Answered step by step

Verified Expert Solution

Question

1 Approved Answer

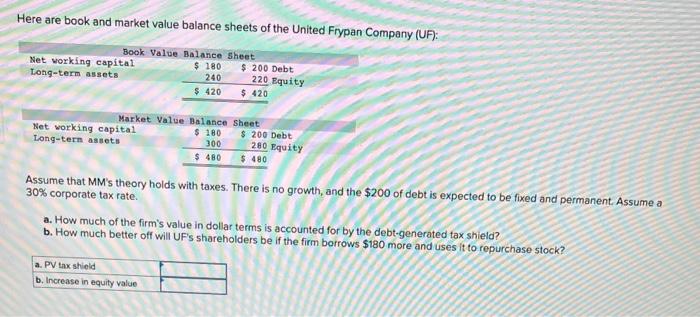

Here are book and market value balance sheets of the United Frypan Company (UF): Book Value Balance Sheet Net working capital Long-term assets. $

Here are book and market value balance sheets of the United Frypan Company (UF): Book Value Balance Sheet Net working capital Long-term assets. $ 180 240 $ 200 Debt 220 Equity $ 420 $420 Market Value Balance Sheet Net working capital Long-term assets $ 180 300 $ 200 Debt 280 Equity $ 480 $ 480 Assume that MM's theory holds with taxes. There is no growth, and the $200 of debt is expected to be fixed and permanent. Assume a 30% corporate tax rate. a. How much of the firm's value in dollar terms is accounted for by the debt-generated tax shield? b. How much better off will UF's shareholders be if the firm borrows $180 more and uses it to repurchase stock? a. PV tax shield b. Increase in equity value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started