hey can someone please answer this one, thank you

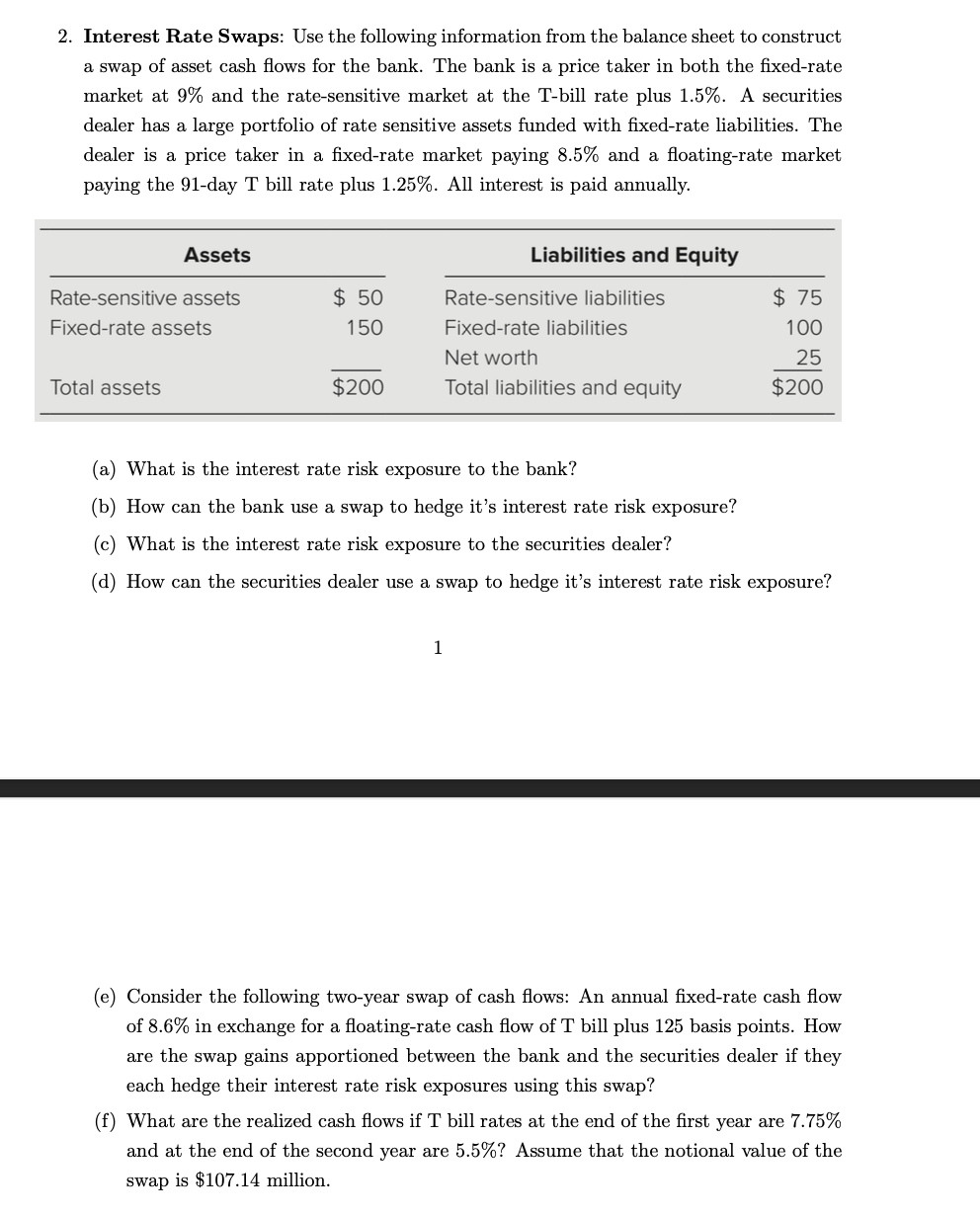

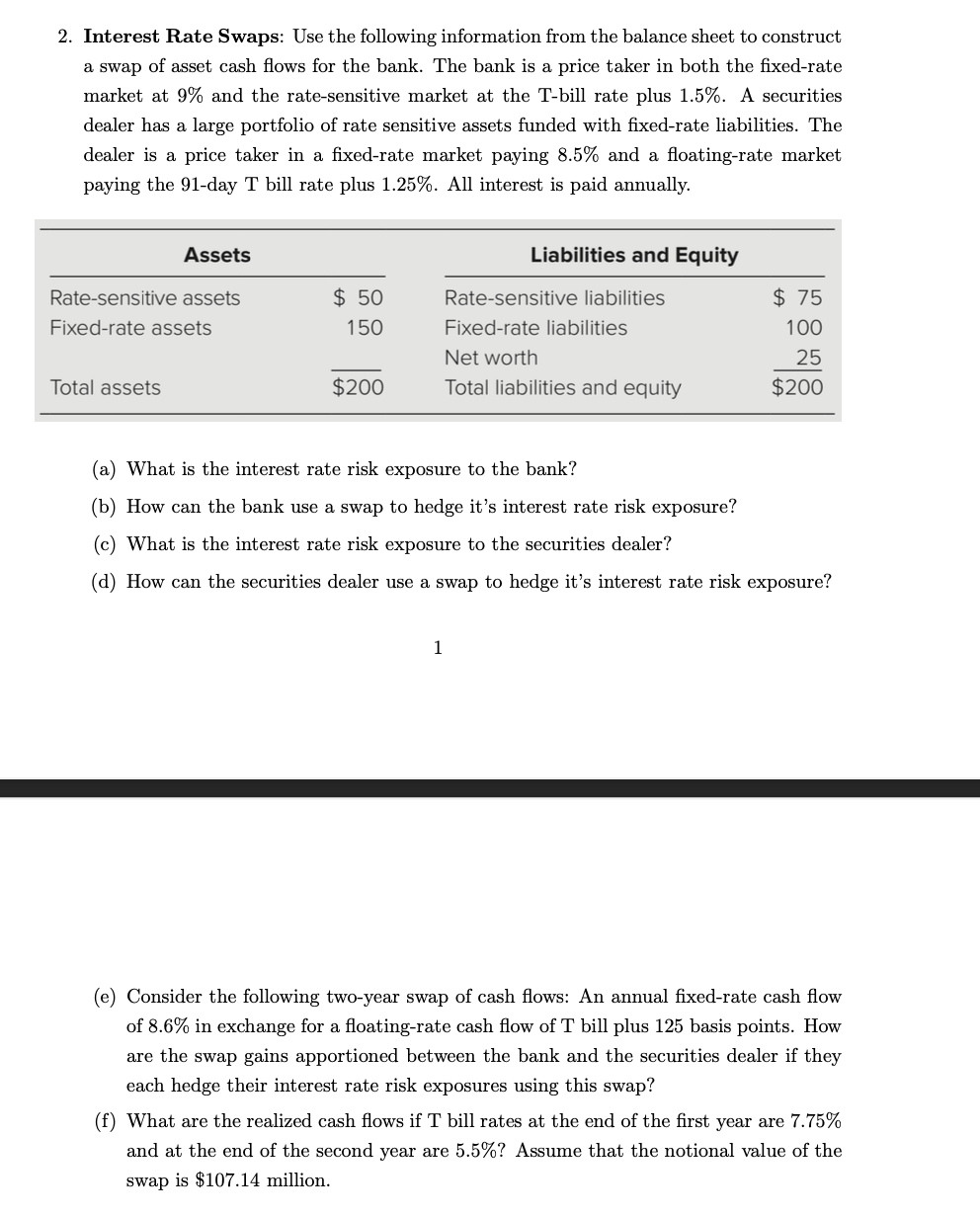

2. Interest Rate Swaps: Use the following information from the balance sheet to construct a swap of asset cash flows for the bank. The bank is a price taker in both the fixed-rate market at 9% and the rate-sensitive market at the T-bill rate plus 1.5%. A securities dealer has a large portfolio of rate sensitive assets funded with fixed-rate liabilities. The dealer is a price taker in a fixed-rate market paying 8.5% and a floating-rate market paying the 91-day T bill rate plus 1.25%. All interest is paid annually. Assets Liabilities and Equity Rate-sensitive assets Fixed-rate assets $ 50 150 $ 75 100 Rate-sensitive liabilities Fixed-rate liabilities Net worth Total liabilities and equity 25 Total assets $200 $200 (a) What is the interest rate risk exposure to the bank? (b) How can the bank use a swap to hedge it's interest rate risk exposure? (c) What is the interest rate risk exposure to the securities dealer? (d) How can the securities dealer use a swap to hedge it's interest rate risk exposure? 1 (e) Consider the following two-year swap of cash flows: An annual fixed-rate cash flow of 8.6% in exchange for a floating-rate cash flow of T bill plus 125 basis points. How are the swap gains apportioned between the bank and the securities dealer if they each hedge their interest rate risk exposures using this swap? (f) What are the realized cash flows if T bill rates at the end of the first year are 7.75% and at the end of the second year are 5.5%? Assume that the notional value of the swap is $107.14 million. 2. Interest Rate Swaps: Use the following information from the balance sheet to construct a swap of asset cash flows for the bank. The bank is a price taker in both the fixed-rate market at 9% and the rate-sensitive market at the T-bill rate plus 1.5%. A securities dealer has a large portfolio of rate sensitive assets funded with fixed-rate liabilities. The dealer is a price taker in a fixed-rate market paying 8.5% and a floating-rate market paying the 91-day T bill rate plus 1.25%. All interest is paid annually. Assets Liabilities and Equity Rate-sensitive assets Fixed-rate assets $ 50 150 $ 75 100 Rate-sensitive liabilities Fixed-rate liabilities Net worth Total liabilities and equity 25 Total assets $200 $200 (a) What is the interest rate risk exposure to the bank? (b) How can the bank use a swap to hedge it's interest rate risk exposure? (c) What is the interest rate risk exposure to the securities dealer? (d) How can the securities dealer use a swap to hedge it's interest rate risk exposure? 1 (e) Consider the following two-year swap of cash flows: An annual fixed-rate cash flow of 8.6% in exchange for a floating-rate cash flow of T bill plus 125 basis points. How are the swap gains apportioned between the bank and the securities dealer if they each hedge their interest rate risk exposures using this swap? (f) What are the realized cash flows if T bill rates at the end of the first year are 7.75% and at the end of the second year are 5.5%? Assume that the notional value of the swap is $107.14 million