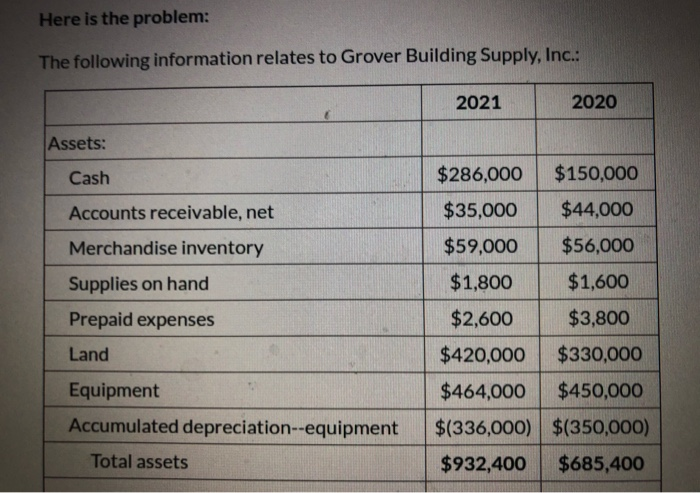

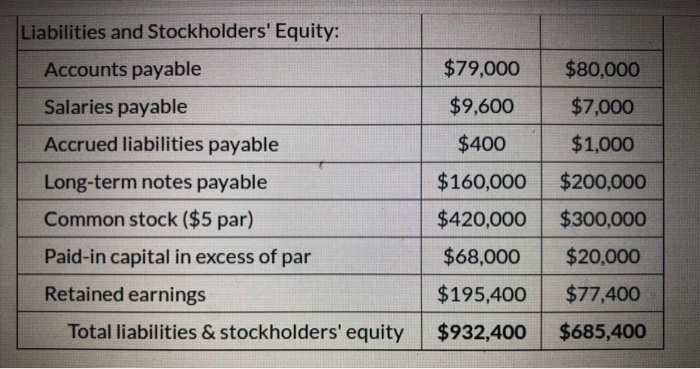

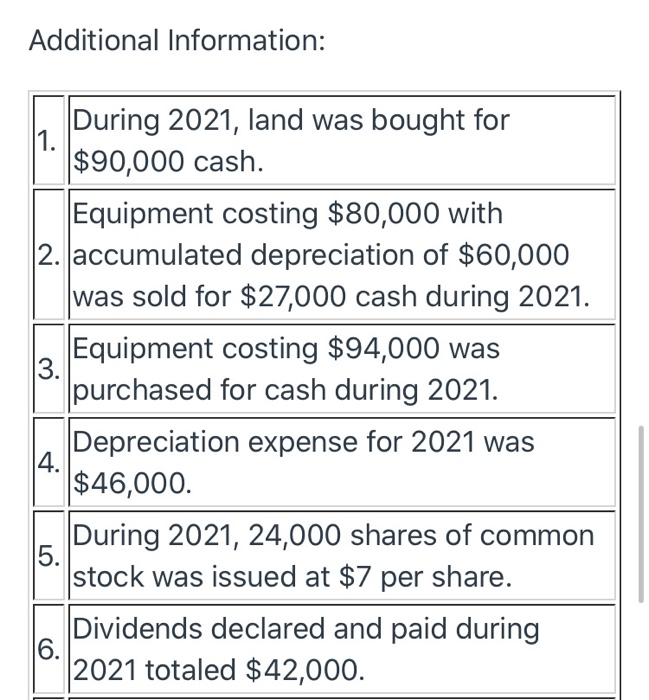

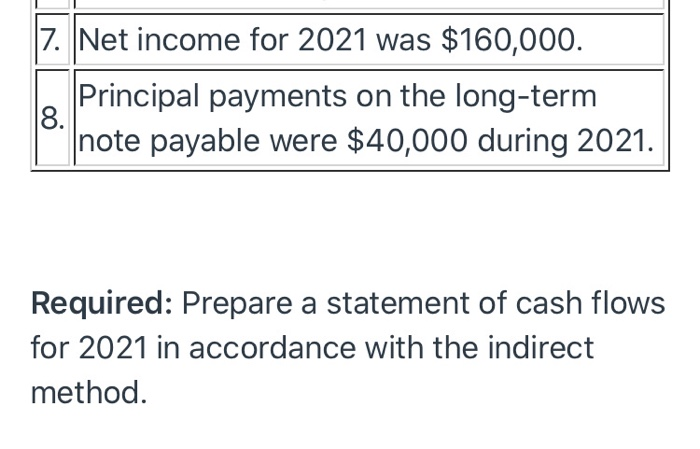

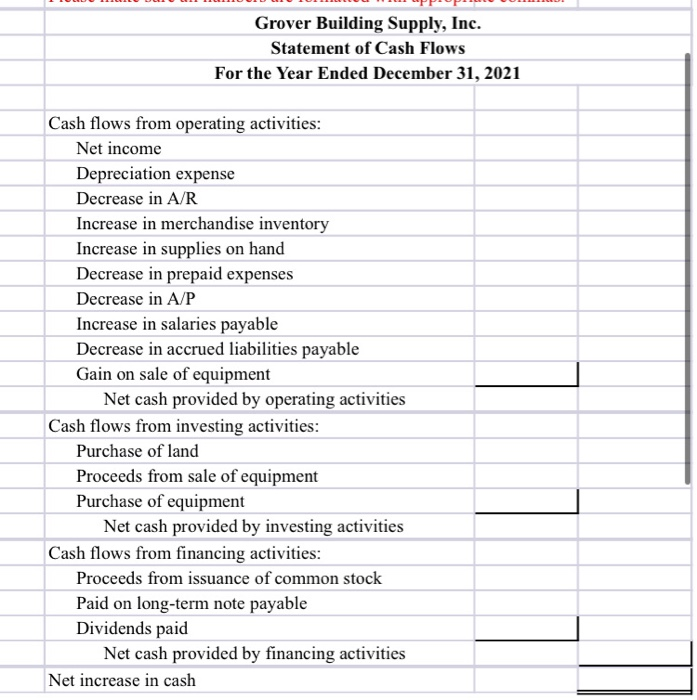

Here is the problem: The following information relates to Grover Building Supply, Inc.: 2021 2020 Assets: Cash Accounts receivable, net Merchandise inventory Supplies on hand Prepaid expenses $286,000 $150,000 $35,000 $44,000 $59,000 $56,000 $1,800 $1,600 $2,600 $3,800 $420,000 $330,000 $464,000 $450,000 $(336,000) $(350,000) $932,400 $685,400 Land Equipment Accumulated depreciation--equipment Total assets $79,000 $9,600 $400 Liabilities and Stockholders' Equity: Accounts payable Salaries payable Accrued liabilities payable Long-term notes payable Common stock ($5 par) Paid-in capital in excess of par Retained earnings Total liabilities & stockholders' equity $160,000 $420,000 $68,000 $195,400 $932,400 $80,000 $7,000 $1,000 $200,000 $300,000 $20,000 $77,400 $685,400 Additional Information: . During 2021, land was bought for $90,000 cash. Equipment costing $80,000 with 2. Jaccumulated depreciation of $60,000 was sold for $27,000 cash during 2021. Equipment costing $94,000 was purchased for cash during 2021. Depreciation expense for 2021 was $46,000. - During 2021, 24,000 shares of common stock was issued at $7 per share. Dividends declared and paid during 2021 totaled $42,000. 7. Net income for 2021 was $160,000. Principal payments on the long-term [Inote payable were $40,000 during 2021. Required: Prepare a statement of cash flows for 2021 in accordance with the indirect method. DE 101L COLEILI LEPPIOPEICOLI Grover Building Supply, Inc. Statement of Cash Flows For the Year Ended December 31, 2021 Cash flows from operating activities: Net income Depreciation expense Decrease in A/R Increase in merchandise inventory Increase in supplies on hand Decrease in prepaid expenses Decrease in A/P Increase in salaries payable Decrease in accrued liabilities payable Gain on sale of equipment Net cash provided by operating activities Cash flows from investing activities: Purchase of land Proceeds from sale of equipment Purchase of equipment Net cash provided by investing activities Cash flows from financing activities: Proceeds from issuance of common stock Paid on long-term note payable Dividends paid Net cash provided by financing activities Net increase in cash