Answered step by step

Verified Expert Solution

Question

1 Approved Answer

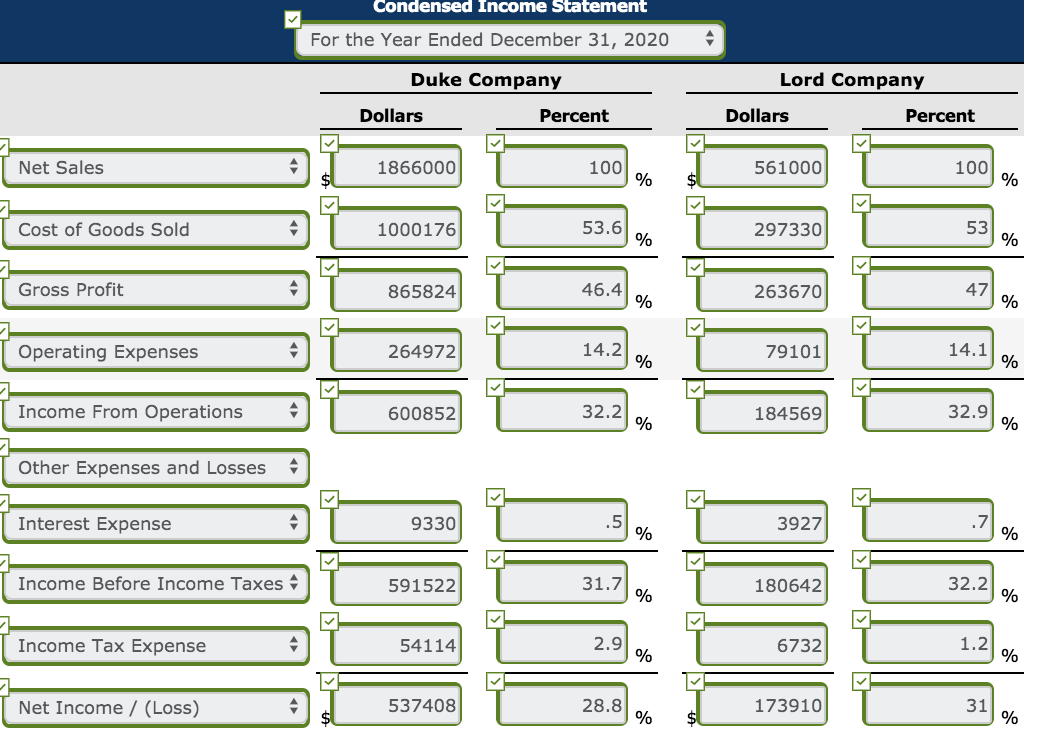

Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December

Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019.

| Duke Company | Lord Company | |||||||

| 2020 | 2019 | 2020 | 2019 | |||||

| Net sales | $1,866,000 | $561,000 | ||||||

| Cost of goods sold | 1,000,176 | 297,330 | ||||||

| Operating expenses | 264,972 | 79,101 | ||||||

| Interest expense | 9,330 | 3,927 | ||||||

| Income tax expense | 54,114 | 6,732 | ||||||

| Current assets | 325,000 | $314,200 | 82,600 | $79,200 | ||||

| Plant assets (net) | 520,200 | 501,800 | 140,400 | 124,200 | ||||

| Current liabilities | 64,800 | 74,400 | 37,000 | 30,200 | ||||

| Long-term liabilities | 107,000 | 90,400 | 28,000 | 25,400 | ||||

| Common stock, $10 par | 503,000 | 503,000 | 116,000 | 116,000 | ||||

| Retained earnings | 170,400 | 148,200 | 42,000 | 31,800 | ||||

Compute the 2020 return on assets and the return on common stockholders equity ratios for both companies. (Round answers to 1 decimal place, e.g. 12.1%.)

| Duke Company | Lord Company | |||||

| Return on assets | % | % | ||||

| Return on common stockholders equity | % | % | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started