Answered step by step

Verified Expert Solution

Question

1 Approved Answer

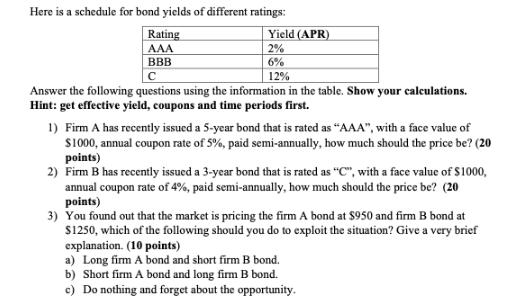

Here is a schedule for bond yields of different ratings: Rating AAA BBB Yield (APR) 2% 6% 12% Answer the following questions using the

Here is a schedule for bond yields of different ratings: Rating AAA BBB Yield (APR) 2% 6% 12% Answer the following questions using the information in the table. Show your calculations. Hint: get effective yield, coupons and time periods first. 1) Firm A has recently issued a 5-year bond that is rated as "AAA", with a face value of $1000, annual coupon rate of 5%, paid semi-annually, how much should the price be? (20 points) 2) Firm B has recently issued a 3-year bond that is rated as "C", with a face value of $1000, annual coupon rate of 4%, paid semi-annually, how much should the price be? (20 points) 3) You found out that the market is pricing the firm A bond at $950 and firm B bond at $1250, which of the following should you do to exploit the situation? Give a very brief explanation. (10 points) a) Long firm A bond and short firm B bond. b) Short firm A bond and long firm B bond. c) Do nothing and forget about the opportunity.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions we first need to calculate the effective yield coupon payments and time periods for each bond Firm A Bond Rating AAA Yield 2 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started