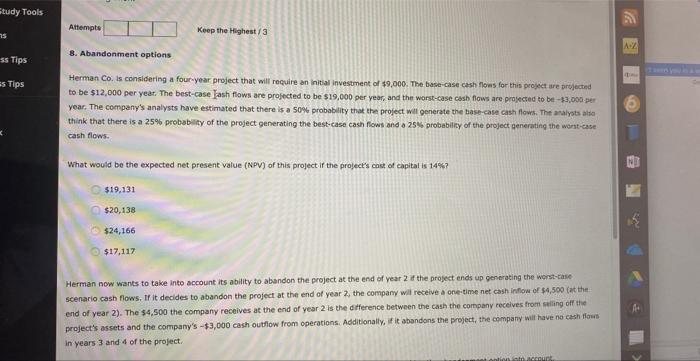

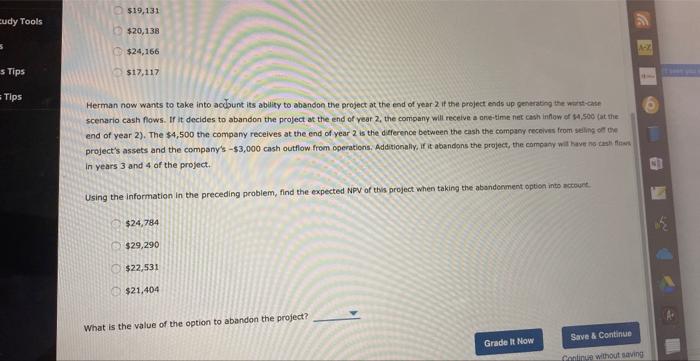

Herman Co. Is consldering a four-year project that will recuire an initial investment of {9,000, The base-case cash flows for this project are projected to be $12, .00 per year. The best-case lash fiows are projected to be $19,000 per year, and the worst-case cash flows are prayected to be - $3,059 ser year, The company's analysts have estimated that there is a 50% probablity that the profect wil generate the hase-case cash flows. The analyota aht think that there is a 25% probabifty of the project generating the best-case cash fows and a 25% probabiliz of the project generating the wort-case cash flows. What would be the expected net present value (NPY) of this project if the project's cost of eapital is 14% ? 519,131 520r+38 424,166 $17,117 Herman now wants to take into sccount its ability to abandon the project at the end of year 2 it the project ends up generating the worst-tale scenario cash flows. If it decides to abandon the project at the end of year 2 , the cornpany will reteive a one-time net cash ir fow of s4, 500 (at theend of year 2). The $4,500 the company receives at the end of year 2 is the difference between the cash the cornpany receives from seiling off the project's assets and the company's $3,000 cash outfow from operations. Additionally, if it abandons the project, the campany will have no cash flous in years 3 arid 4 of the project. $19,131 $20,138 $24,166 517,117 Herman now wants to take into acdount its ability to abandon the project at the end of year 2 if the project ends up qenkrabin the wark-cate scenario cash fows. If it decides to abandon the project at the end of vear 2 , the company will receive a one time fiet cash inflow of th. Soo fat the end of year 2). The \$4,500 the company receives at the end of year 2 is the difference between the eash the campany receivas from seling off tre project's assets and the company's 53,000 cash outfow from operations, Addisionally, if it abandons the project, the campany wit kaye no tasi fitses in years 3 and 4 of the project. Using the information In the preceding problem, find the expected NPV of this project when taking the absiderment opbon into account $24,784$29,290$22,531$21,404 What is the value of the option to abandon the project