Answered step by step

Verified Expert Solution

Question

1 Approved Answer

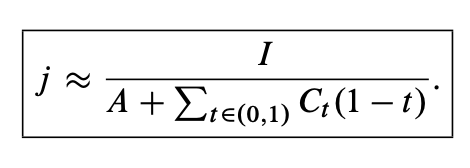

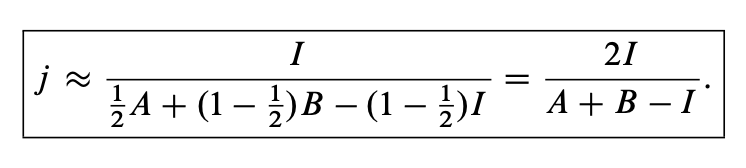

Here are 2.6.5 and 2.6.8: I just need the work to question (b). The answer is 39.87454% by formula 2.6.5 and 34.46967% by formula 2.6.8.

Here are 2.6.5 and 2.6.8:

Here are 2.6.5 and 2.6.8:

I just need the work to question (b). The answer is 39.87454% by formula 2.6.5 and 34.46967% by formula 2.6.8. Your help is greatly appreciated!!!

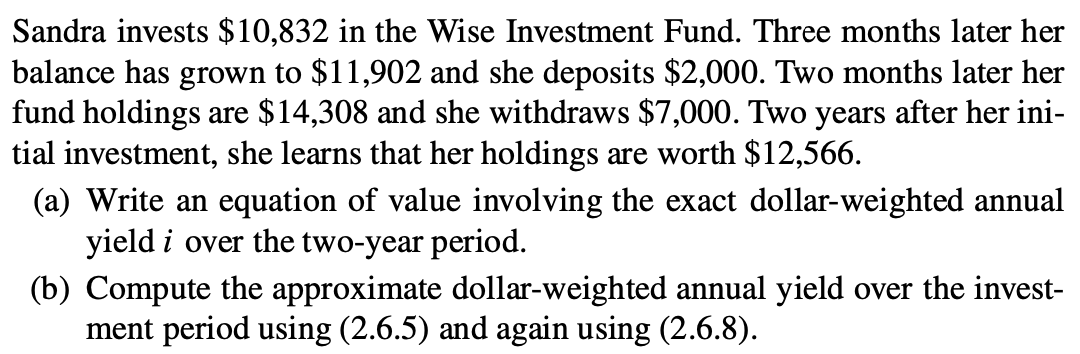

Sandra invests $10,832 in the Wise Investment Fund. Three months later her balance has grown to $11,902 and she deposits $2,000. Two months later her fund holdings are $14,308 and she withdraws $7,000. Two years after her initial investment, she learns that her holdings are worth $12,566. (a) Write an equation of value involving the exact dollar-weighted annual yield i over the two-year period. (b) Compute the approximate dollar-weighted annual yield over the investment period using (2.6.5) and again using (2.6.8). jA+t(0,1)Ct(1t)I j21A+(121)B(121)II=A+BI2I Sandra invests $10,832 in the Wise Investment Fund. Three months later her balance has grown to $11,902 and she deposits $2,000. Two months later her fund holdings are $14,308 and she withdraws $7,000. Two years after her initial investment, she learns that her holdings are worth $12,566. (a) Write an equation of value involving the exact dollar-weighted annual yield i over the two-year period. (b) Compute the approximate dollar-weighted annual yield over the investment period using (2.6.5) and again using (2.6.8). jA+t(0,1)Ct(1t)I j21A+(121)B(121)II=A+BI2IStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started