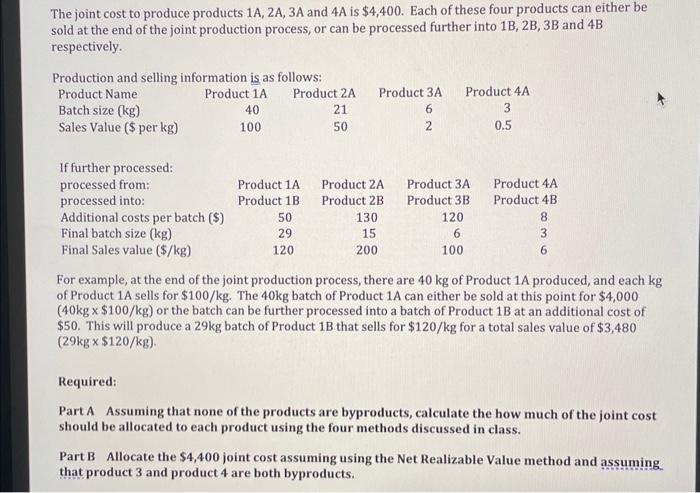

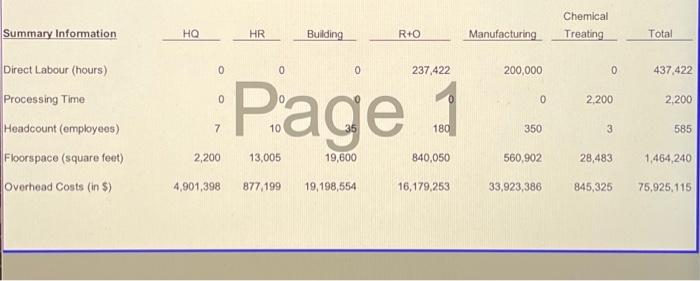

Hevisis harwina andin 1t beidive 310 The joint cost to produce products 1A,2A,3A and 4A is $4,400. Each of these four products can either be sold at the end of the joint production process, or can be processed further into 1B,2B,3B and 4B respectively. Praduction and eallino information is ac follows: For example, at the end of the joint production process, there are 40kg of Product 1A produced, and each kg of Product 1A sells for $100/kg. The 40kg batch of Product 1A can either be sold at this point for $4,000 (40kg$100/kg ) or the batch can be further processed into a batch of Product 1B at an additional cost of $50. This will produce a 29kg batch of Product 1B that sells for $120/kg for a total sales value of $3,480 (29kg$120/kg). Required: Part A Assuming that none of the products are byproducts, calculate the how much of the joint cost should be allocated to each product using the four methods discussed in class. Part B Allocate the $4,400 joint cost assuming using the Net Realizable Value method and assuming. that product 3 and product 4 are both byproducts. Kay and Dee Manufacturing (K+D) has three business lines: - Repair and Overhead (R+O): Repair of truck transmissions. - Manufacturing: manufacturing of custom truck transmission parts - Chemical Treating: cleaning of old parts They also have three support departments. Major activities of each department are: - Human Resources (HR): Payroll, HR staff, employee services, Union/Management relations. Costs for this service department are allocated based on Headcount. - Facility: buildings, building maintenance and related building costs. Costs for this service department are allocated based on area occupied. - Main Office (HQ): salaries for the President, VP, and Finance department. Costs for this service department are allocated based on Direct Laboum hours. Other financial information is in Appendix A. REQUIRED: A. Briefly comment on the cost drivers for the support departments. (ie. Do you think they are appropriate, or can you recommend something better? Briefly explain your answer) B. Using the Direct Method, allocate overhead costs from the support departments to the business lines. C. Using the Step-down method, allocate overhead costs from the support departments to the business lines in the following order: 1.Building2HQ3HR D. Using the Reciprocal Method, allocate overhead costs from the support departments to the business lines. Hevisis harwina andin 1t beidive 310 The joint cost to produce products 1A,2A,3A and 4A is $4,400. Each of these four products can either be sold at the end of the joint production process, or can be processed further into 1B,2B,3B and 4B respectively. Praduction and eallino information is ac follows: For example, at the end of the joint production process, there are 40kg of Product 1A produced, and each kg of Product 1A sells for $100/kg. The 40kg batch of Product 1A can either be sold at this point for $4,000 (40kg$100/kg ) or the batch can be further processed into a batch of Product 1B at an additional cost of $50. This will produce a 29kg batch of Product 1B that sells for $120/kg for a total sales value of $3,480 (29kg$120/kg). Required: Part A Assuming that none of the products are byproducts, calculate the how much of the joint cost should be allocated to each product using the four methods discussed in class. Part B Allocate the $4,400 joint cost assuming using the Net Realizable Value method and assuming. that product 3 and product 4 are both byproducts. Kay and Dee Manufacturing (K+D) has three business lines: - Repair and Overhead (R+O): Repair of truck transmissions. - Manufacturing: manufacturing of custom truck transmission parts - Chemical Treating: cleaning of old parts They also have three support departments. Major activities of each department are: - Human Resources (HR): Payroll, HR staff, employee services, Union/Management relations. Costs for this service department are allocated based on Headcount. - Facility: buildings, building maintenance and related building costs. Costs for this service department are allocated based on area occupied. - Main Office (HQ): salaries for the President, VP, and Finance department. Costs for this service department are allocated based on Direct Laboum hours. Other financial information is in Appendix A. REQUIRED: A. Briefly comment on the cost drivers for the support departments. (ie. Do you think they are appropriate, or can you recommend something better? Briefly explain your answer) B. Using the Direct Method, allocate overhead costs from the support departments to the business lines. C. Using the Step-down method, allocate overhead costs from the support departments to the business lines in the following order: 1.Building2HQ3HR D. Using the Reciprocal Method, allocate overhead costs from the support departments to the business lines