Answered step by step

Verified Expert Solution

Question

1 Approved Answer

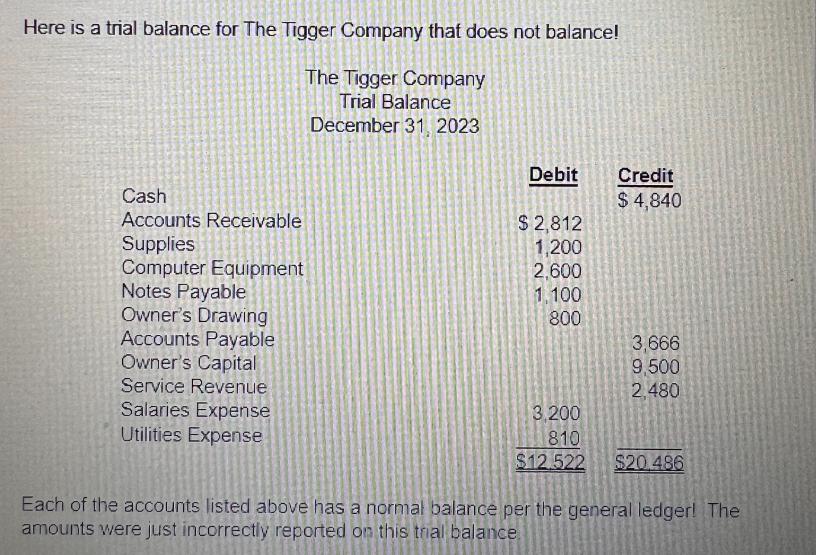

Here is a trial balance for The Tigger Company that does not balance! The Tigger Company Trial Balance December 31, 2023 Cash Accounts Receivable

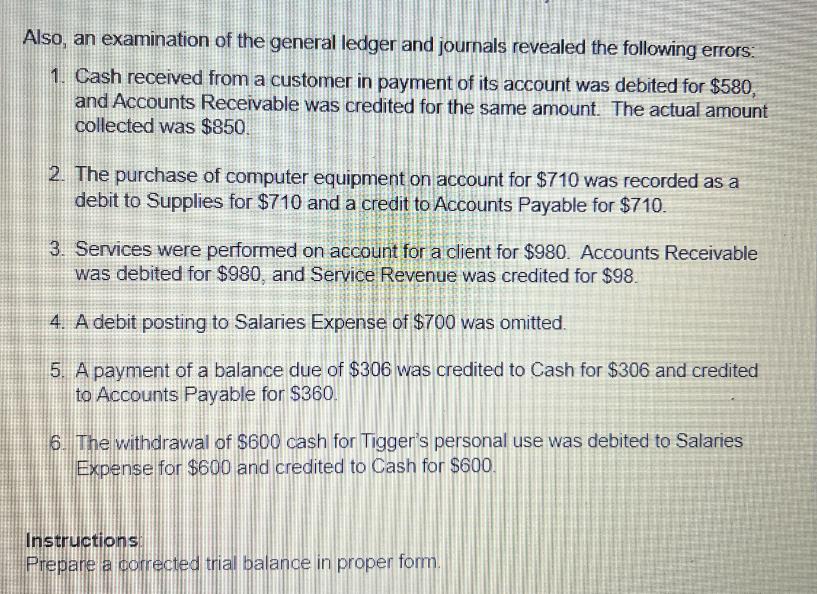

Here is a trial balance for The Tigger Company that does not balance! The Tigger Company Trial Balance December 31, 2023 Cash Accounts Receivable Supplies Computer Equipment Notes Payable Owner's Drawing Accounts Payable Owner's Capital Service Revenue Salaries Expense Utilities Expense Debit Credit $ 4,840 $2,812 1,200 2,600 1,100 800 3,666 9,500 2,480 3,200 810 $12.522 $20.486 Each of the accounts listed above has a normal balance per the general ledger! The amounts were just incorrectly reported on this trial balance Also, an examination of the general ledger and journals revealed the following errors: 1. Cash received from a customer in payment of its account was debited for $580, and Accounts Receivable was credited for the same amount. The actual amount collected was $850. 2. The purchase of computer equipment on account for $710 was recorded as a debit to Supplies for $710 and a credit to Accounts Payable for $710. 3. Services were performed on account for a client for $980. Accounts Receivable was debited for $980, and Service Revenue was credited for $98. 4. A debit posting to Salaries Expense of $700 was omitted. 5. A payment of a balance due of $306 was credited to Cash for $306 and credited to Accounts Payable for $360. 6. The withdrawal of $600 cash for Tigger's personal use was debited to Salaries Expense for $600 and credited to Cash for $600. Instructions Prepare a corrected trial balance in proper form.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started