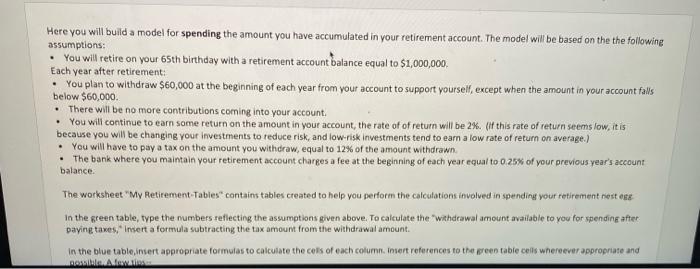

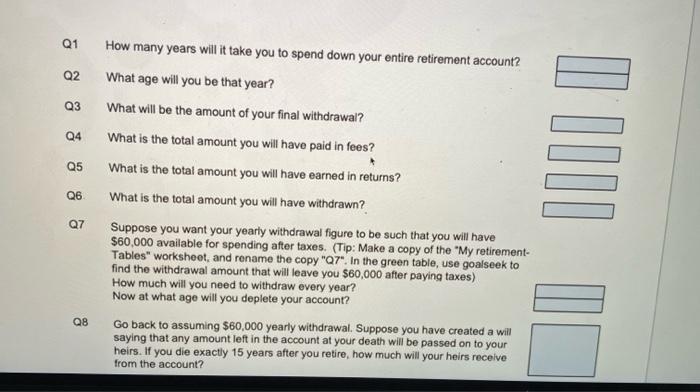

Here you will build a model for spending the amount you have accumulated in your retirement account. The model will be based on the the following assumptions: - You will retire on your 65 th birthday with a retirement account balance equal to $1,000,000. Each year after retirement: - You plan to withdraw $60,000 at the beginning of each year from your account to support yoursell, except when the amount in your account falls below $60,000 - There will be no more contributions coming into your account. - You will continue to earn some return on the amount in your account, the rate of of return will be 2%. (f this rate of return seems low, it is because you will be changing your investments to reduce risk, and low-risk investments tend to eam a low rate of return on average.) - You will have to pay a tax on the amount you withdraw, equal to 12% of the amount withdrawn. - The bank where you maintain your retirement account charges a fee at the beginning of each year equal to 0.25% of your previous year's account balance. The worksheet "My Retirement-Tables" contains tables created to help you perform the calculations involved in spending your retirement nest ess In the green table, type the numbers reflecting the assumptions given above. To calculate the "wathdrawal amount availiable to you for spending after. paying taxes, " Insert a formula subtracting the tax amoum from the withdrawal amount. In the blue tableiniert appropriate formulas to calculate the ceis of each column. insert references to the geen tabie ceils whereever appropriate and nossibile. A fow rios Q1 How many years will it take you to spend down your entire retirement account? Q2 What age will you be that year? Q3 What will be the amount of your final withdrawal? Q4 What is the total amount you will have paid in fees? Q5 What is the total amount you will have earned in returns? Q6. What is the total amount you will have withdrawn? Q7 Suppose you want your yearly withdrawal figure to be such that you will have $60,000 available for spending after taxes. (Tip: Make a copy of the " My retirementTables" worksheot, and rename the copy "Q7". In the green table, use goalseek to find the withdrawal amount that will leave you $60,000 after paying taxes) How much will you need to withdraw every year? Now at what age will you deplete your account? Q8 Go back to assuming $60,000 yearly withdrawal. Suppose you have created a will saying that any amount left in the account at your death will be passed on to your heirs. If you die exactly 15 years after you retire, how much will your heirs receive from the account? Here you will build a model for spending the amount you have accumulated in your retirement account. The model will be based on the the following assumptions: - You will retire on your 65 th birthday with a retirement account balance equal to $1,000,000. Each year after retirement: - You plan to withdraw $60,000 at the beginning of each year from your account to support yoursell, except when the amount in your account falls below $60,000 - There will be no more contributions coming into your account. - You will continue to earn some return on the amount in your account, the rate of of return will be 2%. (f this rate of return seems low, it is because you will be changing your investments to reduce risk, and low-risk investments tend to eam a low rate of return on average.) - You will have to pay a tax on the amount you withdraw, equal to 12% of the amount withdrawn. - The bank where you maintain your retirement account charges a fee at the beginning of each year equal to 0.25% of your previous year's account balance. The worksheet "My Retirement-Tables" contains tables created to help you perform the calculations involved in spending your retirement nest ess In the green table, type the numbers reflecting the assumptions given above. To calculate the "wathdrawal amount availiable to you for spending after. paying taxes, " Insert a formula subtracting the tax amoum from the withdrawal amount. In the blue tableiniert appropriate formulas to calculate the ceis of each column. insert references to the geen tabie ceils whereever appropriate and nossibile. A fow rios Q1 How many years will it take you to spend down your entire retirement account? Q2 What age will you be that year? Q3 What will be the amount of your final withdrawal? Q4 What is the total amount you will have paid in fees? Q5 What is the total amount you will have earned in returns? Q6. What is the total amount you will have withdrawn? Q7 Suppose you want your yearly withdrawal figure to be such that you will have $60,000 available for spending after taxes. (Tip: Make a copy of the " My retirementTables" worksheot, and rename the copy "Q7". In the green table, use goalseek to find the withdrawal amount that will leave you $60,000 after paying taxes) How much will you need to withdraw every year? Now at what age will you deplete your account? Q8 Go back to assuming $60,000 yearly withdrawal. Suppose you have created a will saying that any amount left in the account at your death will be passed on to your heirs. If you die exactly 15 years after you retire, how much will your heirs receive from the account