Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Here's the table to work answer this question as soon as possible thanks answer this question as soon as possible thanks Exterior Designs has two

Here's the table to work

answer this question as soon as possible thanks

answer this question as soon as possible thanks

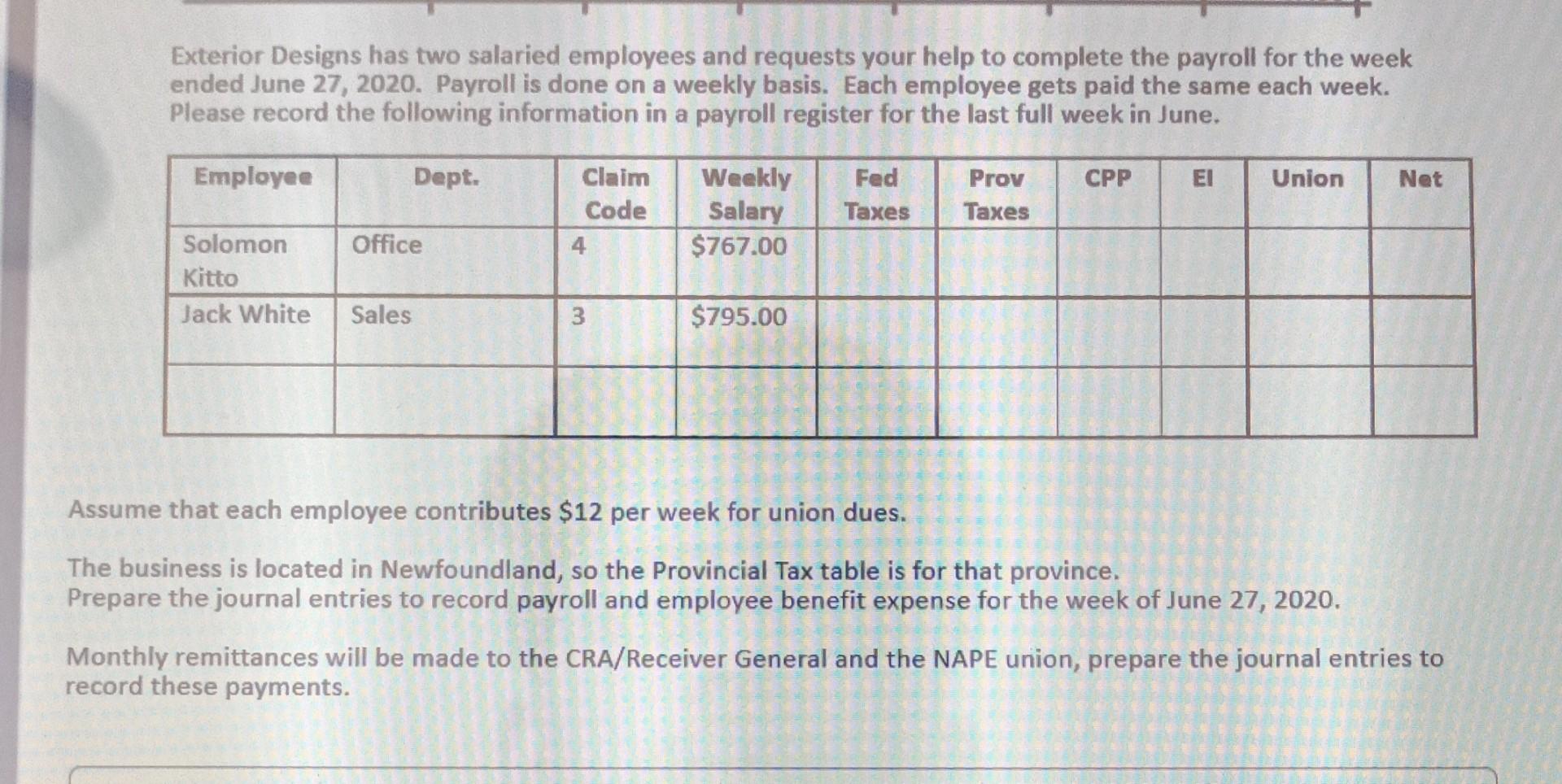

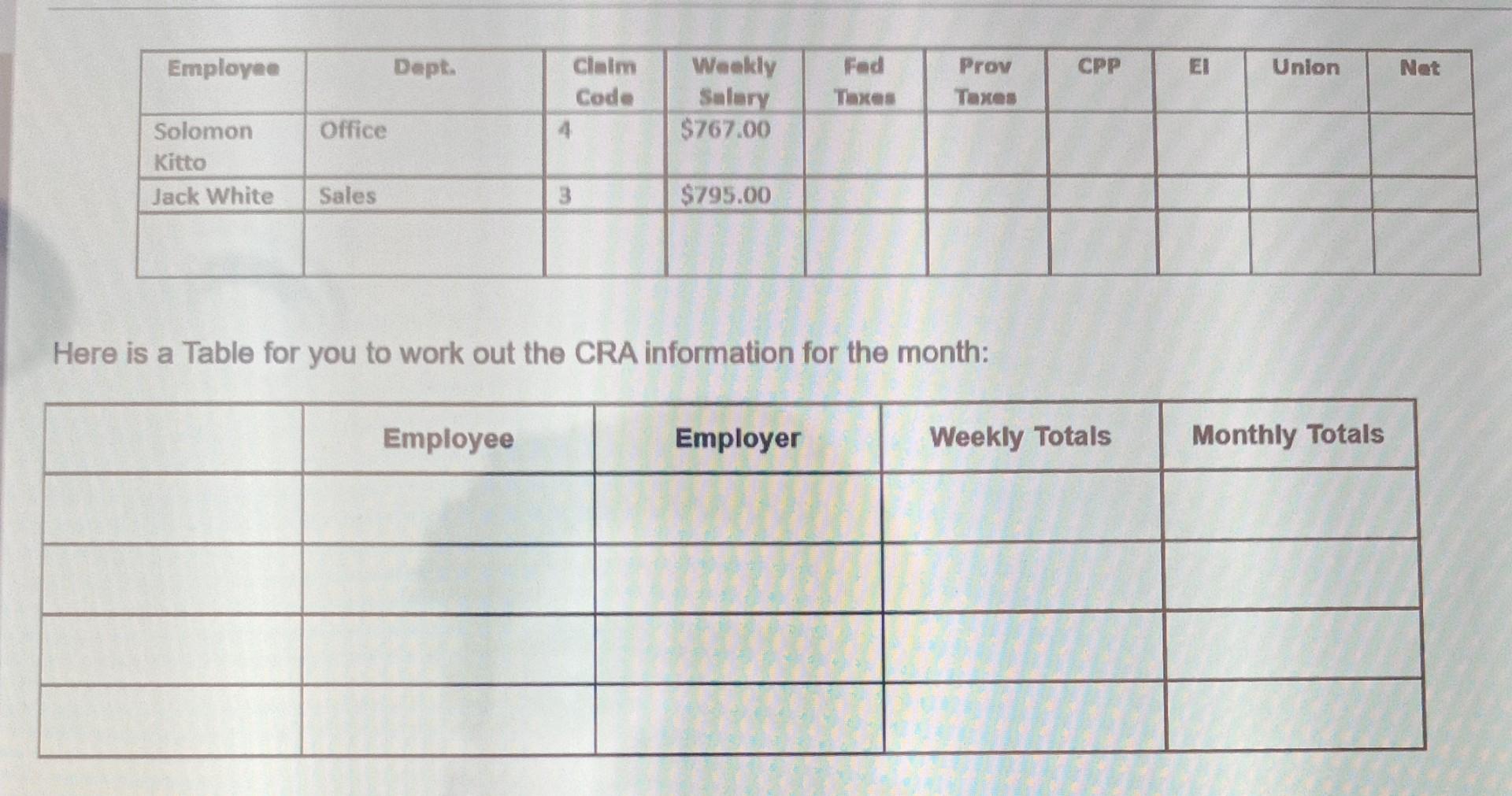

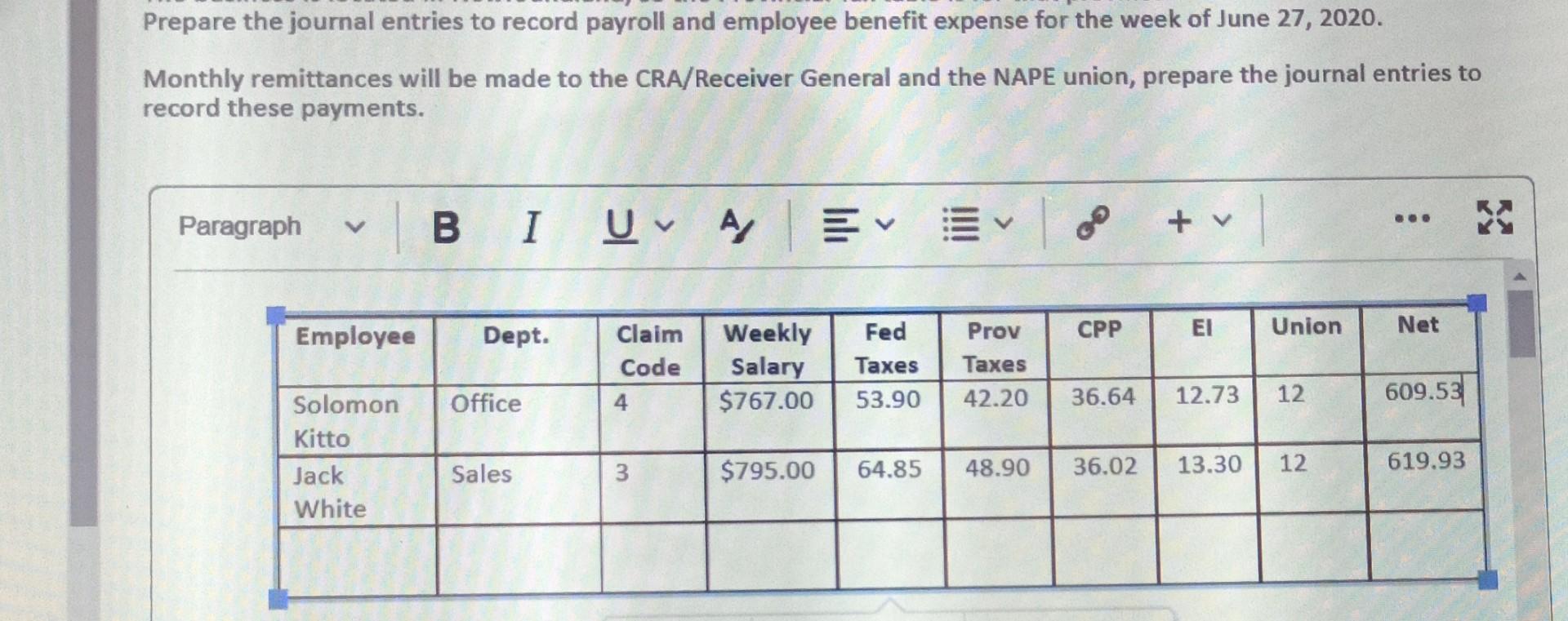

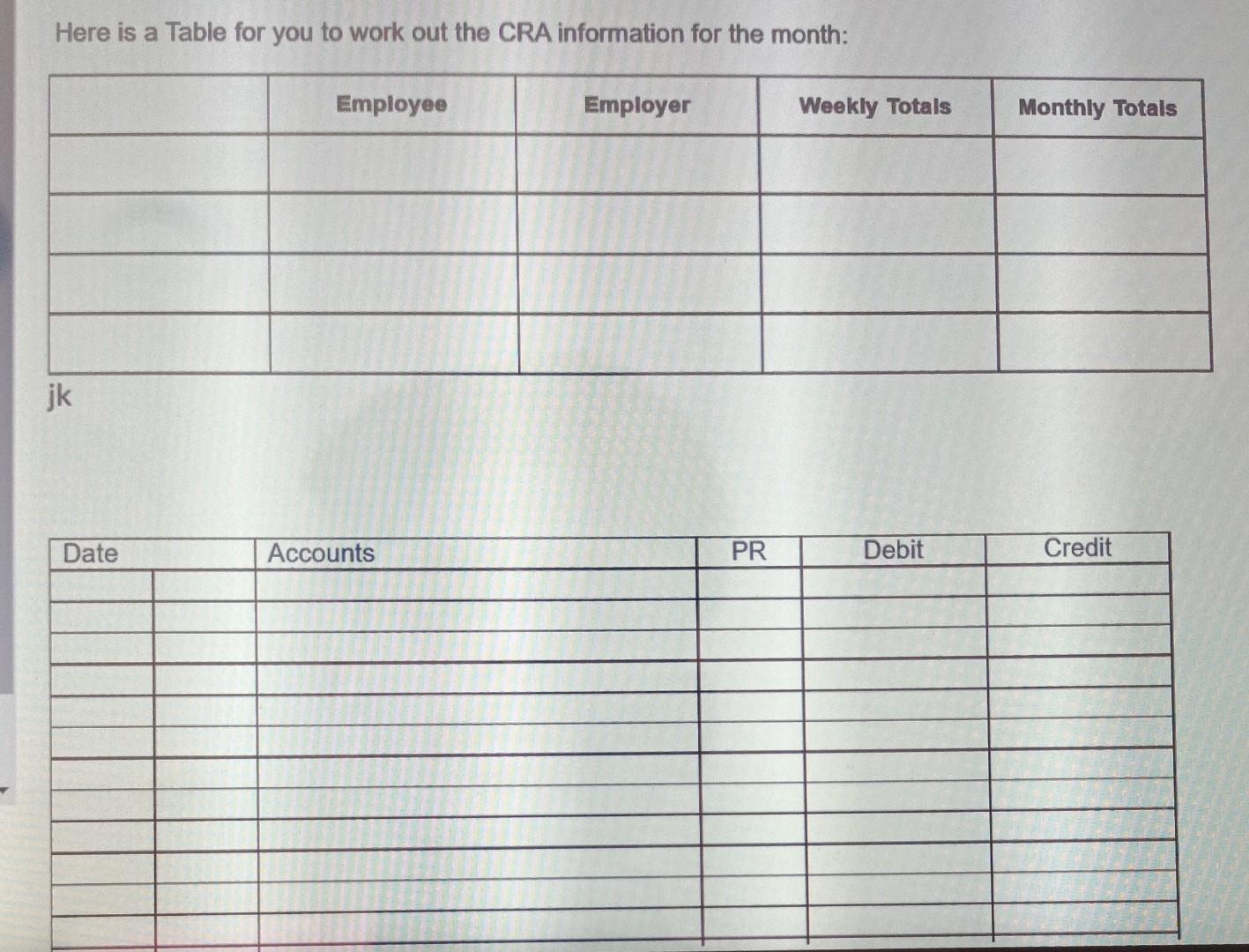

Exterior Designs has two salaried employees and requests your help to complete the payroll for the week ended June 27, 2020. Payroll is done on a weekly basis. Each employee gets paid the same each week. Please record the following information in a payroll register for the last full week in June. Employee Dept. CPP EI Union Net Claim Code 4 Weekly Salary $767.00 Fed Taxes Prov Taxes Office Solomon Kitto Jack White Sales 3 $795.00 Assume that each employee contributes $12 per week for union dues. The business is located in Newfoundland, so the Provincial Tax table is for that province. Prepare the journal entries to record payroll and employee benefit expense for the week of June 27, 2020. Monthly remittances will be made to the CRA/Receiver General and the NAPE union, prepare the journal entries to record these payments. Employee Dept. CPP Union Net Claim Code 4 Waakly Salary $767.00 Fad Taxes Prov Taxes Office Solomon Kitto Jack White Sales $795.00 Here is a Table for you to work out the CRA information for the month: Employee Employer Weekly Totals Monthly Totals Date Accounts PR Debit Credit Prepare the journal entries to record payroll and employee benefit expense for the week of June 27, 2020. Monthly remittances will be made to the CRA/Receiver General and the NAPE union, prepare the journal entries to record these payments. Paragraph V B I UV + Employee Dept. CPP Net Union Claim Code 4 Weekly Salary $767.00 Fed Taxes 53.90 Prov Taxes 42.20 Office 36.64 12.73 12 609.53 Solomon Kitto Jack White Sales 3 $795.00 64.85 48.90 36.02 13.30 12 619.93 Here is a Table for you to work out the CRA information for the month: Employee Employer Weekly Totals Monthly Totals jk Date Accounts PR Debit Credit Exterior Designs has two salaried employees and requests your help to complete the payroll for the week ended June 27, 2020. Payroll is done on a weekly basis. Each employee gets paid the same each week. Please record the following information in a payroll register for the last full week in June. Employee Dept. CPP EI Union Net Claim Code 4 Weekly Salary $767.00 Fed Taxes Prov Taxes Office Solomon Kitto Jack White Sales 3 $795.00 Assume that each employee contributes $12 per week for union dues. The business is located in Newfoundland, so the Provincial Tax table is for that province. Prepare the journal entries to record payroll and employee benefit expense for the week of June 27, 2020. Monthly remittances will be made to the CRA/Receiver General and the NAPE union, prepare the journal entries to record these payments. Employee Dept. CPP Union Net Claim Code 4 Waakly Salary $767.00 Fad Taxes Prov Taxes Office Solomon Kitto Jack White Sales $795.00 Here is a Table for you to work out the CRA information for the month: Employee Employer Weekly Totals Monthly Totals Date Accounts PR Debit Credit Prepare the journal entries to record payroll and employee benefit expense for the week of June 27, 2020. Monthly remittances will be made to the CRA/Receiver General and the NAPE union, prepare the journal entries to record these payments. Paragraph V B I UV + Employee Dept. CPP Net Union Claim Code 4 Weekly Salary $767.00 Fed Taxes 53.90 Prov Taxes 42.20 Office 36.64 12.73 12 609.53 Solomon Kitto Jack White Sales 3 $795.00 64.85 48.90 36.02 13.30 12 619.93 Here is a Table for you to work out the CRA information for the month: Employee Employer Weekly Totals Monthly Totals jk Date Accounts PR Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started