Answered step by step

Verified Expert Solution

Question

1 Approved Answer

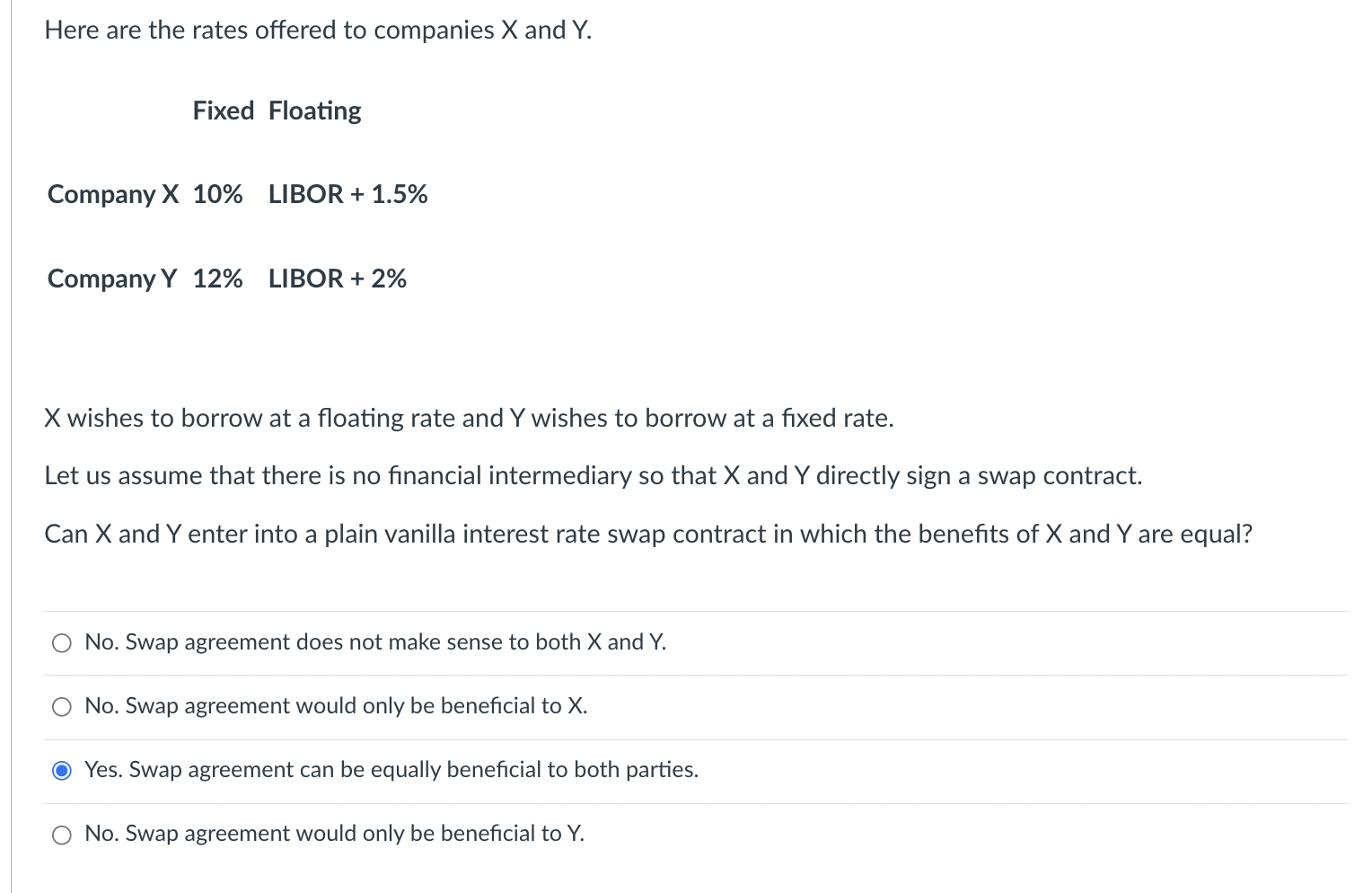

Here are the rates offered to companies x and Y . Fixed Floating Company X 1 0 % LIBOR + 1 . 5 % Company

Here are the rates offered to companies and

Fixed Floating

Company X LIBOR

Company Y LIBOR

wishes to borrow at a floating rate and wishes to borrow at a fixed rate.

Let us assume that there is no financial intermediary so that and directly sign a swap contract.

Can and enter into a plain vanilla interest rate swap contract in which the benefits of and are equal?

No Swap agreement does not make sense to both and

No Swap agreement would only be beneficial to

Yes. Swap agreement can be equally beneficial to both parties.

No Swap agreement would only be beneficial to Y

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started