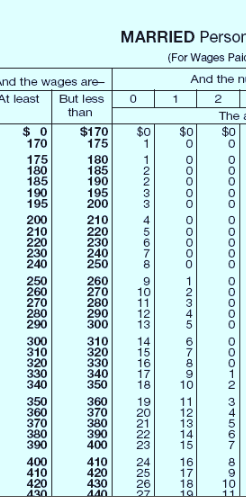

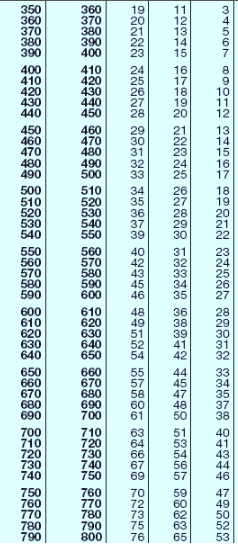

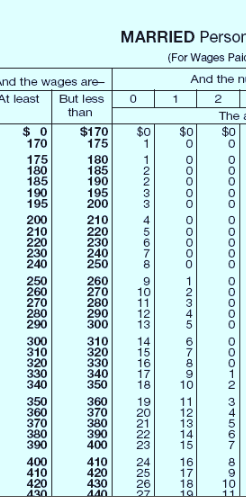

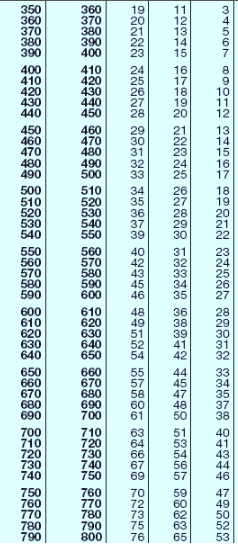

Herman Swayne is a waiter at the Dixie Hotel. In his first weekly pay in March, he earned $360.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($700.00), and the employer withholds the appropriate taxes for the tips from this first pay in March Calculate his net take home pay assuming the employer withheld federal income tax wage bracket, married, 2 allowances social security taxes and state income tax 2%). Enter deductions beginning with a minus sign ( Click here to access the Wage-Bracket Method Tables Gross pay Federal income tax Social security taxes-OASDI Social security taxes HI State income tax Net pay 380 430 34567 89012 34567 89012 34567 89012 34578 01346 79023 22222 22332 33533 44444 44523 12345 67890 12345 67890 12345 68912 45780 13467 90235 11111 11112 22222 22223 33333 33344 44445 55555 56666 90123 45678 90123 45679 02356 89124 57801 34679 02356 12222 22222 23333 33333 44444 44555 55566 66666 77777 360 70 360 90 400 10 20 400 40 50 60 70 400 400 500 10500 70600 10 20 600 40 50 60 70700 10 20 30 40 50 750 70 80 90 800 44445 55 56 66 350 360200 400-400 400 400 250 400 170 400 400 500 $10 $20 $50 500 sro sso sso 600- ese700 210 220 750 750 750 700 170 750 750 Herman Swayne is a waiter at the Dixie Hotel. In his first weekly pay in March, he earned $360.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($700.00), and the employer withholds the appropriate taxes for the tips from this first pay in March Calculate his net take home pay assuming the employer withheld federal income tax wage bracket, married, 2 allowances social security taxes and state income tax 2%). Enter deductions beginning with a minus sign ( Click here to access the Wage-Bracket Method Tables Gross pay Federal income tax Social security taxes-OASDI Social security taxes HI State income tax Net pay 380 430 34567 89012 34567 89012 34567 89012 34578 01346 79023 22222 22332 33533 44444 44523 12345 67890 12345 67890 12345 68912 45780 13467 90235 11111 11112 22222 22223 33333 33344 44445 55555 56666 90123 45678 90123 45679 02356 89124 57801 34679 02356 12222 22222 23333 33333 44444 44555 55566 66666 77777 360 70 360 90 400 10 20 400 40 50 60 70 400 400 500 10500 70600 10 20 600 40 50 60 70700 10 20 30 40 50 750 70 80 90 800 44445 55 56 66 350 360200 400-400 400 400 250 400 170 400 400 500 $10 $20 $50 500 sro sso sso 600- ese700 210 220 750 750 750 700 170 750 750