Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here are the instructions for my assignment and a picture of some of the excel data. I just need help explaining what I need to

Here are the instructions for my assignment and a picture of some of the excel data. I just need help explaining what I need to do. So if you could help explain how to do all the points that will help me a lot.

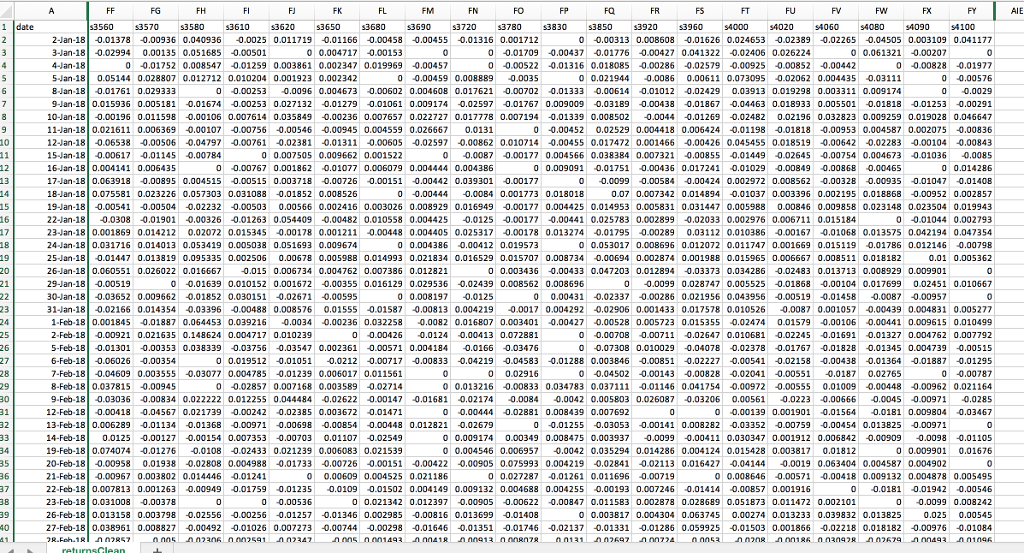

The goal of this exercise is to "back-test" the momentum strategy using Korean stock market data. Please use Microsoft Excel to do this assignment. You may work on this assignment during the class on Nov 12 and Nov 14. If you cannot finish the assignment by the end of class on Nov 14, please work on this at home, and submit your one- page report by the start of class on Nev19 Nov 21 Deadline: 1:30pm, Wednesday, November 21 You may work alone, or in a group of up to 3 persons. If you decide to work in a group of N persons, your investment universe needs to include N*20 stocks. See $1 below. Before starting the analysis, please get familar with the two Excel files that I prepared for you. namesClean.xlsx includes the list of stocks with industry classifiation. returnsClean.xlsx includes daily returns of Kospi stocks. You do not need to download any other data to do this assignment. 1. Your investment universe comprises of 20 stocks. Please see namesClean xlsx for the 20 stocks that you need to include in your investment universe. $2. Your investment period is from the end of Jan 31, 2018 to the end of Oct 31, 2018. 3. At the end of Jan 31, 2018, you rank every stock in your investment universe by the previous- one-month returns (i.e. returns for Jan 1 to Jan 31). The "momentum portfolio" includes the 10 high rank stocks. Create an equal-weighted portfolio out of these 10 stocks. 54. calculate daily returns to this portfolio until the end of February. ou may want to review the portfolio return calculation that we discussed in earlier classes) 5. At the end of February, you rebalance the portfolio. That is, you rank every stock in your investment universe by the previous-one-month returns (i.e. returns for Feb 1 to the end of Feb) Your new portfolio includes the 10 high rank stocks. Again, equal-weight the portfolio. $6. Calculate daily returns to this portfolio until the end of March. The goal of this exercise is to "back-test" the momentum strategy using Korean stock market data. Please use Microsoft Excel to do this assignment. You may work on this assignment during the class on Nov 12 and Nov 14. If you cannot finish the assignment by the end of class on Nov 14, please work on this at home, and submit your one- page report by the start of class on Nev19 Nov 21 Deadline: 1:30pm, Wednesday, November 21 You may work alone, or in a group of up to 3 persons. If you decide to work in a group of N persons, your investment universe needs to include N*20 stocks. See $1 below. Before starting the analysis, please get familar with the two Excel files that I prepared for you. namesClean.xlsx includes the list of stocks with industry classifiation. returnsClean.xlsx includes daily returns of Kospi stocks. You do not need to download any other data to do this assignment. 1. Your investment universe comprises of 20 stocks. Please see namesClean xlsx for the 20 stocks that you need to include in your investment universe. $2. Your investment period is from the end of Jan 31, 2018 to the end of Oct 31, 2018. 3. At the end of Jan 31, 2018, you rank every stock in your investment universe by the previous- one-month returns (i.e. returns for Jan 1 to Jan 31). The "momentum portfolio" includes the 10 high rank stocks. Create an equal-weighted portfolio out of these 10 stocks. 54. calculate daily returns to this portfolio until the end of February. ou may want to review the portfolio return calculation that we discussed in earlier classes) 5. At the end of February, you rebalance the portfolio. That is, you rank every stock in your investment universe by the previous-one-month returns (i.e. returns for Feb 1 to the end of Feb) Your new portfolio includes the 10 high rank stocks. Again, equal-weight the portfolio. $6. Calculate daily returns to this portfolio until the end of MarchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started