Hey Can you help me with the problems below ? Im struggling please help

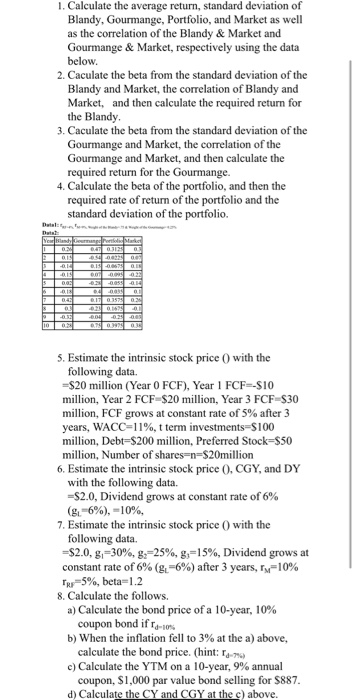

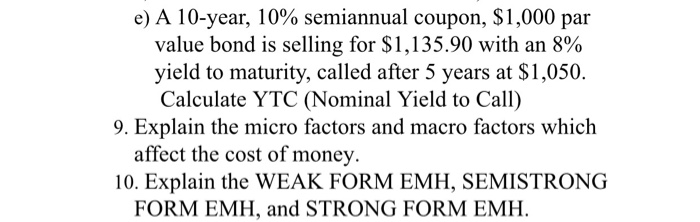

1. Calculate the average return, standard deviation of Blandy, Gourmange, Portfolio, and Market as well as the correlation of the Blandy &Market and Gourmange & Market, respectively using the data 2. Caculate the beta from the standard deviation of the Blandy and Market, the correlation of Blandy and Market, and then calculate the required return for the Blandy 3. Caculate the beta from the standard deviation of the Gourmange and Market, the correlation of the Gourmange and Market, and then calculate the uired return for the Gourmange. 4. Calculate the beta of the portfolio, and then the required rate of return of the portfolio and the standard deviation of the portfolio. 5. Estimate the intrinsic stock price 0 with the -$20 million (Year 0 FCF), Year 1 FCF-$10 million, Year 2 FCF $20 million, Year 3 FCF S30 million, FCF grows at constant rate of 5% after 3 years, WACC-1%, t term investments-S100 million, Debt $200 million, Preferred Stock-$50 million, Number of shares-n-$20million 6. Estimate the intrinsic stock price 0. CGY, and DY -S2.0. Dividend grows at constant rate of 6% 7. Estimate the intrinsic stock price 0 with the following data. $2.0, gp30%, g,-25%, g,-15%, Dividend grows at constant rate of 6% ( -6%) after 3 years, r,-10% a) Calculate the bond price of a 10-year, 10% b) When the inflation fell to 3% at the a) above. c) Calculate the YTM on a 10-year, 9% annual coupon, $1,000 par value bond selling for $887 d) Calculate the CY and CGY at the c) above. 1. Calculate the average return, standard deviation of Blandy, Gourmange, Portfolio, and Market as well as the correlation of the Blandy &Market and Gourmange & Market, respectively using the data 2. Caculate the beta from the standard deviation of the Blandy and Market, the correlation of Blandy and Market, and then calculate the required return for the Blandy 3. Caculate the beta from the standard deviation of the Gourmange and Market, the correlation of the Gourmange and Market, and then calculate the uired return for the Gourmange. 4. Calculate the beta of the portfolio, and then the required rate of return of the portfolio and the standard deviation of the portfolio. 5. Estimate the intrinsic stock price 0 with the -$20 million (Year 0 FCF), Year 1 FCF-$10 million, Year 2 FCF $20 million, Year 3 FCF S30 million, FCF grows at constant rate of 5% after 3 years, WACC-1%, t term investments-S100 million, Debt $200 million, Preferred Stock-$50 million, Number of shares-n-$20million 6. Estimate the intrinsic stock price 0. CGY, and DY -S2.0. Dividend grows at constant rate of 6% 7. Estimate the intrinsic stock price 0 with the following data. $2.0, gp30%, g,-25%, g,-15%, Dividend grows at constant rate of 6% ( -6%) after 3 years, r,-10% a) Calculate the bond price of a 10-year, 10% b) When the inflation fell to 3% at the a) above. c) Calculate the YTM on a 10-year, 9% annual coupon, $1,000 par value bond selling for $887 d) Calculate the CY and CGY at the c) above