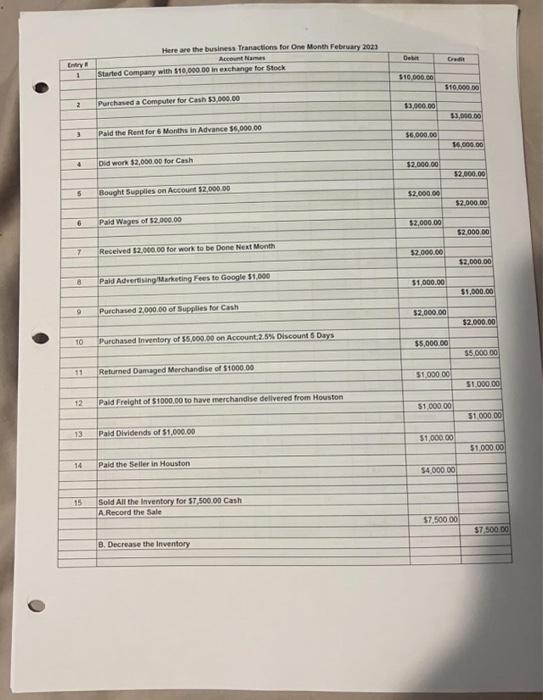

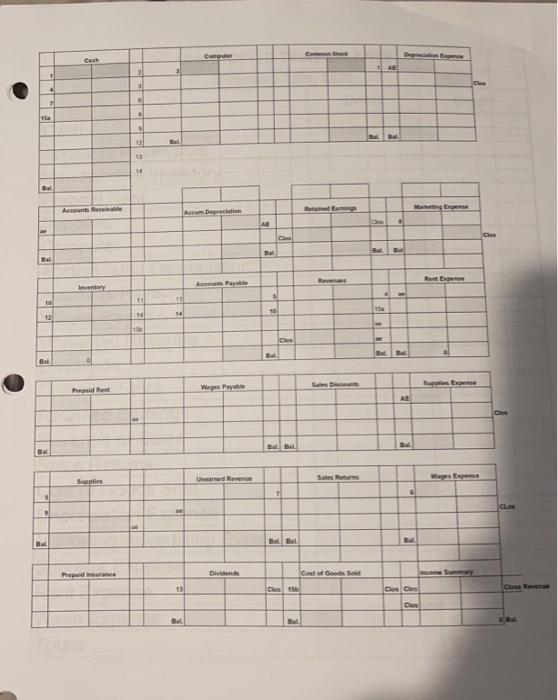

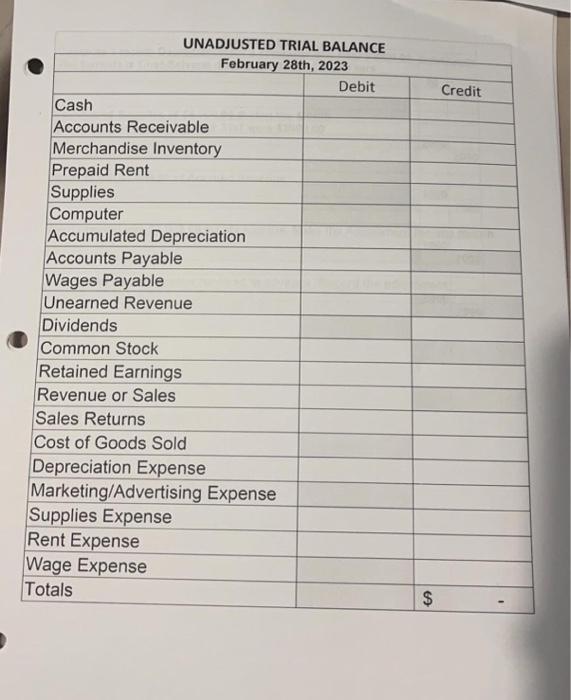

Here are the business Tranactions for One Moneh February auz UNADJUSTED TRIAL BALANCE \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ February 28th, 2023 } \\ \hline & Debit & Credit \\ \hline Cash & & \\ \hline Accounts Receivable & \\ \hline Merchandise Inventory & \\ \hline Prepaid Rent & & \\ \hline Supplies & & \\ \hline Computer & & \\ \hline Accumulated Depreciation & & \\ \hline Accounts Payable & & \\ \hline Wages Payable & & \\ \hline Unearned Revenue & & \\ \hline Dividends & & \\ \hline Common Stock & \\ \hline Retained Earnings & \\ \hline Revenue or Sales & \\ \hline Sales Returns & \\ \hline Cost of Goods Sold & \\ \hline Depreciation Expense & \\ \hline Marketing/Advertising Expense & \\ \hline Supplies Expense & \\ \hline Rent Expense & \\ \hline Wage Expense & \\ \hline Totals & \\ \hline \end{tabular} ADIUSTING ENTRIES Compute 1 month Depreciation for a computer you paid $3000.00 Debit Credit The formula is Cost-Salvaqe divided by Useful Life 5 Years Rent prepaid was $6,000.00 for six months. Make the Adiustment for one month 1000 1000 You earned all the revenue received in advance. Record the adiustment 2000 Adjusted Trial Balance February 28th, 2023 Totals spring aresk \begin{tabular}{|l|l|l|} \hline Cash Flows from Operating Activities & & \\ \hline Net Income \\ \hline Depreciation \\ \hline Increase in Accounts Payable & \\ \hline INcrease in Accounts Receivable & & \\ \hline Increase in Supplies \\ \hline Increase in Prepaid Rent \\ \hline Subtract Gains Add Losses & & \\ \hline Cash Used by Operations & & \\ \hline Cash Flows from Investing Activities & & \\ \hline Cash Used to Purchase Computer & & \\ \hline Cash Used by Investing & & \\ \hline Cash from Financing Activities & & \\ \hline Cash Flow Issuance of Conmon Stock & & \\ \hline Dividends Paid & & \\ \hline Cash Provided by Financing Activities & & \\ \hline Change in Cash for the Month & & \\ \hline Befinning Cash June Ist, 2022 & & \\ \hline Ending Cash June 30th, 2022 & & \\ \hline \end{tabular} Post-Closing Trial Balance \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ February 28th, 2023 } \\ \hline \multicolumn{2}{|c|}{ Debit } & Credit \\ \hline Cash & & \\ \hline Accounts Receivable & & \\ \hline Prepaid Rent & & \\ \hline Supplies & & \\ \hline Computer & & \\ \hline Accumulated Depreciation & & \\ \hline Accounts Payable & & \\ \hline Wages Payable & & \\ \hline Interest Payable & & \\ \hline Unearned Revenue & & \\ \hline Common Stock & & \\ \hline Retained Earnings & & \\ \hline Totals & $ & \\ \hline \end{tabular} Here are the business Tranactions for One Moneh February auz UNADJUSTED TRIAL BALANCE \begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ February 28th, 2023 } \\ \hline & Debit & Credit \\ \hline Cash & & \\ \hline Accounts Receivable & \\ \hline Merchandise Inventory & \\ \hline Prepaid Rent & & \\ \hline Supplies & & \\ \hline Computer & & \\ \hline Accumulated Depreciation & & \\ \hline Accounts Payable & & \\ \hline Wages Payable & & \\ \hline Unearned Revenue & & \\ \hline Dividends & & \\ \hline Common Stock & \\ \hline Retained Earnings & \\ \hline Revenue or Sales & \\ \hline Sales Returns & \\ \hline Cost of Goods Sold & \\ \hline Depreciation Expense & \\ \hline Marketing/Advertising Expense & \\ \hline Supplies Expense & \\ \hline Rent Expense & \\ \hline Wage Expense & \\ \hline Totals & \\ \hline \end{tabular} ADIUSTING ENTRIES Compute 1 month Depreciation for a computer you paid $3000.00 Debit Credit The formula is Cost-Salvaqe divided by Useful Life 5 Years Rent prepaid was $6,000.00 for six months. Make the Adiustment for one month 1000 1000 You earned all the revenue received in advance. Record the adiustment 2000 Adjusted Trial Balance February 28th, 2023 Totals spring aresk \begin{tabular}{|l|l|l|} \hline Cash Flows from Operating Activities & & \\ \hline Net Income \\ \hline Depreciation \\ \hline Increase in Accounts Payable & \\ \hline INcrease in Accounts Receivable & & \\ \hline Increase in Supplies \\ \hline Increase in Prepaid Rent \\ \hline Subtract Gains Add Losses & & \\ \hline Cash Used by Operations & & \\ \hline Cash Flows from Investing Activities & & \\ \hline Cash Used to Purchase Computer & & \\ \hline Cash Used by Investing & & \\ \hline Cash from Financing Activities & & \\ \hline Cash Flow Issuance of Conmon Stock & & \\ \hline Dividends Paid & & \\ \hline Cash Provided by Financing Activities & & \\ \hline Change in Cash for the Month & & \\ \hline Befinning Cash June Ist, 2022 & & \\ \hline Ending Cash June 30th, 2022 & & \\ \hline \end{tabular} Post-Closing Trial Balance \begin{tabular}{|l|c|c|} \hline \multicolumn{2}{|c|}{ February 28th, 2023 } \\ \hline \multicolumn{2}{|c|}{ Debit } & Credit \\ \hline Cash & & \\ \hline Accounts Receivable & & \\ \hline Prepaid Rent & & \\ \hline Supplies & & \\ \hline Computer & & \\ \hline Accumulated Depreciation & & \\ \hline Accounts Payable & & \\ \hline Wages Payable & & \\ \hline Interest Payable & & \\ \hline Unearned Revenue & & \\ \hline Common Stock & & \\ \hline Retained Earnings & & \\ \hline Totals & $ & \\ \hline \end{tabular}