Question

Here is some information about Stokenchurch Incorporated Beta of common stock - 1.2 Treasury bill rate=4% Market risk premium - 6.5% Yield to maturity

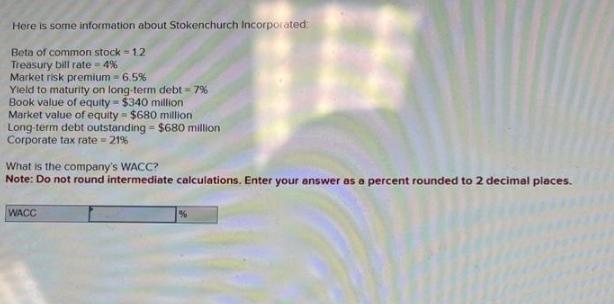

Here is some information about Stokenchurch Incorporated Beta of common stock - 1.2 Treasury bill rate=4% Market risk premium - 6.5% Yield to maturity on long-term debt = 7% Book value of equity = $340 million Market value of equity - $680 million Long-term debt outstanding - $680 million Corporate tax rate=21% What is the company's WACC? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. WACC

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The companys WACC can be calculated using the following formula WACC Market value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th Edition

1260772381, 978-1260772388

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App