Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here is your situation: You bought your home 10 years ago. When you bought the home, you took a 30 years fixed rate self-amortizing mortgage

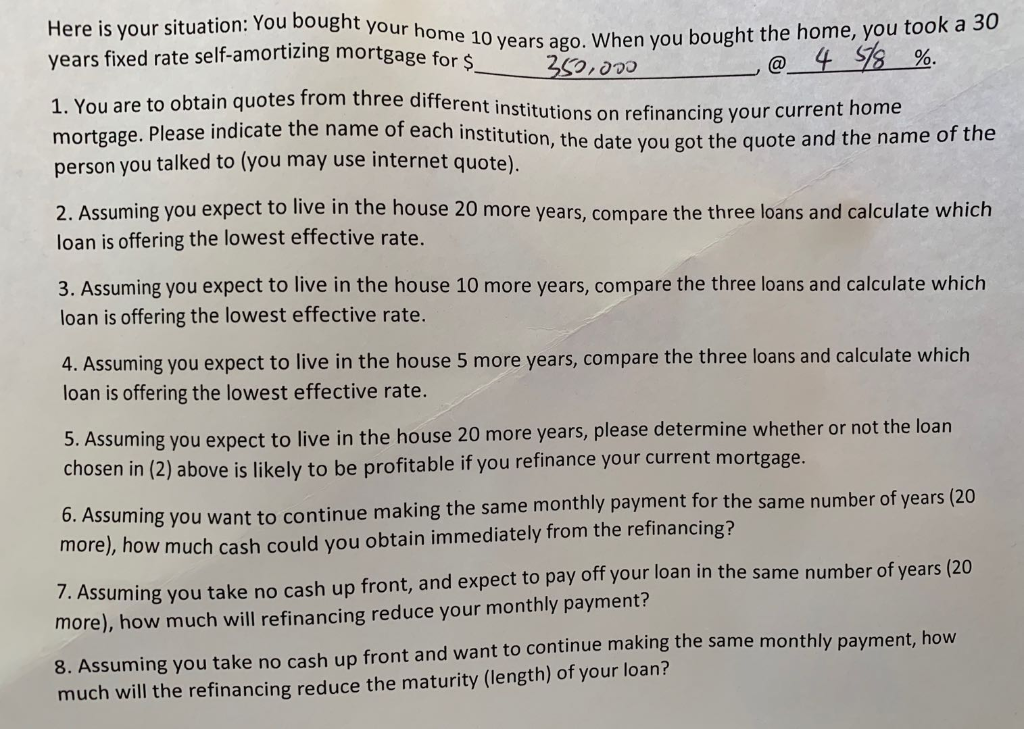

Here is your situation: You bought your home 10 years ago. When you bought the home, you took a 30 years fixed rate self-amortizing mortgage for $350,000, at 4 5/8%

Here is your situation: You bought your home 10 years ago. When you bought the home, you took a 30 years fixed rate self-amortizing mortgage for $350,000, at 4 5/8%

Here is your situation: You bought your home 10 years ago. When you bought the home, you took a 30 years fixed rate self-amortizing mortgage for 4 $8 % 25,00 1. You are to obtain quotes from three different institutions on refinancing your current home mortgage.Please indicate the name of each institution, the date you got the quote and the name of the person you talked to (you may use internet quote). 2. Assuming you expect to live in the house 20 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 3. Assuming you expect to live in the house 10 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 4.Assuming you expect to live in the house 5 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 5. Assuming you expect to live in the house 20 more years, please determine whether or not the loan chosen in (2) above is likely to be profitable if you refinance your current mortgage. 6. Assuming you want to continue making the same monthly payment for the same number of years (20 more),how much cash could you obtain immediately from the refinancing? 7. Assuming you take no cash up front, and expect to pay off your loan in the same number of vears (20 more), how much will refinancing reduce your monthly payment? 8. Assuming you take no cash up front and want to continue making the same monthly payment. how much will the refinancing reduce the maturity (length) of your loan? Here is your situation: You bought your home 10 years ago. When you bought the home, you took a 30 years fixed rate self-amortizing mortgage for 4 $8 % 25,00 1. You are to obtain quotes from three different institutions on refinancing your current home mortgage.Please indicate the name of each institution, the date you got the quote and the name of the person you talked to (you may use internet quote). 2. Assuming you expect to live in the house 20 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 3. Assuming you expect to live in the house 10 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 4.Assuming you expect to live in the house 5 more years, compare the three loans and calculate which loan is offering the lowest effective rate. 5. Assuming you expect to live in the house 20 more years, please determine whether or not the loan chosen in (2) above is likely to be profitable if you refinance your current mortgage. 6. Assuming you want to continue making the same monthly payment for the same number of years (20 more),how much cash could you obtain immediately from the refinancing? 7. Assuming you take no cash up front, and expect to pay off your loan in the same number of vears (20 more), how much will refinancing reduce your monthly payment? 8. Assuming you take no cash up front and want to continue making the same monthly payment. how much will the refinancing reduce the maturity (length) of your loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started