Answered step by step

Verified Expert Solution

Question

1 Approved Answer

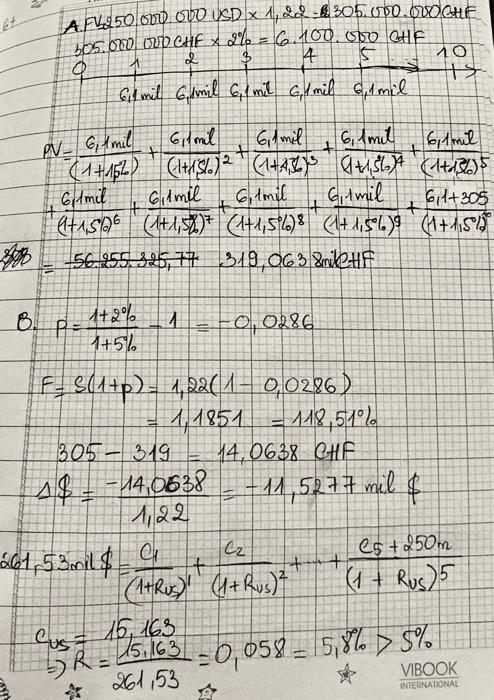

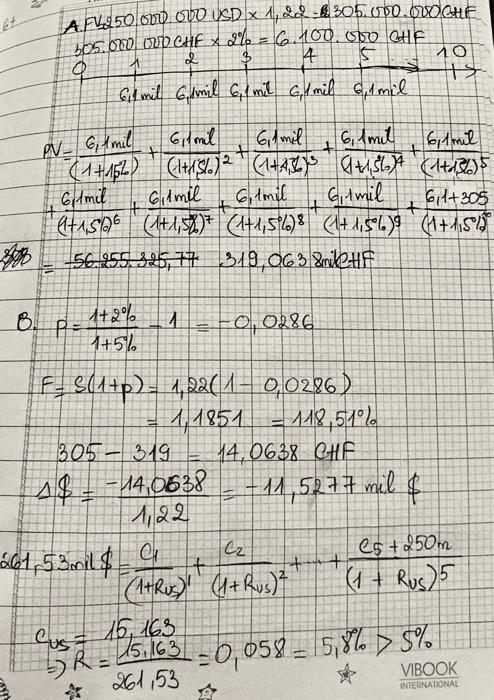

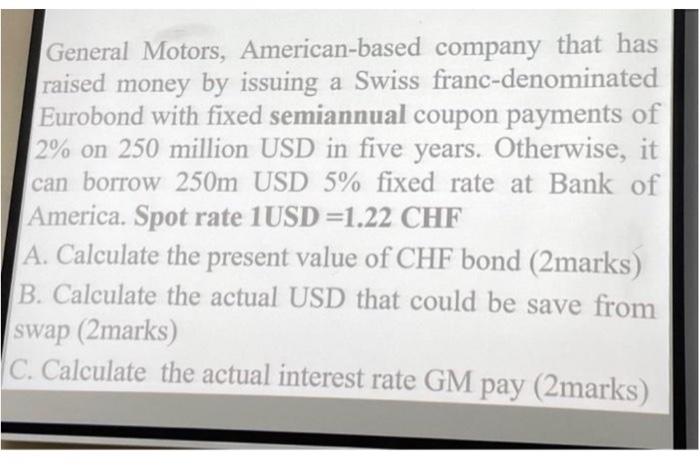

Here is the detailed answer to this question. A. FV250 000 000 USD 1,22=6305.000.000 QHF 305.000.000cHF2%=6.100.000cHF PV=(1+1L)6,1mil+(1+1,0)26,1mil+(1+1,1,)36,1mil+(1+1,5)4)46,1mil+(1+1,%0)56,1mil +(1+1,5)66,1mil+(1+1,5%076,1mil+(1+1,5%%86,1mil+(1+1,5%)9611mil+(1+1,5%)26,1+305 =56.255.325,77,319,0638 miletf B. P=1+5%1+2%1=0,0286 F=S(1+p)=1,22(10,0286)=1,1851=118,51%305319=14,0638CHF$=1,2214,0638=11,5277mil$61,53mil$=(1+Rus)1C1+(1+Rus)2C2++(1+RuS)5C5+250mCus=15,163R=261,5315,163=0,058=5,8%>5% General Motors,

Here is the detailed answer to this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started