Answered step by step

Verified Expert Solution

Question

1 Approved Answer

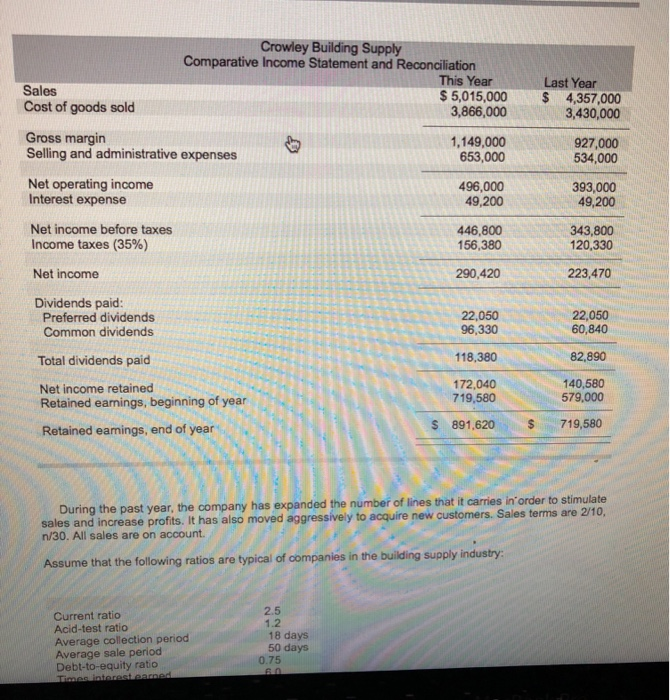

hey can someone answer question C(1-8) Crowley Building Supply Comparative Income Statement and Reconciliation This Year Last Year Sales 5,015,0004,357,000 3,430,000 Cost of goods sold

hey can someone answer question C(1-8)

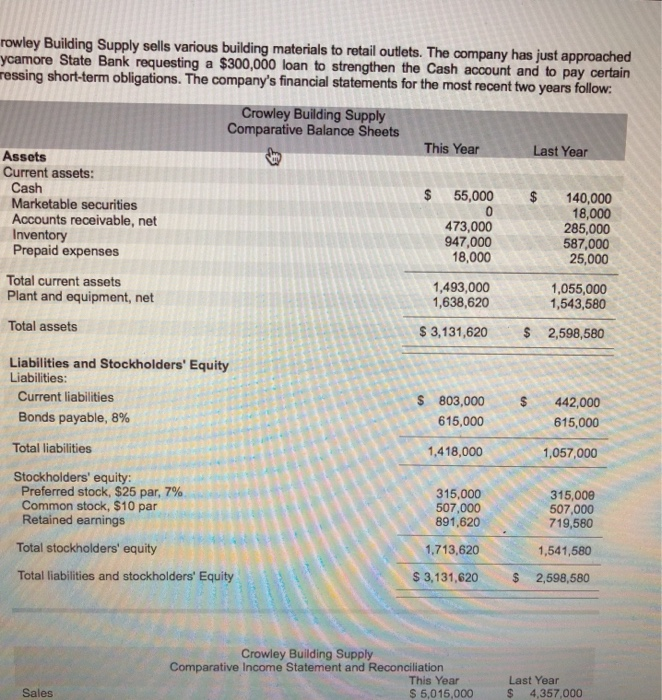

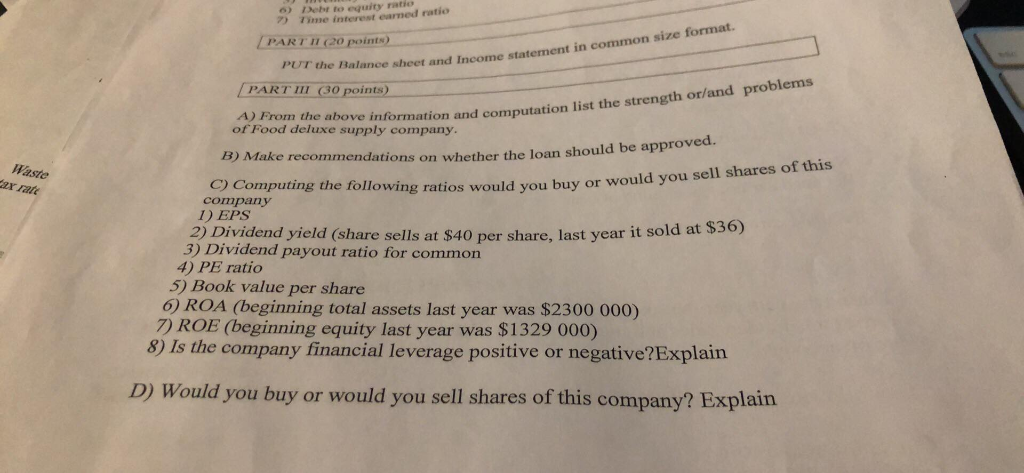

Crowley Building Supply Comparative Income Statement and Reconciliation This Year Last Year Sales 5,015,0004,357,000 3,430,000 Cost of goods sold 3,866,000 Gross margin 1,149,000 653,000 927,000 534,000 Selling and administrative expenses Net operating income 496,000 49,200 393,000 Interest expense 49,200 Net income before taxes 446,800 156,380 343,800 120,330 Income taxes (35%) Net income Dividends paid: 290,420 223,470 22,050 96,330 Preferred dividends 22,050 Common dividends Total dividends paid Net income retained 60,840 82,890 140,580 118,380 172,040 719,580 579,000 Retained earmings, beginning of year Retained eamings, end of year $891,620719,580 During the past year, the company has expanded the number of lines that it carries in'order to stimulate sales and increase profits. It has also moved aggressively to acquire new custome n/30. All sales are on account. s. Sales terms are 2/10, Assume that the following ratios are typical of companies in the building supply industry- 2.5 Current ratio Acid-test ratio Average collection period Average sale period Debt-to-equity ratio 1.2 18 days 50 days 0.75 rowley Building Supply sells various building materials to retail outlets. The company has just approached essing short-term obligations. The company's financial statements for the most recent two years follow State Bank requesting a $300,000 loan to strengthen the Cash account and to pay certain Crowley Building Supply Comparative Balance Sheets This Year Last Year Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses 55,000 140,000 18,000 285,000 473,000 947,000 18,000 587,000 25,000 Total current assets 1,493,000 1,638,620 1,055,000 1,543,580 Plant and equipment, net Total assets $ 3,131,620 2,598,580 Liabilities and Stockholders' Equity Liabilities: s 803,000 442,000 Current liabilities Bonds payable, 8% 615,000 615,000 Total liabilities 1,418,000 1,057,000 Stockholders' equity Preferred stock, $25 par, 7% Common stock, $10 par Retained earnings 315,000 507,000 891,620 315,000 507,000 719,580 Total stockholders' equity 1,713,620 1,541,580 Total liabilities and stockholders' Equity $ 3,131,620 2,598,580 Crowley Building Supply Comparative Income Statement and Reconciliatiorn Last Year $ 4,357,000 This Year Sales 5,015,000 o) Debt to equity ratio Time interest earned ratio PARTI2o points) PUT the PART III 30 points) e Ralance sheet and Income statement in common ts A) From the above nformation and computation list the strength or/and problems of Food deluxe supply company B) Mak e recommendations on whether the loan should be approved Waste ax rate C) Computing the following ra tios would you buy or would you sell shares of this company ID EPS 2) Dividend yield (share sells at $40 per share, last year it sold at $36) 3) Dividend payout ratio for common 4) PE ratio 5) Book value per share 6) ROA (beginning total assets last year was $2300 000) 7) ROE (beginning equity last year was $1329 000) 8) Is the company financial leverage positive or negative?Explairn D) Would you buy or would you sell shares of this company? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started