Question

Here is the ORIGINAL data of the Sport Hotel project: Suppose that everything is the same as in that problem except TWO things: the worth

Here is the ORIGINAL data of the Sport Hotel project:

Suppose that everything is the same as in that problem except TWO things: the worth of the hotel, should the city be awarded the franchise, is not $8 million but some unknown smaller number; and the probability of getting the franchise is NOT 50% but is upgraded to 80%. What must the new worth of the hotel when the franchise is granted be in order for the NPV of the Sporthotel project to be equal to exactly zero?

a. The value of the hotel should the city be awarded the franchise = $4.50 million

b. The value of the hotel should the city be awarded the franchise = $6.00 million

c. The value of the hotel should the city be awarded the franchise = $5.25 million

d. The value of the hotel should the city be awarded the franchise = $6.50 million

e. The value of the hotel should the city be awarded the franchise = $5 million

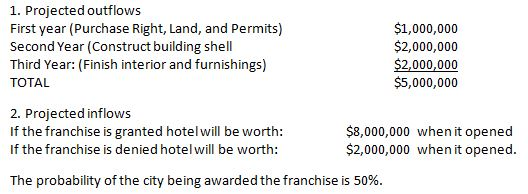

1. Projected outflows First year (Purchase Right, Land, and Permits) $1,000,000 $2,000,000 Second Year (Construct building shell Third Yea r: (Finish erior and furnishings 2,000,000 $5,000,000 TOTAL 2. Projected inflows $8,000,000 when it opened If the franchise is granted hotel will be worth $2,000,000 when it opened If the franchise is denied hotel will be worth The probability of the city being awarded the franchise is 50%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started