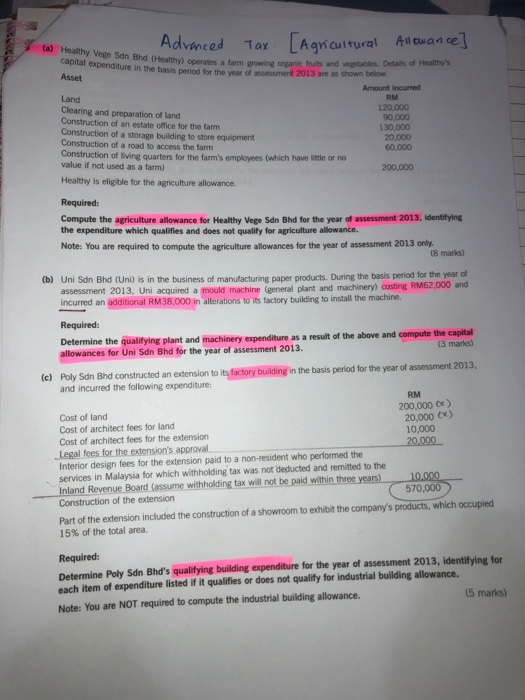

3 (a) Healthy Vege Sdn Bhd (Healthy) operates a farm growing organic fruits and vegetables. Details of Healthy's capital expenditure in the basis period for the year of assessment 2013 are as shown below: Asset Amount incurred RM Land 120,000 Clearing and preparation of land 90.000 Construction of an estate office for the farm 130.000 Construction of a storage building to store equipment 20.000 Construction of a road to access the farm 60,000 Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) 200,000 Healthy is eligible for the agriculture allowance. Required: Compute the agriculture allowance for Healthy Vege Sdn Bhd for the year of assessment 2013, identifying the expenditure which qualifies and does not qualify for agriculture allowance. Note: You are required to compute the agriculture allowances for the year of assessment 2013 only. (8 marks) (b) Uni Sdn Bhd (Uni) is in the business of manufacturing paper products. During the basis period for the year of assessment 2013, Uni acquired a mould machine (general plant and machinery) costing RM62,000 and incurred an additional RM38.000 in alterations to its factory building to install the machine. Required: Determine the qualifying plant and machinery expenditure as a result of the above and compute the capital allowances for Uni Sdn Bhd for the year of assessment 2013. (3 marks) (c) Poly Sdn Bhd constructed an extension to its factory building in the basis period for the year of assessment 2013, and incurred the following expenditure: RM Cost of land 200.000 Cost of architect fees for land 20.000 Cost of architect fees for the extension 10.000 Legal fees for the extension's approval 20.000 Interior design fees for the extension paid to a non-resident who performed the Services in Malaysia for which withholding tax was not deducted and remitted to the Inland Revenue Board (assume withholding tax will not be paid within three years) 10,000 Construction of the extension 570,000 Part of the extension included the construction of a showroom to exhibit the company's products, which occupied 15% of the total area. Required: Determine Poly Sdn Bhd's qualifying building expenditure for the year of assessment 2013, identifying for each item of expenditure listed if it qualifies or does not qualify for industrial building allowance. Note: You are NOT required to compute the industrial building allowance. (5 marks) Advanced Tax [Agricultural Allowance] (a) tealthy Verse Sdn Bhd (Heathy) operates a farm growing organic truts and vegetables Details of Healthy's capital expenditure in the basis period for the year o esmer 2013 as shown below. Asset Land Clearing and preparation of land Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) Healthy is eligible for the agriculture allowance. Amount incurred RM 120,000 90,000 130.000 20.000 60,000 200.000 Required: Compute the agriculture allowance for Healthy Vege Sdn Bhd for the year of assessment 2013, identifying the expenditure which qualifies and does not qualify for agriculture allowance. Note: You are required to compute the agriculture allowances for the year of assessment 2013 only. (8 marks) (b) Uni Sdn Bhd (Uni) is in the business of manufacturing paper products. During the basis period for the year of assessment 2013. Uni acquired a mould machine (general plant and machinery) costing RM62,000 and incurred an additional RM38,000 in alterations to its factory building to install the machine. Required: Determine the qualifying plant and machinery expenditure as a result of the above and compute the capital allowances for Uni Sdn Bhd for the year of assessment 2013. (3 marks) (c) Poly Sdn Bhd constructed an extension to its factory building in the basis period for the year of assessment 2013, and incurred the following expenditure: RM Cost of land 200,000 Cost of architect fees for land 20,000 C) Cost of architect fees for the extension 10,000 Legal fees for the extension's approval 20.000 Interior design fees for the extension paid to a non-resident who performed the services in Malaysia for which withholding tax was not deducted and remitted to the Inland Revenue Board (assume withholding tax will not be paid within three years) 10.000 Construction of the extension 570,000 Part of the extension included the construction of a showroom to exhibit the company's products, which occupied 15% of the total area, Required: Determine Poly Sdn Bhd's qualifying building expenditure for the year of assessment 2013, identifying for each item of expenditure listed if it qualifies or does not qualify for industrial building allowance. Note: You are NOT required to compute the industrial building allowance. (5 marks) 3 (a) Healthy Vege Sdn Bhd (Healthy) operates a farm growing organic fruits and vegetables. Details of Healthy's capital expenditure in the basis period for the year of assessment 2013 are as shown below: Asset Amount incurred RM Land 120,000 Clearing and preparation of land 90.000 Construction of an estate office for the farm 130.000 Construction of a storage building to store equipment 20.000 Construction of a road to access the farm 60,000 Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) 200,000 Healthy is eligible for the agriculture allowance. Required: Compute the agriculture allowance for Healthy Vege Sdn Bhd for the year of assessment 2013, identifying the expenditure which qualifies and does not qualify for agriculture allowance. Note: You are required to compute the agriculture allowances for the year of assessment 2013 only. (8 marks) (b) Uni Sdn Bhd (Uni) is in the business of manufacturing paper products. During the basis period for the year of assessment 2013, Uni acquired a mould machine (general plant and machinery) costing RM62,000 and incurred an additional RM38.000 in alterations to its factory building to install the machine. Required: Determine the qualifying plant and machinery expenditure as a result of the above and compute the capital allowances for Uni Sdn Bhd for the year of assessment 2013. (3 marks) (c) Poly Sdn Bhd constructed an extension to its factory building in the basis period for the year of assessment 2013, and incurred the following expenditure: RM Cost of land 200.000 Cost of architect fees for land 20.000 Cost of architect fees for the extension 10.000 Legal fees for the extension's approval 20.000 Interior design fees for the extension paid to a non-resident who performed the Services in Malaysia for which withholding tax was not deducted and remitted to the Inland Revenue Board (assume withholding tax will not be paid within three years) 10,000 Construction of the extension 570,000 Part of the extension included the construction of a showroom to exhibit the company's products, which occupied 15% of the total area. Required: Determine Poly Sdn Bhd's qualifying building expenditure for the year of assessment 2013, identifying for each item of expenditure listed if it qualifies or does not qualify for industrial building allowance. Note: You are NOT required to compute the industrial building allowance. (5 marks) Advanced Tax [Agricultural Allowance] (a) tealthy Verse Sdn Bhd (Heathy) operates a farm growing organic truts and vegetables Details of Healthy's capital expenditure in the basis period for the year o esmer 2013 as shown below. Asset Land Clearing and preparation of land Construction of an estate office for the farm Construction of a storage building to store equipment Construction of a road to access the farm Construction of living quarters for the farm's employees (which have little or no value if not used as a farm) Healthy is eligible for the agriculture allowance. Amount incurred RM 120,000 90,000 130.000 20.000 60,000 200.000 Required: Compute the agriculture allowance for Healthy Vege Sdn Bhd for the year of assessment 2013, identifying the expenditure which qualifies and does not qualify for agriculture allowance. Note: You are required to compute the agriculture allowances for the year of assessment 2013 only. (8 marks) (b) Uni Sdn Bhd (Uni) is in the business of manufacturing paper products. During the basis period for the year of assessment 2013. Uni acquired a mould machine (general plant and machinery) costing RM62,000 and incurred an additional RM38,000 in alterations to its factory building to install the machine. Required: Determine the qualifying plant and machinery expenditure as a result of the above and compute the capital allowances for Uni Sdn Bhd for the year of assessment 2013. (3 marks) (c) Poly Sdn Bhd constructed an extension to its factory building in the basis period for the year of assessment 2013, and incurred the following expenditure: RM Cost of land 200,000 Cost of architect fees for land 20,000 C) Cost of architect fees for the extension 10,000 Legal fees for the extension's approval 20.000 Interior design fees for the extension paid to a non-resident who performed the services in Malaysia for which withholding tax was not deducted and remitted to the Inland Revenue Board (assume withholding tax will not be paid within three years) 10.000 Construction of the extension 570,000 Part of the extension included the construction of a showroom to exhibit the company's products, which occupied 15% of the total area, Required: Determine Poly Sdn Bhd's qualifying building expenditure for the year of assessment 2013, identifying for each item of expenditure listed if it qualifies or does not qualify for industrial building allowance. Note: You are NOT required to compute the industrial building allowance