Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the correct answers to this problem. can someone please show me the correcy way to calculate these answers? XYZ Company currently has the

Here is the correct answers to this problem. can someone please show me the correcy way to calculate these answers?

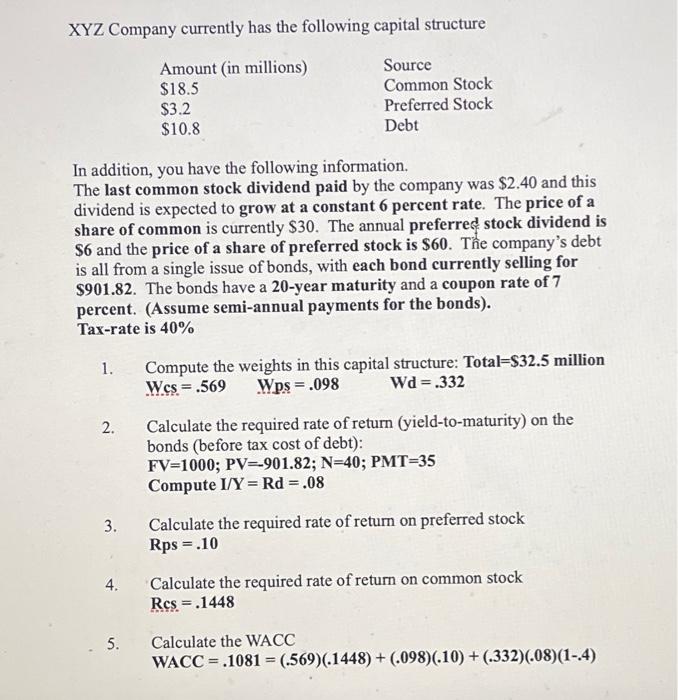

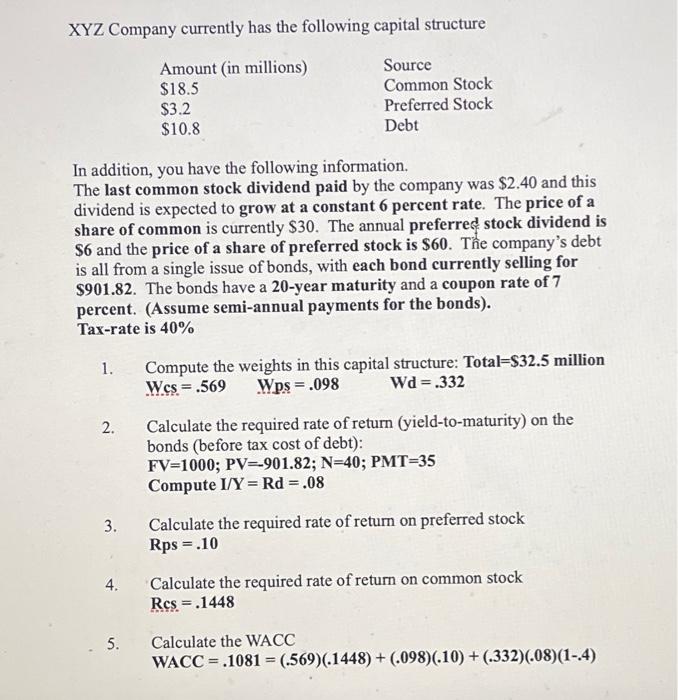

XYZ Company currently has the following capital structure In addition, you have the following information. The last common stock dividend paid by the company was $2.40 and this dividend is expected to grow at a constant 6 percent rate. The price of a share of common is currently $30. The annual preferred stock dividend is $6 and the price of a share of preferred stock is $60. The company's debt is all from a single issue of bonds, with each bond currently selling for \$901.82. The bonds have a 20-year maturity and a coupon rate of 7 percent. (Assume semi-annual payments for the bonds). Tax-rate is 40% 1. Compute the weights in this capital structure: Total=$32.5 million W.s =.569 Wps =.098Wd=.332 2. Calculate the required rate of return (yield-to-maturity) on the bonds (before tax cost of debt): FV=1000;PV=901.82;N=40;PMT=35 Compute I/Y=Rd=.08 3. Calculate the required rate of return on preferred stock Rps=.10 4. Calculate the required rate of return on common stock Rcs =.1448 5. Calculate the WACC WACC=.1081=(.569)(.1448)+(.098)(.10)+(.332)(.08)(1.4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started