Answered step by step

Verified Expert Solution

Question

1 Approved Answer

here's the solution for the problem but still not coming up with the answer. how to calculate the problem on calculator? 1. Sammy anticipates that

here's the solution for the problem but still not coming up with the answer. how to calculate the problem on calculator?

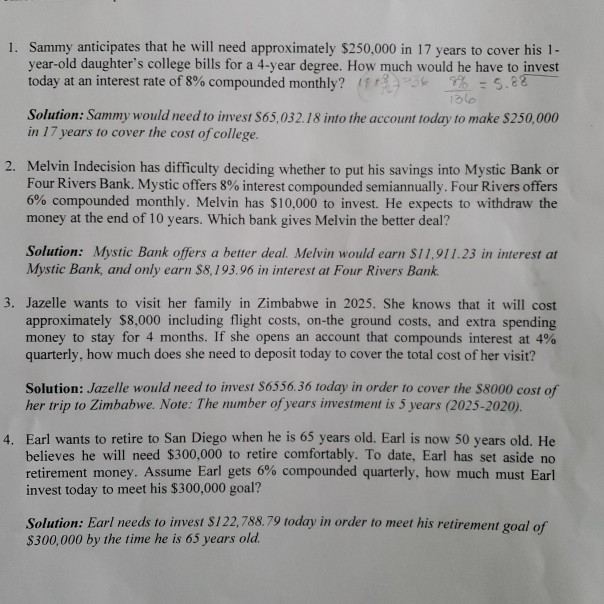

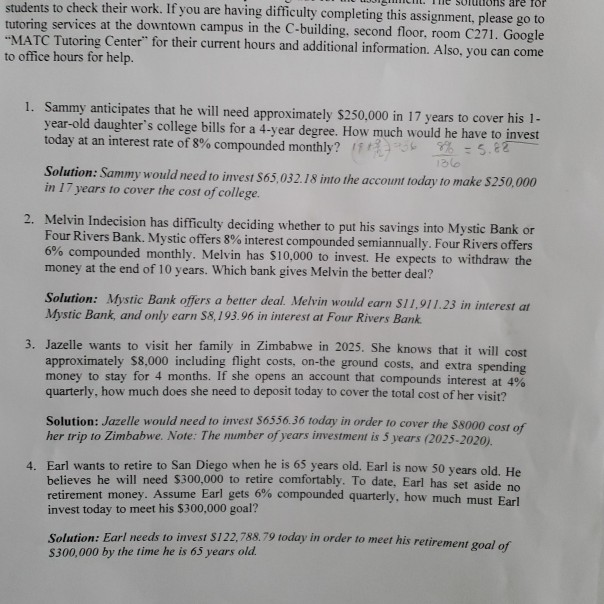

1. Sammy anticipates that he will need approximately $250,000 in 17 years to cover his 1- year-old daughter's college bills for a 4-year degree. How much would he have to invest today at an interest rate of 8% compounded monthly? 1113 69% = 5.82 1310 Solution: Sammy would need to invest $65,032.18 into the account today to make $250,000 in 17 years to cover the cost of college. 2. Melvin Indecision has difficulty deciding whether to put his savings into Mystic Bank of Four Rivers Bank. Mystic offers 8% interest compounded semiannually. Four Rivers offers 6% compounded monthly. Melvin has $10,000 to invest. He expects to withdraw the money at the end of 10 years. Which bank gives Melvin the better deal? Solution: Mystic Bank offers a better deal. Melvin would earn $11.911.23 in interest at Mystic Bank, and only earn $8,193.96 in interest at Four Rivers Bank 3. Jazelle wants to visit her family in Zimbabwe in 2025. She knows that it will cost approximately $8,000 including flight costs, on-the ground costs, and extra spending money to stay for 4 months. If she opens an account that compounds interest at 4% quarterly, how much does she need to deposit today to cover the total cost of her visit? Solution: Jazelle would need to invest $6356.36 today in order to cover the $8000 cost of her trip to Zimbabwe. Note: The number of years investment is 5 years (2025-2020). 4. Earl wants to retire to San Diego when he is 65 years old. Earl is now 50 years old. He believes he will need $300,000 to retire comfortably. To date, Earl has set aside no retirement money. Assume Earl gets 6% compounded quarterly, how much must Earl invest today to meet his $300,000 goal? Solution: Earl needs to invest $722,788.79 today in order to meet his retirement goal of $300,000 by the time he is 65 years old. I M JUILICIIL. TE SUTULIONIS are lor students to check their work. If you are having difficulty completing this assignment, please go to tutoring services at the downtown campus in the C-building, second floor, room C271. Google "MATC Tutoring Center for their current hours and additional information. Also, you can come to office hours for help. 1. Sammy anticipates that he will need approximately $250.000 in 17 years to cover his 1- year-old daughter's college bills for a 4-year degree. How much would he have to invest today at an interest rate of 8% compounded monthly? 1 6 96 = 5.22 136 Solution: Sammy would need to invest S65,032.18 into the account today to make $250.000 in 17 years to cover the cost of college. 2. Melvin Indecision has difficulty deciding whether to put his savings into Mystic Bank or Four Rivers Bank. Mystic offers 8% interest compounded semiannually. Four Rivers offers 6% compounded monthly. Melvin has $10,000 to invest. He expects to withdraw the money at the end of 10 years. Which bank gives Melvin the better deal? Solution: Mystic Bank offers a better deal. Melvin would earn $11.911.23 in interest at Mystic Bank, and only earn $8,193.96 in interest at Four Rivers Bank 3. Jazelle wants to visit her family in Zimbabwe in 2025. She knows that it will cost approximately $8.000 including flight costs, on-the ground costs, and extra spending money to stay for 4 months. If she opens an account that compounds interest at 4% quarterly, how much does she need to deposit today to cover the total cost of her visita Solution: Jazelle would need to invest $6556.30 today in order to cover the $8000 cost of her trin to Zimbabwe. Note: The number of years investment is 5 vears 72025.2020 4. Earl wants to retire to San Diego when he is o years old. Earl is now 50 years old He helieves he will need $300,000 to retire comfortably. To date, Earl has set aside retirement money. Assume Earl gets 6% compounded quarterly, how much must Farl invest today to meet his $300,000 goal? Calutinn. Farl needs to invest S/22,788.79 today in order to meet his retirement goal of $300,000 by the time he is 65 years old

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started