Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here are the related invoices: Here is the actual question. Green means correct, red and purple incorrect Gulf Corp. 4073 Paper Street Ottawa, Ontario T3E

Here are the related invoices:

Here is the actual question. Green means correct, red and purple incorrect

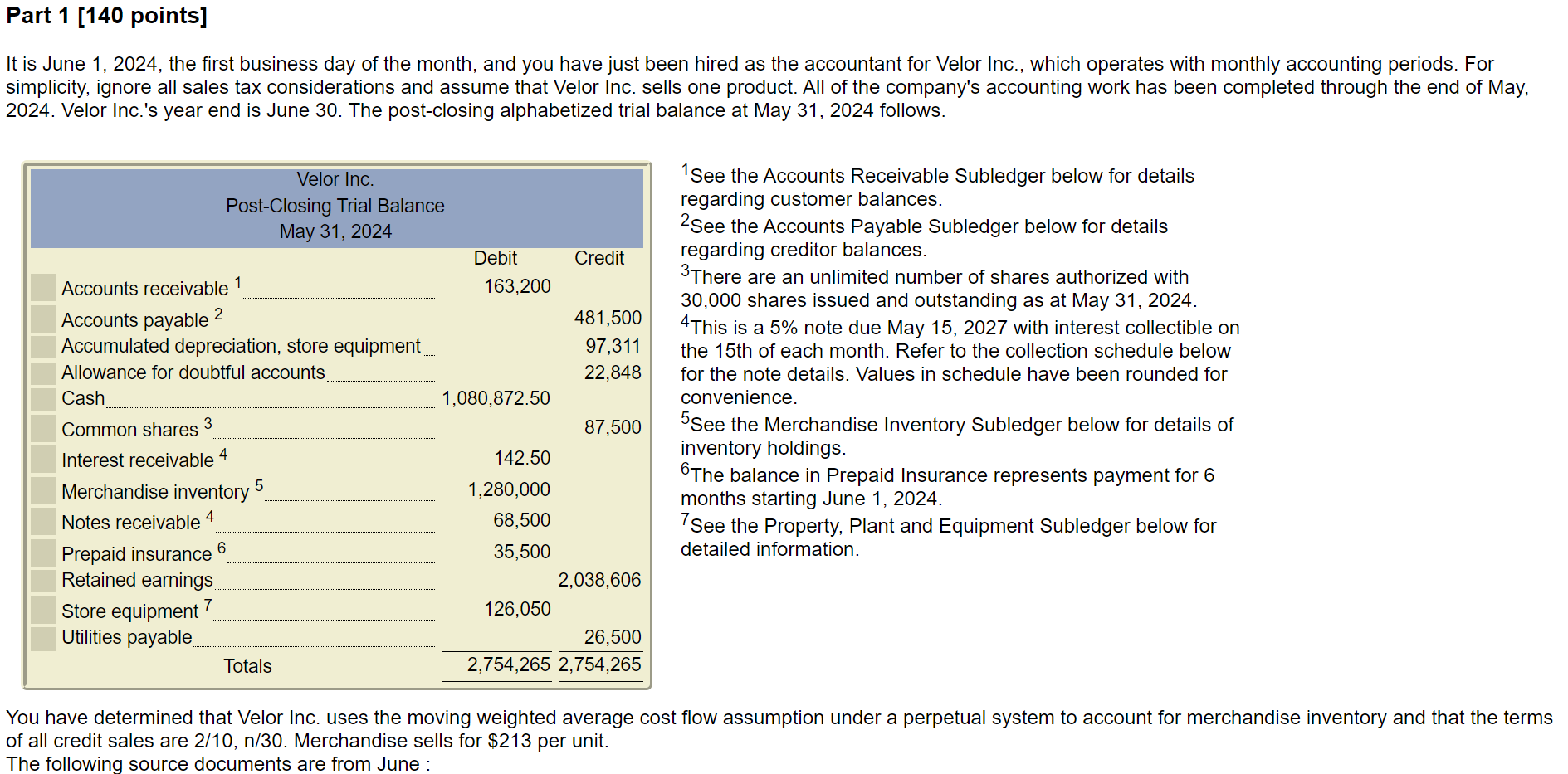

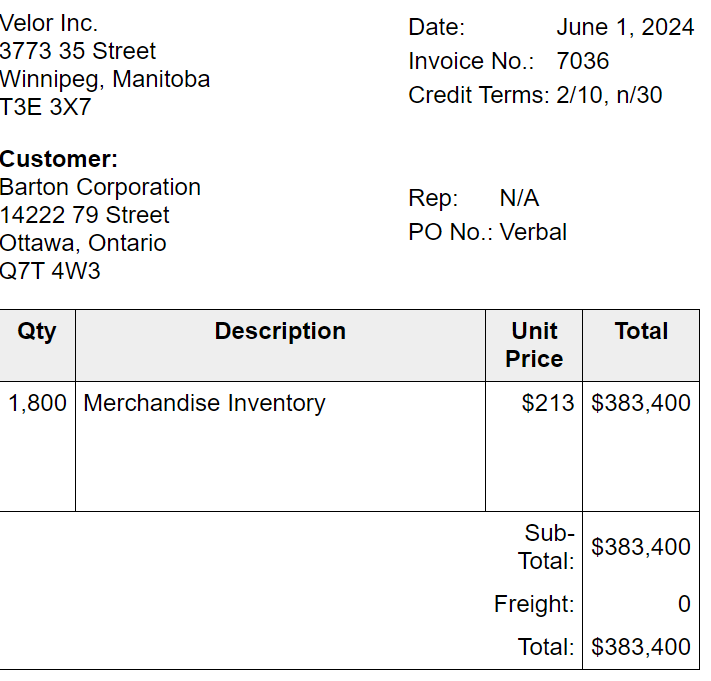

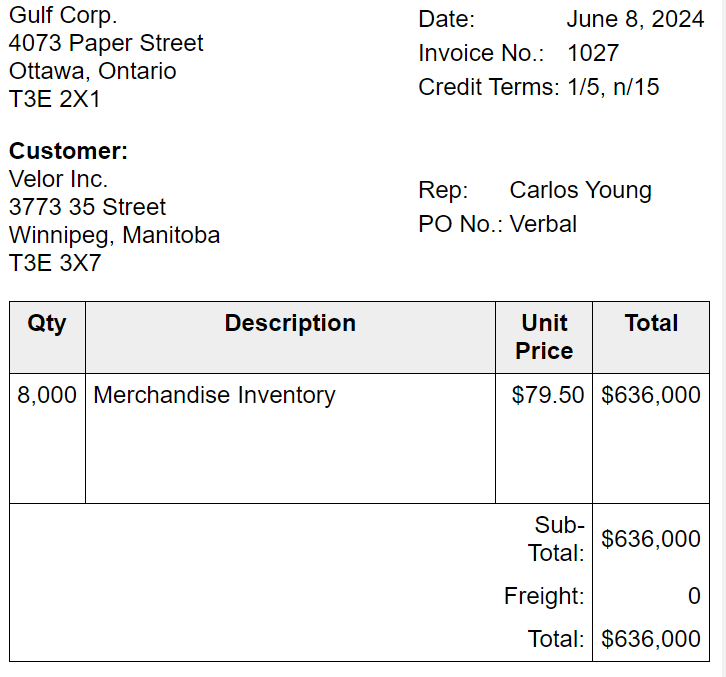

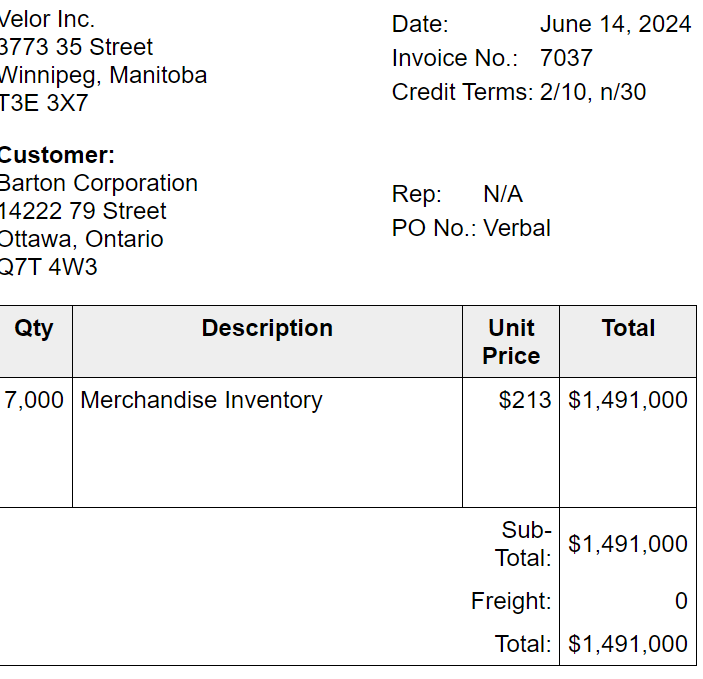

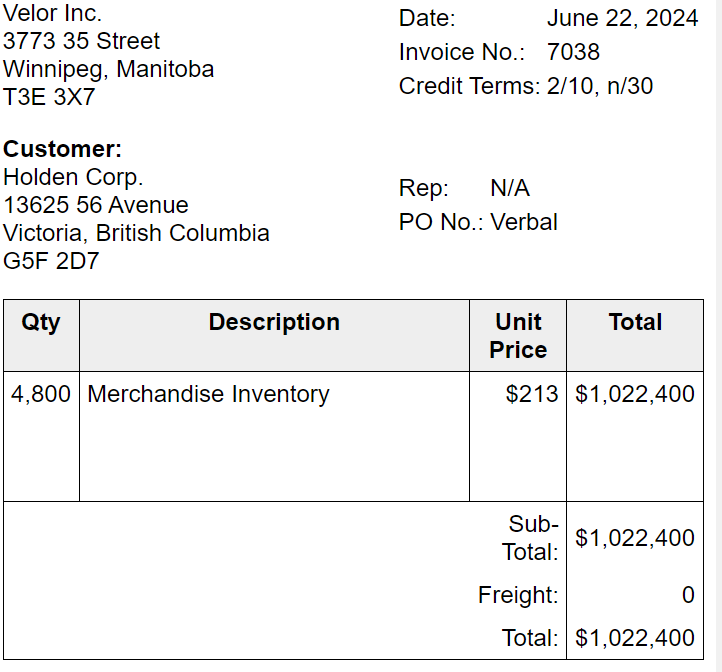

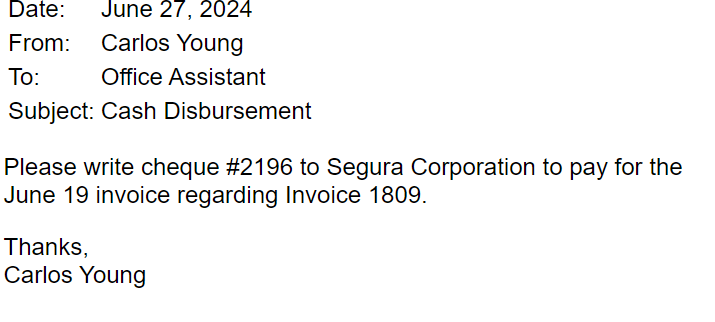

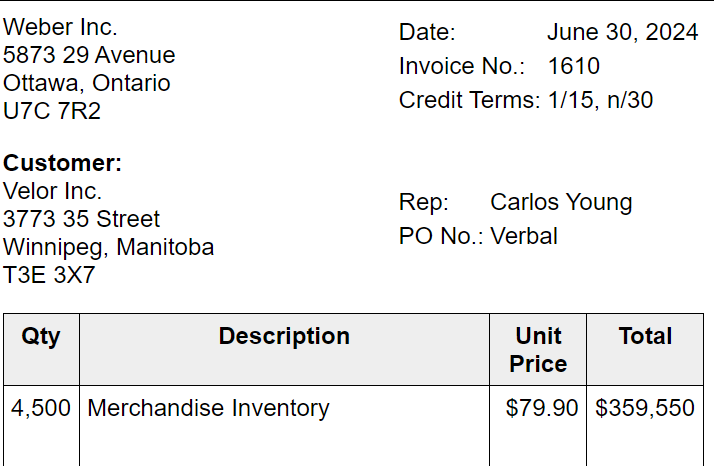

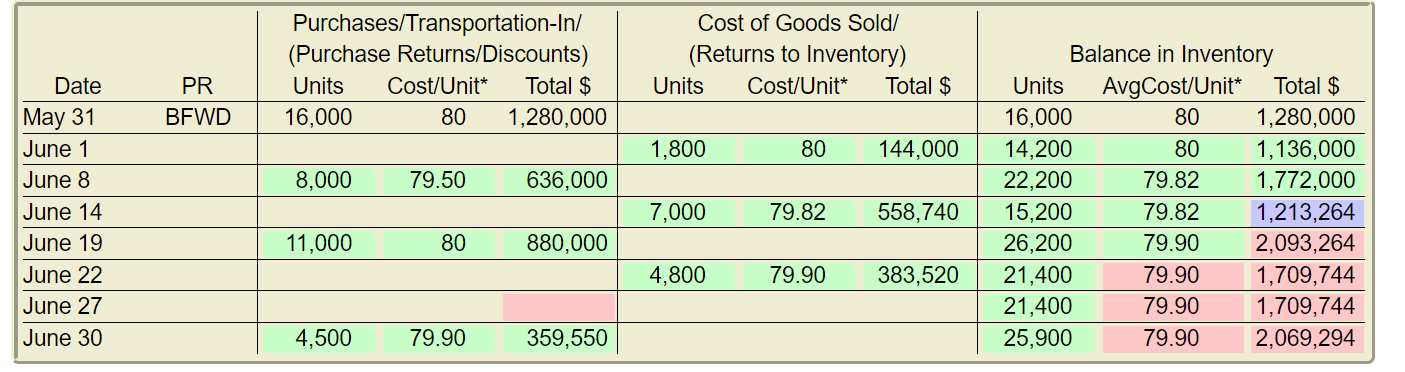

Gulf Corp. 4073 Paper Street Ottawa, Ontario T3E 2X1 Customer: Velor Inc. 377335 Street Winnipeg, Manitoba T3E 3X7 Date: June 8, 2024 Invoice No.: 1027 Credit Terms: 1/5, n/15 Rep: Carlos Young PO No.: Verbal \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 8,000 & Merchandise Inventory & $79.50 & $636,000 \\ & & & \\ \hline & Sub- & $636,000 \\ & Total: & \\ & & Freight: & 0 \\ & & Total: & $636,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \begin{tabular}{l} elor Inc. \\ 77335 Street \\ linnipeg, Manitoba \\ 3E 37 \end{tabular} & \begin{tabular}{l} Date: June 1,2024 \\ Invoice No.: 7036 \\ Credit Terms: 2/10,n/30 \end{tabular} \\ \hline 9 Street & \begin{tabular}{l} Rep: N/A \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} Q7T 4W3 \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 1,800 & Merchandise Inventory & $213 & $383,400 \\ & & & \\ \hline & \begin{tabular}{r} Sub- \\ Total: \end{tabular} & $383,400 \\ & Freight: & 0 \\ & Total: & $383,400 \\ \hline \end{tabular} Please write cheque \#2196 to Segura Corporation to pay for the June 19 invoice regarding Invoice 1809. Thanks, Carlos Young \begin{tabular}{|c|c|} \hline \begin{tabular}{l} Weber Inc. \\ 587329 Avenue \\ Ottawa, Ontario \\ U7C 7R2 \end{tabular} & \begin{tabular}{ll} Date: & June 30,2024 \\ Invoice No.: & 1610 \\ Credit Terms: & 1/15,n/30 \end{tabular} \\ \hline \begin{tabular}{l} Customer: \\ Velor Inc. \\ 377335 Street \\ Winnipeg, Manitoba \end{tabular} & \begin{tabular}{l} Rep: Carlos Young \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} T3E 3X7 \begin{tabular}{|c|l|c|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,500 & Merchandise Inventory & $79.90 & $359,550 \\ \hline \end{tabular} velor Inc. 377335 Street Ninnipeg, Manitoba T3E 3X7 Customer: Barton Corporation 1422279 Street Ottawa, Ontario Q7T 4W3 Date: June 14,2024 Invoice No.: 7037 Credit Terms: 2/10, n/30 Rep: N/A PO No.: Verbal \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 7,000 & Merchandise Inventory & $213 & $1,491,000 \\ & & & \\ \hline & Sub- & $1,491,000 \\ & Freight: & 0 \\ & Total: & $1,491,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multirow[b]{2}{*}{ PR } & \multicolumn{3}{|c|}{\begin{tabular}{l} Purchases/Transportation-In/ \\ (Purchase Returns/Discounts) \end{tabular}} & \multicolumn{3}{|c|}{\begin{tabular}{l} Cost of Goods Sold/ \\ (Returns to Inventory) \end{tabular}} & \multicolumn{3}{|c|}{ Balance in Inventory } \\ \hline & & Units & Cost/Unit* & Total \$ & Units & Cost/Unit* & Total \$ & Units & AvgCost/Unit* & Total \$ \\ \hline May 31 & BFWD & 16,000 & 80 & 1,280,000 & & & & 16,000 & 80 & 1,280,000 \\ \hline June 1 & & & & & 1,800 & 80 & 144,000 & 14,200 & 80 & 1,136,000 \\ \hline June 8 & & 8,000 & 79.50 & 636,000 & & & & 22,200 & 79.82 & 1,772,000 \\ \hline June 14 & & & & & 7,000 & 79.82 & 558,740 & 15,200 & 79.82 & 1,213,264 \\ \hline June 19 & & 11,000 & 80 & 880,000 & & & & 26,200 & 79.90 & 2,093,264 \\ \hline June 22 & & & & & 4,800 & 79.90 & 383,520 & 21,400 & 79.90 & 1,709,744 \\ \hline June 27 & & & & & & & & 21,400 & 79.90 & 1,709,744 \\ \hline June 30 & & 4,500 & 79.90 & 359,550 & & & & 25,900 & 79.90 & 2,069,294 \\ \hline \end{tabular} \begin{tabular}{ll} Velor Inc. & Date: June 22, 2024 \\ 3773 35 Street & Invoice No.: 7038 \\ Winnipeg, Manitoba & Credit Terms: 2/10, n/30 \\ T3E 3X7 & \\ Customer: & \\ Holden Corp. & Rep: N/A \\ 13625 56 Avenue & PO No.: Verbal \end{tabular} G5F 2D7 \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,800 & Merchandise Inventory & $213 & $1,022,400 \\ & & & \\ \hline & Sub- & $1,022,400 \\ & Total: & \\ & & Freight: & 0 \\ & Total: & $1,022,400 \\ \hline \end{tabular} It is June 1,2024 , the first business day of the month, and you have just been hired as the accountant for Velor Inc., which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Velor Inc. sells one product. All of the company's accounting work has been completed through the end of May, 2024. Velor Inc.'s year end is June 30. The post-closing alphabetized trial balance at May 31, 2024 follows. 1 See the Accounts Receivable Subledger below for details regarding customer balances. 2 See the Accounts Payable Subledger below for details regarding creditor balances. 3 There are an unlimited number of shares authorized with 30,000 shares issued and outstanding as at May 31, 2024. 4 This is a 5% note due May 15, 2027 with interest collectible on the 15th of each month. Refer to the collection schedule below for the note details. Values in schedule have been rounded for convenience. 5 See the Merchandise Inventory Subledger below for details of inventory holdings. 6 The balance in Prepaid Insurance represents payment for 6 months starting June 1, 2024. 7 See the Property, Plant and Equipment Subledger below for detailed information. You have determined that Velor Inc. uses the moving weighted average cost flow assumption under a perpetual system to account for merchandise inventory and that the terms of all credit sales are 2/10,n/30. Merchandise sells for $213 per unit. The following source documents are from June : Gulf Corp. 4073 Paper Street Ottawa, Ontario T3E 2X1 Customer: Velor Inc. 377335 Street Winnipeg, Manitoba T3E 3X7 Date: June 8, 2024 Invoice No.: 1027 Credit Terms: 1/5, n/15 Rep: Carlos Young PO No.: Verbal \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 8,000 & Merchandise Inventory & $79.50 & $636,000 \\ & & & \\ \hline & Sub- & $636,000 \\ & Total: & \\ & & Freight: & 0 \\ & & Total: & $636,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \begin{tabular}{l} elor Inc. \\ 77335 Street \\ linnipeg, Manitoba \\ 3E 37 \end{tabular} & \begin{tabular}{l} Date: June 1,2024 \\ Invoice No.: 7036 \\ Credit Terms: 2/10,n/30 \end{tabular} \\ \hline 9 Street & \begin{tabular}{l} Rep: N/A \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} Q7T 4W3 \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 1,800 & Merchandise Inventory & $213 & $383,400 \\ & & & \\ \hline & \begin{tabular}{r} Sub- \\ Total: \end{tabular} & $383,400 \\ & Freight: & 0 \\ & Total: & $383,400 \\ \hline \end{tabular} Please write cheque \#2196 to Segura Corporation to pay for the June 19 invoice regarding Invoice 1809. Thanks, Carlos Young \begin{tabular}{|c|c|} \hline \begin{tabular}{l} Weber Inc. \\ 587329 Avenue \\ Ottawa, Ontario \\ U7C 7R2 \end{tabular} & \begin{tabular}{ll} Date: & June 30,2024 \\ Invoice No.: & 1610 \\ Credit Terms: & 1/15,n/30 \end{tabular} \\ \hline \begin{tabular}{l} Customer: \\ Velor Inc. \\ 377335 Street \\ Winnipeg, Manitoba \end{tabular} & \begin{tabular}{l} Rep: Carlos Young \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} T3E 3X7 \begin{tabular}{|c|l|c|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,500 & Merchandise Inventory & $79.90 & $359,550 \\ \hline \end{tabular} velor Inc. 377335 Street Ninnipeg, Manitoba T3E 3X7 Customer: Barton Corporation 1422279 Street Ottawa, Ontario Q7T 4W3 Date: June 14,2024 Invoice No.: 7037 Credit Terms: 2/10, n/30 Rep: N/A PO No.: Verbal \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 7,000 & Merchandise Inventory & $213 & $1,491,000 \\ & & & \\ \hline & Sub- & $1,491,000 \\ & Freight: & 0 \\ & Total: & $1,491,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multirow[b]{2}{*}{ PR } & \multicolumn{3}{|c|}{\begin{tabular}{l} Purchases/Transportation-In/ \\ (Purchase Returns/Discounts) \end{tabular}} & \multicolumn{3}{|c|}{\begin{tabular}{l} Cost of Goods Sold/ \\ (Returns to Inventory) \end{tabular}} & \multicolumn{3}{|c|}{ Balance in Inventory } \\ \hline & & Units & Cost/Unit* & Total \$ & Units & Cost/Unit* & Total \$ & Units & AvgCost/Unit* & Total \$ \\ \hline May 31 & BFWD & 16,000 & 80 & 1,280,000 & & & & 16,000 & 80 & 1,280,000 \\ \hline June 1 & & & & & 1,800 & 80 & 144,000 & 14,200 & 80 & 1,136,000 \\ \hline June 8 & & 8,000 & 79.50 & 636,000 & & & & 22,200 & 79.82 & 1,772,000 \\ \hline June 14 & & & & & 7,000 & 79.82 & 558,740 & 15,200 & 79.82 & 1,213,264 \\ \hline June 19 & & 11,000 & 80 & 880,000 & & & & 26,200 & 79.90 & 2,093,264 \\ \hline June 22 & & & & & 4,800 & 79.90 & 383,520 & 21,400 & 79.90 & 1,709,744 \\ \hline June 27 & & & & & & & & 21,400 & 79.90 & 1,709,744 \\ \hline June 30 & & 4,500 & 79.90 & 359,550 & & & & 25,900 & 79.90 & 2,069,294 \\ \hline \end{tabular} \begin{tabular}{ll} Velor Inc. & Date: June 22, 2024 \\ 3773 35 Street & Invoice No.: 7038 \\ Winnipeg, Manitoba & Credit Terms: 2/10, n/30 \\ T3E 3X7 & \\ Customer: & \\ Holden Corp. & Rep: N/A \\ 13625 56 Avenue & PO No.: Verbal \end{tabular} G5F 2D7 \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,800 & Merchandise Inventory & $213 & $1,022,400 \\ & & & \\ \hline & Sub- & $1,022,400 \\ & Total: & \\ & & Freight: & 0 \\ & Total: & $1,022,400 \\ \hline \end{tabular} It is June 1,2024 , the first business day of the month, and you have just been hired as the accountant for Velor Inc., which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Velor Inc. sells one product. All of the company's accounting work has been completed through the end of May, 2024. Velor Inc.'s year end is June 30. The post-closing alphabetized trial balance at May 31, 2024 follows. 1 See the Accounts Receivable Subledger below for details regarding customer balances. 2 See the Accounts Payable Subledger below for details regarding creditor balances. 3 There are an unlimited number of shares authorized with 30,000 shares issued and outstanding as at May 31, 2024. 4 This is a 5% note due May 15, 2027 with interest collectible on the 15th of each month. Refer to the collection schedule below for the note details. Values in schedule have been rounded for convenience. 5 See the Merchandise Inventory Subledger below for details of inventory holdings. 6 The balance in Prepaid Insurance represents payment for 6 months starting June 1, 2024. 7 See the Property, Plant and Equipment Subledger below for detailed information. You have determined that Velor Inc. uses the moving weighted average cost flow assumption under a perpetual system to account for merchandise inventory and that the terms of all credit sales are 2/10,n/30. Merchandise sells for $213 per unit. The following source documents are from June

Gulf Corp. 4073 Paper Street Ottawa, Ontario T3E 2X1 Customer: Velor Inc. 377335 Street Winnipeg, Manitoba T3E 3X7 Date: June 8, 2024 Invoice No.: 1027 Credit Terms: 1/5, n/15 Rep: Carlos Young PO No.: Verbal \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 8,000 & Merchandise Inventory & $79.50 & $636,000 \\ & & & \\ \hline & Sub- & $636,000 \\ & Total: & \\ & & Freight: & 0 \\ & & Total: & $636,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \begin{tabular}{l} elor Inc. \\ 77335 Street \\ linnipeg, Manitoba \\ 3E 37 \end{tabular} & \begin{tabular}{l} Date: June 1,2024 \\ Invoice No.: 7036 \\ Credit Terms: 2/10,n/30 \end{tabular} \\ \hline 9 Street & \begin{tabular}{l} Rep: N/A \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} Q7T 4W3 \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 1,800 & Merchandise Inventory & $213 & $383,400 \\ & & & \\ \hline & \begin{tabular}{r} Sub- \\ Total: \end{tabular} & $383,400 \\ & Freight: & 0 \\ & Total: & $383,400 \\ \hline \end{tabular} Please write cheque \#2196 to Segura Corporation to pay for the June 19 invoice regarding Invoice 1809. Thanks, Carlos Young \begin{tabular}{|c|c|} \hline \begin{tabular}{l} Weber Inc. \\ 587329 Avenue \\ Ottawa, Ontario \\ U7C 7R2 \end{tabular} & \begin{tabular}{ll} Date: & June 30,2024 \\ Invoice No.: & 1610 \\ Credit Terms: & 1/15,n/30 \end{tabular} \\ \hline \begin{tabular}{l} Customer: \\ Velor Inc. \\ 377335 Street \\ Winnipeg, Manitoba \end{tabular} & \begin{tabular}{l} Rep: Carlos Young \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} T3E 3X7 \begin{tabular}{|c|l|c|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,500 & Merchandise Inventory & $79.90 & $359,550 \\ \hline \end{tabular} velor Inc. 377335 Street Ninnipeg, Manitoba T3E 3X7 Customer: Barton Corporation 1422279 Street Ottawa, Ontario Q7T 4W3 Date: June 14,2024 Invoice No.: 7037 Credit Terms: 2/10, n/30 Rep: N/A PO No.: Verbal \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 7,000 & Merchandise Inventory & $213 & $1,491,000 \\ & & & \\ \hline & Sub- & $1,491,000 \\ & Freight: & 0 \\ & Total: & $1,491,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multirow[b]{2}{*}{ PR } & \multicolumn{3}{|c|}{\begin{tabular}{l} Purchases/Transportation-In/ \\ (Purchase Returns/Discounts) \end{tabular}} & \multicolumn{3}{|c|}{\begin{tabular}{l} Cost of Goods Sold/ \\ (Returns to Inventory) \end{tabular}} & \multicolumn{3}{|c|}{ Balance in Inventory } \\ \hline & & Units & Cost/Unit* & Total \$ & Units & Cost/Unit* & Total \$ & Units & AvgCost/Unit* & Total \$ \\ \hline May 31 & BFWD & 16,000 & 80 & 1,280,000 & & & & 16,000 & 80 & 1,280,000 \\ \hline June 1 & & & & & 1,800 & 80 & 144,000 & 14,200 & 80 & 1,136,000 \\ \hline June 8 & & 8,000 & 79.50 & 636,000 & & & & 22,200 & 79.82 & 1,772,000 \\ \hline June 14 & & & & & 7,000 & 79.82 & 558,740 & 15,200 & 79.82 & 1,213,264 \\ \hline June 19 & & 11,000 & 80 & 880,000 & & & & 26,200 & 79.90 & 2,093,264 \\ \hline June 22 & & & & & 4,800 & 79.90 & 383,520 & 21,400 & 79.90 & 1,709,744 \\ \hline June 27 & & & & & & & & 21,400 & 79.90 & 1,709,744 \\ \hline June 30 & & 4,500 & 79.90 & 359,550 & & & & 25,900 & 79.90 & 2,069,294 \\ \hline \end{tabular} \begin{tabular}{ll} Velor Inc. & Date: June 22, 2024 \\ 3773 35 Street & Invoice No.: 7038 \\ Winnipeg, Manitoba & Credit Terms: 2/10, n/30 \\ T3E 3X7 & \\ Customer: & \\ Holden Corp. & Rep: N/A \\ 13625 56 Avenue & PO No.: Verbal \end{tabular} G5F 2D7 \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,800 & Merchandise Inventory & $213 & $1,022,400 \\ & & & \\ \hline & Sub- & $1,022,400 \\ & Total: & \\ & & Freight: & 0 \\ & Total: & $1,022,400 \\ \hline \end{tabular} It is June 1,2024 , the first business day of the month, and you have just been hired as the accountant for Velor Inc., which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Velor Inc. sells one product. All of the company's accounting work has been completed through the end of May, 2024. Velor Inc.'s year end is June 30. The post-closing alphabetized trial balance at May 31, 2024 follows. 1 See the Accounts Receivable Subledger below for details regarding customer balances. 2 See the Accounts Payable Subledger below for details regarding creditor balances. 3 There are an unlimited number of shares authorized with 30,000 shares issued and outstanding as at May 31, 2024. 4 This is a 5% note due May 15, 2027 with interest collectible on the 15th of each month. Refer to the collection schedule below for the note details. Values in schedule have been rounded for convenience. 5 See the Merchandise Inventory Subledger below for details of inventory holdings. 6 The balance in Prepaid Insurance represents payment for 6 months starting June 1, 2024. 7 See the Property, Plant and Equipment Subledger below for detailed information. You have determined that Velor Inc. uses the moving weighted average cost flow assumption under a perpetual system to account for merchandise inventory and that the terms of all credit sales are 2/10,n/30. Merchandise sells for $213 per unit. The following source documents are from June : Gulf Corp. 4073 Paper Street Ottawa, Ontario T3E 2X1 Customer: Velor Inc. 377335 Street Winnipeg, Manitoba T3E 3X7 Date: June 8, 2024 Invoice No.: 1027 Credit Terms: 1/5, n/15 Rep: Carlos Young PO No.: Verbal \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 8,000 & Merchandise Inventory & $79.50 & $636,000 \\ & & & \\ \hline & Sub- & $636,000 \\ & Total: & \\ & & Freight: & 0 \\ & & Total: & $636,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \begin{tabular}{l} elor Inc. \\ 77335 Street \\ linnipeg, Manitoba \\ 3E 37 \end{tabular} & \begin{tabular}{l} Date: June 1,2024 \\ Invoice No.: 7036 \\ Credit Terms: 2/10,n/30 \end{tabular} \\ \hline 9 Street & \begin{tabular}{l} Rep: N/A \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} Q7T 4W3 \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 1,800 & Merchandise Inventory & $213 & $383,400 \\ & & & \\ \hline & \begin{tabular}{r} Sub- \\ Total: \end{tabular} & $383,400 \\ & Freight: & 0 \\ & Total: & $383,400 \\ \hline \end{tabular} Please write cheque \#2196 to Segura Corporation to pay for the June 19 invoice regarding Invoice 1809. Thanks, Carlos Young \begin{tabular}{|c|c|} \hline \begin{tabular}{l} Weber Inc. \\ 587329 Avenue \\ Ottawa, Ontario \\ U7C 7R2 \end{tabular} & \begin{tabular}{ll} Date: & June 30,2024 \\ Invoice No.: & 1610 \\ Credit Terms: & 1/15,n/30 \end{tabular} \\ \hline \begin{tabular}{l} Customer: \\ Velor Inc. \\ 377335 Street \\ Winnipeg, Manitoba \end{tabular} & \begin{tabular}{l} Rep: Carlos Young \\ PO No.: Verbal \end{tabular} \\ \hline \end{tabular} T3E 3X7 \begin{tabular}{|c|l|c|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,500 & Merchandise Inventory & $79.90 & $359,550 \\ \hline \end{tabular} velor Inc. 377335 Street Ninnipeg, Manitoba T3E 3X7 Customer: Barton Corporation 1422279 Street Ottawa, Ontario Q7T 4W3 Date: June 14,2024 Invoice No.: 7037 Credit Terms: 2/10, n/30 Rep: N/A PO No.: Verbal \begin{tabular}{|l|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 7,000 & Merchandise Inventory & $213 & $1,491,000 \\ & & & \\ \hline & Sub- & $1,491,000 \\ & Freight: & 0 \\ & Total: & $1,491,000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{ Date } & \multirow[b]{2}{*}{ PR } & \multicolumn{3}{|c|}{\begin{tabular}{l} Purchases/Transportation-In/ \\ (Purchase Returns/Discounts) \end{tabular}} & \multicolumn{3}{|c|}{\begin{tabular}{l} Cost of Goods Sold/ \\ (Returns to Inventory) \end{tabular}} & \multicolumn{3}{|c|}{ Balance in Inventory } \\ \hline & & Units & Cost/Unit* & Total \$ & Units & Cost/Unit* & Total \$ & Units & AvgCost/Unit* & Total \$ \\ \hline May 31 & BFWD & 16,000 & 80 & 1,280,000 & & & & 16,000 & 80 & 1,280,000 \\ \hline June 1 & & & & & 1,800 & 80 & 144,000 & 14,200 & 80 & 1,136,000 \\ \hline June 8 & & 8,000 & 79.50 & 636,000 & & & & 22,200 & 79.82 & 1,772,000 \\ \hline June 14 & & & & & 7,000 & 79.82 & 558,740 & 15,200 & 79.82 & 1,213,264 \\ \hline June 19 & & 11,000 & 80 & 880,000 & & & & 26,200 & 79.90 & 2,093,264 \\ \hline June 22 & & & & & 4,800 & 79.90 & 383,520 & 21,400 & 79.90 & 1,709,744 \\ \hline June 27 & & & & & & & & 21,400 & 79.90 & 1,709,744 \\ \hline June 30 & & 4,500 & 79.90 & 359,550 & & & & 25,900 & 79.90 & 2,069,294 \\ \hline \end{tabular} \begin{tabular}{ll} Velor Inc. & Date: June 22, 2024 \\ 3773 35 Street & Invoice No.: 7038 \\ Winnipeg, Manitoba & Credit Terms: 2/10, n/30 \\ T3E 3X7 & \\ Customer: & \\ Holden Corp. & Rep: N/A \\ 13625 56 Avenue & PO No.: Verbal \end{tabular} G5F 2D7 \begin{tabular}{|r|l|r|c|} \hline Qty & \multicolumn{1}{|c|}{ Description } & \begin{tabular}{c} Unit \\ Price \end{tabular} & Total \\ \hline 4,800 & Merchandise Inventory & $213 & $1,022,400 \\ & & & \\ \hline & Sub- & $1,022,400 \\ & Total: & \\ & & Freight: & 0 \\ & Total: & $1,022,400 \\ \hline \end{tabular} It is June 1,2024 , the first business day of the month, and you have just been hired as the accountant for Velor Inc., which operates with monthly accounting periods. For simplicity, ignore all sales tax considerations and assume that Velor Inc. sells one product. All of the company's accounting work has been completed through the end of May, 2024. Velor Inc.'s year end is June 30. The post-closing alphabetized trial balance at May 31, 2024 follows. 1 See the Accounts Receivable Subledger below for details regarding customer balances. 2 See the Accounts Payable Subledger below for details regarding creditor balances. 3 There are an unlimited number of shares authorized with 30,000 shares issued and outstanding as at May 31, 2024. 4 This is a 5% note due May 15, 2027 with interest collectible on the 15th of each month. Refer to the collection schedule below for the note details. Values in schedule have been rounded for convenience. 5 See the Merchandise Inventory Subledger below for details of inventory holdings. 6 The balance in Prepaid Insurance represents payment for 6 months starting June 1, 2024. 7 See the Property, Plant and Equipment Subledger below for detailed information. You have determined that Velor Inc. uses the moving weighted average cost flow assumption under a perpetual system to account for merchandise inventory and that the terms of all credit sales are 2/10,n/30. Merchandise sells for $213 per unit. The following source documents are from June Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started