Question

Consider a two step binomial tree model for an American put option whose strike price is K = 101, with the following parameters: Sto

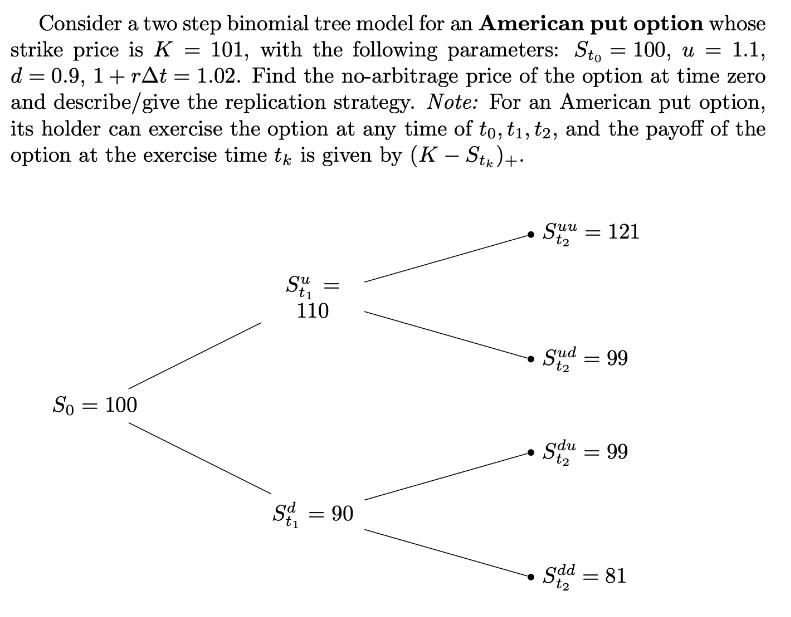

Consider a two step binomial tree model for an American put option whose strike price is K = 101, with the following parameters: Sto u = 1.1, d = 0.9, 1+rAt=1.02. Find the no-arbitrage price of the option at time zero and describe/give the replication strategy. Note: For an American put option, its holder can exercise the option at any time of to, t1, t2, and the payoff of the option at the exercise time tk is given by (K-St)+. So = 100 SU = 110 St = 90 Suu Sud Sdu = = 121 = 99 = 99 Sdd = 81 t2

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

EXPLANATION The noarbitrage price at t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Statistics

Authors: Michael Sullivan III

4th Edition

978-032184460, 032183870X, 321844602, 9780321838704, 978-0321844606

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App