Answered step by step

Verified Expert Solution

Question

1 Approved Answer

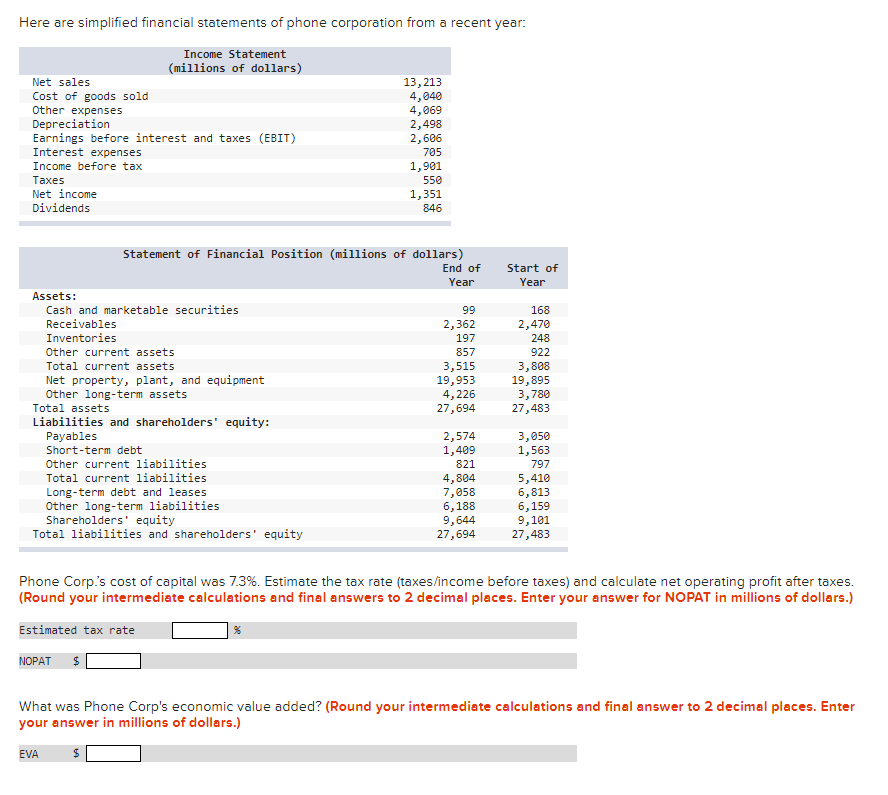

Here are simplified financial statements of phone corporation from a recent year: Income Statement (millions of dollars) Net sales 13,213 Cost of goods sold 4,040

Here are simplified financial statements of phone corporation from a recent year:

| Income Statement (millions of dollars) | |

| Net sales | 13,213 |

| Cost of goods sold | 4,040 |

| Other expenses | 4,069 |

| Depreciation | 2,498 |

| Earnings before interest and taxes (EBIT) | 2,606 |

| Interest expenses | 705 |

| Income before tax | 1,901 |

| Taxes | 550 |

| Net income | 1,351 |

| Dividends | 846 |

| Statement of Financial Position (millions of dollars) | |||

| End of Year | Start of Year | ||

| Assets: | |||

| Cash and marketable securities | 99 | 168 | |

| Receivables | 2,362 | 2,470 | |

| Inventories | 197 | 248 | |

| Other current assets | 857 | 922 | |

| Total current assets | 3,515 | 3,808 | |

| Net property, plant, and equipment | 19,953 | 19,895 | |

| Other long-term assets | 4,226 | 3,780 | |

| Total assets | 27,694 | 27,483 | |

| Liabilities and shareholders' equity: | |||

| Payables | 2,574 | 3,050 | |

| Short-term debt | 1,409 | 1,563 | |

| Other current liabilities | 821 | 797 | |

| Total current liabilities | 4,804 | 5,410 | |

| Long-term debt and leases | 7,058 | 6,813 | |

| Other long-term liabilities | 6,188 | 6,159 | |

| Shareholders' equity | 9,644 | 9,101 | |

| Total liabilities and shareholders' equity | 27,694 | 27,483 | |

Phone Corp.s cost of capital was 7.3%. Estimate the tax rate (taxes/income before taxes) and calculate net operating profit after taxes. (Round your intermediate calculations and final answers to 2 decimal places. Enter your answer for NOPAT in millions of dollars.)

| Estimated tax rate | % |

| NOPAT | $ |

What was Phone Corp's economic value added? (Round your intermediate calculations and final answer to 2 decimal places. Enter your answer in millions of dollars.)

| EVA | $ |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started