Question

Here's question 1-3 that it was missing: 1. Amounts due from customers totaled $175,000 at 12/31/2016. 2. In analyzing amounts due from customers at 12/31/2016,

Here's question 1-3 that it was missing:

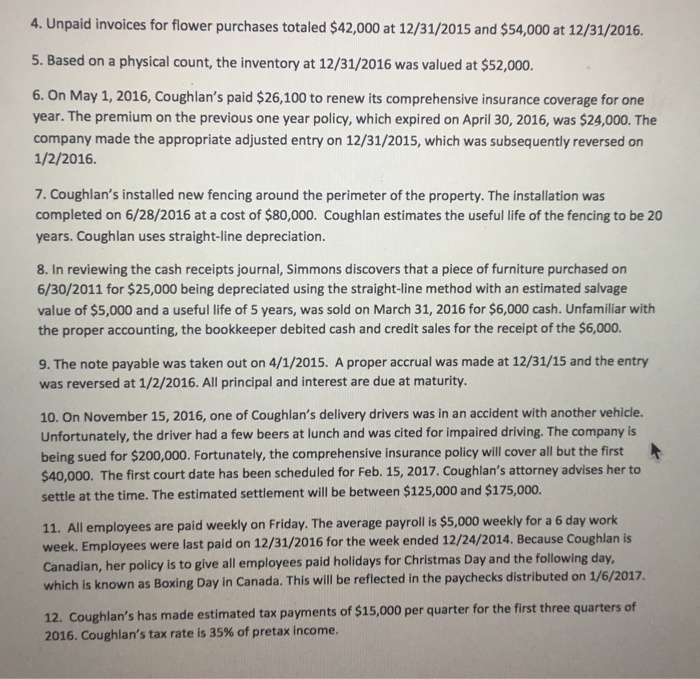

1. Amounts due from customers totaled $175,000 at 12/31/2016.

2. In analyzing amounts due from customers at 12/31/2016, Simmons discovers that Coughlans has a $6,000 receivable more than 9 months overdue from Jims Retail Store. Simmons discovers that Jims filed for bankruptcy on 12/02/2016 and determines that it is highly unlikely that Coughlans will recover any of the $6,000 and that the amount should be written off.

3. A further analysis and aging of accounts receivable at 12/31/2016 shows approximately $18,000 of potential uncollectible accounts other than the Jims Retail Store account.

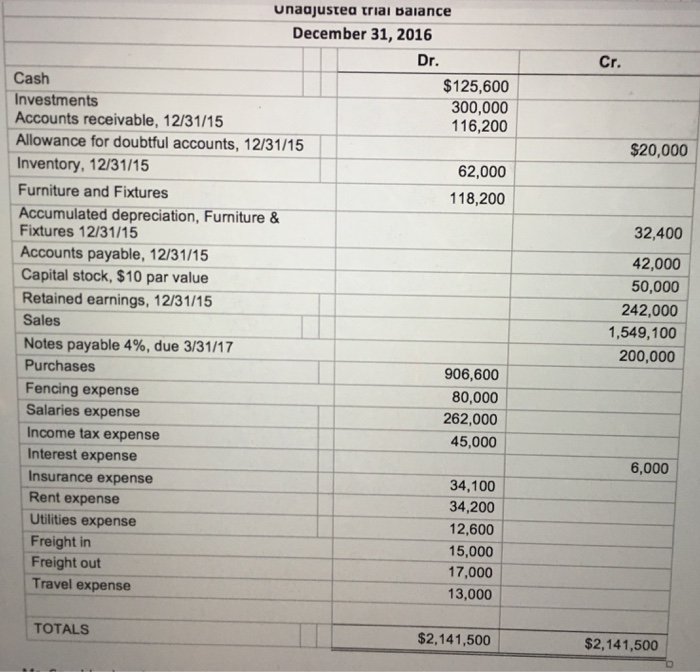

unaajustea triai baiance December 31, 2016 Dr. Cr. $125,600 300,000 116,200 Cash Investments Accounts receivable, 12/31/15 Allowance for doubtful accounts, 12/31/15 Inventory, 12/31/15 Furniture and Fixtures Accumulated depreciation, Furniture & Fixtures 12/31/15 Accounts payable, 12/31/15 Capital stock, $10 par value Retained earnings, 12/31/15 Sales Notes payable 4%, due 3/31/17 $20,000 62,000 118,200 32,400 42,000 50,000 242,000 1,549,100 200,000 906,600 80,000 262,000 45,000 Purchases Fencing expense Salaries expense Income tax expense Interest expense Insurance expense 6,000 Rent expense Utilities expense Freight in Freight out Travel expense 34,100 34,200 12,600 15,000 17,000 3,000 TOTALS $2,141,500 $2,141,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started