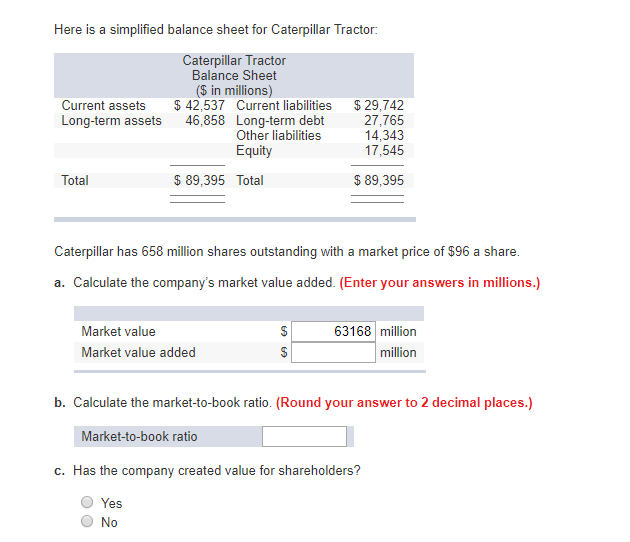

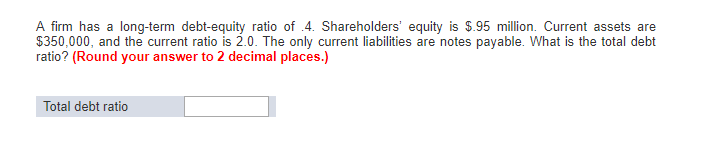

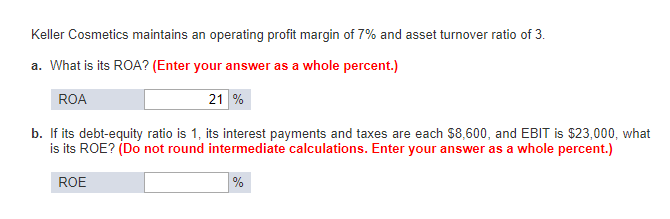

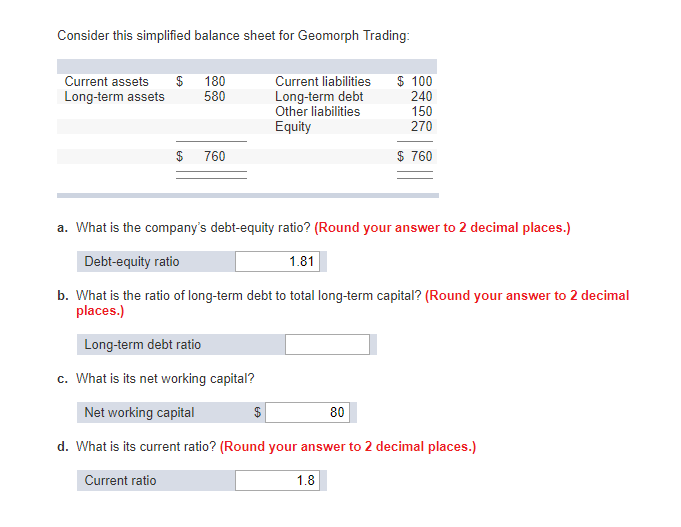

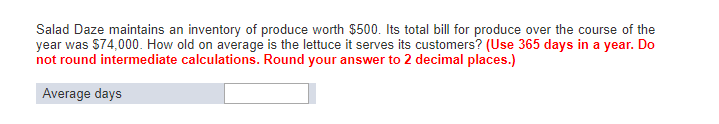

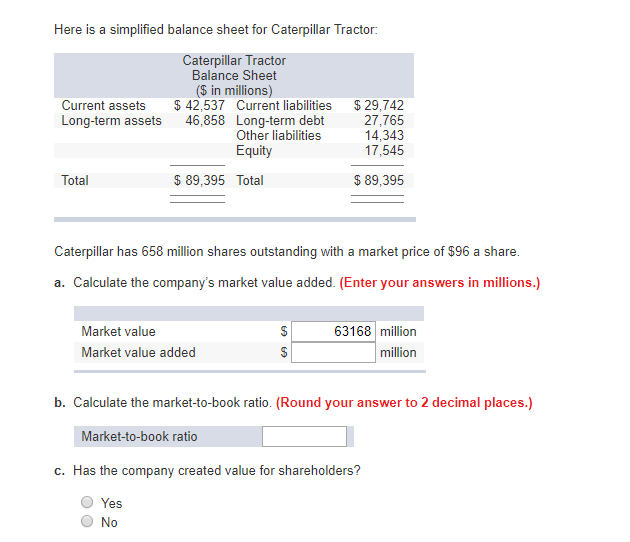

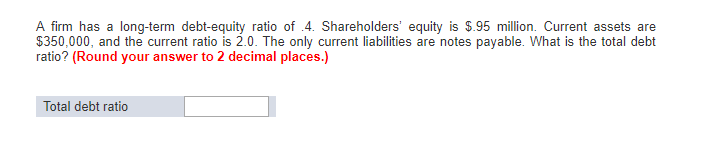

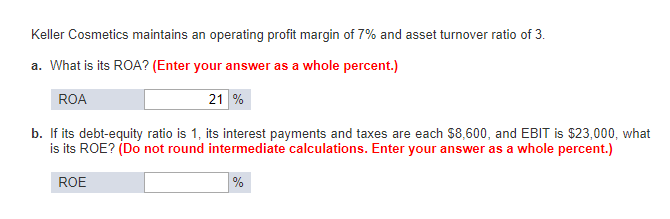

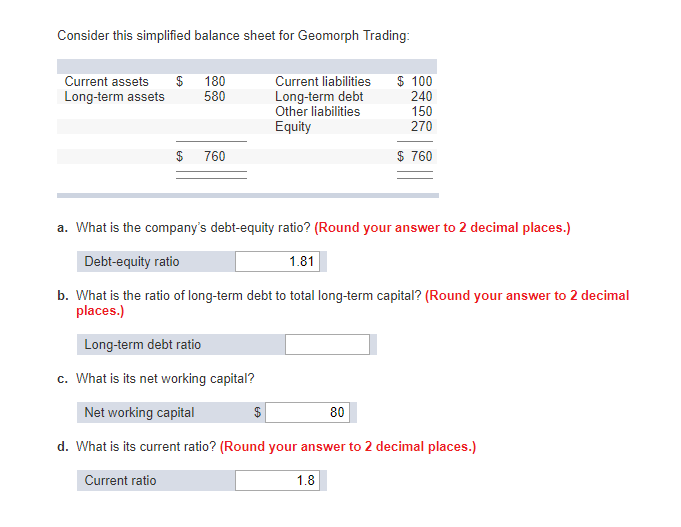

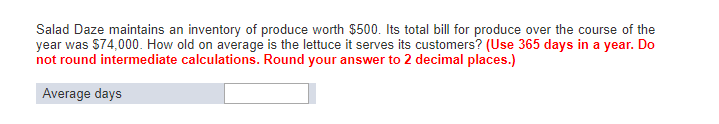

Here is a simplified balance sheet for Caterpillar Tractor: Caterpillar Tractor Balance Sheet (S in millions) Current assets $ 42,537 Current liabilities $29,742 27,765 14,343 17,545 Long-term assets 46,858 Long-term debt Other liabilities Equity Total $ 89,395 Total $ 89,395 Caterpillar has 658 million shares outstanding with a market price of $96 a share a. Calculate the company's market value added. (Enter your answers in millions.) Market value 63168 million Market value added million b. Calculate the market-to-book ratio. (Round your answer to 2 decimal places.) Market-to-book ratio c. Has the company created value for shareholders? O Yes 0 A firm has a long-term debt-equity ratio of .4. Shareholders' equity is $.95 million. Current assets are $350,000, and the current ratio is 2.0. The only current liabilities are notes payable. What is the total debt ratio? (Round your answer to 2 decimal places.) Total debt ratio Keller Cosmetics maintains an operating profit margin of 7% and asset turnover ratio of 3. a. What is its ROA? (Enter your answer as a whole percent.) ROA 21 % b. If its debt-equity ratio is 1, its interest payments and taxes are each $8,600, and EBIT is $23,000, what is its ROE? (Do not round intermediate calculations. Enter your answer as a whole percent.) ROE Consider this simplified balance sheet for Geomorph Trading Current assets $ 180 Long-term assets Current liabilities 100 240 150 270 580 Long-term debt Other liabilities Equity $ 760 $ 760 a. What is the company's debt-equity ratio? (Round your answer to 2 decimal places.) Debt-equity ratio 1.81 b. What is the ratio of long-term debt to total long-term capital? (Round your answer to 2 decimal places.) Long-term debt ratio c. What is its net working capital? Net working capital 80 d. What is its current ratio? (Round your answer to 2 decimal places.) Current ratio 1.8 Salad Daze maintains an inventory of produce worth $500. Its total bill for produce over the course of the year was $74,000. How old on average is the lettuce it serves its customers? (Use 365 days in a year. Do not round intermediate calculations. Round your answer to 2 decimal places.) Average days