Answered step by step

Verified Expert Solution

Question

1 Approved Answer

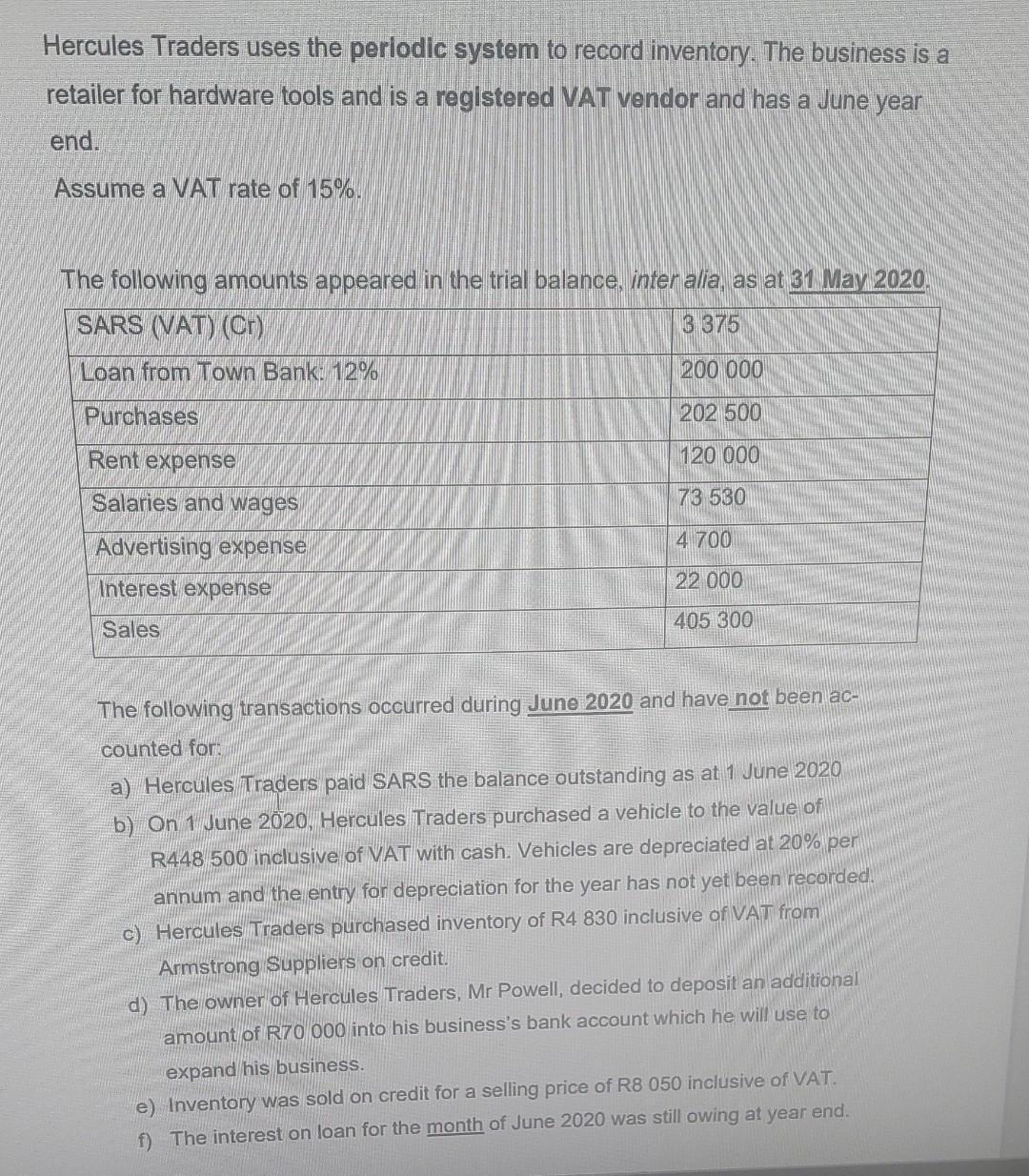

Hercules Traders uses the periodic system to record inventory. The business is a retailer for hardware tools and is a registered VAT vendor and

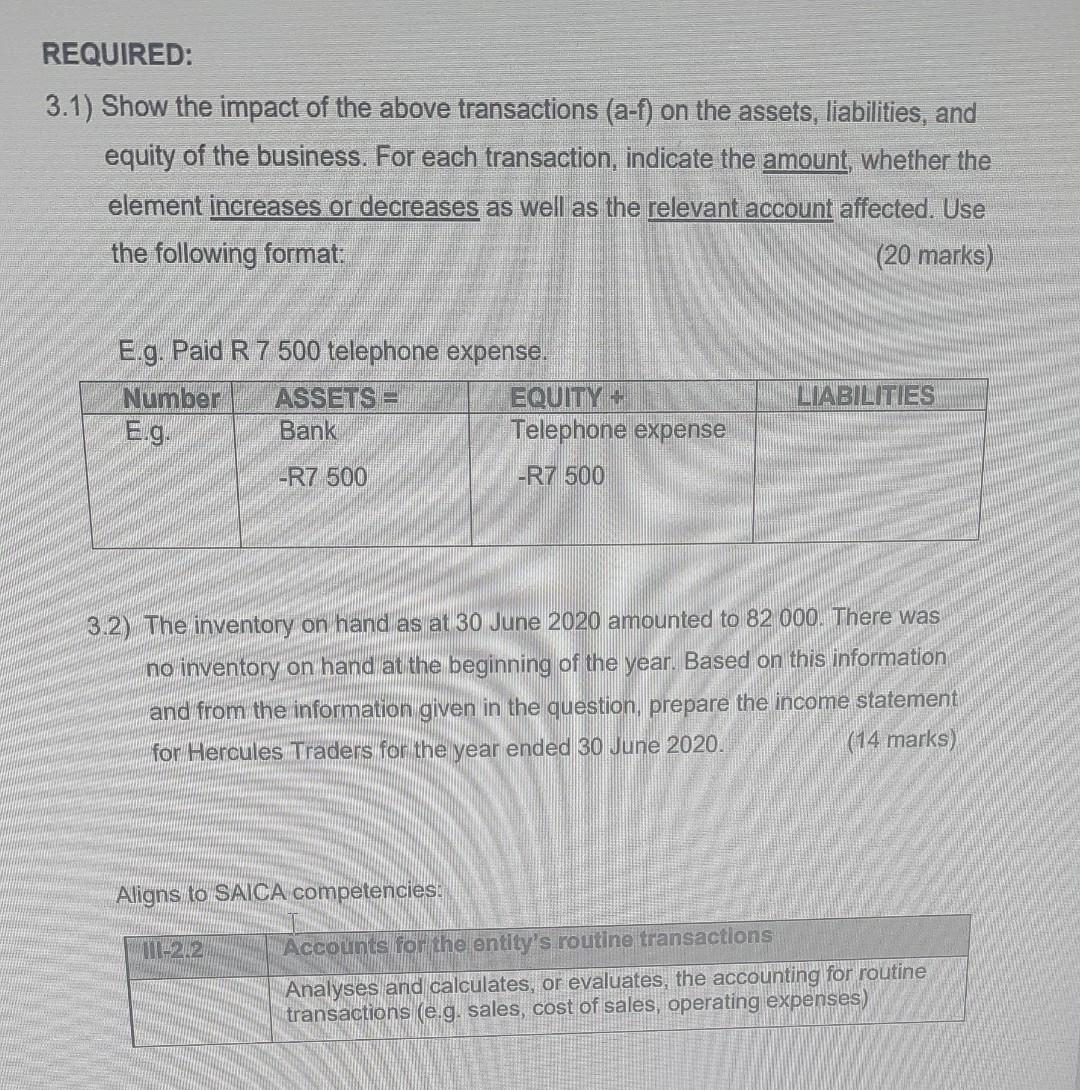

Hercules Traders uses the periodic system to record inventory. The business is a retailer for hardware tools and is a registered VAT vendor and has a June year end. Assume a VAT rate of 15%. The following amounts appeared in the trial balance, inter alia, as at 31 May 2020. SARS (VAT) (Cr) 3 375 Loan from Town Bank: 12% 200 000 Purchases 202 500 Rent expense 120 000 Salaries and wages 73 530 Advertising expense 4 700 Interest expense 22 000 Sales 405 300 The following transactions occurred during June 2020 and have not been ac- counted for: a) Hercules Traders paid SARS the balance outstanding as at 1 June 2020 b) On 1 June 2020, Hercules Traders purchased a vehicle to the value of R448 500 inclusive of VAT with cash. Vehicles are depreciated at 20% per annum and the entry for depreciation for the year has not yet been recorded. c) Hercules Traders purchased inventory of R4 830 inclusive of VAT from Armstrong Suppliers on credit. d) The owner of Hercules Traders, Mr Powell, decided to deposit an additional amount of R70 000 into his business's bank account which he will use to expand his business. e) Inventory was sold on credit for a selling price of R8 050 inclusive of VAT. f) The interest on loan for the month of June 2020 was still owing at year end. REQUIRED: 3.1) Show the impact of the above transactions (a-f) on the assets, liabilities, and equity of the business. For each transaction, indicate the amount, whether the element increases or decreases as well as the relevant account affected. Use the following format. (20 marks) E.g. Paid R 7 500 telephone expense. EQUITY Telephone expense LIABILITIES Number E g. ASSETS = Bank -R7 500 -R7 500 3.2) The inventory on hand as at 30 June 2020 amounted to 82 000. There was no inventory on hand at the beginning of the year. Based on this information and from the information given in the question, prepare the income statement (14 marks) for Hercules Traders for the year ended 30 June 2020. Aligns to SAICA competencies: 1-2.2 Accounts for the entity's routine transactions Analyses and calculates, or evaluates, the accounting for routine transactions (e.g. sales, cost of sales, operating expenses)

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Number ASSETS EQUITY LIABILITIES a Cash R3375 VAT R3375 b Vehicles R390000 VAT R58500 Cash R448500 b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started