Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the answer to question 3, please answer question 4. Show all work First find the depreciation rates which are 33.33%, 44.44%, 14.81% and

Here is the answer to question 3, please answer question 4. Show all work

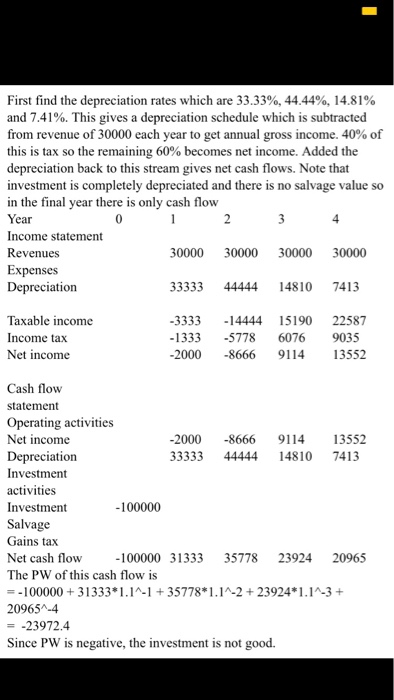

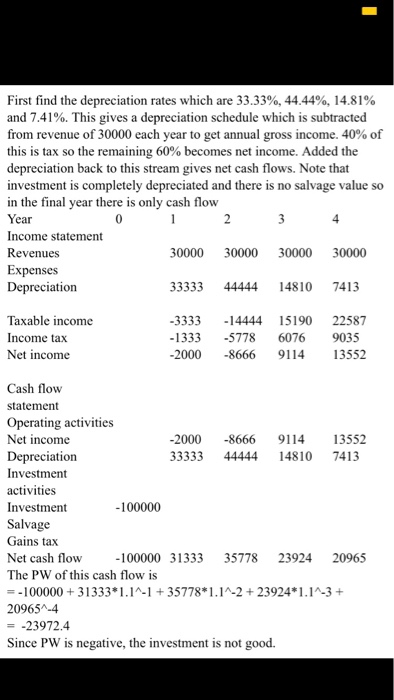

First find the depreciation rates which are 33.33%, 44.44%, 14.81% and 7.41%. This gives a depreciation schedule which is subtracted from revenue of 30000 each year to get annual gross income, 40% of this is tax so the remaining 60% becomes net income. Added the depreciation back to this stream gives net cash flows. Note that investment is completely depreciated and there is no salvage value so in the final year there is only cash flow Year Income statement Revenues Expenses Depreciation 4 30000 30000 30000 30000 33333 44444 14810 7413 Taxable income Income tax Net income 3333 -14444 15190 22587 1333 5778 6076 9035 2000 -8666 9114 3552 Cash flow statement Operating activities Net income Depreciation Investment activities Investment Salvage Gains tax Net cash flow 100000 31333 35778 23924 20965 The PW of this cash flow is -100000 313331.1-1357781.14-2 +23924 1.1-3+ 20965A-4 --23972.4 Since PW is negative, the investment is not good. -2000 -8666 9114 3552 33333 4444414810 7413 -100000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started