Here are the given tables! Thank you!

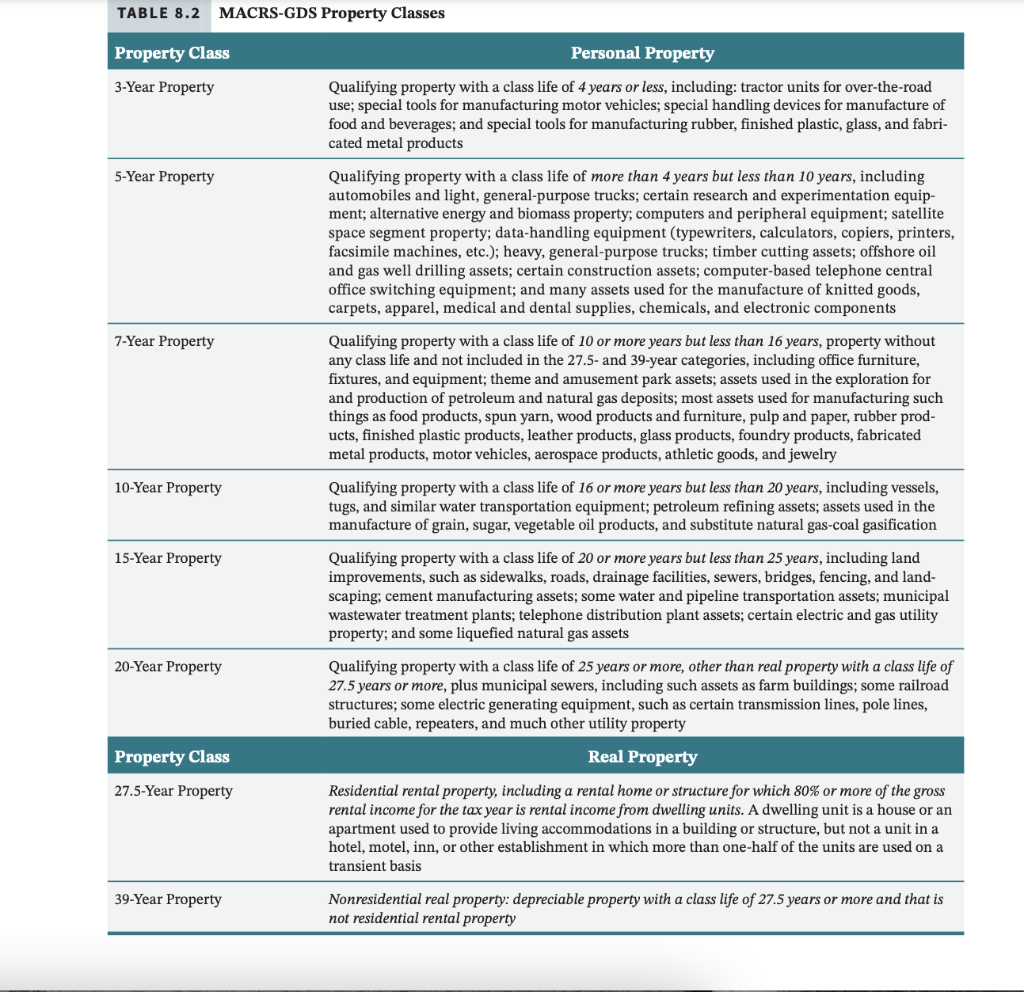

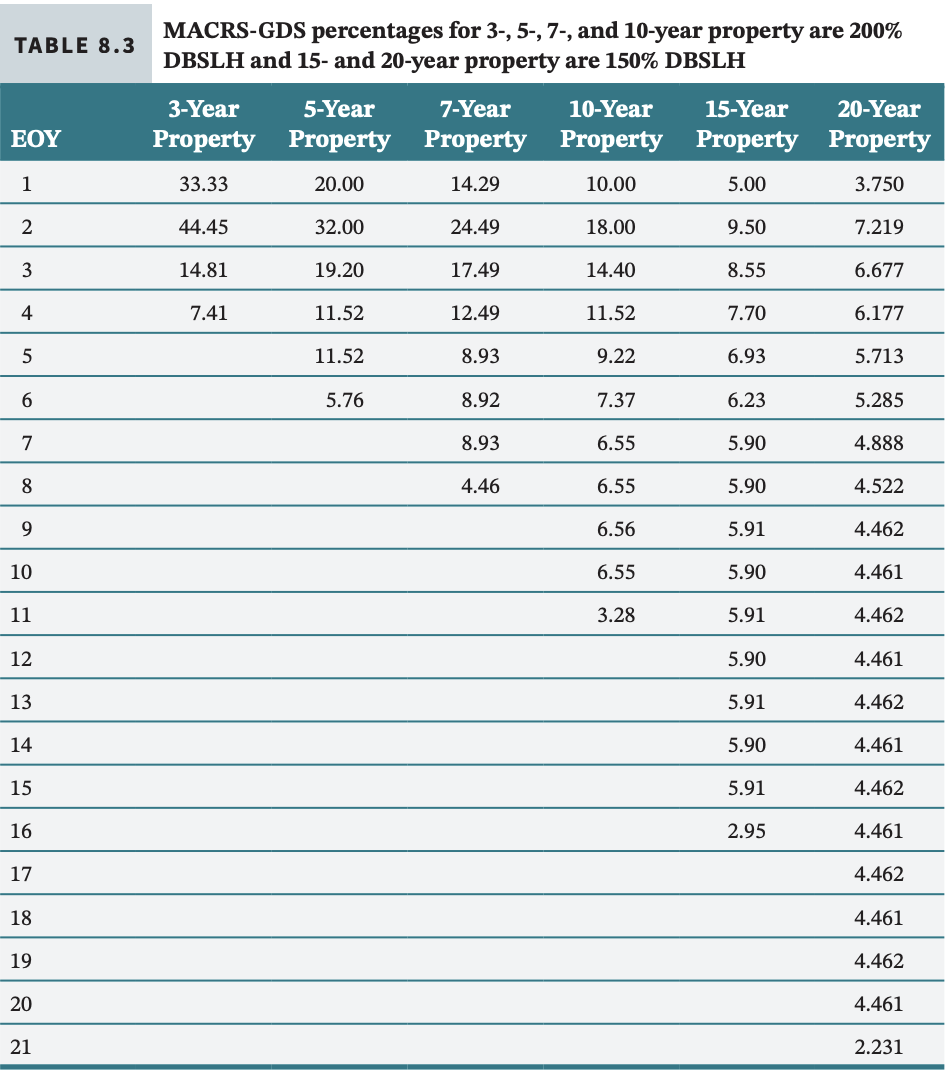

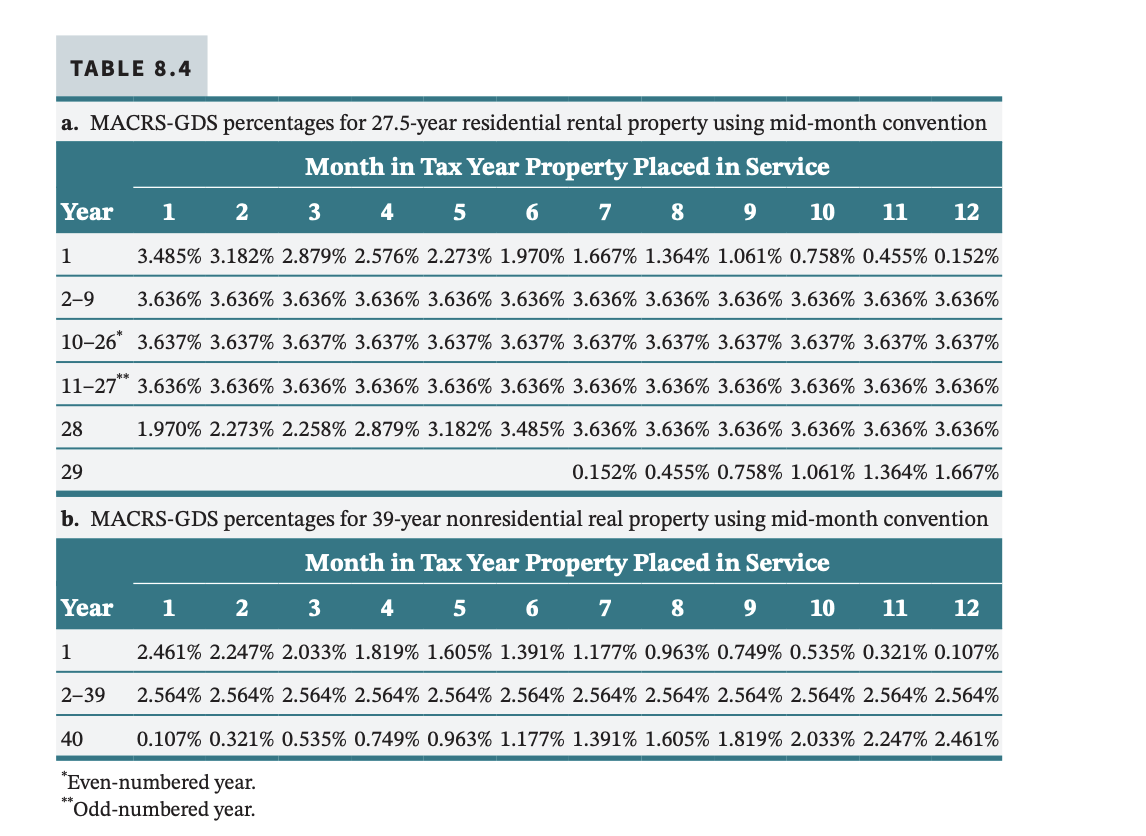

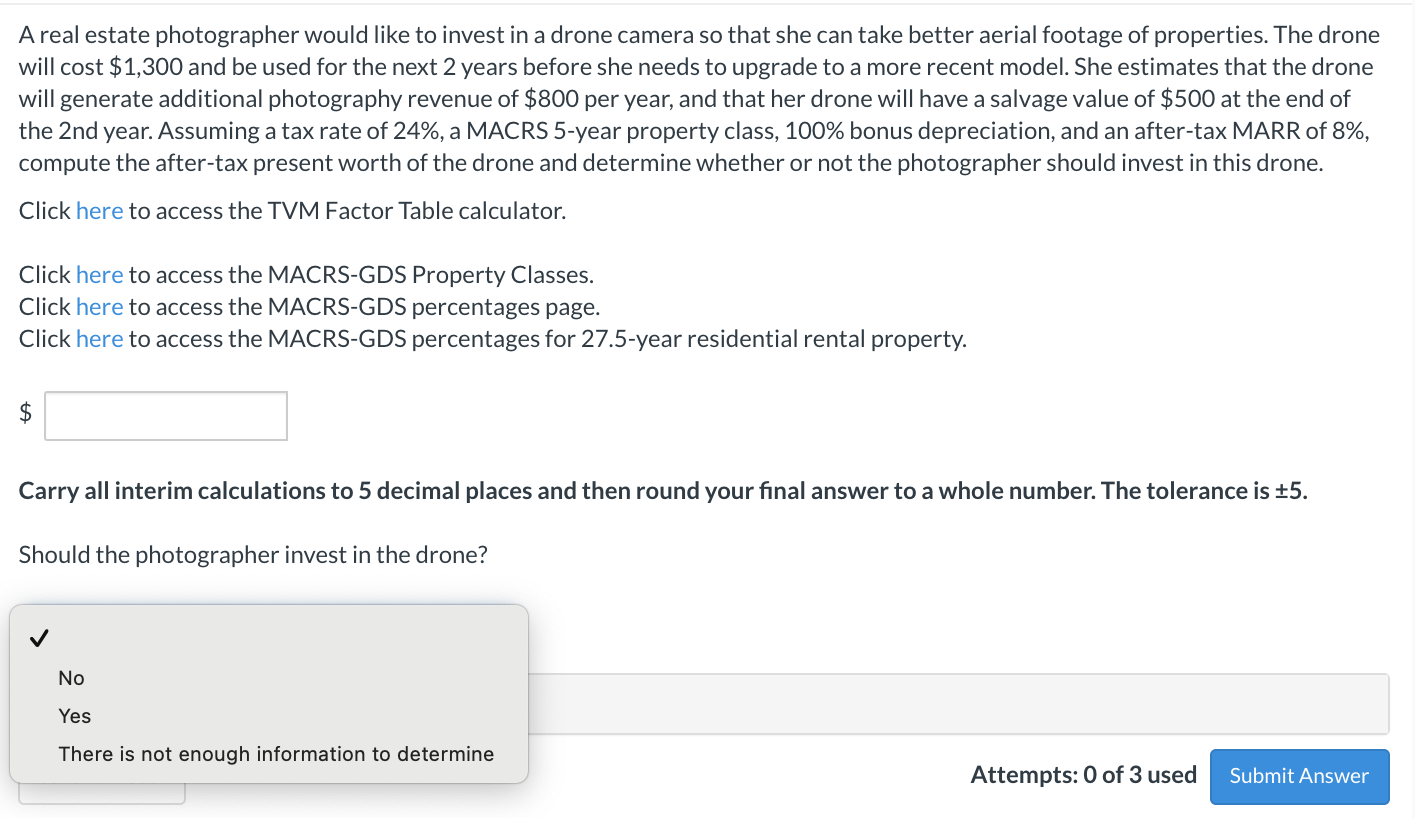

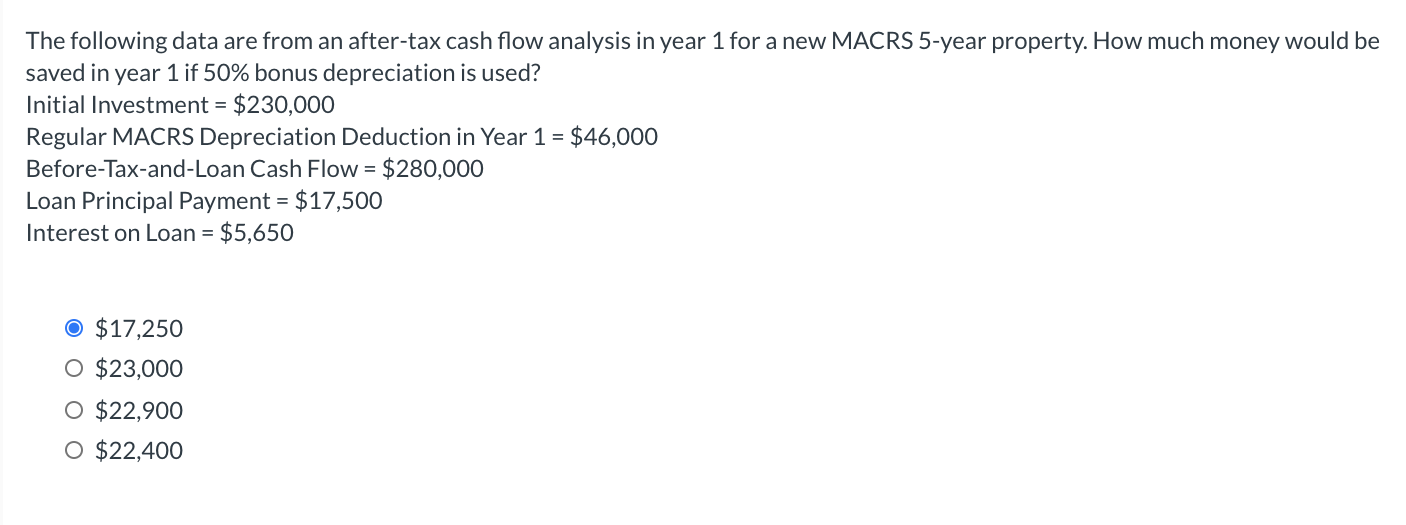

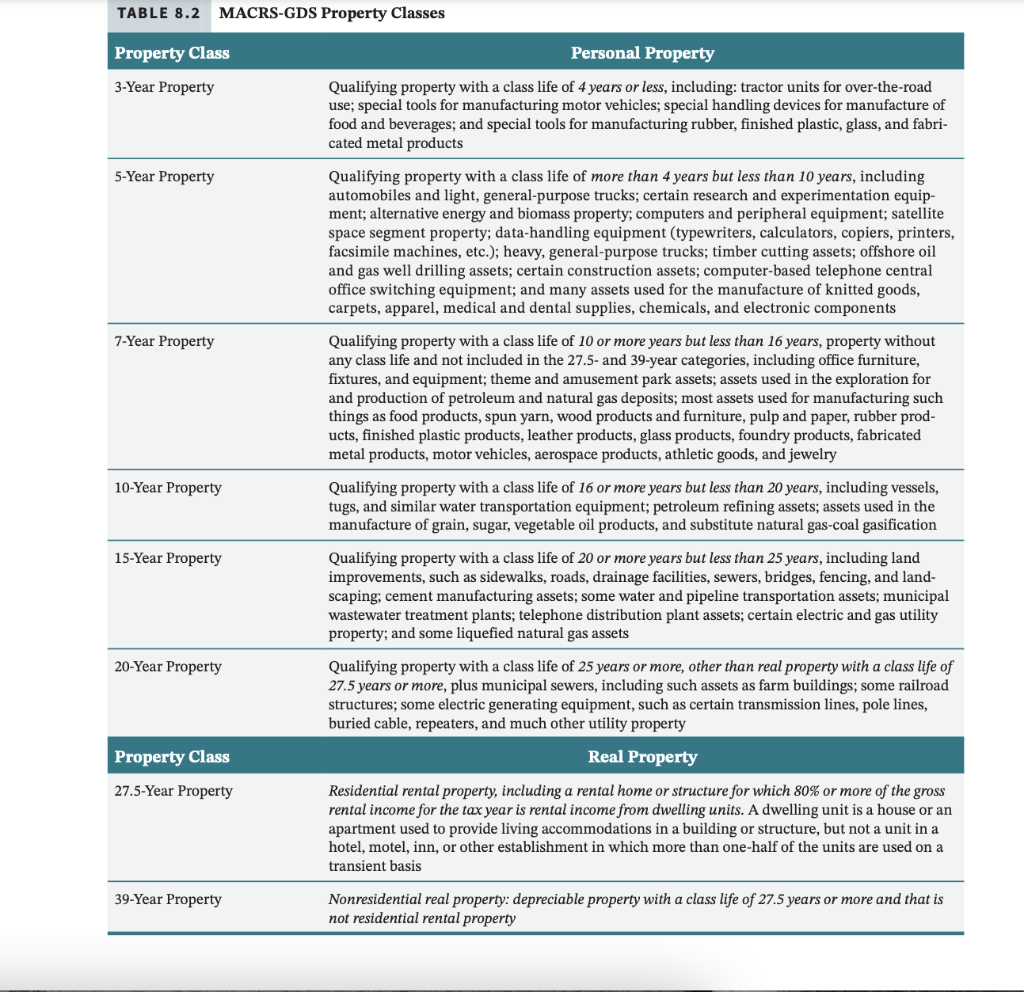

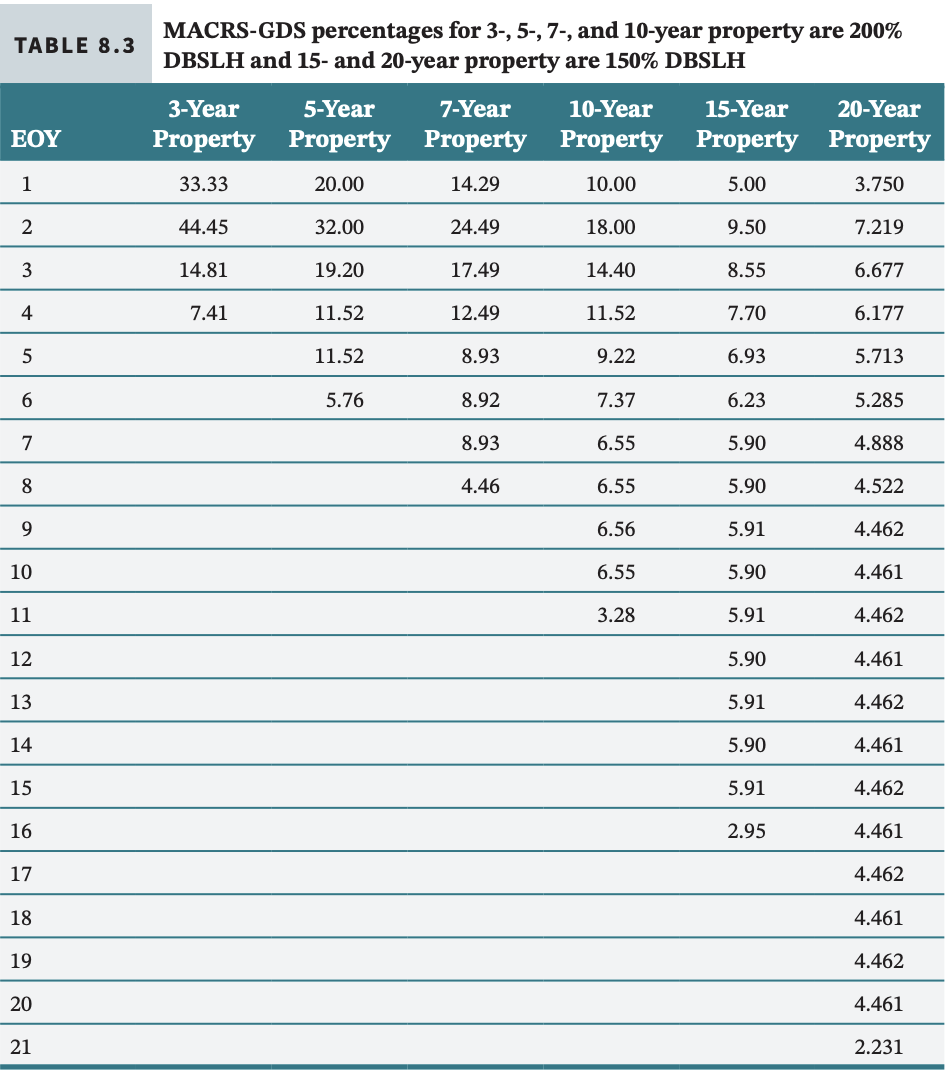

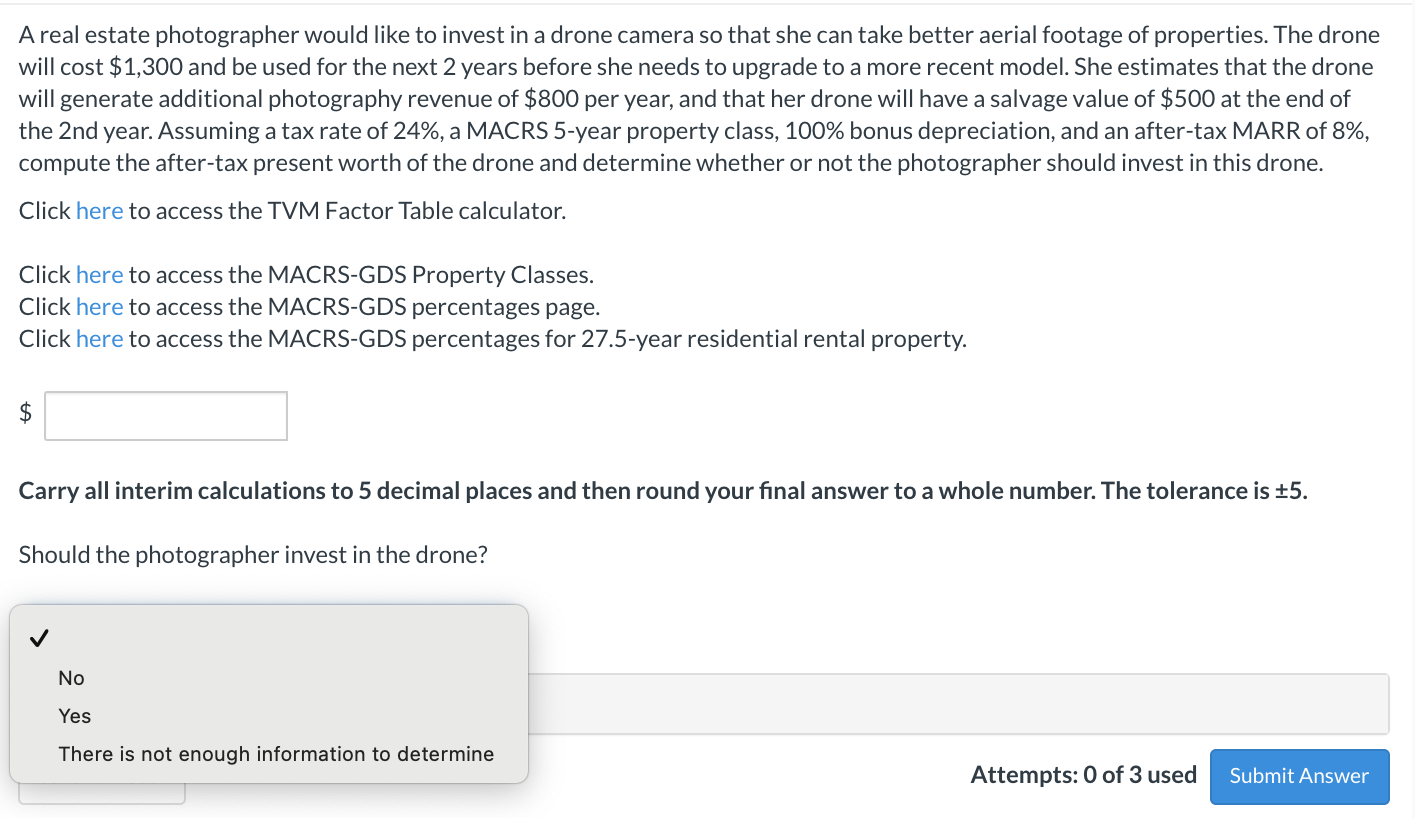

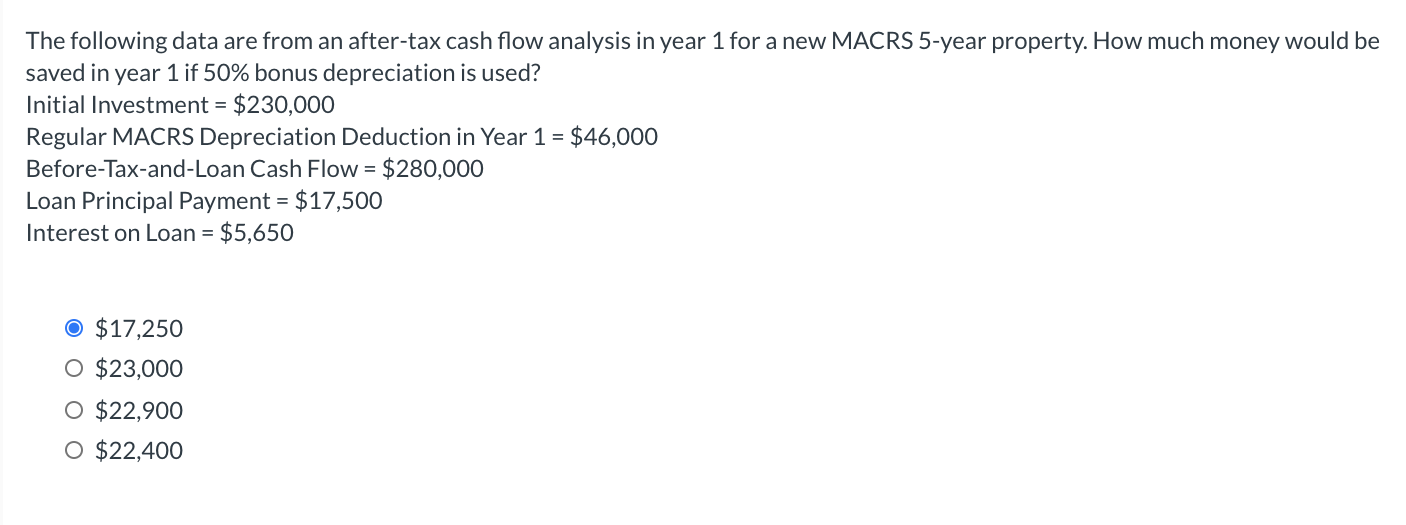

TABLE 8.2 MACRS-GDS Property Classes Property Class Personal Property 3-Year Property 5-Year Property 7-Year Property Qualifying property with a class life of 4 years or less, including: tractor units for over-the-road use; special tools for manufacturing motor vehicles; special handling devices for manufacture of food and beverages, and special tools for manufacturing rubber, finished plastic, glass, and fabri- cated metal products Qualifying property with a class life of more than 4 years but less than 10 years, including automobiles and light, general-purpose trucks; certain research and experimentation equip- ment; alternative energy and biomass property, computers and peripheral equipment; satellite space segment property; data-handling equipment (typewriters, calculators, copiers, printers, facsimile machines, etc.); heavy, general-purpose trucks; timber cutting assets; offshore oil and gas well drilling assets; certain construction assets; computer-based telephone central office switching equipment; and many assets used for the manufacture of knitted goods, carpets, apparel, medical and dental supplies, chemicals, and electronic components Qualifying property with a class life of 10 or more years but less than 16 years, property without any class life and not included in the 27.5- and 39-year categories, including office furniture, fixtures, and equipment; theme and amusement park assets; assets used in the exploration for and production of petroleum and natural gas deposits; most assets used for manufacturing such things as food products, spun yarn, wood products and furniture, pulp and paper, rubber prod- ucts, finished plastic products, leather products, glass products, foundry products, fabricated metal products, motor vehicles, aerospace products, athletic goods, and jewelry Qualifying property with a class life of 16 or more years but less than 20 years, including vessels, tugs, and similar water transportation equipment; petroleum refining assets; assets used in the manufacture of grain, sugar, vegetable oil products, and substitute natural gas-coal gasification Qualifying property with a class life of 20 or more years but less than 25 years, including land improvements, such as sidewalks, roads, drainage facilities, sewers, bridges, fencing, and land- scaping, cement manufacturing assets; some water and pipeline transportation assets; municipal wastewater treatment plants; telephone distribution plant assets; certain electric and gas utility property; and some liquefied natural gas assets Qualifying property with a class life of 25 years or more, other than real property with a class life of 27.5 years or more, plus municipal sewers, including such assets as farm buildings, some railroad structures, some electric generating equipment, such as certain transmission lines, pole lines, buried cable, repeaters, and much other utility property 10-Year Property 15-Year Property 20-Year Property Property Class Real Property 27.5-Year Property Residential rental property, including a rental home or structure for which 80% or more of the gross rental income for the tax year is rental income from dwelling units. A dwelling unit is a house or an apartment used to provide living accommodations in a building or structure, but not a unit in a hotel, motel, inn, or other establishment in which more than one-half of the units are used on a transient basis 39-Year Property Nonresidential real property: depreciable property with a class life of 27.5 years or more and that is not residential rental property TABLE 8.3 MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% DBSLH and 15- and 20-year property are 150% DBSLH 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property EOY 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 TABLE 8.4 a. MACRS-GDS percentages for 27.5-year residential rental property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 12 1 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 1.061% 0.758% 0.455% 0.152% 2-9 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 10-26* 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 11-27** 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 28 1.970% 2.273% 2.258% 2.879% 3.182% 3.485% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 29 0.152% 0.455% 0.758% 1.061% 1.364% 1.667% b. MACRS-GDS percentages for 39-year nonresidential real property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461% 2.247% 2.033% 1.819% 1.605% 1.391% 1.177% 0.963% 0.749% 0.535% 0.321% 0.107% 2-39 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 40 0.107% 0.321% 0.535% 0.749% 0.963% 1.177% 1.391% 1.605% 1.819% 2.033% 2.247% 2.461% *Even-numbered year. **Odd-numbered year. A real estate photographer would like to invest in a drone camera so that she can take better aerial footage of properties. The drone will cost $1,300 and be used for the next 2 years before she needs to upgrade to a more recent model. She estimates that the drone will generate additional photography revenue of $800 per year, and that her drone will have a salvage value of $500 at the end of the 2nd year. Assuming a tax rate of 24%, a MACRS 5-year property class, 100% bonus depreciation, and an after-tax MARR of 8%, compute the after-tax present worth of the drone and determine whether or not the photographer should invest in this drone. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. $ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is +5. Should the photographer invest in the drone? No Yes There is not enough information to determine Attempts: 0 of 3 used Submit Answer The following data are from an after-tax cash flow analysis in year 1 for a new MACRS 5-year property. How much money would be saved in year 1 if 50% bonus depreciation is used? Initial Investment = $230,000 Regular MACRS Depreciation Deduction in Year 1 = $46,000 Before-Tax-and-Loan Cash Flow = $280,000 Loan Principal Payment = $17,500 Interest on Loan = $5,650 $17,250 O $23,000 O $22,900 O $22,400 TABLE 8.2 MACRS-GDS Property Classes Property Class Personal Property 3-Year Property 5-Year Property 7-Year Property Qualifying property with a class life of 4 years or less, including: tractor units for over-the-road use; special tools for manufacturing motor vehicles; special handling devices for manufacture of food and beverages, and special tools for manufacturing rubber, finished plastic, glass, and fabri- cated metal products Qualifying property with a class life of more than 4 years but less than 10 years, including automobiles and light, general-purpose trucks; certain research and experimentation equip- ment; alternative energy and biomass property, computers and peripheral equipment; satellite space segment property; data-handling equipment (typewriters, calculators, copiers, printers, facsimile machines, etc.); heavy, general-purpose trucks; timber cutting assets; offshore oil and gas well drilling assets; certain construction assets; computer-based telephone central office switching equipment; and many assets used for the manufacture of knitted goods, carpets, apparel, medical and dental supplies, chemicals, and electronic components Qualifying property with a class life of 10 or more years but less than 16 years, property without any class life and not included in the 27.5- and 39-year categories, including office furniture, fixtures, and equipment; theme and amusement park assets; assets used in the exploration for and production of petroleum and natural gas deposits; most assets used for manufacturing such things as food products, spun yarn, wood products and furniture, pulp and paper, rubber prod- ucts, finished plastic products, leather products, glass products, foundry products, fabricated metal products, motor vehicles, aerospace products, athletic goods, and jewelry Qualifying property with a class life of 16 or more years but less than 20 years, including vessels, tugs, and similar water transportation equipment; petroleum refining assets; assets used in the manufacture of grain, sugar, vegetable oil products, and substitute natural gas-coal gasification Qualifying property with a class life of 20 or more years but less than 25 years, including land improvements, such as sidewalks, roads, drainage facilities, sewers, bridges, fencing, and land- scaping, cement manufacturing assets; some water and pipeline transportation assets; municipal wastewater treatment plants; telephone distribution plant assets; certain electric and gas utility property; and some liquefied natural gas assets Qualifying property with a class life of 25 years or more, other than real property with a class life of 27.5 years or more, plus municipal sewers, including such assets as farm buildings, some railroad structures, some electric generating equipment, such as certain transmission lines, pole lines, buried cable, repeaters, and much other utility property 10-Year Property 15-Year Property 20-Year Property Property Class Real Property 27.5-Year Property Residential rental property, including a rental home or structure for which 80% or more of the gross rental income for the tax year is rental income from dwelling units. A dwelling unit is a house or an apartment used to provide living accommodations in a building or structure, but not a unit in a hotel, motel, inn, or other establishment in which more than one-half of the units are used on a transient basis 39-Year Property Nonresidential real property: depreciable property with a class life of 27.5 years or more and that is not residential rental property TABLE 8.3 MACRS-GDS percentages for 3-, 5-, 7-, and 10-year property are 200% DBSLH and 15- and 20-year property are 150% DBSLH 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Property Property Property Property Property Property EOY 1 33.33 20.00 14.29 10.00 5.00 3.750 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 TABLE 8.4 a. MACRS-GDS percentages for 27.5-year residential rental property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 12 1 3.485% 3.182% 2.879% 2.576% 2.273% 1.970% 1.667% 1.364% 1.061% 0.758% 0.455% 0.152% 2-9 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 10-26* 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 3.637% 11-27** 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 28 1.970% 2.273% 2.258% 2.879% 3.182% 3.485% 3.636% 3.636% 3.636% 3.636% 3.636% 3.636% 29 0.152% 0.455% 0.758% 1.061% 1.364% 1.667% b. MACRS-GDS percentages for 39-year nonresidential real property using mid-month convention Month in Tax Year Property Placed in Service Year 1 2 3 4 5 6 7 8 9 10 11 12 1 2.461% 2.247% 2.033% 1.819% 1.605% 1.391% 1.177% 0.963% 0.749% 0.535% 0.321% 0.107% 2-39 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 2.564% 40 0.107% 0.321% 0.535% 0.749% 0.963% 1.177% 1.391% 1.605% 1.819% 2.033% 2.247% 2.461% *Even-numbered year. **Odd-numbered year. A real estate photographer would like to invest in a drone camera so that she can take better aerial footage of properties. The drone will cost $1,300 and be used for the next 2 years before she needs to upgrade to a more recent model. She estimates that the drone will generate additional photography revenue of $800 per year, and that her drone will have a salvage value of $500 at the end of the 2nd year. Assuming a tax rate of 24%, a MACRS 5-year property class, 100% bonus depreciation, and an after-tax MARR of 8%, compute the after-tax present worth of the drone and determine whether or not the photographer should invest in this drone. Click here to access the TVM Factor Table calculator. Click here to access the MACRS-GDS Property Classes. Click here to access the MACRS-GDS percentages page. Click here to access the MACRS-GDS percentages for 27.5-year residential rental property. $ Carry all interim calculations to 5 decimal places and then round your final answer to a whole number. The tolerance is +5. Should the photographer invest in the drone? No Yes There is not enough information to determine Attempts: 0 of 3 used Submit Answer The following data are from an after-tax cash flow analysis in year 1 for a new MACRS 5-year property. How much money would be saved in year 1 if 50% bonus depreciation is used? Initial Investment = $230,000 Regular MACRS Depreciation Deduction in Year 1 = $46,000 Before-Tax-and-Loan Cash Flow = $280,000 Loan Principal Payment = $17,500 Interest on Loan = $5,650 $17,250 O $23,000 O $22,900 O $22,400