Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the condensed 2 0 2 1 balance sheet for Skye Computer Company ( in thousands of dollars ) : table [ [

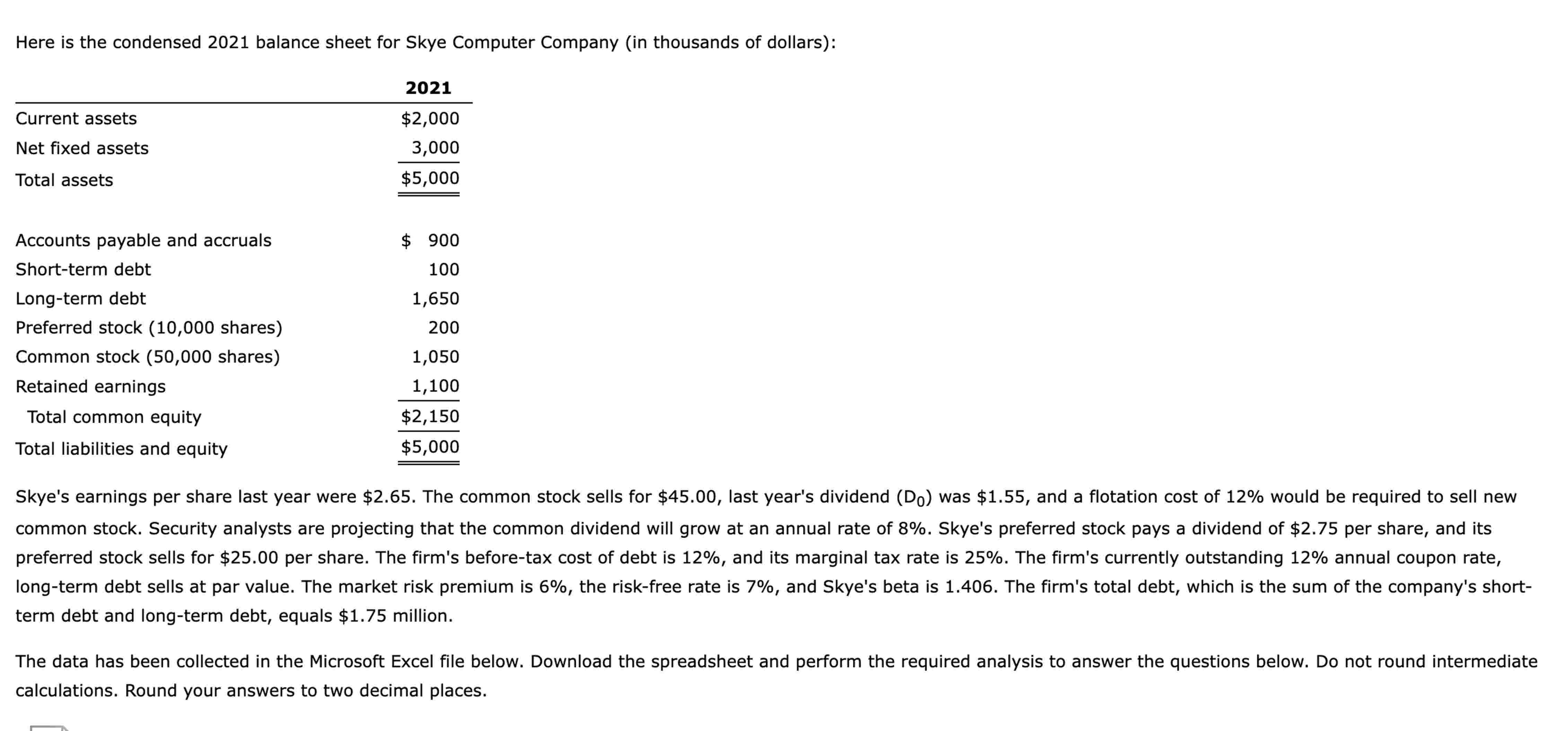

Here is the condensed balance sheet for Skye Computer Company in thousands of dollars:

table

Calculate the cost of each capital component, that is the aftertax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity.

Aftertax cost of debt: fill in the blank

Cost of preferred stock: fill in the blank

Cost of retained earnings: fill in the blank

Cost of new common stock: fill in the blank

Now calculate the cost of common equity from retained earnings, using the CAPM method.

fill in the blank

What is the cost of new common stock based on the CAPM? Hint: Find the difference between re and rs as determined by the DCF method, and add that differential to the CAPM value for rs

fill in the blank

If Skye continues to use the same marketvalue capital structure, what is the firm's WACC assuming that it uses only retained earnings for equity and if it expands so rapidly that it must issue new common stock? Hint: Use the market value capital structure excluding current liabilities to determine the weights. Also, use the simple average of the required values obtained under the two methods in calculating WACC.

WACC: fill in the blank

WACC: fill in the blank

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started