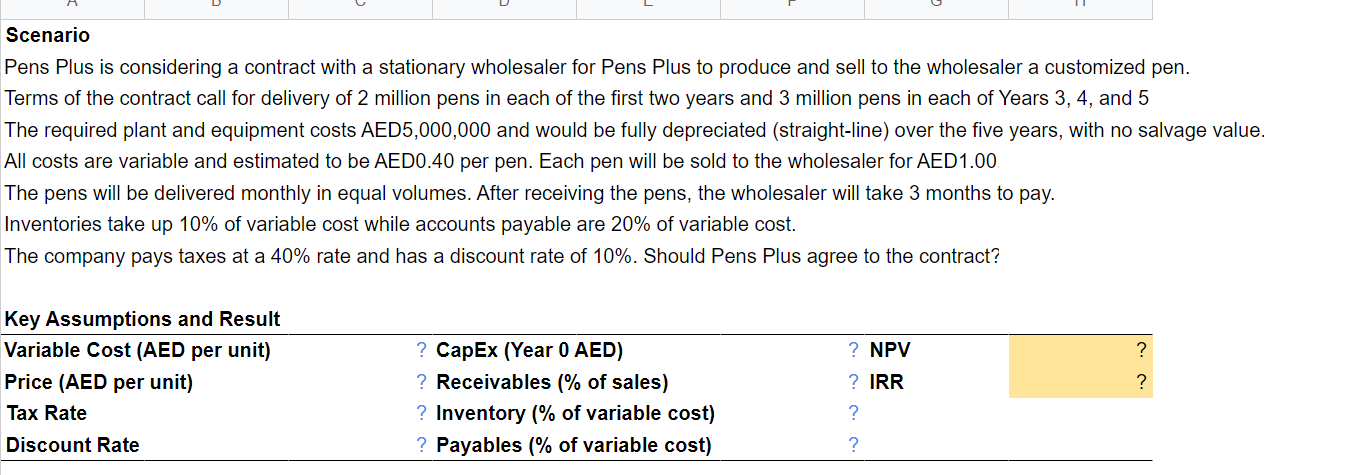

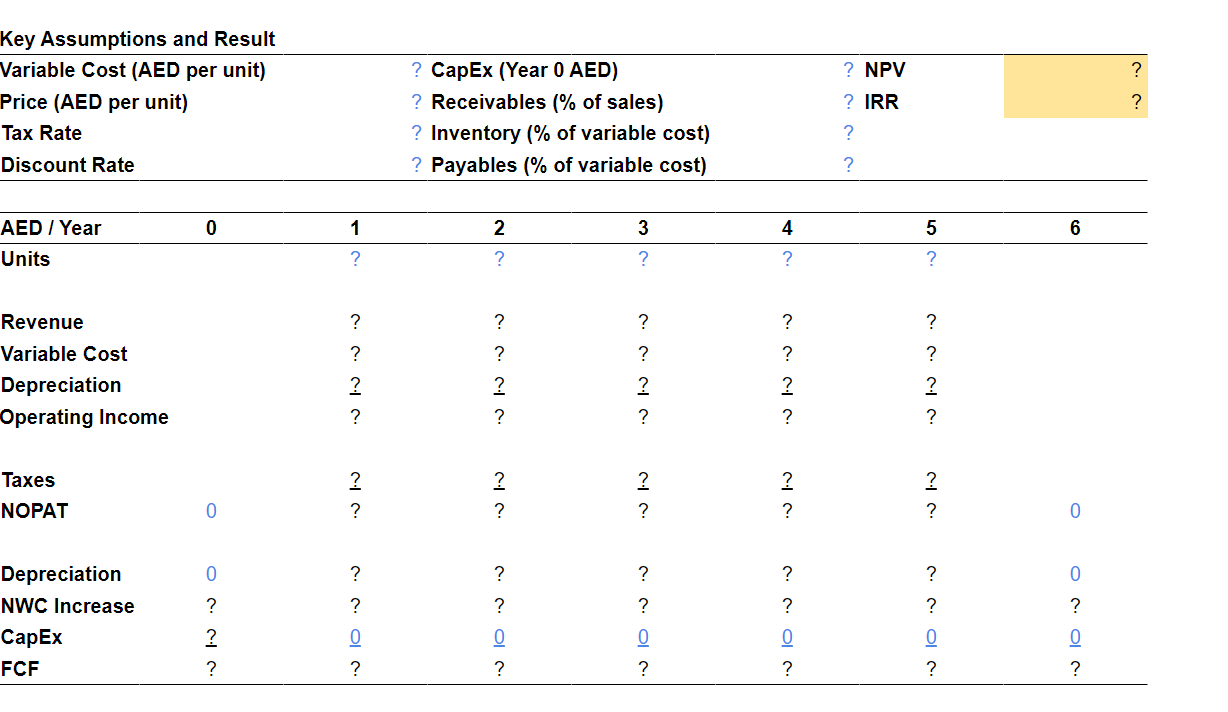

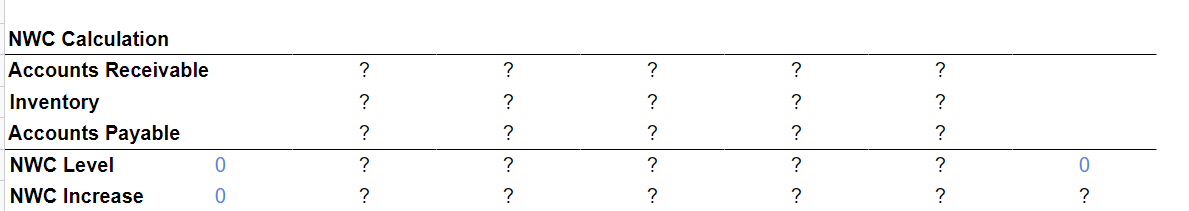

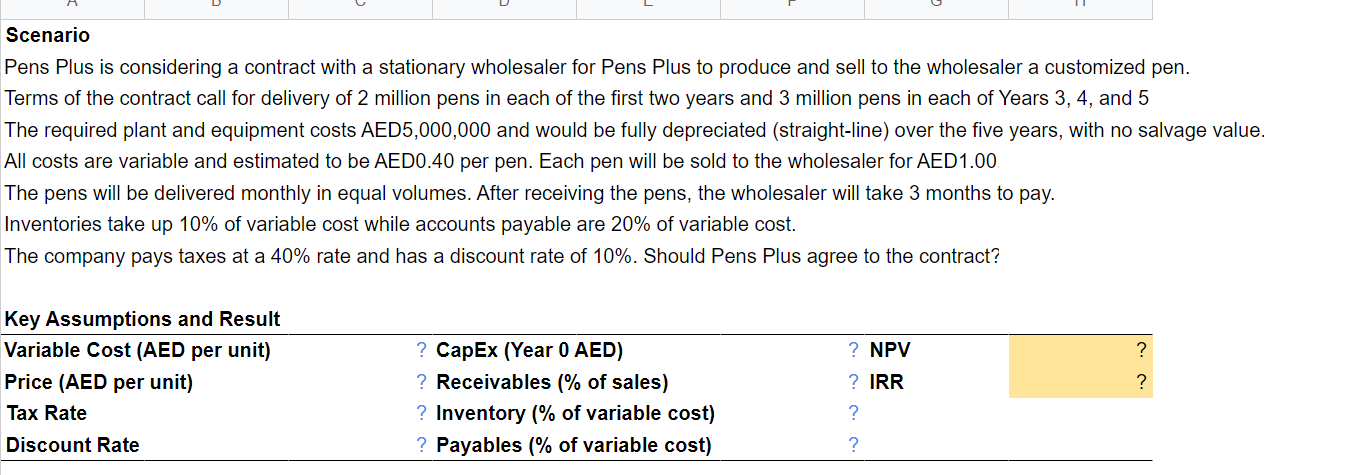

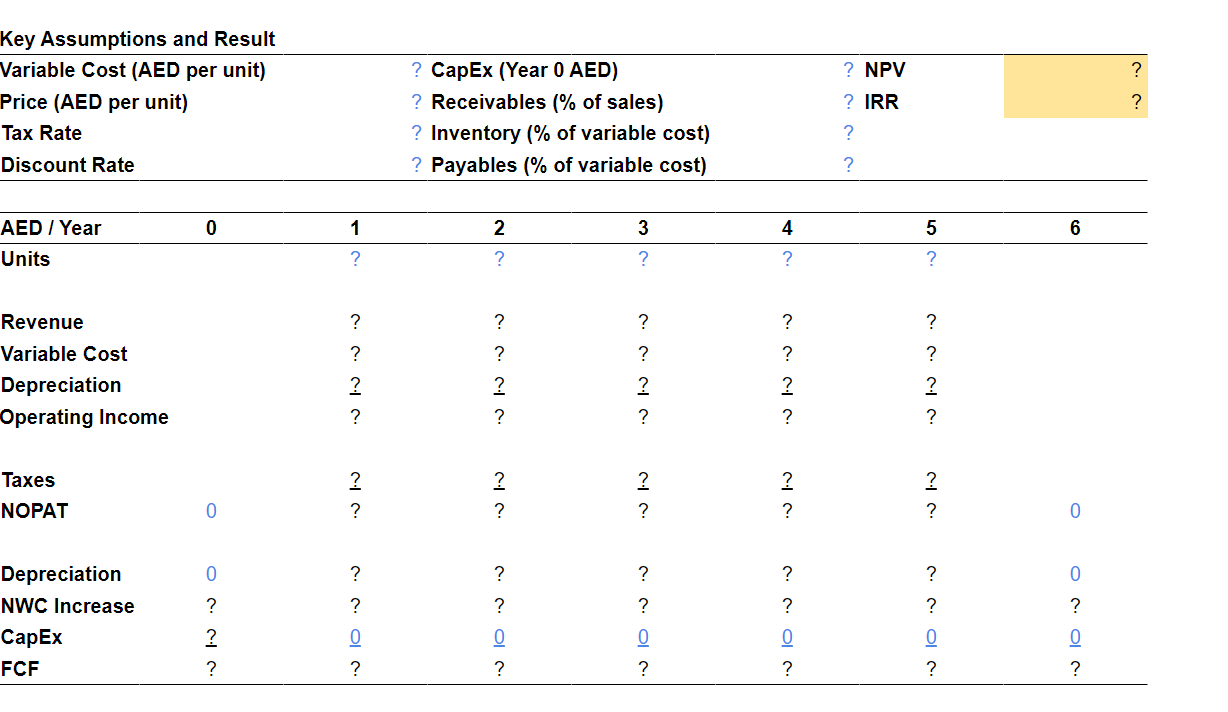

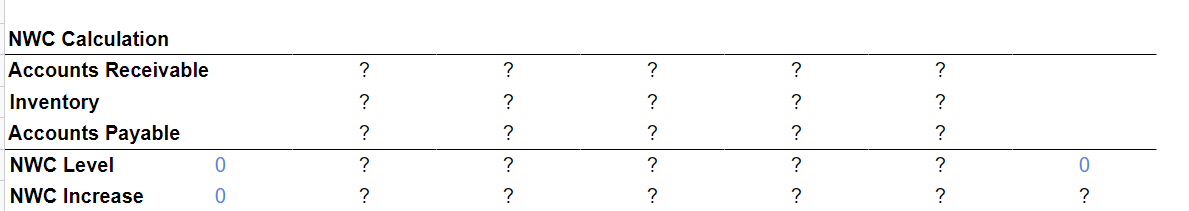

Pens Plus is considering a contract with a stationary wholesaler for Pens Plus to produce and sell to the wholesaler a customized pen. Terms of the contract call for delivery of 2 million pens in each of the first two years and 3 million pens in each of Years 3,4 , and 5 The required plant and equipment costs AED5,000,000 and would be fully depreciated (straight-line) over the five years, with no salvage value. All costs are variable and estimated to be AED0.40 per pen. Each pen will be sold to the wholesaler for AED1.00 The pens will be delivered monthly in equal volumes. After receiving the pens, the wholesaler will take 3 months to pay. Inventories take up 10% of variable cost while accounts payable are 20% of variable cost. The company pays taxes at a 40% rate and has a discount rate of 10%. Should Pens Plus agree to the contract? Key Assumptions and Result NWC Calculation \begin{tabular}{lllllll} \hline Accounts Receivable & ? & ? & ? & ? & \\ Inventory & ? & ? & ? & ? & \\ Accounts Payable & & ? & ? & ? & ? & \\ \hline NWC Level & 0 & ? & ? & ? & ? & \\ NWC Increase & 0 & ? & ? & ? & ? & \\ \end{tabular} Pens Plus is considering a contract with a stationary wholesaler for Pens Plus to produce and sell to the wholesaler a customized pen. Terms of the contract call for delivery of 2 million pens in each of the first two years and 3 million pens in each of Years 3,4 , and 5 The required plant and equipment costs AED5,000,000 and would be fully depreciated (straight-line) over the five years, with no salvage value. All costs are variable and estimated to be AED0.40 per pen. Each pen will be sold to the wholesaler for AED1.00 The pens will be delivered monthly in equal volumes. After receiving the pens, the wholesaler will take 3 months to pay. Inventories take up 10% of variable cost while accounts payable are 20% of variable cost. The company pays taxes at a 40% rate and has a discount rate of 10%. Should Pens Plus agree to the contract? Key Assumptions and Result NWC Calculation \begin{tabular}{lllllll} \hline Accounts Receivable & ? & ? & ? & ? & \\ Inventory & ? & ? & ? & ? & \\ Accounts Payable & & ? & ? & ? & ? & \\ \hline NWC Level & 0 & ? & ? & ? & ? & \\ NWC Increase & 0 & ? & ? & ? & ? & \\ \end{tabular}