Answered step by step

Verified Expert Solution

Question

1 Approved Answer

here is an example If Alchemax were all-equity financed, its annual income would be $4,814, and the required return rate of equity would be 12%.

here is an example

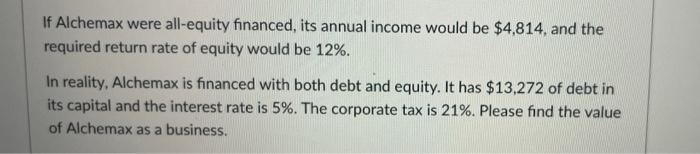

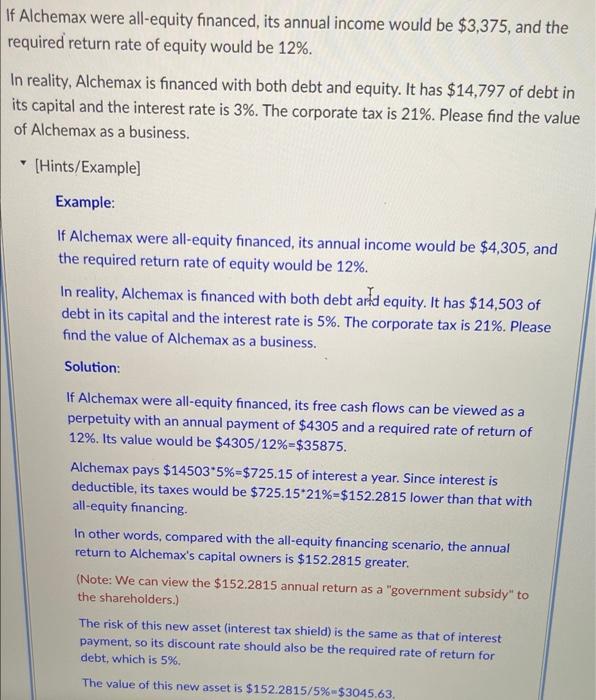

If Alchemax were all-equity financed, its annual income would be $4,814, and the required return rate of equity would be 12%. In reality, Alchemax is financed with both debt and equity. It has $13,272 of debt in its capital and the interest rate is 5%. The corporate tax is 21%. Please find the value of Alchemax as a business. If Alchemax were all-equity financed, its annual income would be $3,375, and the required return rate of equity would be 12%. In reality, Alchemax is financed with both debt and equity. It has $14,797 of debt in its capital and the interest rate is 3%. The corporate tax is 21%. Please find the value of Alchemax as a business. T [Hints/Example] Example: If Alchemax were all-equity financed, its annual income would be $4,305, and the required return rate of equity would be 12%. In reality, Alchemax is financed with both debt and equity. It has $14,503 of debt in its capital and the interest rate is 5%. The corporate tax is 21%. Please find the value of Alchemax as a business. Solution: If Alchemax were all-equity financed, its free cash flows can be viewed as a perpetuity with an annual payment of $4305 and a required rate of return of 12%. Its value would be $4305/12%-$35875. Alchemax pays $14503*5 % - $725.15 of interest a year. Since interest is deductible, its taxes would be $725.15*21%-$152.2815 lower than that with all-equity financing. In other words, compared with the all-equity financing scenario, the annual return to Alchemax's capital owners is $152.2815 greater. (Note: We can view the $152.2815 annual return as a "government subsidy" to the shareholders.) The risk of this new asset (interest tax shield) is the same as that of interest payment, so its discount rate should also be the required rate of return for debt, which is 5%. The value of this new asset is $152.2815/5 %-$3045.63

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started