Question

Here's a practice problem I have been trying to figure out: The following shareholders' equity section was taken from the books of the Kendra Corporation

Here's a practice problem I have been trying to figure out:

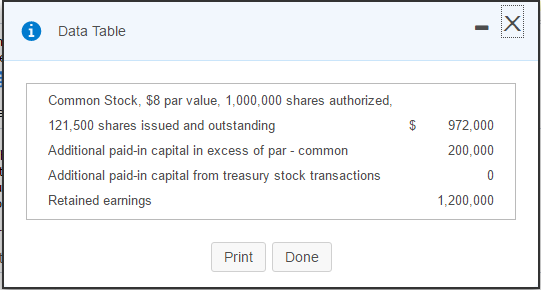

The following shareholders' equity section was taken from the books of the Kendra Corporation at the beginning of the current year:

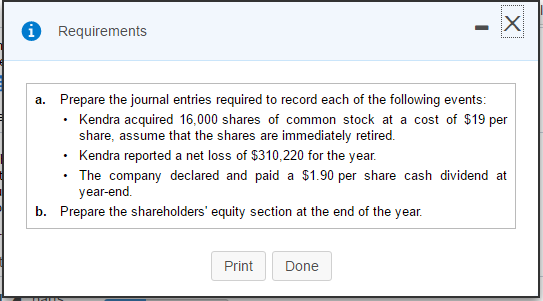

I am trying to figure out how to calculate the average additional paid-in capital in excess of par- common per share. According to the solutions, to calculate this, you take the additional paid-in capital divided by the number of shares issued and outstanding. However, I do not understand how they got $212,625 as the additional paid-in capital in excess of par-common amount.

Can someone explain how to get to that figure? I must be overlooking something.

Thanks in advance!

Data Table Common Stock, $8 par value, 1,000,000 shares authorized, 121,500 shares issued and outstanding Additional paid-in capital in excess of par common Additional paid-in capital from treasury stock transactions Retained earnings Print Done 972.000 200,000 1,200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started