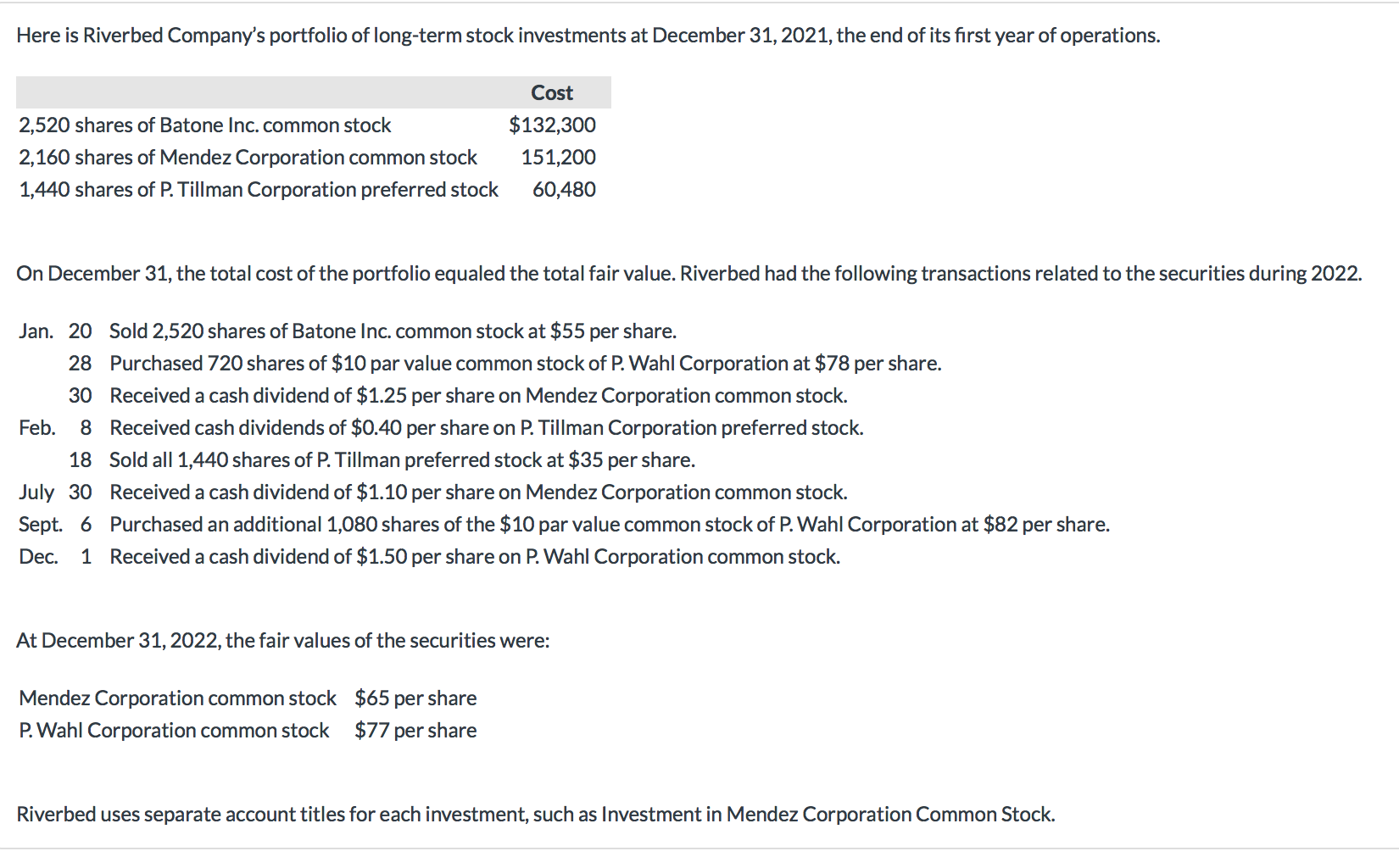

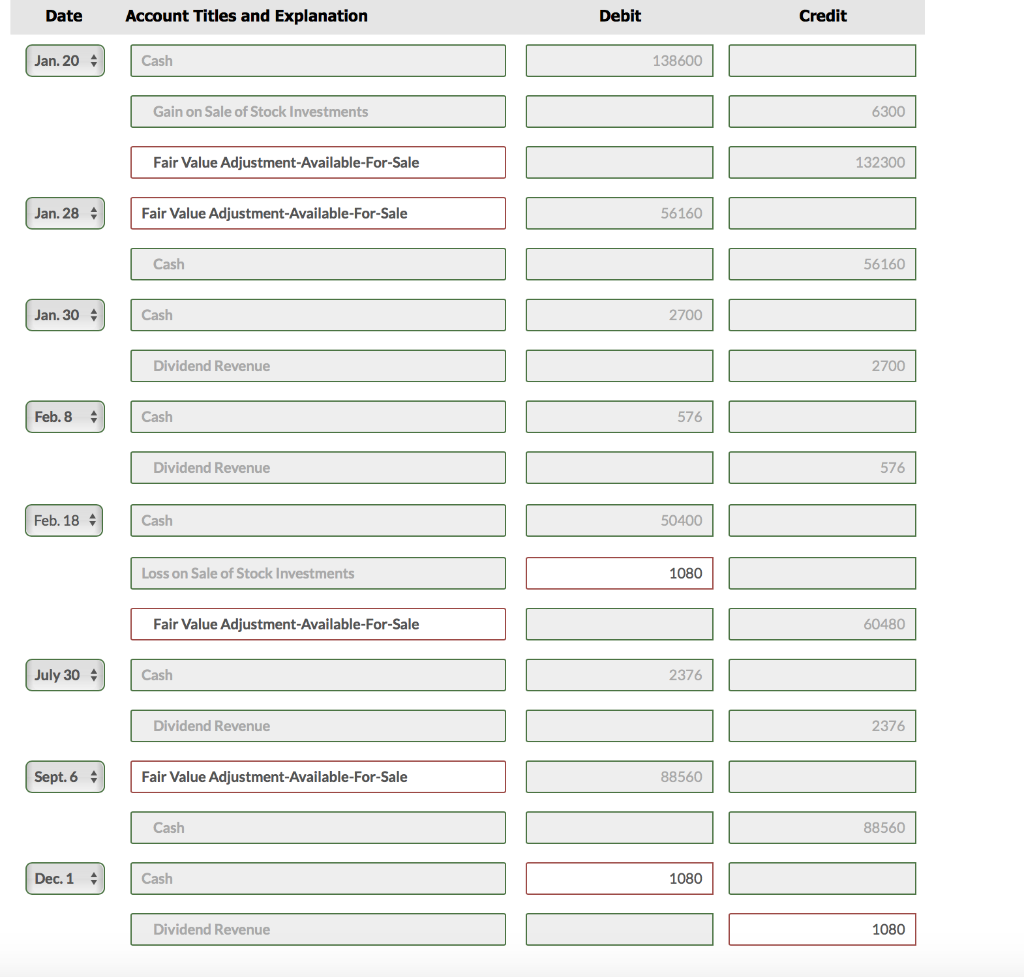

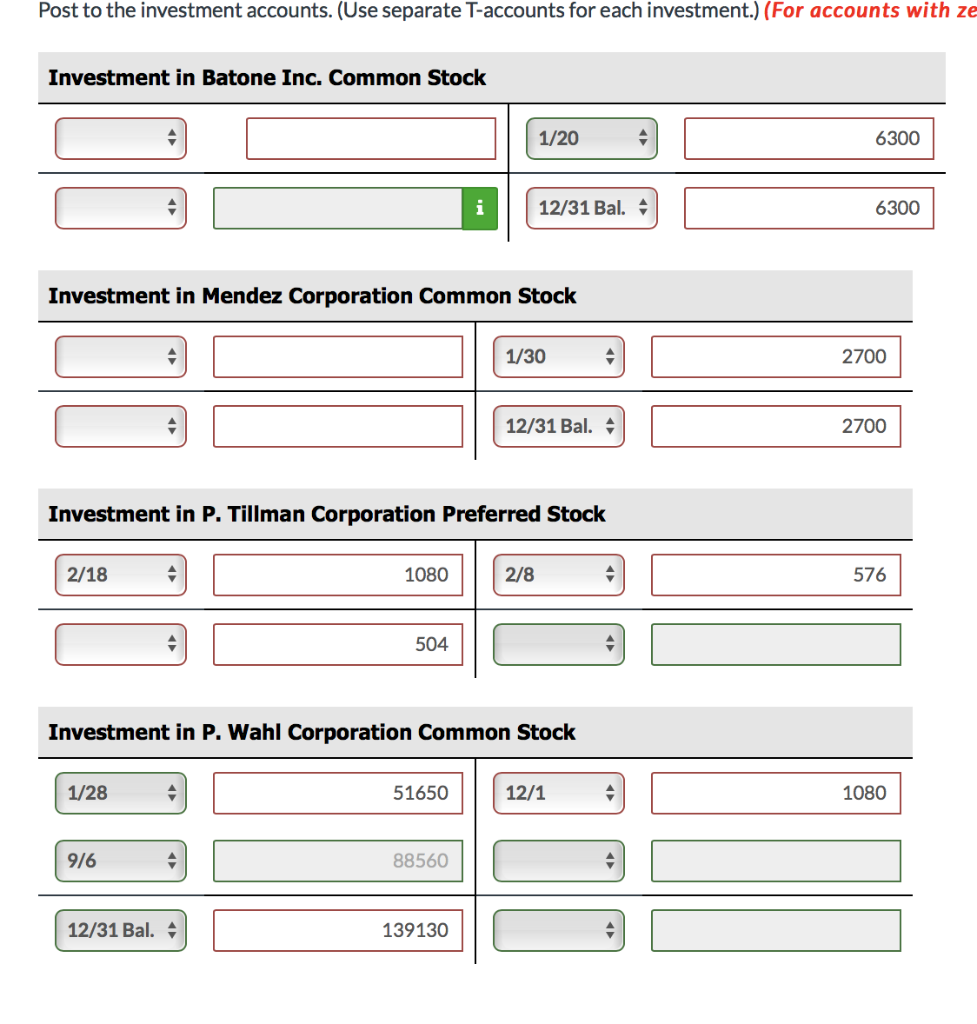

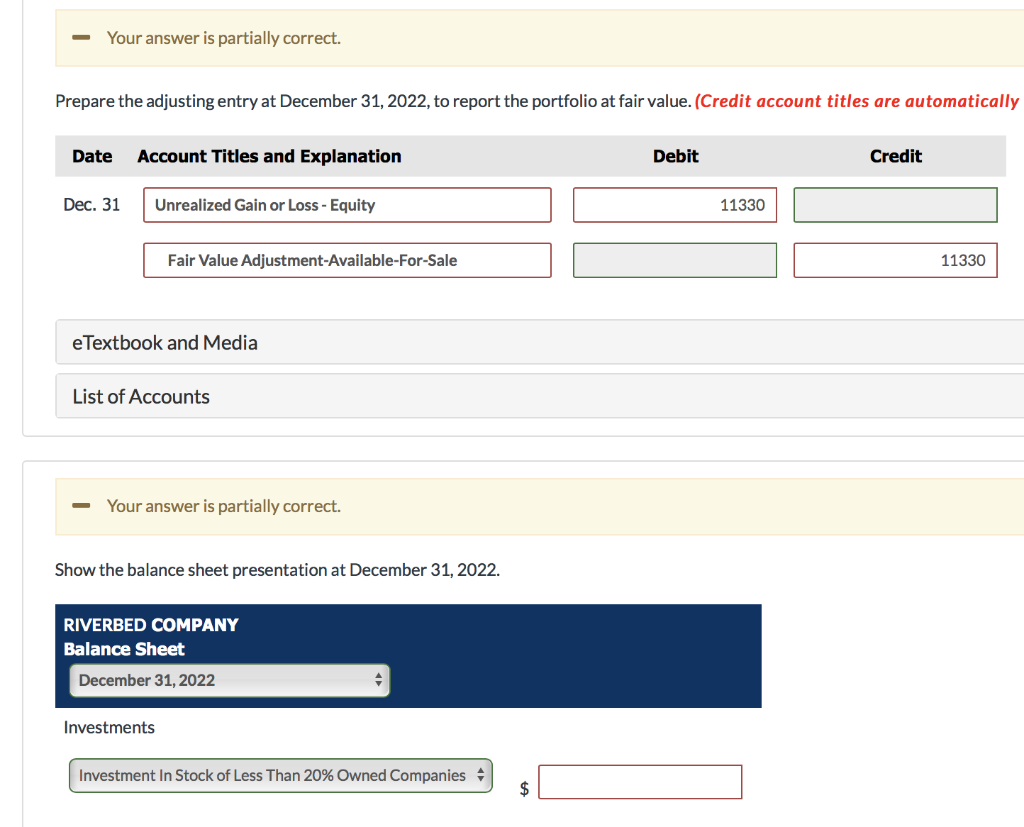

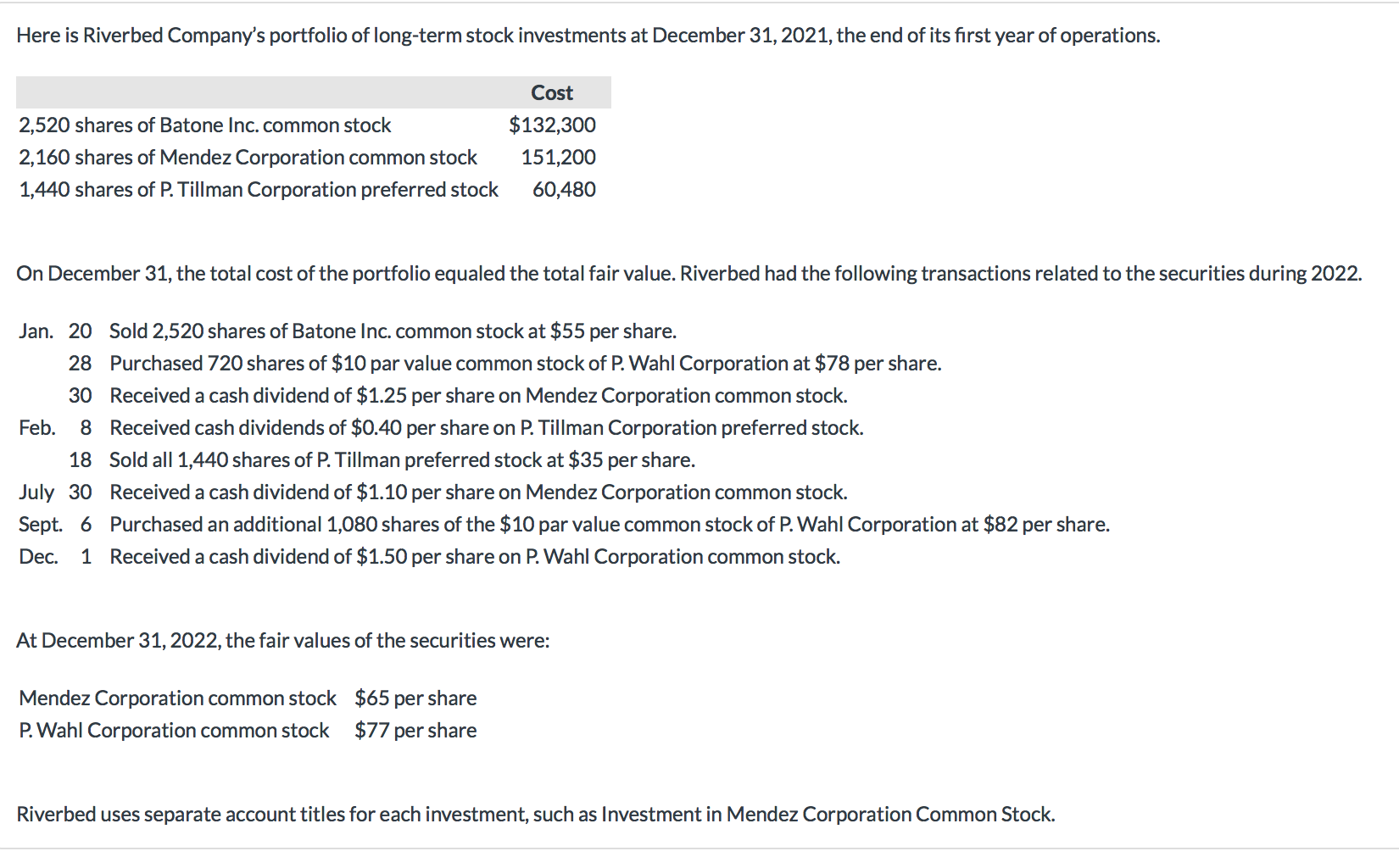

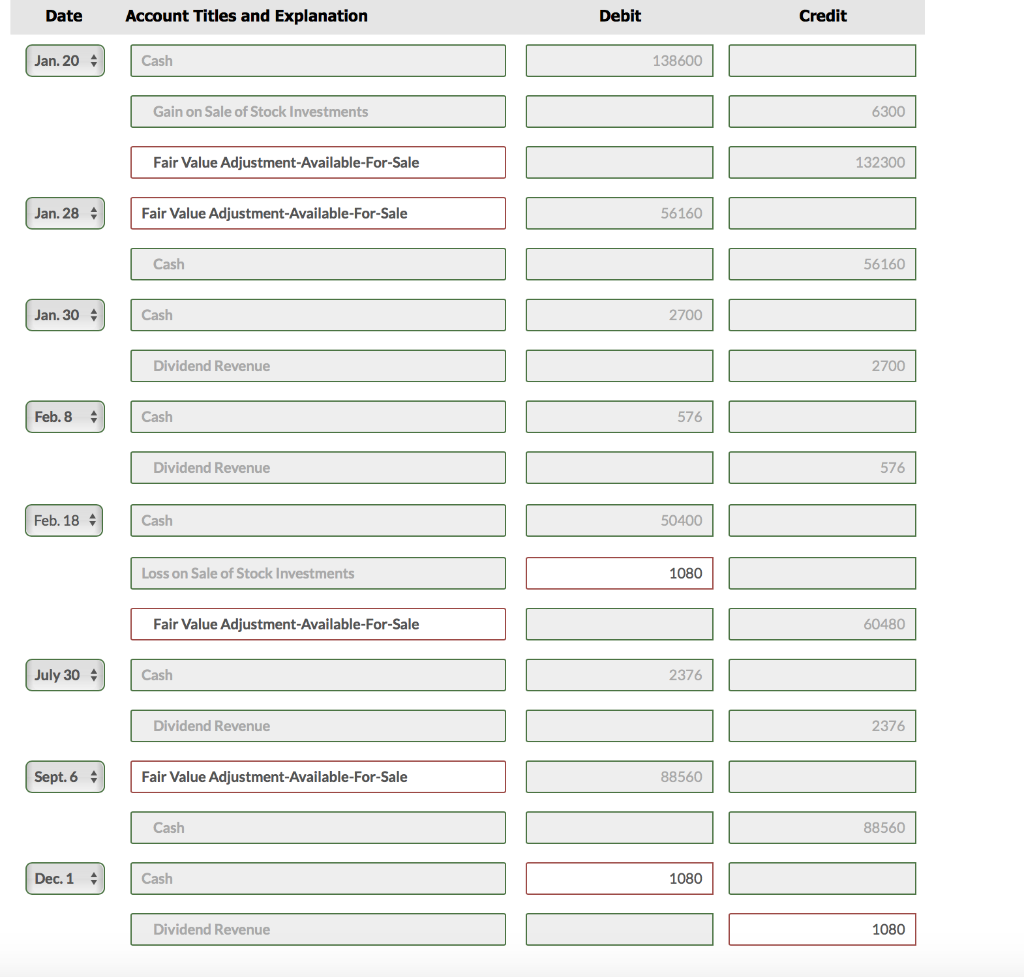

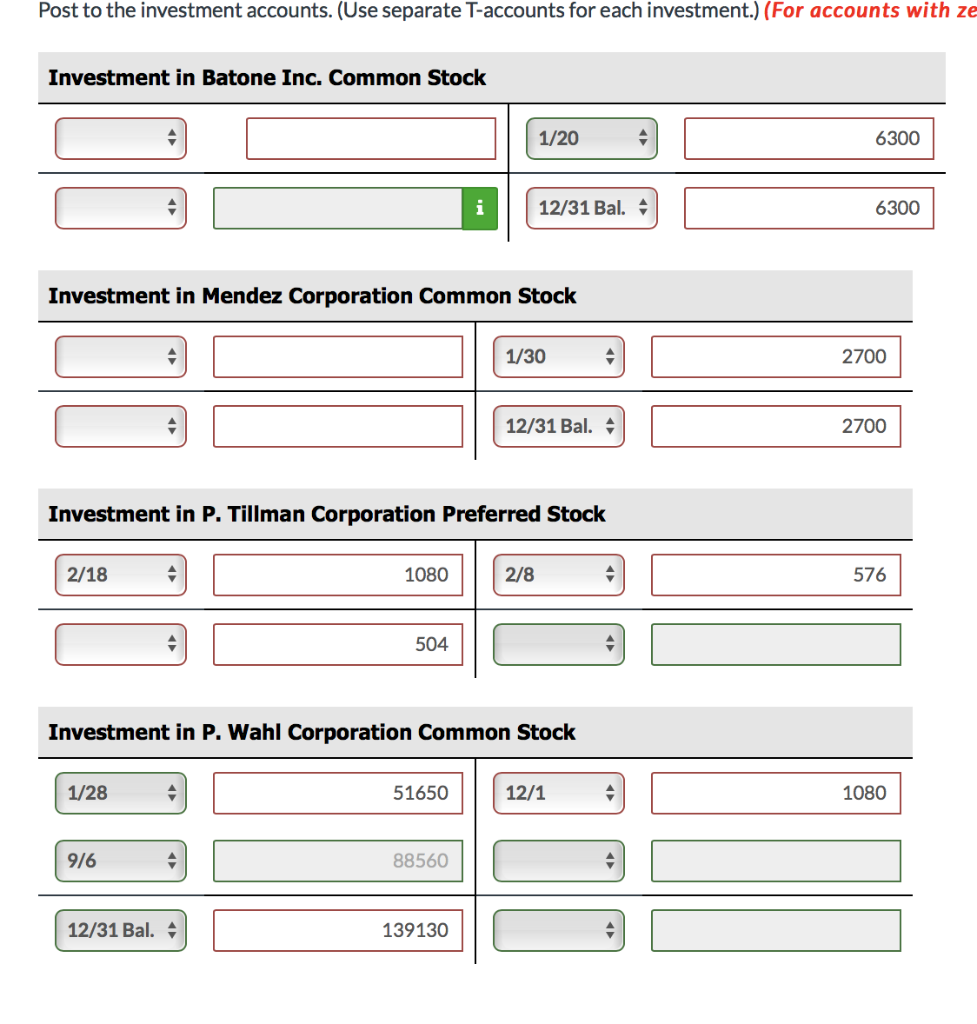

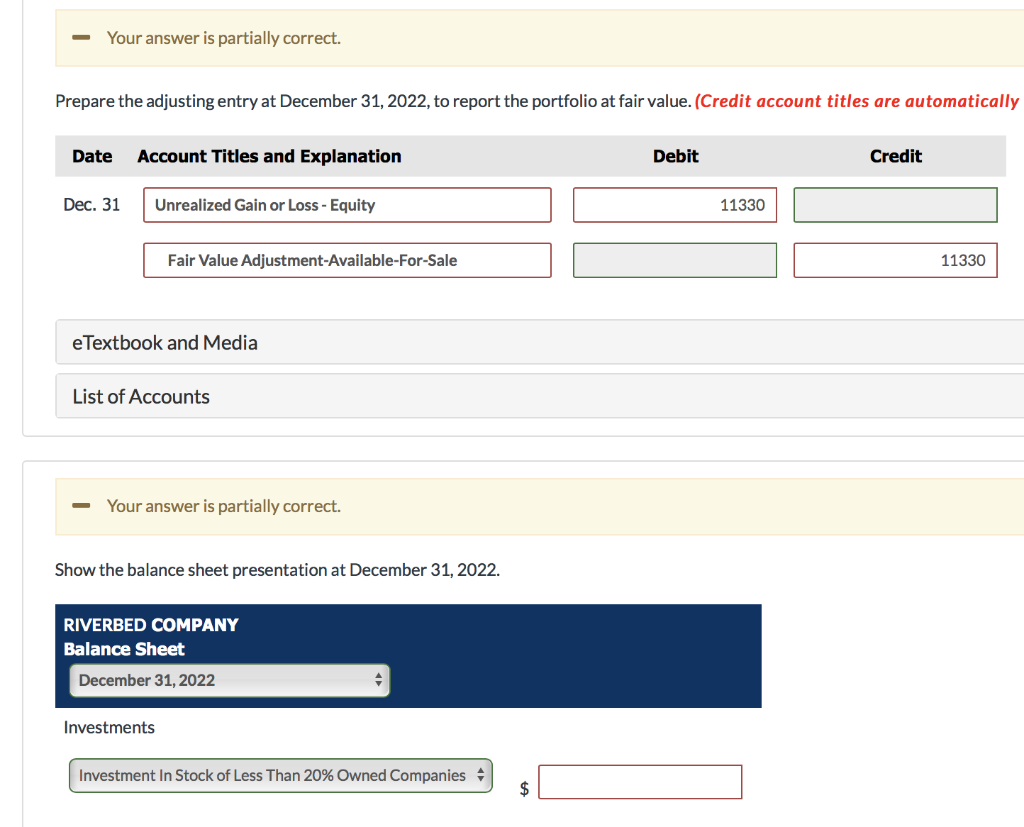

Here is Riverbed Company's portfolio of long-term stock investments at December 31, 2021, the end of its first year of operations. 2,520 shares of Batone Inc. common stock 2,160 shares of Mendez Corporation common stock 1,440 shares of P. Tillman Corporation preferred stock Cost $132,300 151,200 60,480 On December 31, the total cost of the portfolio equaled the total fair value. Riverbed had the following transactions related to the securities during 2022. Jan. 20 Sold 2,520 shares of Batone Inc. common stock at $55 per share. 28 Purchased 720 shares of $10 par value common stock of P. Wahl Corporation at $78 per share. 30 Received a cash dividend of $1.25 per share on Mendez Corporation common stock. Feb. 8 Received cash dividends of $0.40 per share on P. Tillman Corporation preferred stock. 18 Sold all 1,440 shares of P. Tillman preferred stock at $35 per share. July 30 Received a cash dividend of $1.10 per share on Mendez Corporation common stock. Sept. 6 Purchased an additional 1,080 shares of the $10 par value common stock of P. Wahl Corporation at $82 per share. Dec. 1 Received a cash dividend of $1.50 per share on P. Wahl Corporation common stock. At December 31, 2022, the fair values of the securities were: Mendez Corporation common stock $65 per share P. Wahl Corporation common stock $77 per share Riverbed uses separate account titles for each investment, such as Investment in Mendez Corporation Common Stock. Date Account Titles and Explanation Debit Credit Jan. 20 Cash 138600 Gain on Sale of Stock Investments 6300 Fair Value Adjustment-Available-For-Sale ent-Available-For-Sale C C 132300 Jan. 284 Fair Value Adjustment-Available-For-Sale 56160 Cash 56160 Jan. 30 - Cash 2700 Dividend Revenue 2700 Feb. 8 4 Cash L Dividend Revenue 576 Feb. 18 Cash 50400 Loss on Sale of Stock Investments 1080 Fair Value Adjustment-Available-For-Sale 60480 July 30 Cash 2376 Dividend Revenue 2376 Sept. 64 Fair Value Adjustment-Available-For-Sale 88560 Cash 88560 Dec. 1 * Cash 1080 Dividend Revenue 1080 Post to the investment accounts. (Use separate T-accounts for each investment.) (For accounts with ze Investment in Batone Inc. Common Stock | 1/20 AN 6300 12/31 Bal., 6300 6300 Investment in Mendez Corporation Common Stock 1/30 9 2700 12/31 Bal. A 2700 Investment in P. Tillman Corporation Preferred Stock 2/18 - 1080 2/8 576 504 Investment in P. Wahl Corporation Common Stock 1/28 51650 12/1 1080 916 - 88560 12/31 Bal. A 139130 Here is Riverbed Company's portfolio of long-term stock investments at December 31, 2021, the end of its first year of operations. 2,520 shares of Batone Inc. common stock 2,160 shares of Mendez Corporation common stock 1,440 shares of P. Tillman Corporation preferred stock Cost $132,300 151,200 60,480 On December 31, the total cost of the portfolio equaled the total fair value. Riverbed had the following transactions related to the securities during 2022. Jan. 20 Sold 2,520 shares of Batone Inc. common stock at $55 per share. 28 Purchased 720 shares of $10 par value common stock of P. Wahl Corporation at $78 per share. 30 Received a cash dividend of $1.25 per share on Mendez Corporation common stock. Feb. 8 Received cash dividends of $0.40 per share on P. Tillman Corporation preferred stock. 18 Sold all 1,440 shares of P. Tillman preferred stock at $35 per share. July 30 Received a cash dividend of $1.10 per share on Mendez Corporation common stock. Sept. 6 Purchased an additional 1,080 shares of the $10 par value common stock of P. Wahl Corporation at $82 per share. Dec. 1 Received a cash dividend of $1.50 per share on P. Wahl Corporation common stock. At December 31, 2022, the fair values of the securities were: Mendez Corporation common stock $65 per share P. Wahl Corporation common stock $77 per share Riverbed uses separate account titles for each investment, such as Investment in Mendez Corporation Common Stock. Date Account Titles and Explanation Debit Credit Jan. 20 Cash 138600 Gain on Sale of Stock Investments 6300 Fair Value Adjustment-Available-For-Sale ent-Available-For-Sale C C 132300 Jan. 284 Fair Value Adjustment-Available-For-Sale 56160 Cash 56160 Jan. 30 - Cash 2700 Dividend Revenue 2700 Feb. 8 4 Cash L Dividend Revenue 576 Feb. 18 Cash 50400 Loss on Sale of Stock Investments 1080 Fair Value Adjustment-Available-For-Sale 60480 July 30 Cash 2376 Dividend Revenue 2376 Sept. 64 Fair Value Adjustment-Available-For-Sale 88560 Cash 88560 Dec. 1 * Cash 1080 Dividend Revenue 1080 Post to the investment accounts. (Use separate T-accounts for each investment.) (For accounts with ze Investment in Batone Inc. Common Stock | 1/20 AN 6300 12/31 Bal., 6300 6300 Investment in Mendez Corporation Common Stock 1/30 9 2700 12/31 Bal. A 2700 Investment in P. Tillman Corporation Preferred Stock 2/18 - 1080 2/8 576 504 Investment in P. Wahl Corporation Common Stock 1/28 51650 12/1 1080 916 - 88560 12/31 Bal. A 139130