Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is the income statement for Month Ended March 31, 2025 and the retained earnings statement Journalize and post closing entries and complete the closing

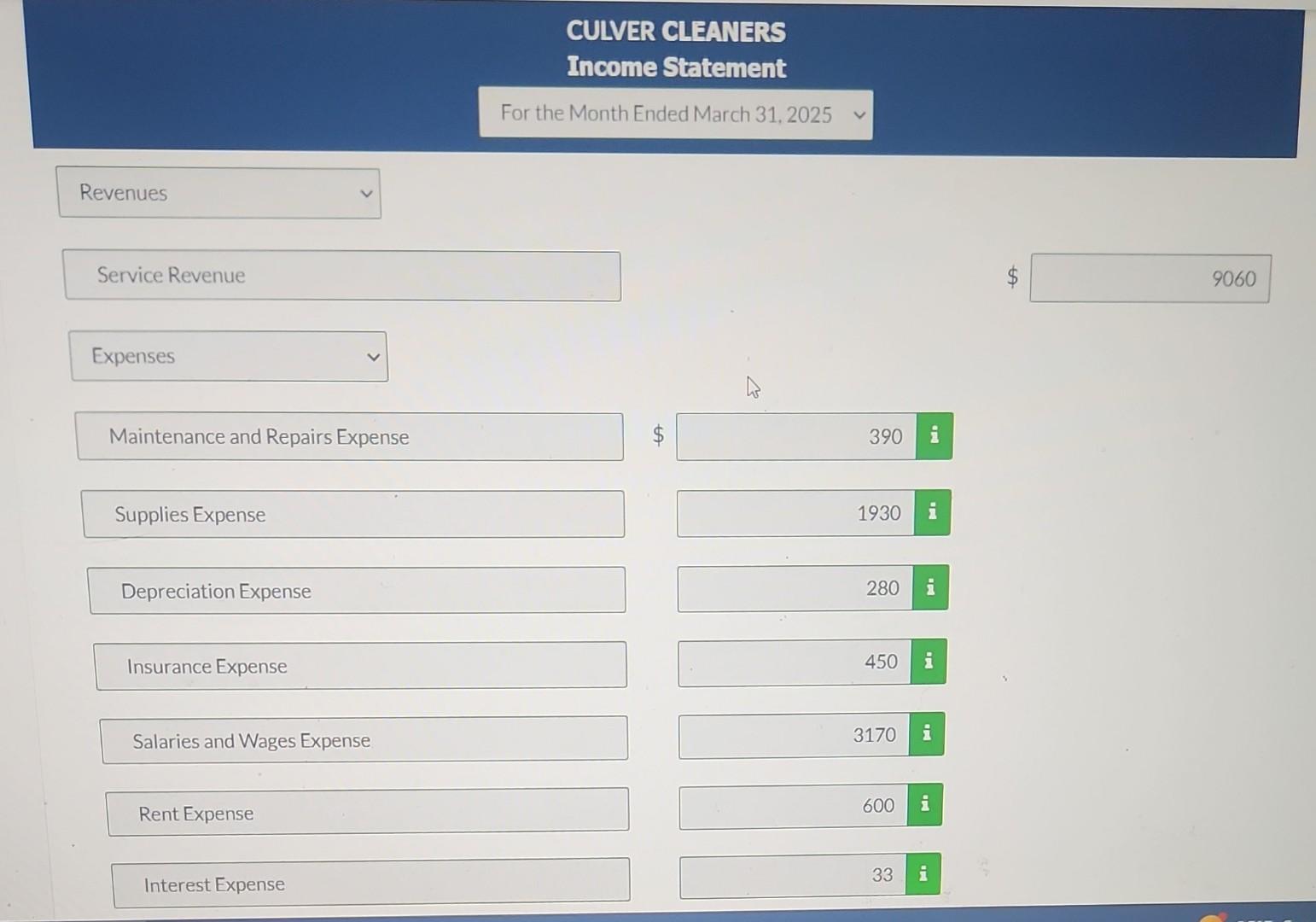

Here is the income statement for Month Ended March 31, 2025

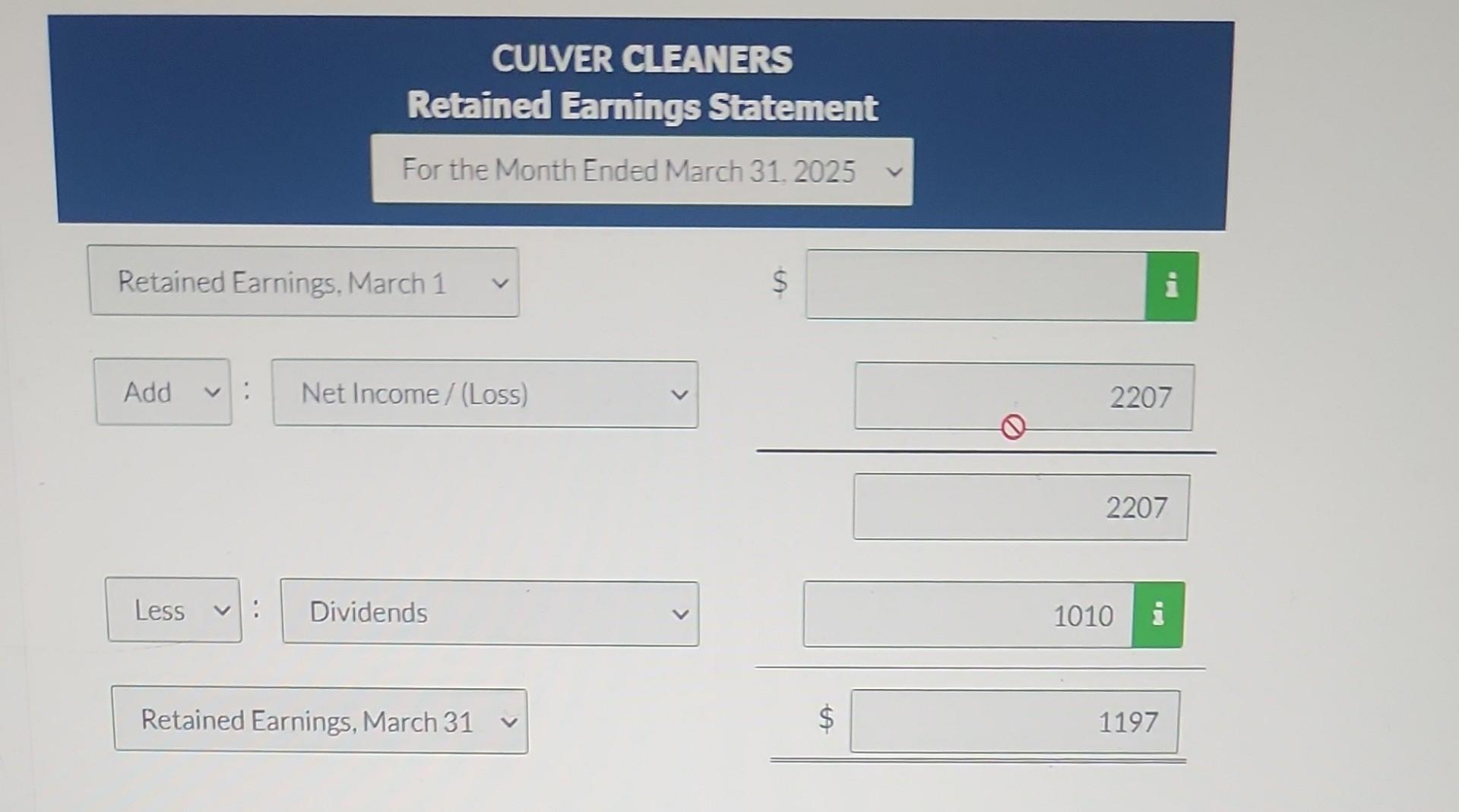

and the retained earnings statement

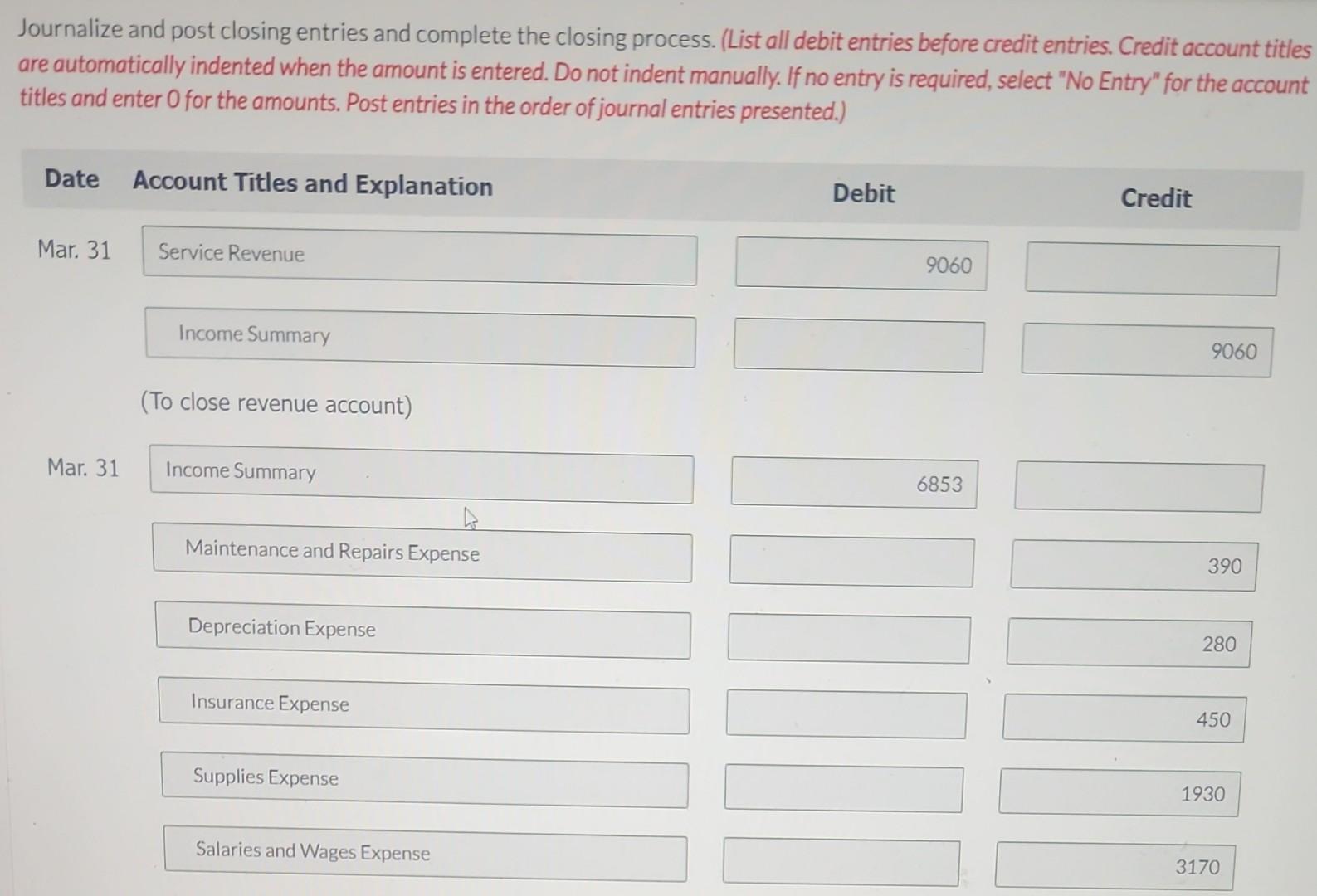

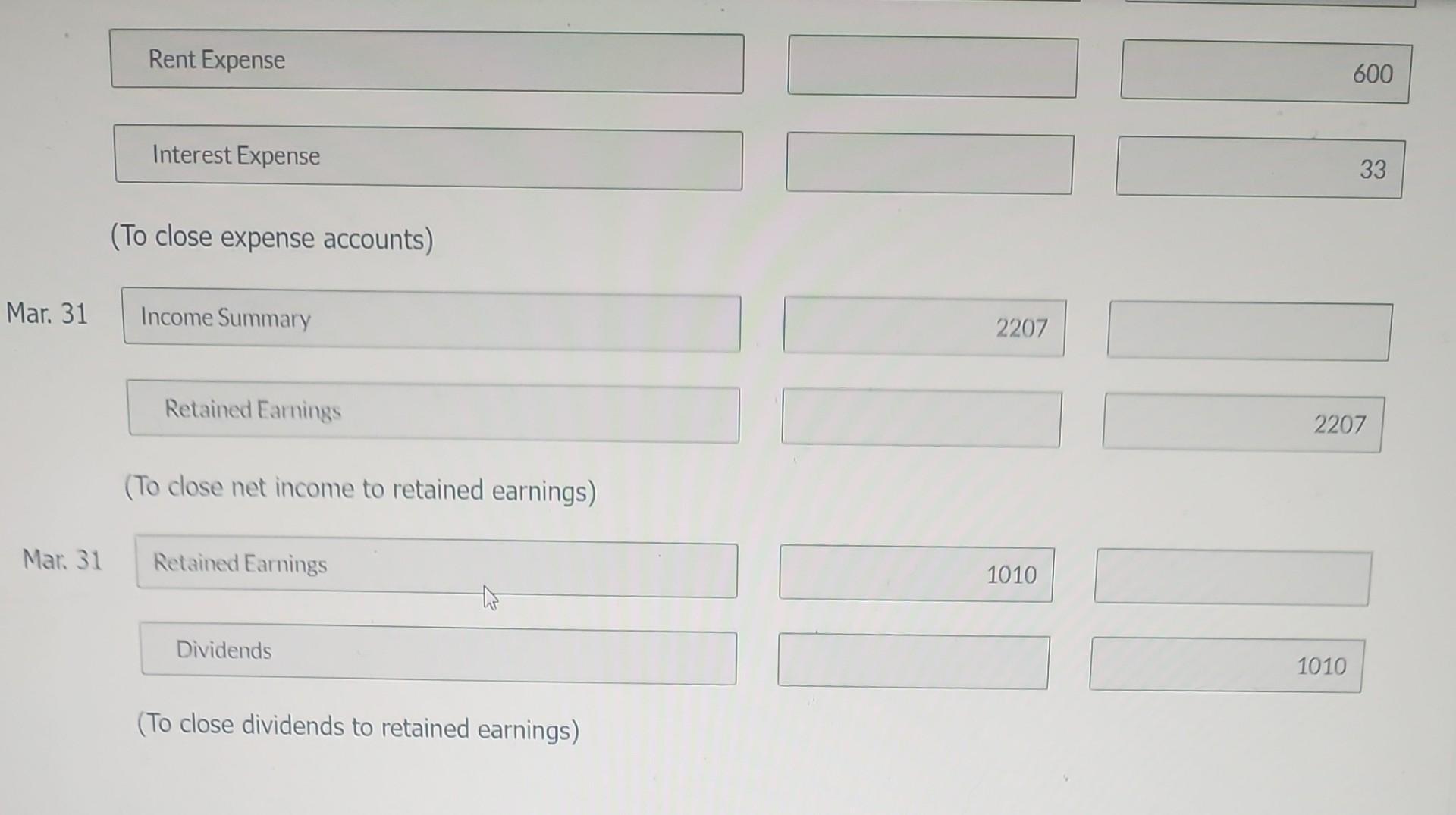

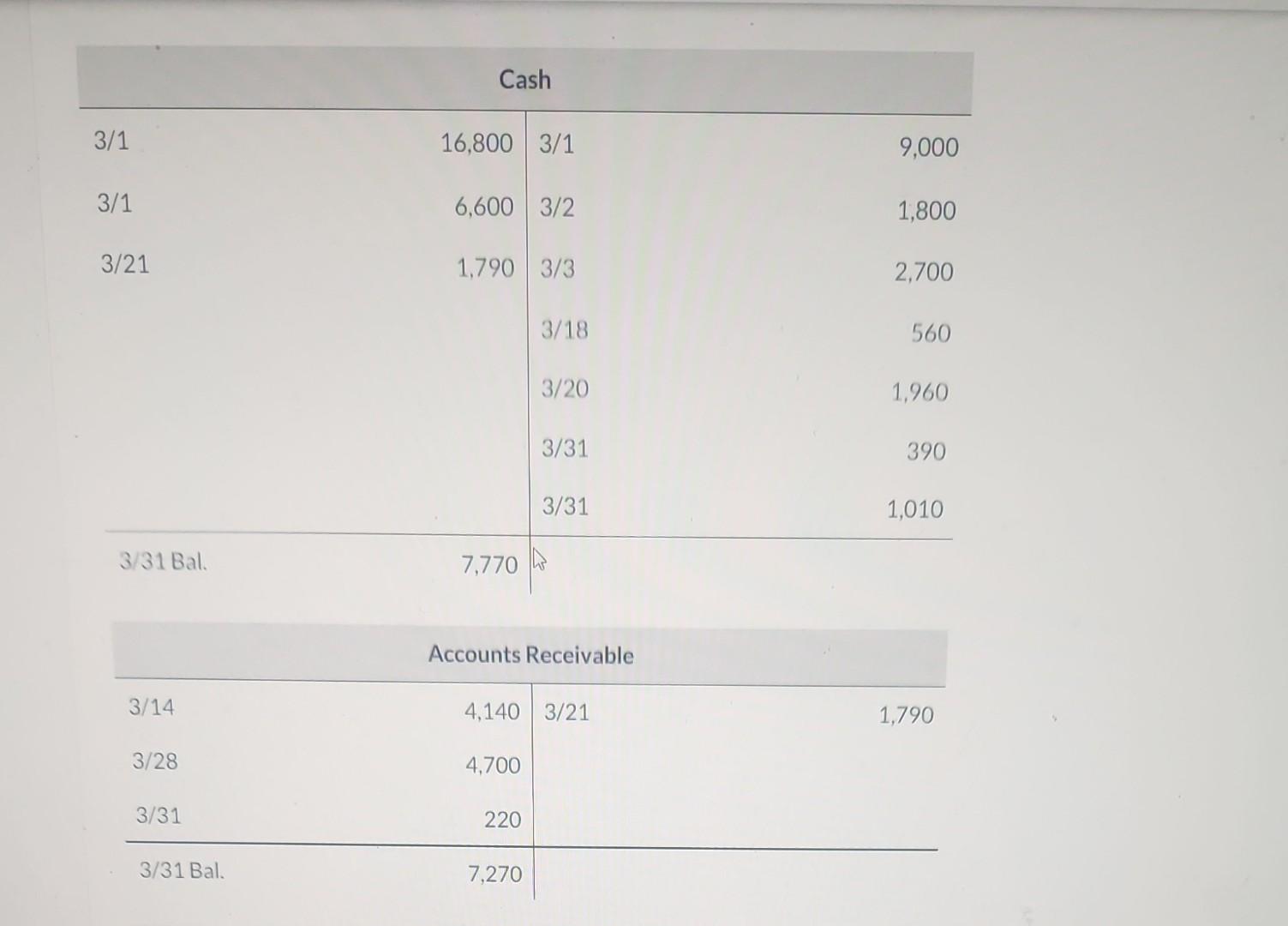

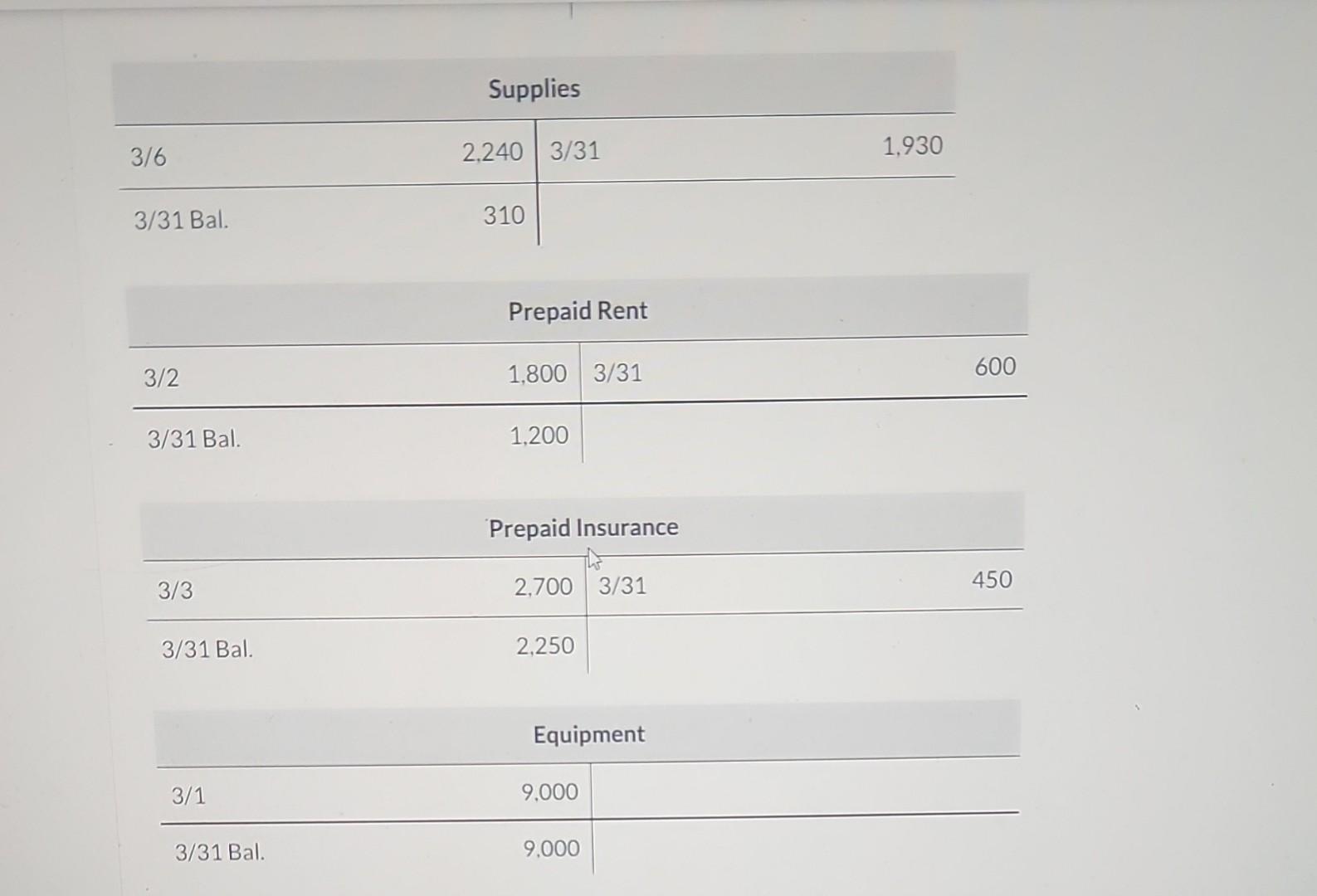

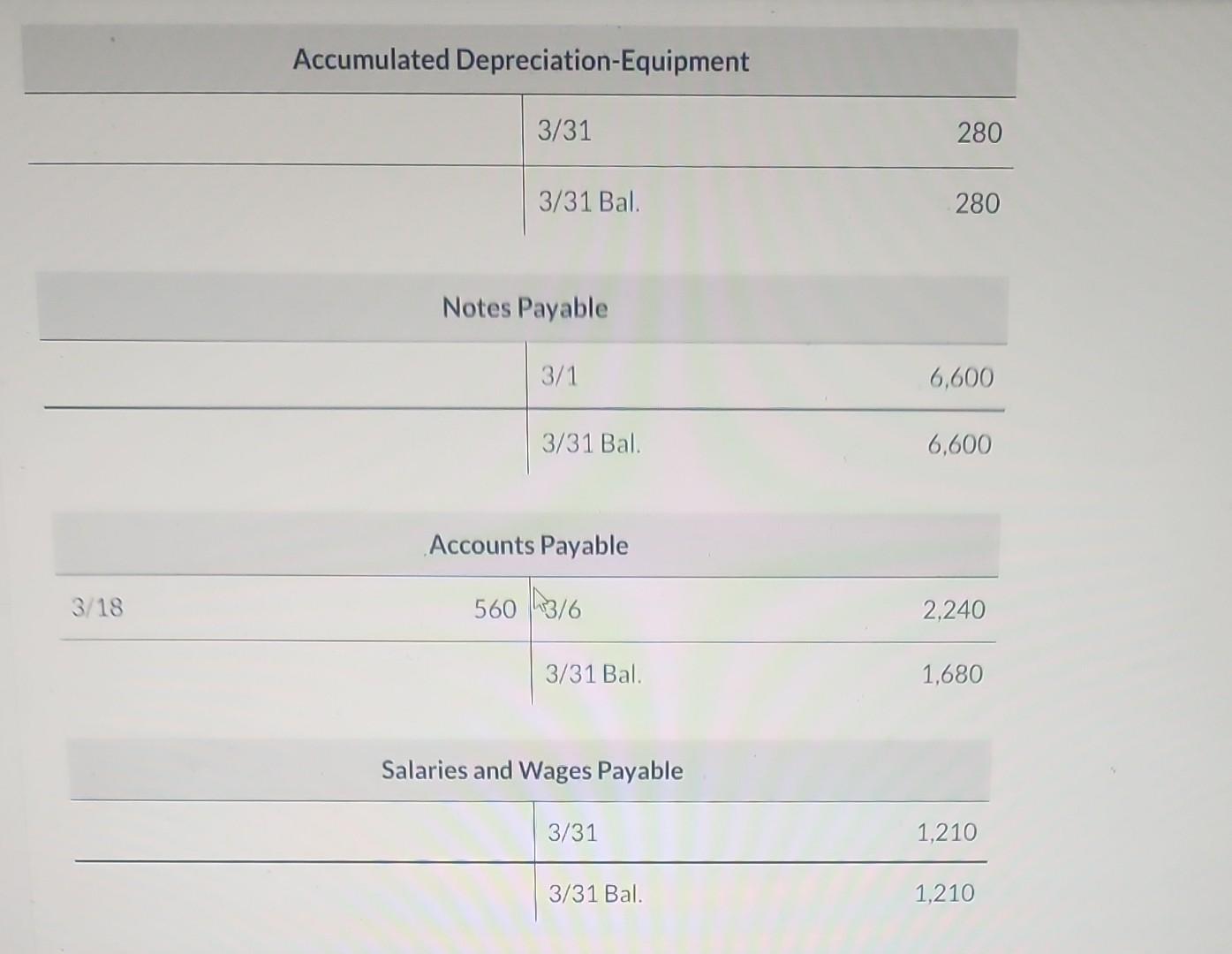

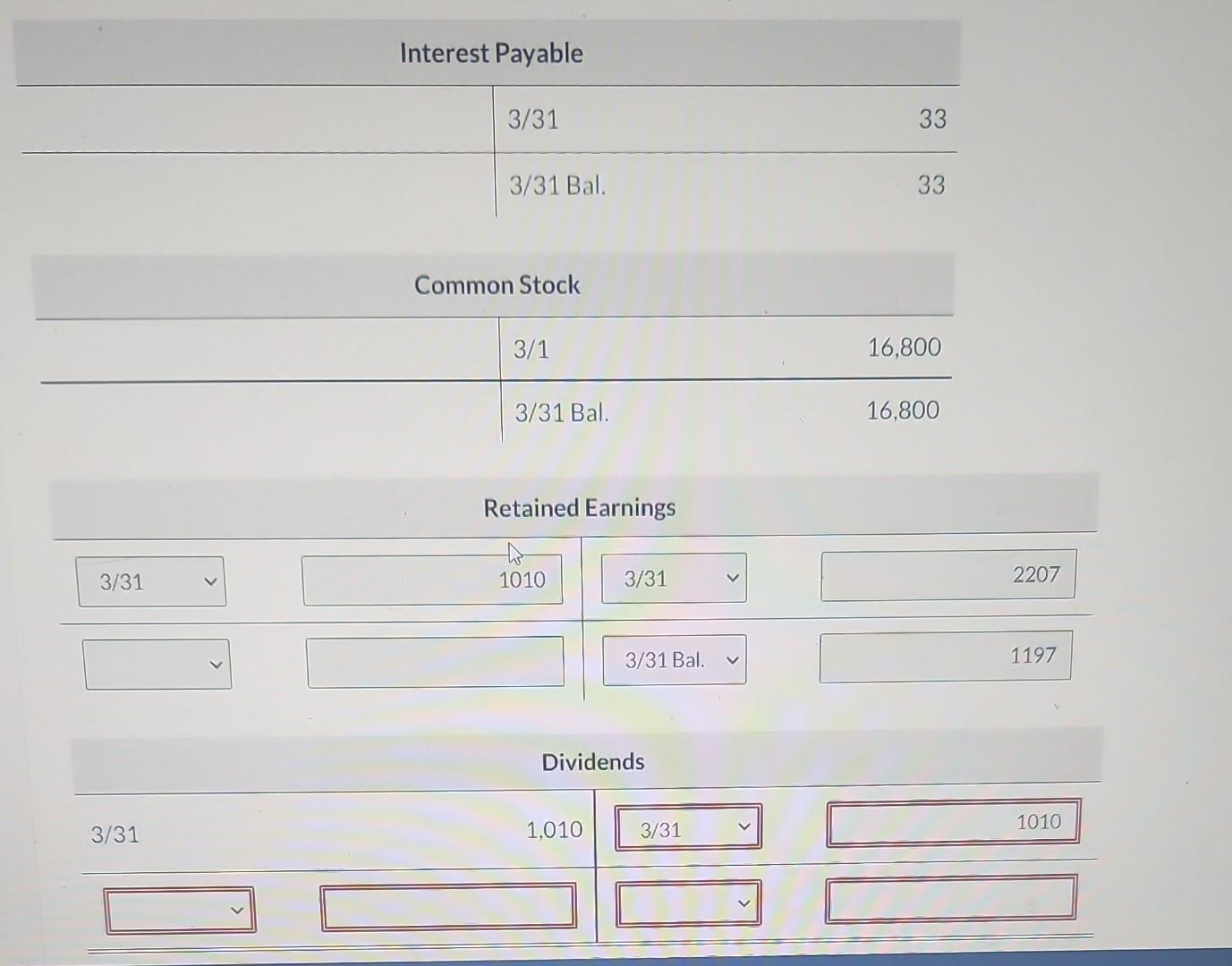

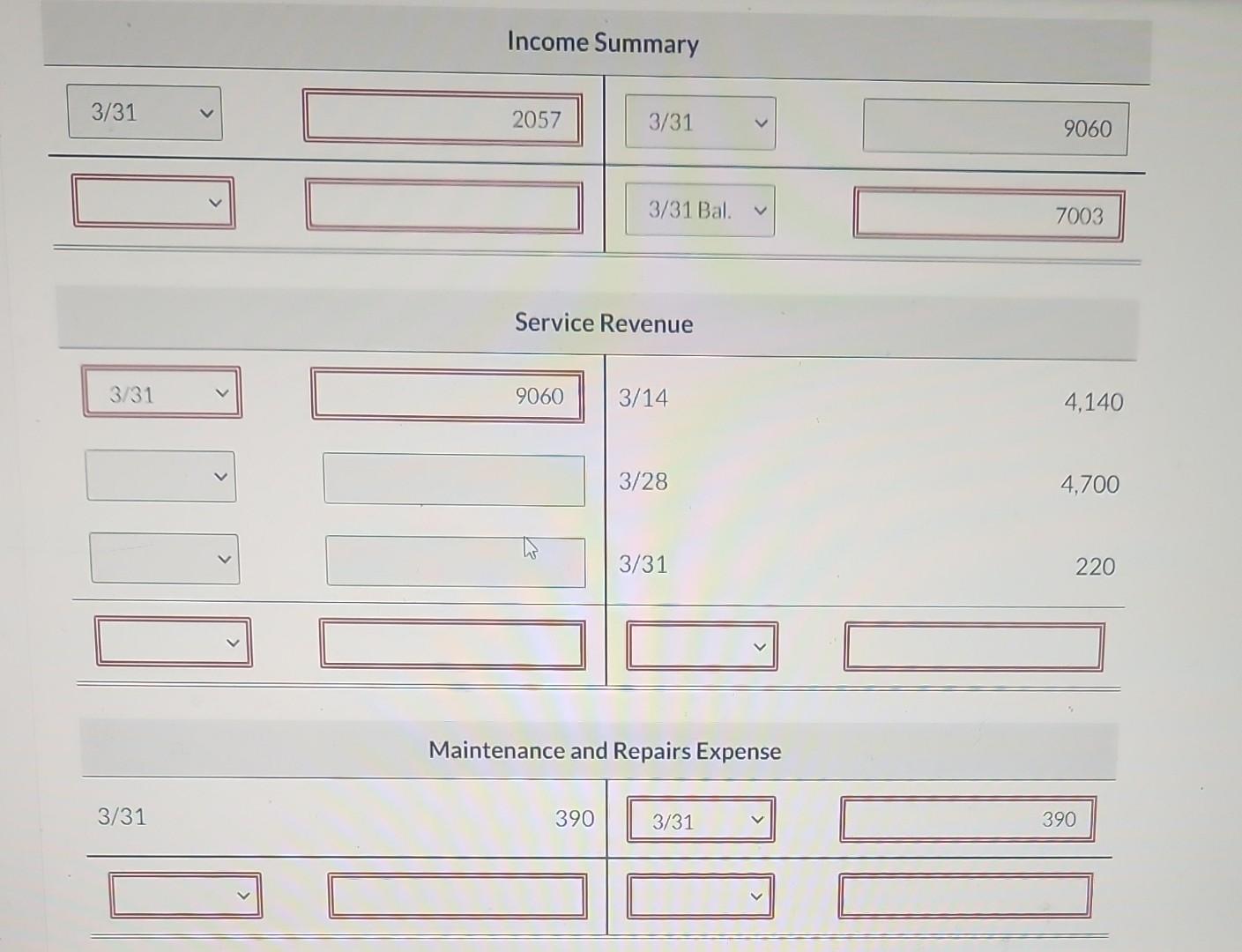

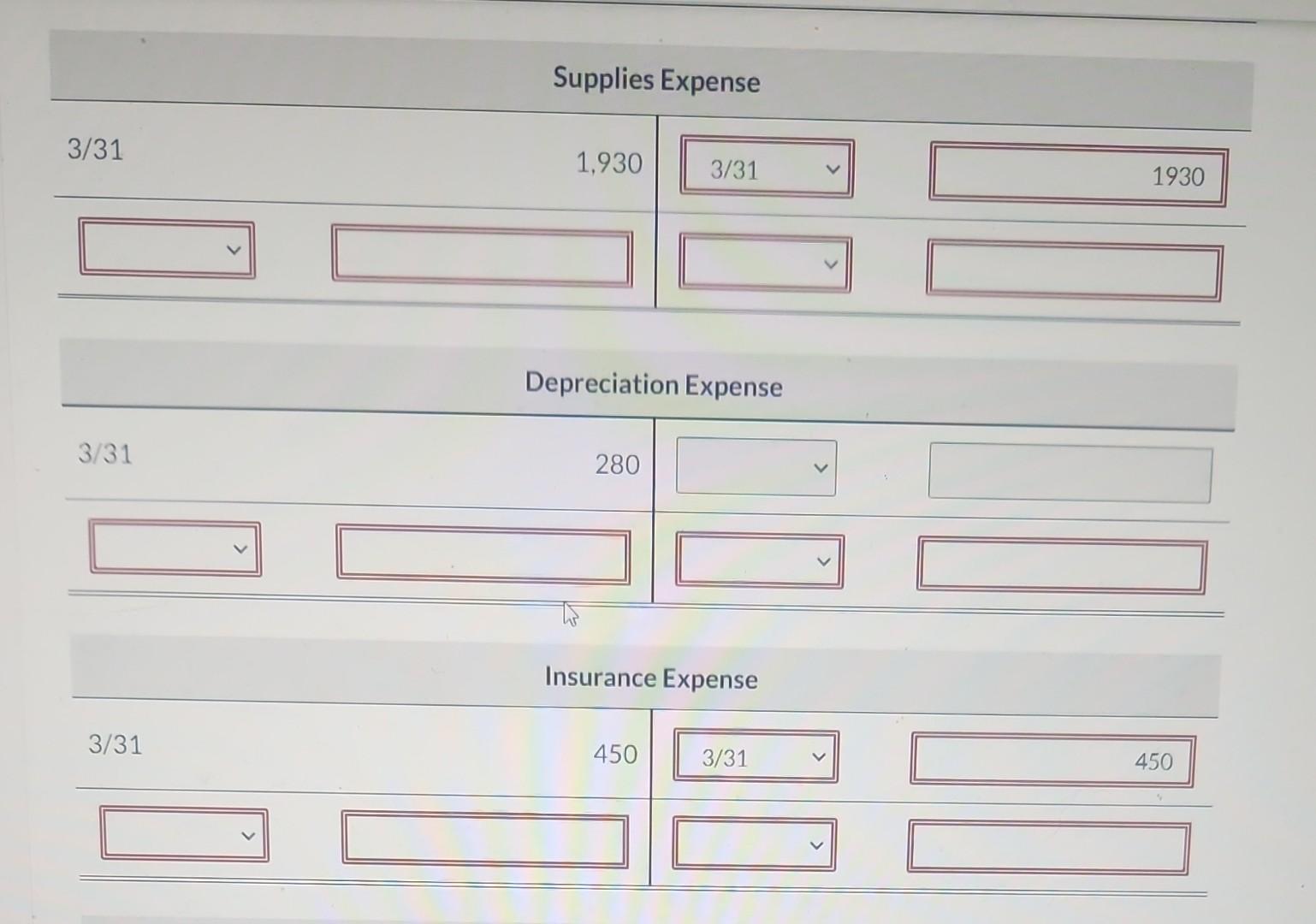

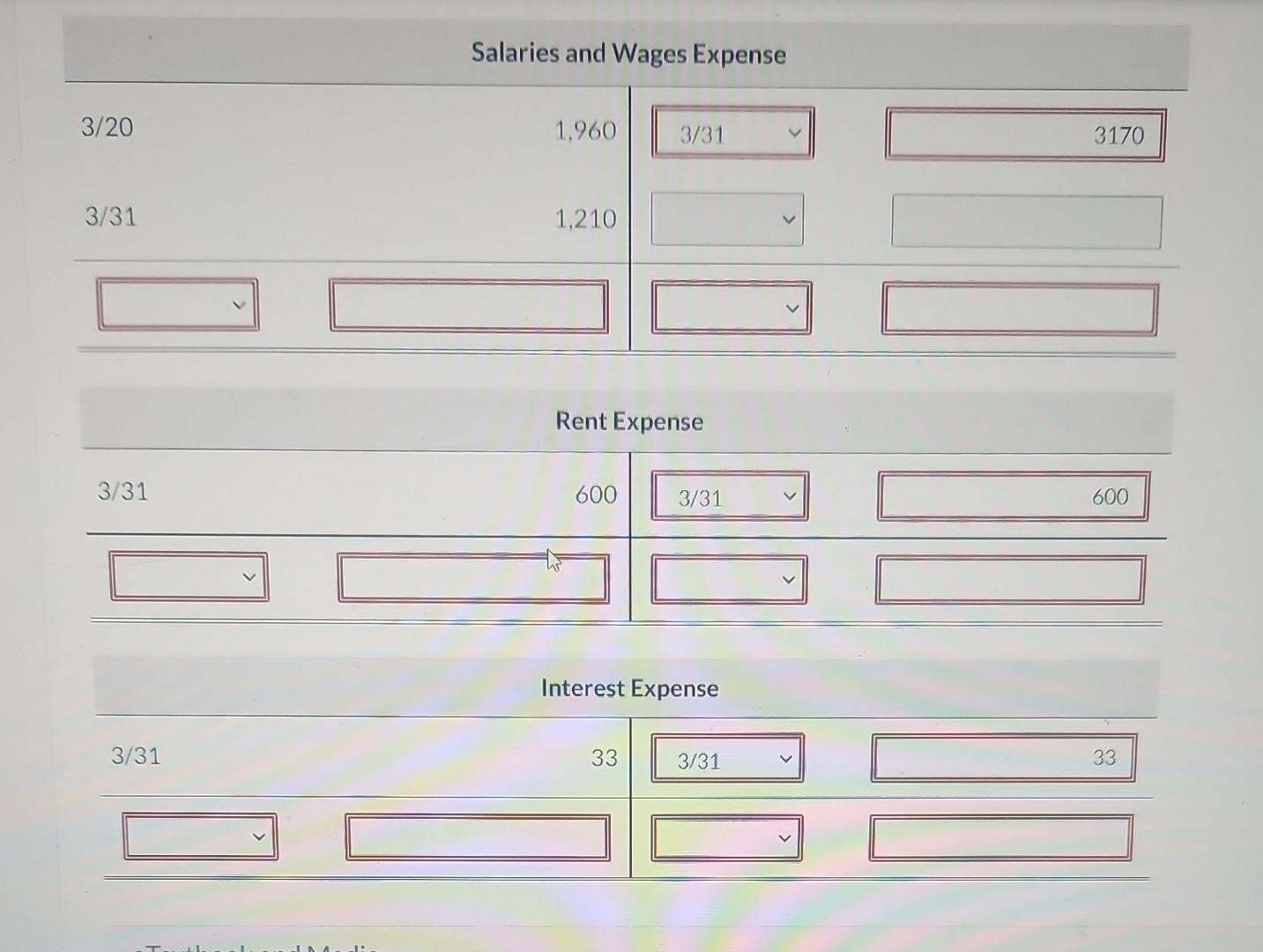

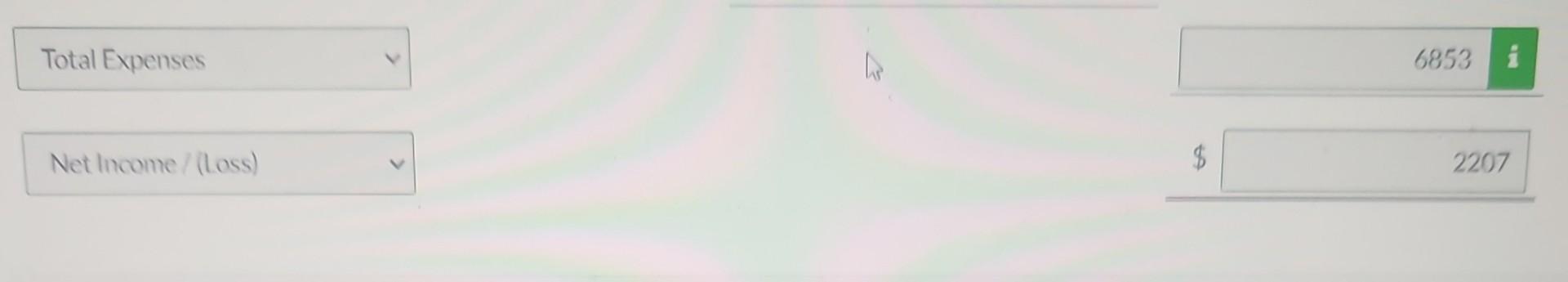

Journalize and post closing entries and complete the closing process. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Post entries in the order of journal entries presented.) Rent Expense Interest Expense (To close expense accounts) Mar. 31 Income Summary 2207 Retained Earnings (To close net income to retained earnings) Mar. 31 Retained Earnings Dividends (To close dividends to retained earnings) \begin{tabular}{lr|lr} \multicolumn{5}{c}{ Cash } \\ \hline 3/1 & 16,800 & 3/1 & 9,000 \\ 3/1 & 6,600 & 3/2 & 1,800 \\ 3/21 & 1,790 & 3/3 & 2,700 \\ & & 3/18 & 560 \\ & & 3/20 & 1,960 \\ & & 3/31 & 390 \\ & & 3/31 & 1,010 \\ \hline 3/31 Bal. & & 7,770 & \\ & & & \\ & Accounts Receivable & \\ \hline 3/14 & 4,140 & 3/21 & \\ \hline 3/28 & 4,700 & & \\ \hline 3/31 & 220 & & \\ \hline 3/31 Bal. & 7,270 & & \end{tabular} Supplies \begin{tabular}{lr|ll} \hline 3/6 & 2,240 & 3/31 & 1,930 \\ \hline 3/31Bal. & 310 & \end{tabular} Prepaid Rent \begin{tabular}{ll|lr} \hline 3/2 & 1,800 & 3/31 & 600 \\ \hline 3/31Bal. & 1,200 & \end{tabular} Prepaid Insurance \begin{tabular}{lr|l|} \hline 3/3 & 2,700 & 3/31 \\ \hline 3/31Bal. & 2,250 & \\ \hline \end{tabular} Equipment 3/31Bal3/1 9.000 9.000 Accumulated Depreciation-Equipment Accounts Payable \begin{tabular}{l|lll} \hline 3/18 & 560 & 43/6 & 2,240 \\ \hline & 3/31 Bal. & 1,680 \end{tabular} Salaries and Wages Payable \begin{tabular}{l|lr} \hline & 3/31 & 1,210 \\ \hline & 3/31Bal. & 1,210 \end{tabular} Interest Payable \begin{tabular}{l|lc} \hline & 3/31 & 33 \\ \hline & 3/31Bal & 33 \end{tabular} Common Stock \begin{tabular}{l|lr} \hline & 3/1 & 16,800 \\ \hline & 3/31 Bal. & 16,800 \end{tabular} Retained Earnings Dividends Income Summary Service Revenue Maintenance and Repairs Expense Supplies Expense \( \begin{array}{r}3 / 31 \\ \hline \multicolumn{4}{|c|}{}\end{array} \) Depreciation Expense \begin{tabular}{l} \hline 3/31 \\ \hline \\ \hline \end{tabular} Insurance Expense Salaries and Wages Expense CULVER CLEANERS Income Statement For the Month Ended March 31, 2025 Revenues Service Revenue Expenses Maintenance and Repairs Expense Supplies Expense Depreciation Expense Insurance Expense Salaries and Wages Expense \begin{tabular}{|l|l|} \hline & 450 \\ \hline \end{tabular} Rent Expense Total Expenses Net Income / (Loss) $2207 CULVER CLEANERS Retained Earnings Statement For the Month Ended March 31. 2025 Retained Earnings, March 1 Retained Earnings, March 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started