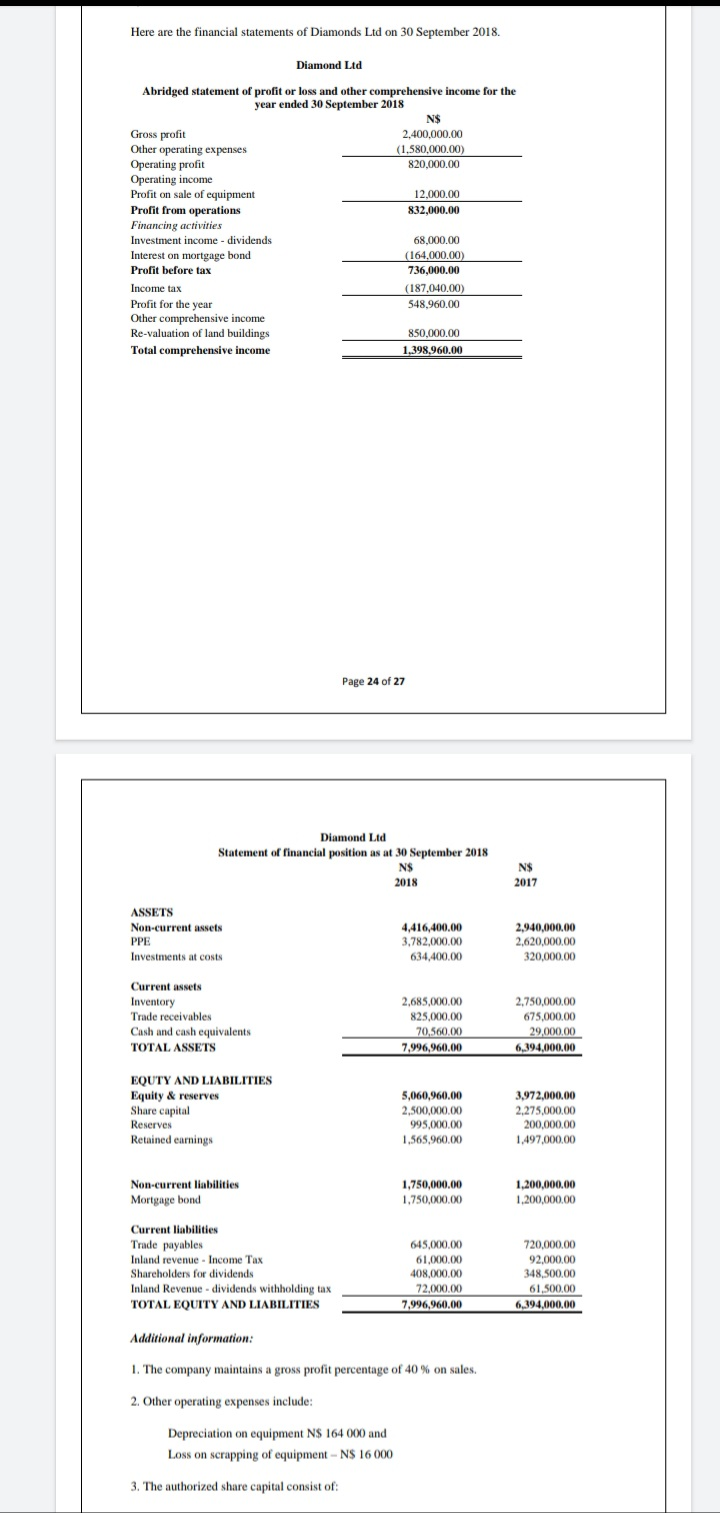

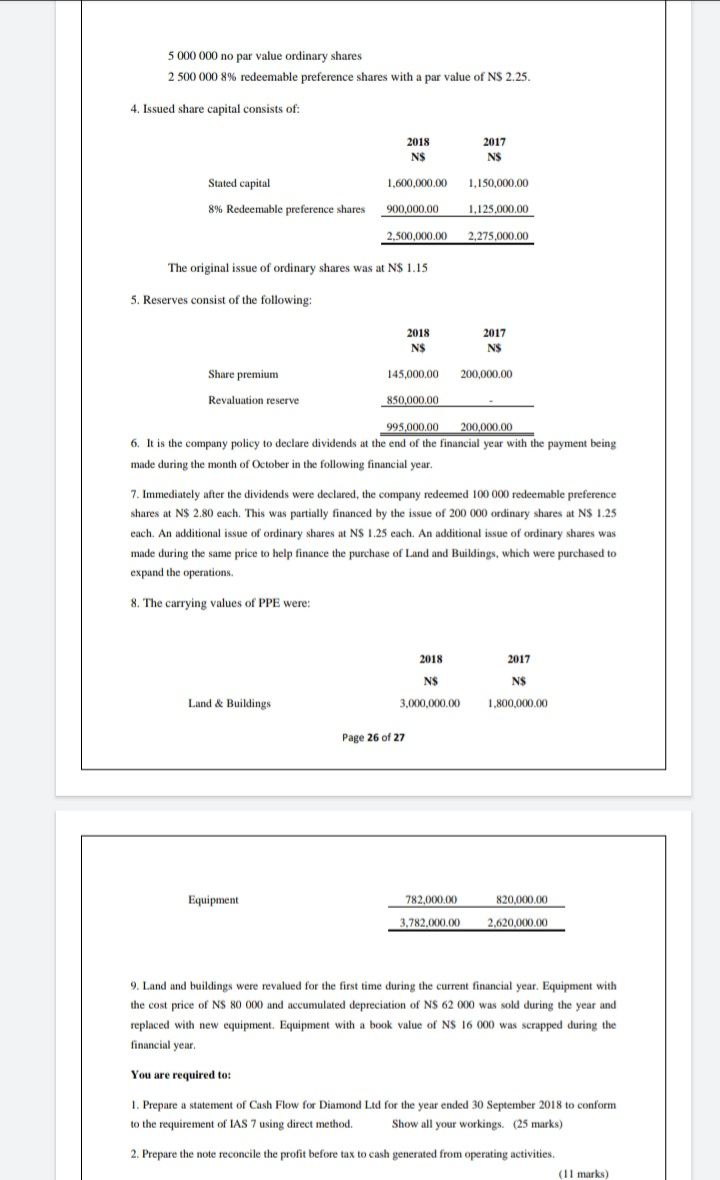

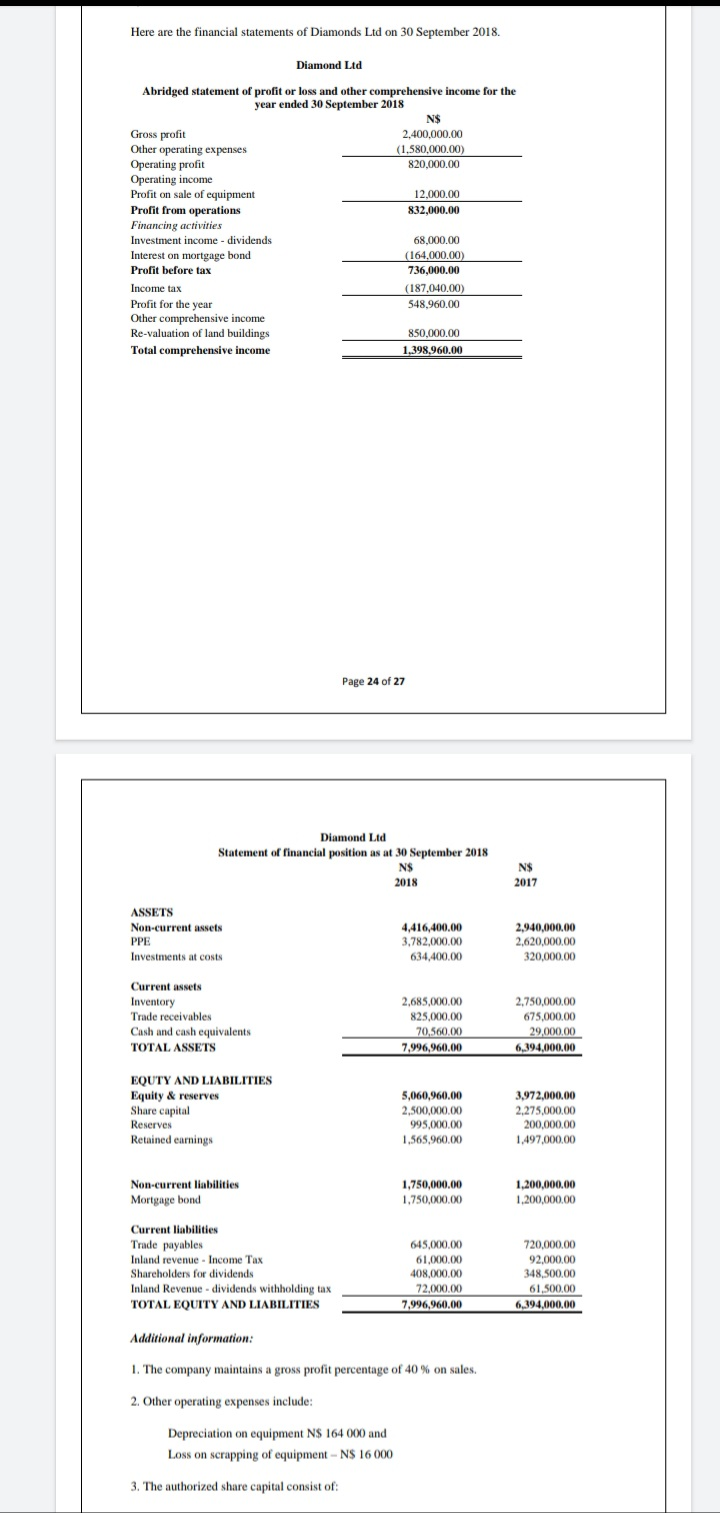

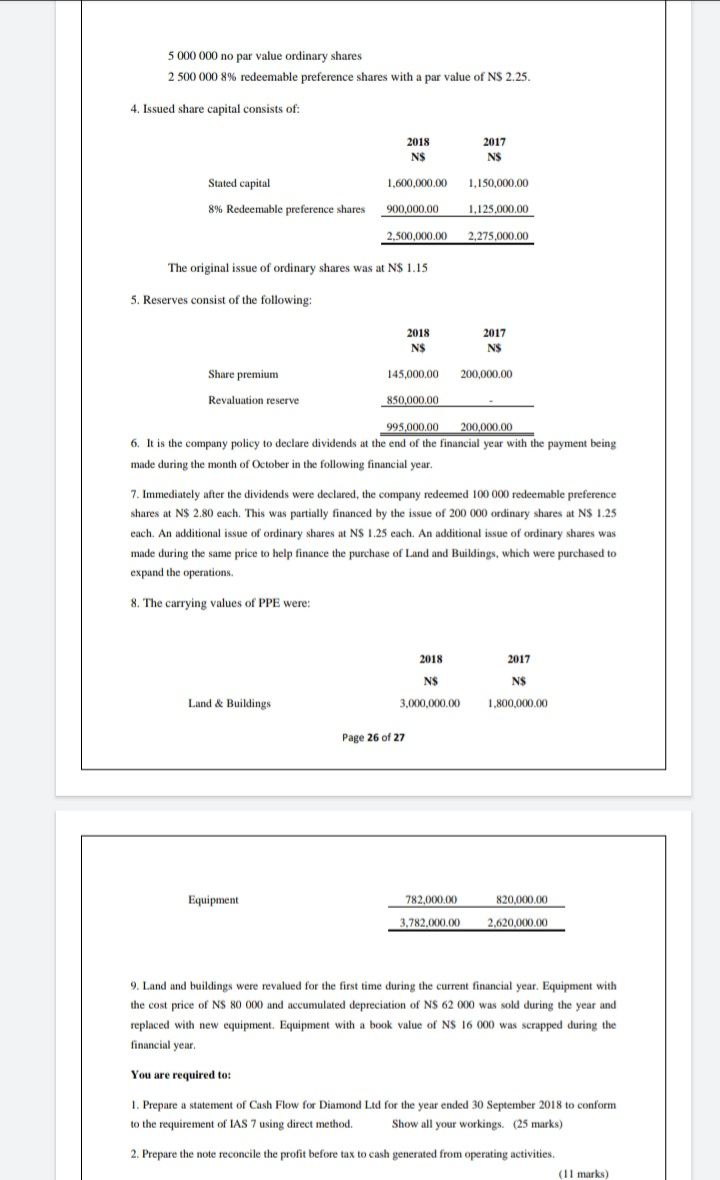

Here are the financial statements of Diamonds Ltd on 30 September 2018. Diamond Ltd Abridged statement of profit or loss and other comprehensive income for the year ended 30 September 2018 N$ Gross profit 2.400,000.00 Other operating expenses (1.580,000.00) Operating profit 820,000.00 Operating income Profit on sale of equipment 12,000.00 Profit from operations 832,000.00 Financing activities Investment income - dividends 68,000.00 Interest on mortgage bond (164,000.00) Profit before tax 736,000.00 (187.040.00) Profit for the year 548,960,00 Other comprehensive income Re-valuation of land buildings 850.000,00 Total comprehensive income 1,398,960.00 Income tax Page 24 of 27 Diamond Ltd Statement of financial position as at 30 September 2018 NS 2018 N$ 2017 ASSETS Non-current assets PPE Investments at costs 4,416,400.00 3,782,000.00 634,400.00 2,940,000.00 2.620,000.00 320,000.00 Current assets Inventory Trade receivables Cash and cash equivalents TOTAL ASSETS 2.685,000.00 825,000.00 70,560.00 7,996,960.00 2,750,000.00 675,000.00 29,000.00 6,394,000.00 EQUTY AND LIABILITIES Equity & reserves Share capital Reserves Retained earnings 5,060,960.00 2,500,000.00 995,000.00 1.565,900.00 3,972,000.00 2.275,000.00 200,000.00 1,497,000.00 Non-current liabilities Mortgage bond 1,750,000.00 1,750,000.00 1,200,000.00 1.200,000.00 Current liabilities Trade payables Inland revenue - Income Tax Shareholders for dividends Inland Revenue dividends withholding tax TOTAL EQUITY AND LIABILITIES 645,000.00 61.000.00 408,000.00 72,000.00 7,996,960.00 720,000.00 92,000.00 348,500.00 61,500.00 6,394,000.00 Additional information: 1. The company maintains a gross profit percentage of 40% on sales. . 2. Other operating expenses include: Depreciation on equipment N$ 164 000 and Loss on scrapping of equipment - N$ 16 000 3. The authorized share capital consist of: 5 000 000 no par value ordinary shares 2 500 000 8% redeemable preference shares with a par value of N$ 2.25. 4. Issued share capital consists of: 2018 N$ 2017 NS Stated capital 1,600,000.00 1,150,000.00 1,125,000.00 8% Redeemable preference shares 900,000.00 2,500,000.00 2,275,000.00 The original issue of ordinary shares was at N$ 1.15 5. Reserves consist of the following: 2018 NS 2017 NS Share premium 145,000.00 200,000.00 Revaluation reserve 850,000.00 995,000.00 200,000.00 6. It is the company policy to declare dividends at the end of the financial year with the payment being made during the month of October in the following financial year, 7. Immediately after the dividends were declared, the company redeemed 100 000 redeemable preference shares at N$ 2.80 each. This was partially financed by the issue of 200 000 ordinary shares at NS 1.25 each. An additional issue of ordinary shares at N$ 1.25 each. An additional issue of ordinary shares was made during the same price to help finance the purchase of Land and Buildings, which were purchased to expand the operations 8. The carrying values of PPE were: 2017 2018 NS 3,000,000.00 NS Land & Buildings 1,800,000.00 Page 26 of 27 Equipment 782,000,00 820,000.00 3,782,000.00 2,620,000.00 9. Land and buildings were revalued for the first time during the current financial year. Equipment with the cost price of NS 80 000 and accumulated depreciation of NS 62 000 was sold during the year and replaced with new equipment. Equipment with a book value of NS 16 000 was scrapped during the financial year You are required to: 1. Prepare a statement of Cash Flow for Diamond Ltd for the year ended 30 September 2018 to conform to the requirement of IAS 7 using direct method Show all your workings. (25 marks) 2. Prepare the note reconcile the profit before tax to cash generated from operating activities. (11 marks)