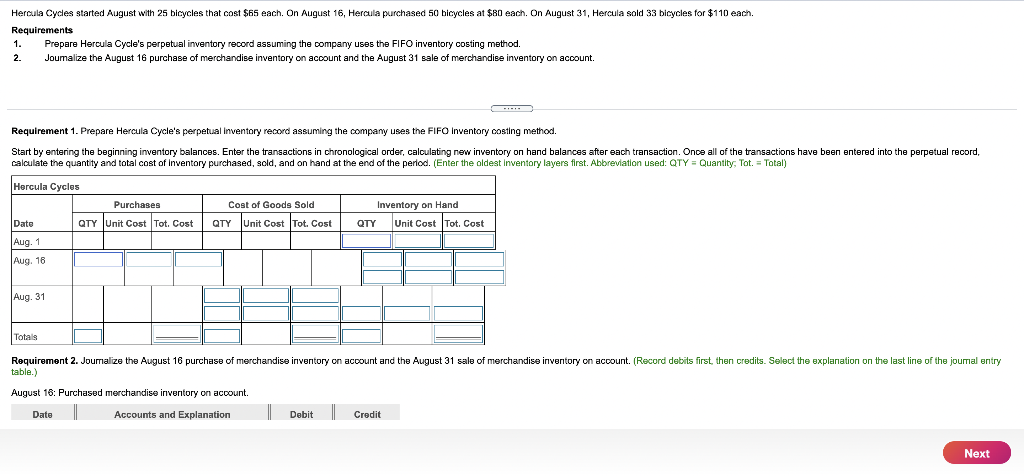

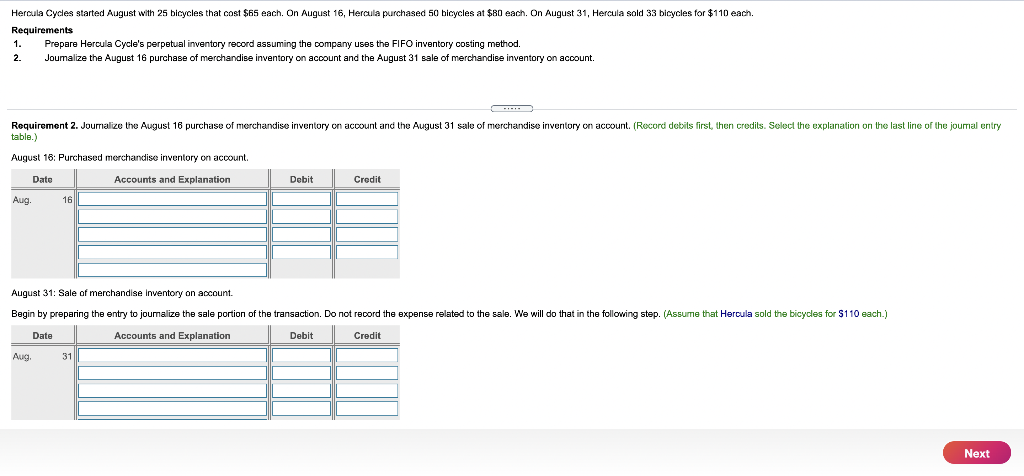

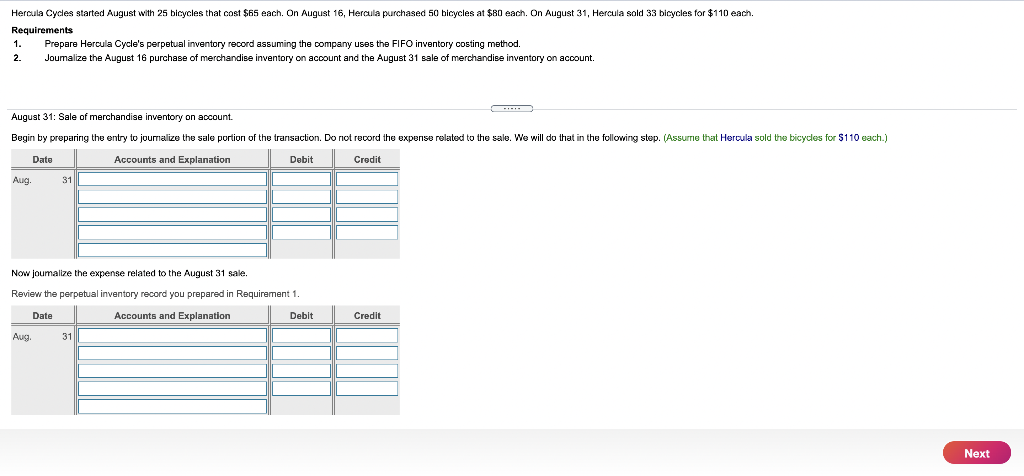

Hercula Cycles started August with 25 bicycles that cost $65 each. On August 16, Hercula purchased 50 bicycles at $80 each. On August 31, Hercula sold 33 bicycles for $110 each. Requirements 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the FIFO inventory costing method. 2 Joumalize the August 16 purchase of merchandise inventory on account and the August 31 sale of merchandise inventory on account. Requirement 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the FIFO Inventory costing method. Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of Inventory purchased, sold, and on hand at the end of the period. (Enter the oldest Inventory layers first. Abbreviation used: QTY = Quantity: Tot. = Total) Hercula Cycles Purchases Cost of Goods Sold Inventory on Hand QTY Unit Cost Tot. Cost Date QTY Unit Cost Tot. Cost QTY JUnit Cost Tot. Cost Aug. 1 Aug. 16 Aug. 31 Totals Requirement 2. Joumalize the August 16 purchase of merchandise inventory on account and the August 31 sale of merchandise inventory on account. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) August 18: Purchased merchandise inventory on account. Date Accounts and Explanation Debit | Credit Next Hercula Cycles started August with 25 bicycles that cost $65 each. On August 16, Hercula purchased 50 bicycles at $80 each. On August 31, Hercula sold 33 bicycles for $110 each. Requirements 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the FIFO inventory costing method. 2. Joumalize the August 16 purchase of merchandise inventory on account and the August 31 sale of merchandise inventory on account. Requirement 2. Jourrialize the August 16 purchase of merchandise inventory on account and the August 31 sale of merchandise inventory on account. (Record debils first, then credits. Select the explanation on the last line of the journal entry table.) August 18: Purchased merchandise inventory on account. Date Accounts and Explanation Debit Credit Aug. 16 August 31: Sale of merchandise Inventory on account. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. (Assume that Hercula sold the bicycles for $110 each.) Accounts and Explanation Debit Credit Date Aug 31 Next Hercula Cycles started August with 25 bicycles that cost $65 each. On August 16, Hercula purchased 50 bicycles at $80 each. On August 31, Hercula sold 33 bicycles for $110 each. Requirements 1. Prepare Hercula Cycle's perpetual inventory record assuming the company uses the FIFO inventory costing method. 2. Joumalize the August 16 purchase of merchandise inventory on account and the August 31 sale of merchandise inventory on account. August 31: Sale of merchandise inventory on account. Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related to the sale. We will do that in the following step. (Assure that Hercula sold the bicycles for $110 each.) Date Accounts and Explanation Debit Credit Aug 31 Now joumalize the expense related to the August 31 sale, Review the perpetual inventory record you prepared in Requirement 1. Date Accounts and Explanation Debit Credit Aug. 31 Next