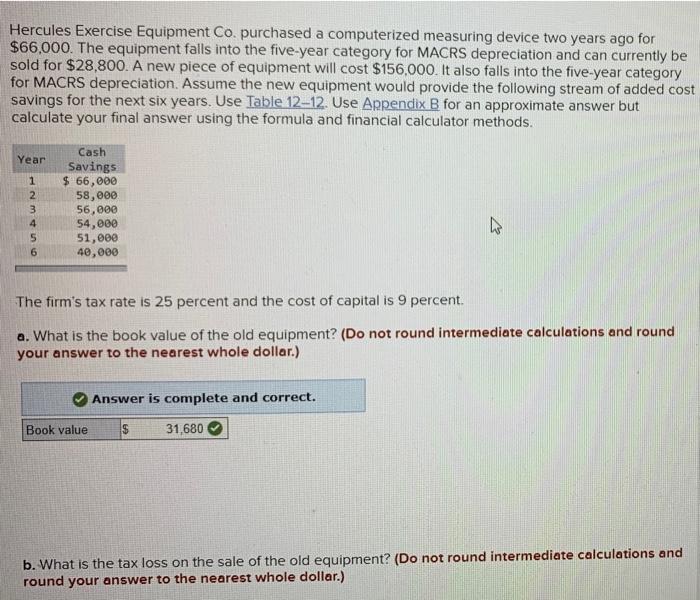

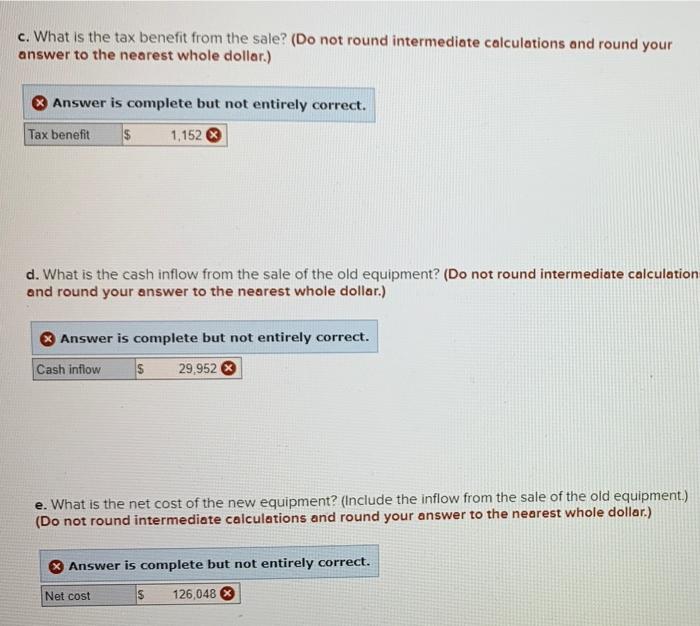

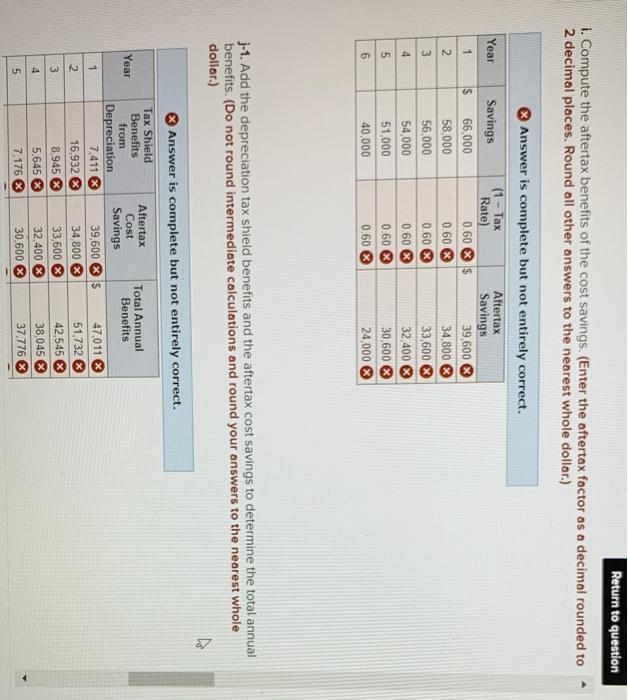

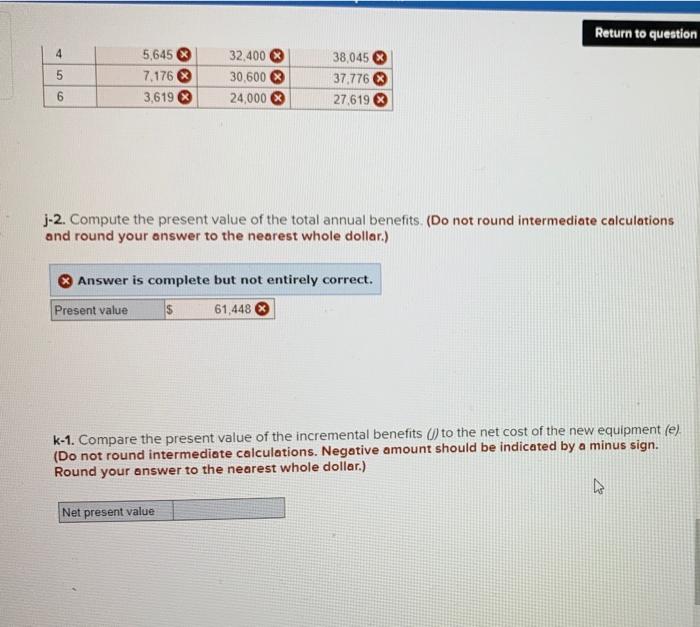

Hercules Exercise Equipment Co. purchased a computerized measuring device two years ago for $66,000. The equipment falls into the five-year category for MACRS depreciation and can currently be sold for $28,800. A new piece of equipment will cost $156,000. It also falls into the five-year category for MACRS depreciation. Assume the new equipment would provide the following stream of added cost savings for the next six years. Use Table 12-12. Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Year 1 2 3 4 5 6 Cash Savings $ 66,000 58,000 56,000 54,000 51,000 40,000 The firm's tax rate is 25 percent and the cost of capital is 9 percent. a. What is the book value of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Answer is complete and correct. Book value $ 31,680 b. What is the tax loss on the sale of the old equipment? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) c. What is the tax benefit from the sale? (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Answer is complete but not entirely correct. Tax benefit $ 1,152 & d. What is the cash inflow from the sale of the old equipment? (Do not round intermediate calculation and round your answer to the nearest whole dollar.) Answer is complete but not entirely correct. Cash inflow $ 29,952 e. What is the net cost of the new equipment? (Include the inflow from the sale of the old equipment.) (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Answer is complete but not entirely correct. Net cost S 126,048 Return to question 1. Compute the aftertax benefits of the cost savings. (Enter the aftertax factor as a decimal rounded to 2 decimal places. Round all other answers to the nearest whole dollar.) Year 1 2 Answer is complete but not entirely correct. Aftertax (1 - Tax Savings Rate) Savings $ 66,000 0.60 $ 39,600 58,000 0.60 34,800 56.000 0.60 $ 33,600 54,000 0.60 X 32,400 51,000 0.60 $ 30,600 % 40,000 0.60 24,000 $ 3 4 on on 1-1. Add the depreciation tax shield benefits and the aftertax cost savings to determine the total annual benefits. (Do not round intermediate calculations and round your answers to the nearest whole dollar.) Year 1 3 Answer is complete but not entirely correct. Tax Shield Benefits Aftertax Total Annual Cost from Benefits Savings Depreciation 7.411 39,600 S 47.011 % 16,932 % 34,800 51.732 8,945 33,600 42,545 5,645 32.400 38,045 7,176 % 30,600 37.776 2 x 5 Return to question 4 5 5,645 7.176 3,619 32,400 30.600 24,000 38,045 37.776 27,619 j-2. Compute the present value of the total annual benefits (Do not round intermediate calculations and round your answer to the nearest whole dollar.) Answer is complete but not entirely correct. Present value $ 61,448 k-1. Compare the present value of the incremental benefits (1) to the net cost of the new equipment (e). (Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round your answer to the nearest whole dollar.) Net present value