Answered step by step

Verified Expert Solution

Question

1 Approved Answer

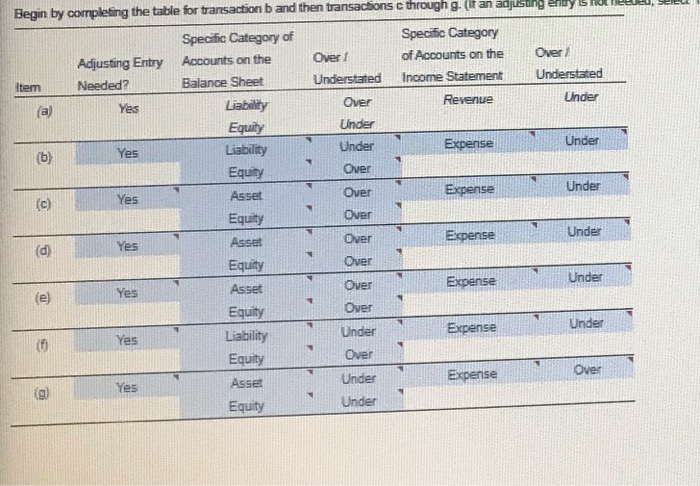

heres the solution. i need an full, complete explaination of each step from a-g, i.e. why the specific category of accounts on balance sheet of

heres the solution. i need an full, complete explaination of each step from a-g, i.e. why the specific category of accounts on balance sheet of a is libaility and equity showing why it os overstated/understed, why the specifc category of accounting on the income statement is either revenue or expense, and so on for the rest!

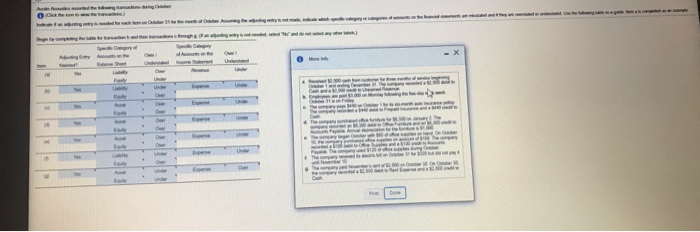

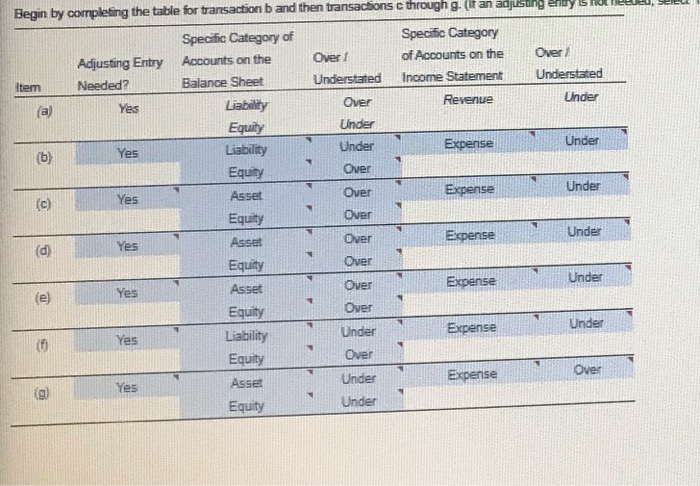

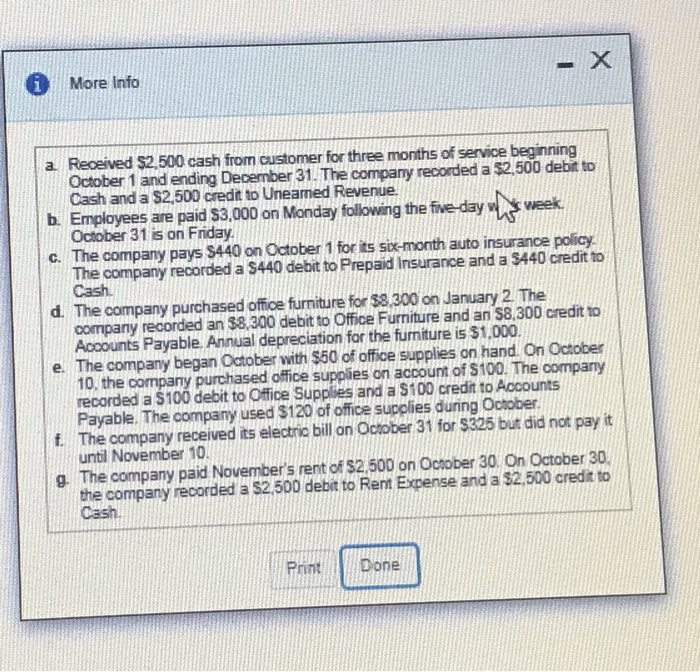

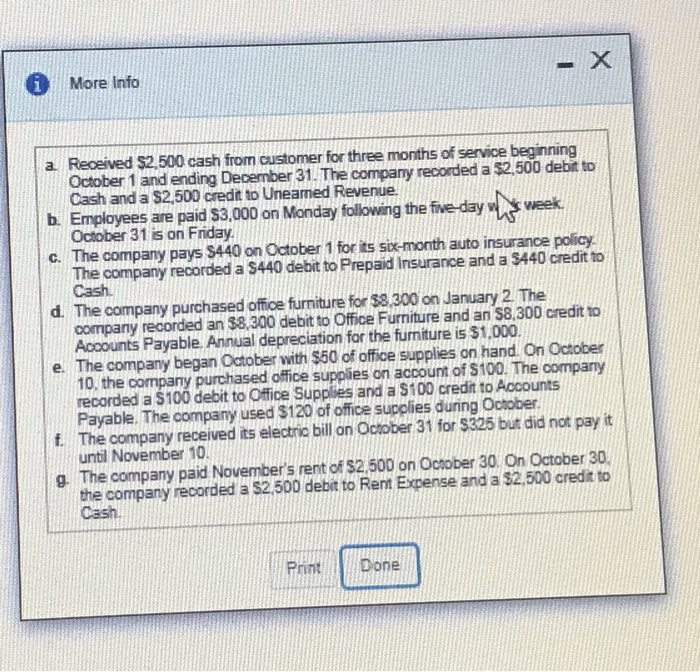

ho) RE w - . D Begin by completing the table for transaction b and then transactions through g. (It an adjusung eney Specific Category of Specific Category Over 1 of Accounts on the Over Adjusting Entry Accounts on the Needed? Understated Balance Sheet Understated Item Income Statement Under Over (a) Yes Liability Revenue Equity Under Under Liability Yes Under Expense (b) Equity Over Over Expense Under Asset Yes Equity Over Over Under Expense Asset (d) Yes Equity Over Under Expense Asset Yes Over Equity Over Expense Under Under Yes Liability Equity Over Over Expense Yes Asset Under Equity Under (c) e - X * More Info a Received $2,500 cash from customer for three months of service beginning October 1 and ending December 31. The company recorded a $2,500 debit to Cash and a $2,500 credit to Uneamed Revenue. b. Employees are paid $3,000 on Monday following the five-day was week October 31 is on Friday. C. The company pays $440 on October 1 for its six-month auto insurance policy. The company recorded a S440 debit to Prepaid Insurance and a $440 credit to Cash. d. The company purchased office furniture for $8.300 on January 2. The company recorded an 38,300 debit to Office Furniture and an $8,300 credit to Accounts Payable. Annual depreciation for the furniture is 31,000. e. The company began October with 550 of office supplies on hand. On October 10. the company purchased office supplies on account of $100. The company recorded a $100 debit to Office Supplies and a $100 credit to Accounts Payable. The company used $120 of office supplies during October f. The company received its electric bill on October 31 for $325 but did not pay it until November 10. g. The company paid November's rent of $2,500 on October 30 On October 30 the company recorded a $2,500 debit to Rent Expense and a $2,500 credit to Cash Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started