Question

Hey Chegg Users, Here is the question: BA220 has invested in new equipment worth $15 million, and new working capital at the beginning of each

Hey Chegg Users,

Here is the question:

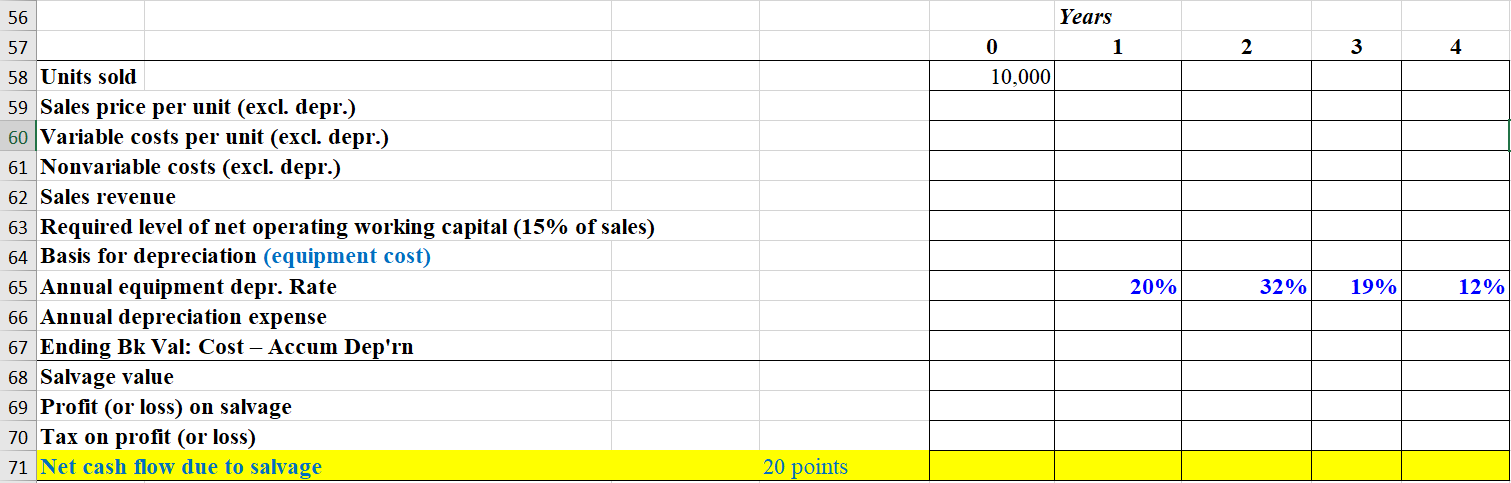

BA220 has invested in new equipment worth $15 million, and new working capital at the beginning of each year will be 15% of the year's projected sales. Salvage value is 500,000.

The firm projects it can sell 10,000 units in year 1 and will increase by 10% for three years. Each unit will sell at $1,000 and variable cost is 50% of selling price. The nonvariable cost is $10,000 and will be maintained in the four years. Inflation rate is expected to be 3% per year. The selling price, variable cost will increase by 3%.

The company will have a life of four years. The equipment would be depreciated over a five year period, using MACRS. Depreciation years Year 1 Year 2 Year 3 Year 4 Depreciation rates 20% 32% 19% 12% The tax rate is 25% and WACC is 8% A.Determine the net cashflow from years 0-4 B. NPV C. IRR D. MIRR E. Payback F. Discounted payback G.Will you accept or reject the project?

Thank you in advance!

Years 1 0 2 3 4 10,000 56 57 58 Units sold 59 Sales price per unit (excl. depr.) 60 Variable costs per unit (excl. depr.) 61 Nonvariable costs (excl. depr.) 62 Sales revenue 63 Required level of net operating working capital (15% of sales) 64 Basis for depreciation (equipment cost) 65 Annual equipment depr. Rate 66 Annual depreciation expense 67 Ending Bk Val: Cost Accum Dep'rn 68 Salvage value 69 Profit (or loss) on salvage 70 Tax on profit (or loss) 71 Net cash flow due to salvage 20% 32% 19% 12% 20 pointsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started