Here is Part A, B and C

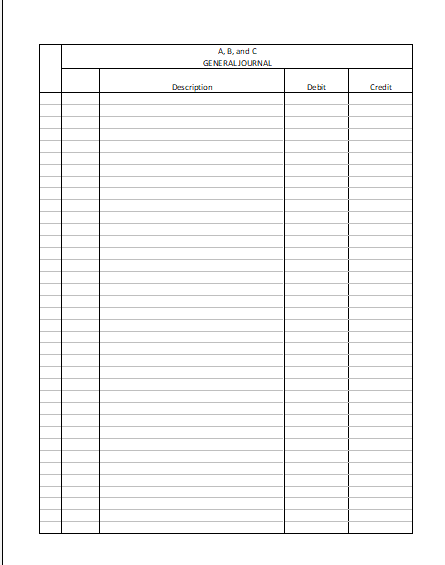

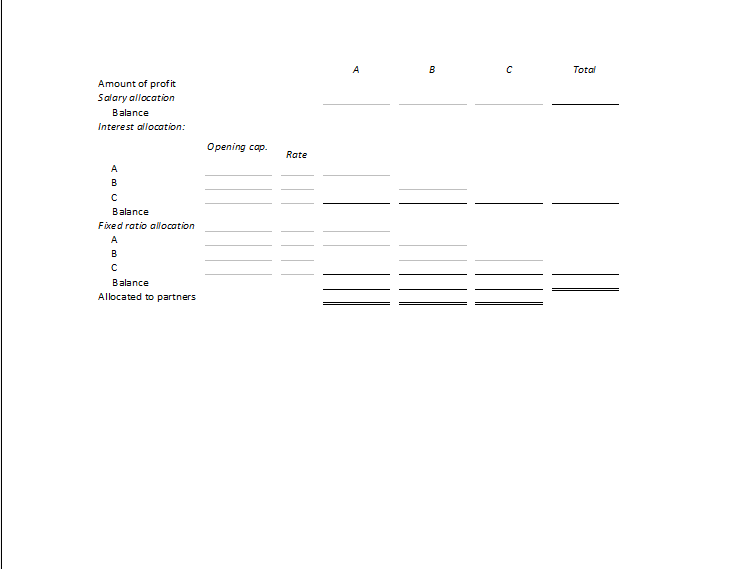

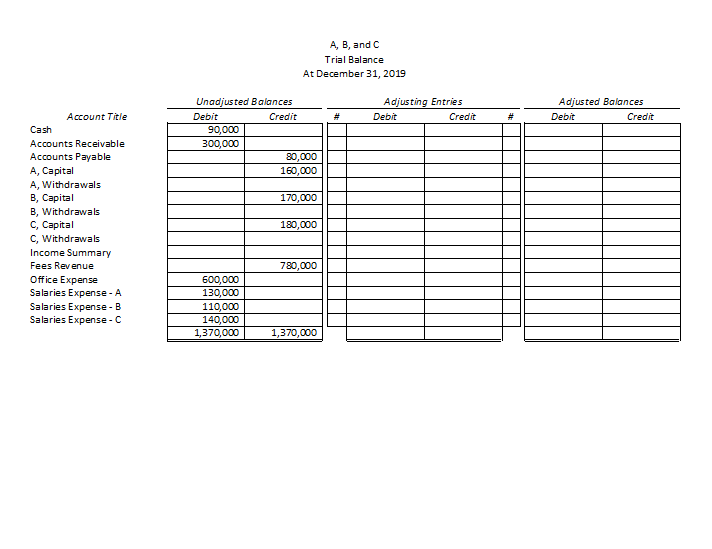

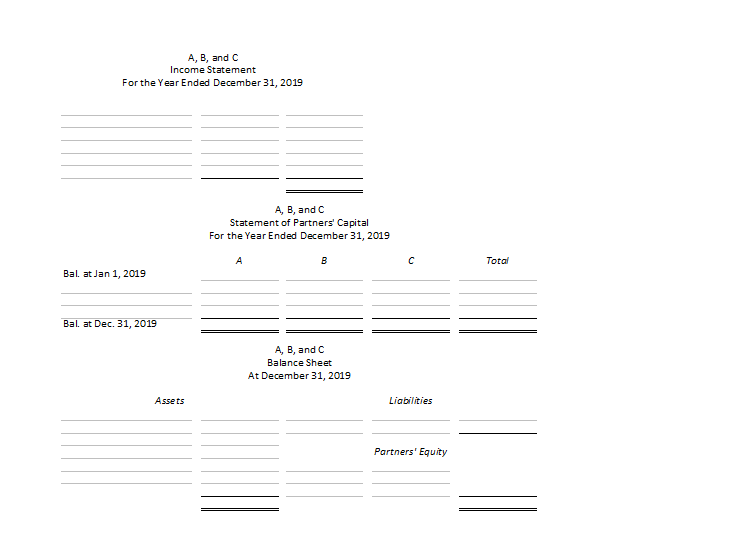

Here are the work pages for the problems

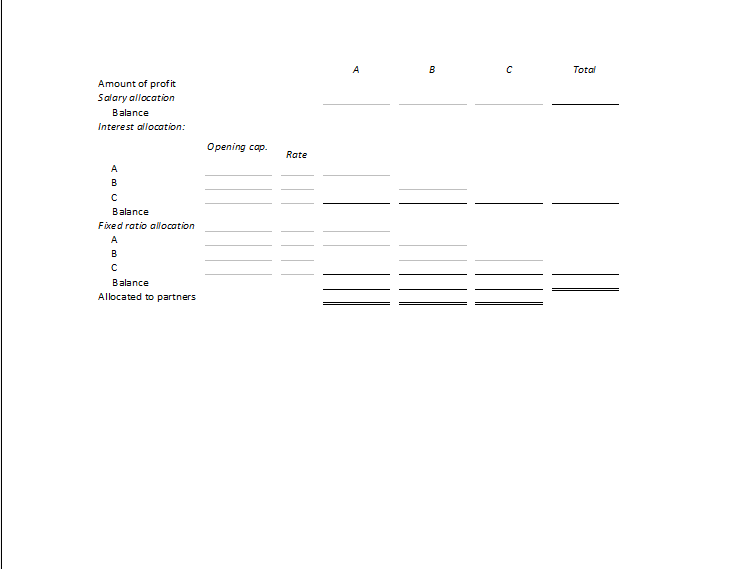

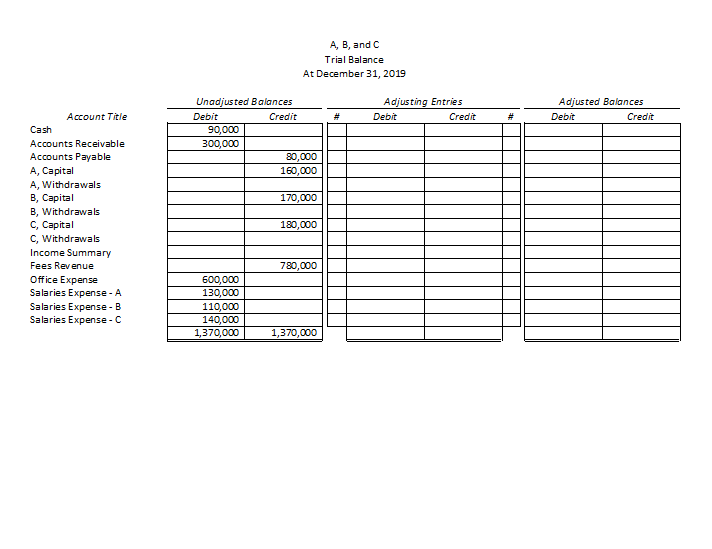

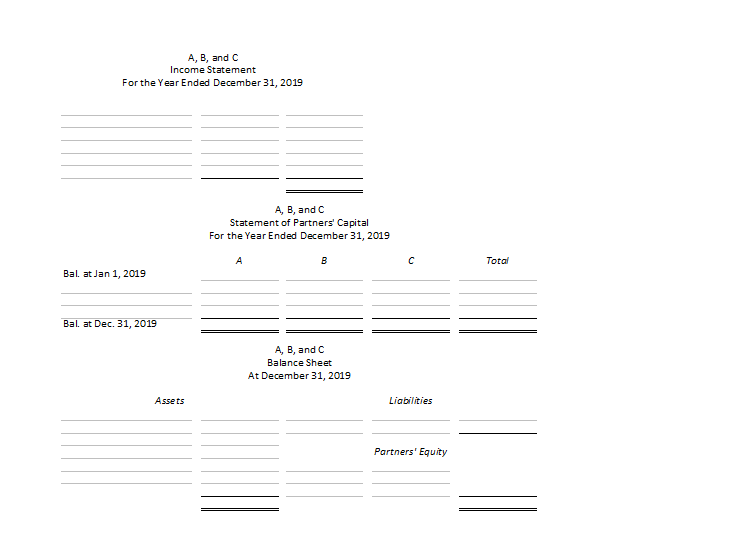

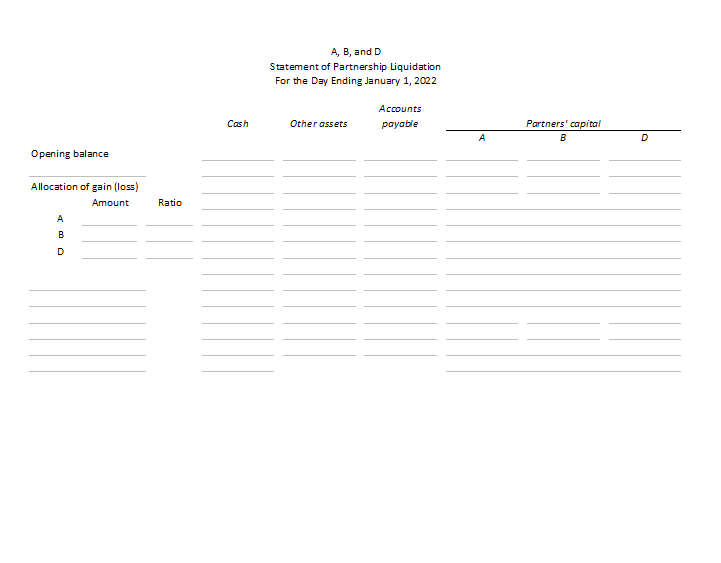

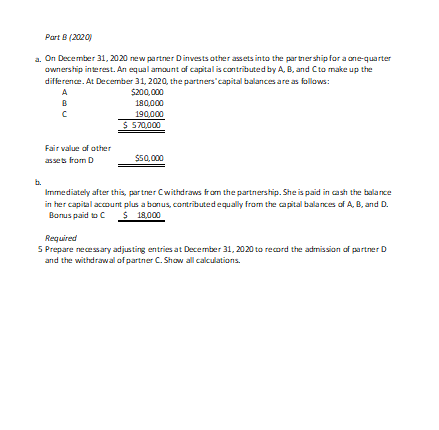

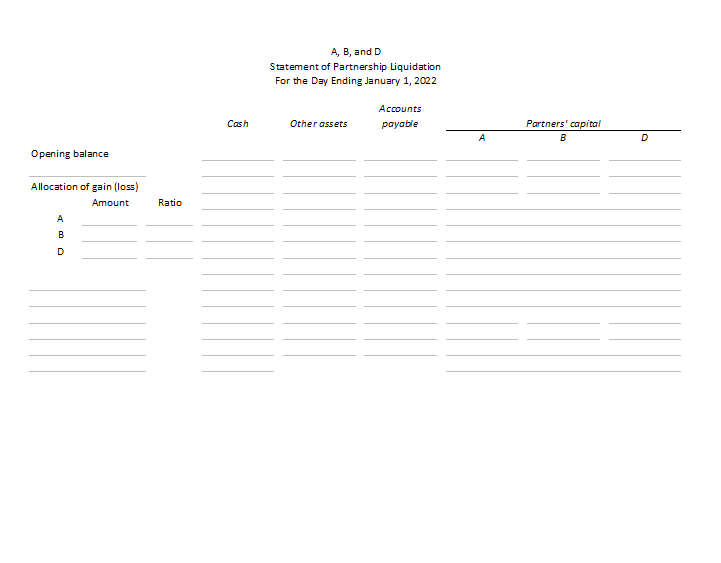

Part B (2020 a. On Decermber 31, 2020 new partner D inves ts other assets into the par trher ship for a one-quarter ownerstip interest.An equal armount af capital is contributed by A, B, and Cto make up the difference. At December 31, 2020, the partners capital balances are as fallaws 5200,000 180,000 190,000 5 570,000 Fair value of ather assets from D 550,000 mmediately after this, partner Cwithdraws fram the partnersthip. She is paid in cash the balance in her capital account plus a bonus, contributed equally from the pital balances of A, B, and D. Bonus paid to 18,000 Prepare necessary adjusting entries at December 31, 2020 to recard the adrmission of partnerD Part C (2021 and 2022) The trial balance of A, B, and D at December 31, 2021 after all adjustrments have been made is as follaws Adjus ted Balances Debit Acount Title Credft Cash Other Assets Accounts Payable A, Capital B, Capital C, Capital 83,000 0,000 140,000 .000 .000 9,000 163,000163,000 0 On lanuary 1, 2022 the partnershipis liquidated. 144,000 Other asses are sold for: Gains and lasses are liquidated in a ratio of Required G Print out the Part. Liqu."page (se tab be low. Complete the schedule. Assune any partner deficiency (debit balance)is repaid with cash by the appicable partner 7 Prepare hejournal entries torecard the liquidatian A, B, and C GENERALIOURNAL Description Credit A, B, and C GENERALIOURNAL Description A, B, and C GENERALIOURNAL Descriptian Debit Credit Total Amount of profit Salary allocation Balance Interest allocation Opening cap. Balance Fixed ratio allocation Balance Allocated to partners A, B, and C Trial Balance At December 31, 2019 Unadjusted Balances Debit Adjusting Entries Adjusted Balances Account Title Credit Credit Credit Cash Accounts Receivable Accounts Payable A, Capital A, Withdrawals B, Capital B, Withdrawals C, Capital C, Withdrawals Income Summary Fees Revenue Office Expense Salaries Expense- A Salaries Expense B Salaries Expense-C 80,000 160,000 180,000 780,000 110,000 140,000 1,370,000 1,370,000 A, B, and C Income Statement For the Year Ended December 31, 2019 A, B, and C Statement of Partners Capital For the Year Ended December 31, 2019 Total Bal at Jan 1,2019 A, B, and C Balance Sheet At December 31, 2019 Assets Liabilities Partners' Equity A, B, and D Statement of Partnership Liquidation For the Day Ending January 1, 2022 Accounts Cash Other assets payable Partners' capital Opening balance Allocation of gain (loss) Amount Ratio Part B (2020 a. On Decermber 31, 2020 new partner D inves ts other assets into the par trher ship for a one-quarter ownerstip interest.An equal armount af capital is contributed by A, B, and Cto make up the difference. At December 31, 2020, the partners capital balances are as fallaws 5200,000 180,000 190,000 5 570,000 Fair value of ather assets from D 550,000 mmediately after this, partner Cwithdraws fram the partnersthip. She is paid in cash the balance in her capital account plus a bonus, contributed equally from the pital balances of A, B, and D. Bonus paid to 18,000 Prepare necessary adjusting entries at December 31, 2020 to recard the adrmission of partnerD Part C (2021 and 2022) The trial balance of A, B, and D at December 31, 2021 after all adjustrments have been made is as follaws Adjus ted Balances Debit Acount Title Credft Cash Other Assets Accounts Payable A, Capital B, Capital C, Capital 83,000 0,000 140,000 .000 .000 9,000 163,000163,000 0 On lanuary 1, 2022 the partnershipis liquidated. 144,000 Other asses are sold for: Gains and lasses are liquidated in a ratio of Required G Print out the Part. Liqu."page (se tab be low. Complete the schedule. Assune any partner deficiency (debit balance)is repaid with cash by the appicable partner 7 Prepare hejournal entries torecard the liquidatian A, B, and C GENERALIOURNAL Description Credit A, B, and C GENERALIOURNAL Description A, B, and C GENERALIOURNAL Descriptian Debit Credit Total Amount of profit Salary allocation Balance Interest allocation Opening cap. Balance Fixed ratio allocation Balance Allocated to partners A, B, and C Trial Balance At December 31, 2019 Unadjusted Balances Debit Adjusting Entries Adjusted Balances Account Title Credit Credit Credit Cash Accounts Receivable Accounts Payable A, Capital A, Withdrawals B, Capital B, Withdrawals C, Capital C, Withdrawals Income Summary Fees Revenue Office Expense Salaries Expense- A Salaries Expense B Salaries Expense-C 80,000 160,000 180,000 780,000 110,000 140,000 1,370,000 1,370,000 A, B, and C Income Statement For the Year Ended December 31, 2019 A, B, and C Statement of Partners Capital For the Year Ended December 31, 2019 Total Bal at Jan 1,2019 A, B, and C Balance Sheet At December 31, 2019 Assets Liabilities Partners' Equity A, B, and D Statement of Partnership Liquidation For the Day Ending January 1, 2022 Accounts Cash Other assets payable Partners' capital Opening balance Allocation of gain (loss) Amount Ratio