Answered step by step

Verified Expert Solution

Question

1 Approved Answer

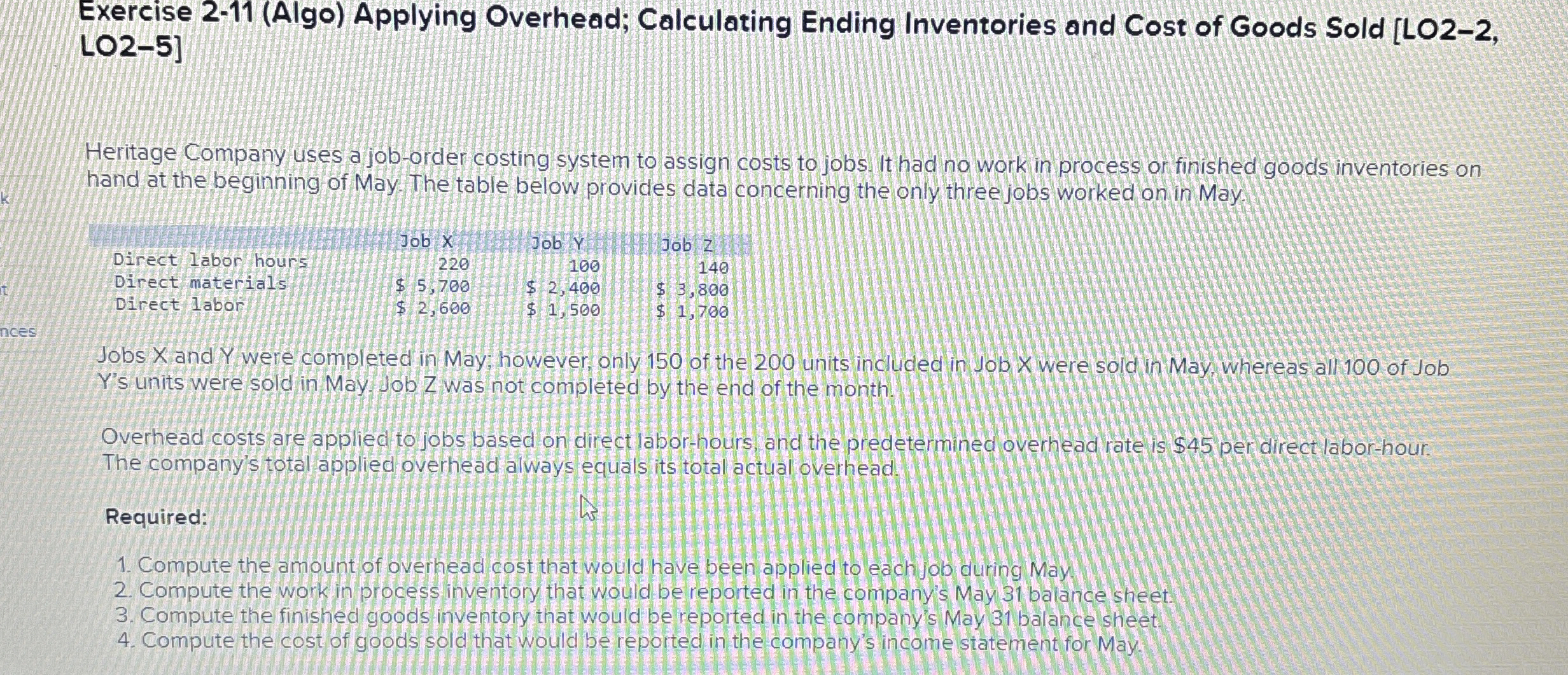

Heritage Company uses a job - order costing system to assign costs to jobs. It had no work in process or finished goods inventories on

Heritage Company uses a joborder costing system to assign costs to jobs. It had no work in process or finished goods inventories on

hand at the beginning of May. The table below provides data concerning the only three jobs worked on in May.

Jobs and were completed in May however, only of the units included in Job were sold in May whereas all of Job

Ys units were sold in May Job Z was not completed by the end of the month.

Overhead costs are applied to jobs based on direct laborhours, and the predetermined overhead rate is $ per direct laborhour.

The company's total applied overhead always equals its total actual overhead.

Required:

Compute the amount of overhead cost that would have been applied to each job during May

Compute the work in process inventory that would be reported in the company's May balance sheet

Compute the finished goods inventory that would be reported in the company's May balance sheet

Compute the cost of goods sold that would be reported in the company's income statement for May.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started