hey guys,

can you help to find for red line incorrect for right answer

thank you

hey guys, can someone help me to find red part for right answer?

sorry for picture are bot together because it wont fit it in one.

please. can someone help me. thank you

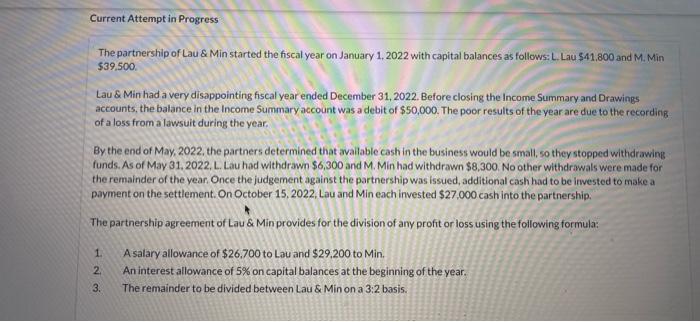

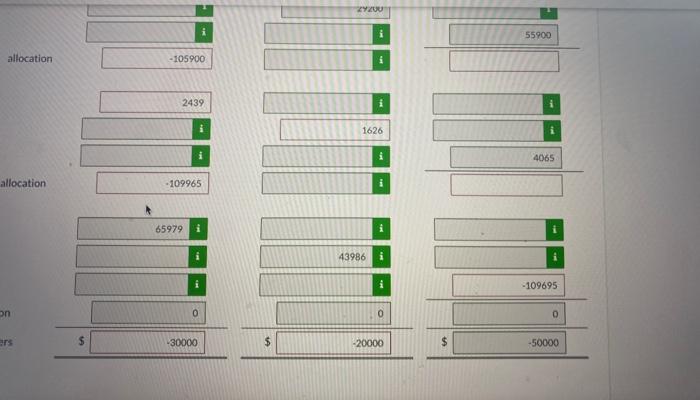

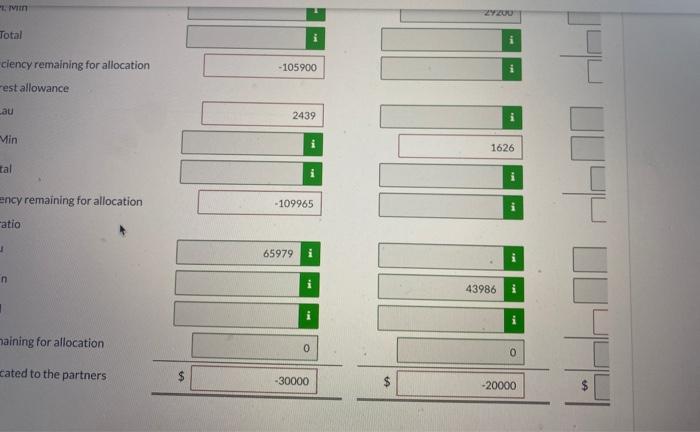

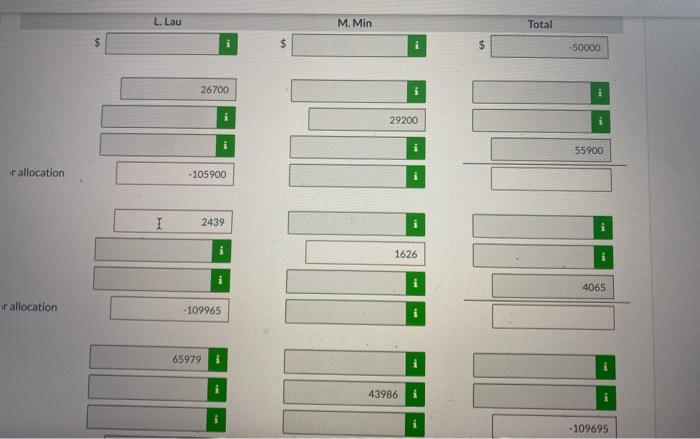

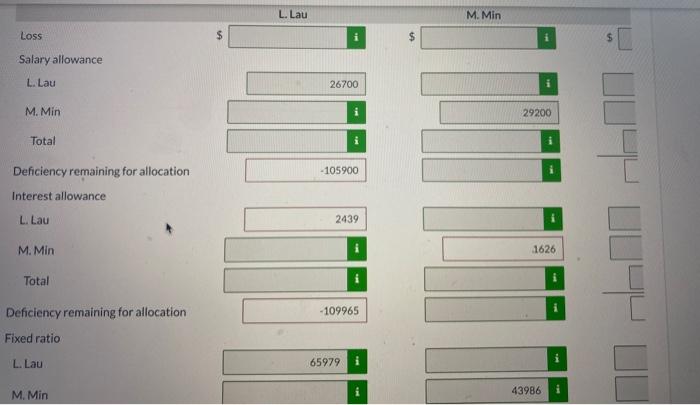

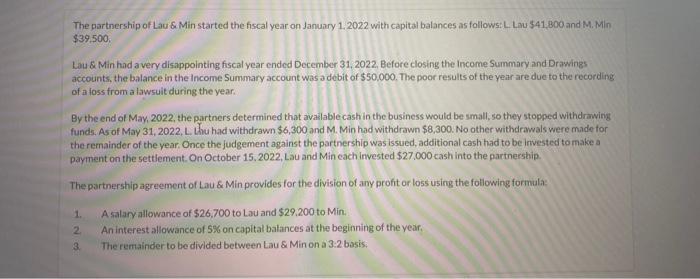

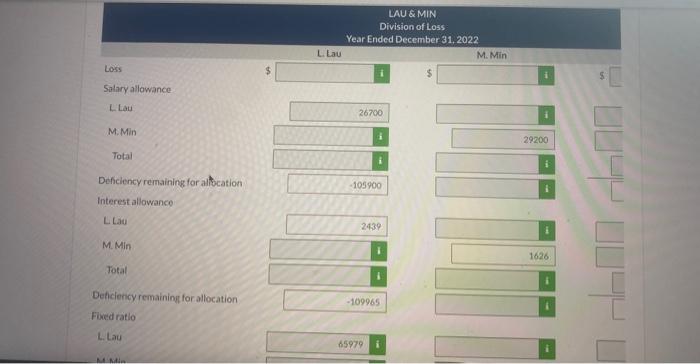

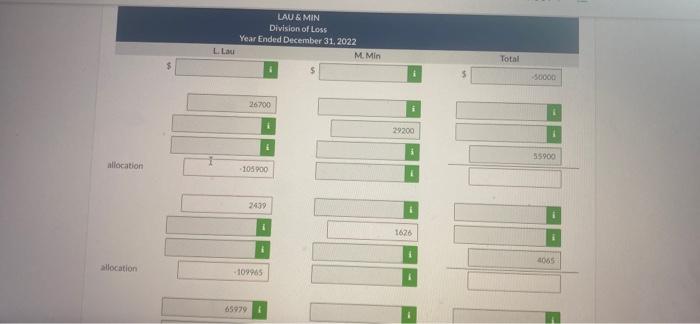

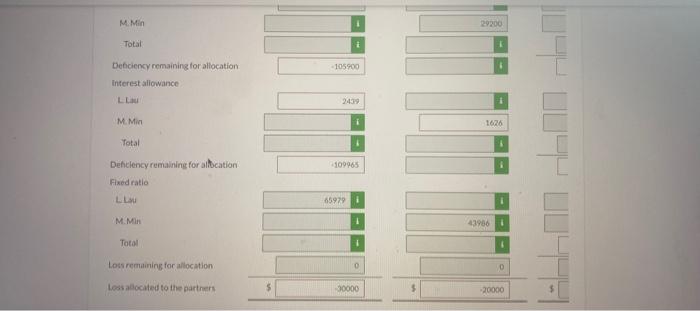

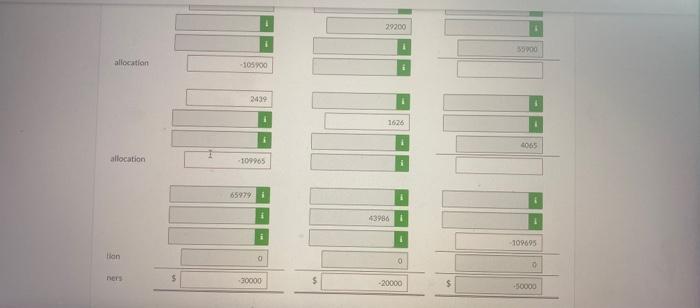

Current Attempt in Progress The partnership of Lau & Min started the fiscal year on January 1, 2022 with capital balances as follows: L. Lau 541,800 and M. Min $39.500 Lau & Min had a very disappointing fiscal year ended December 31, 2022. Before closing the Income Summary and Drawings accounts, the balance in the Income Summary account was a debit of $50,000. The poor results of the year are due to the recording of a loss from a lawsuit during the year, By the end of May, 2022, the partners determined that waitable cash in the business would be small, so they stopped withdrawing funds. As of May 31, 2022. L. Lau had withdrawn $6,300 and M. Min had withdrawn $8,300. No other withdrawals were made for the remainder of the year. Once the judgement against the partnership was issued, additional cash had to be invested to make a payment on the settlement. On October 15, 2022. Lau and Min each invested $27,000 cash into the partnership The partnership agreement of Lau & Min provides for the division of any profit or loss using the following formula: A salary allowance of $26,700 to Lau and $29.200 to Min. An interest allowance of 5% on capital balances at the beginning of the year. 3. The remainder to be divided between Lau & Min on a 3:2 basis. 1. 2 2920 i 55900 allocation - 105900 i 2439 i 1626 i i 4065 allocation - 109965 i 65979 43986 i i i -109695 on 0 0 0 ers $ -30000 $ -20000 -50000 1. TV Total -105900 ciency remaining for allocation est allowance cau 2439 Min i 1626 tal i -109965 Ency remaining for allocation atio 1 65979 i n i 43986 1 i maining for allocation 0 0 cated to the partners $ - 30000 -20000 $ L. Lau M. Min Total $ $ -50000 26700 i 29200 55900 rallocation -105900 I 2439 1626 4065 rallocation -109965 65979 i i 43986 i i -109695 L. Lau M. Min Loss $ $ Salary allowance L. Lau 26700 M. Min 29200 Total -105900 Deficiency remaining for allocation Interest allowance L. Lau 2439 M. Min 1626 Total -109965 Deficiency remaining for allocation Fixed ratio L. Lau 65979 i M. Min i 43986 i The partnership of Law & Min started the fiscal year on January 1, 2022 with capital balances as follows:L Lmu $41.800 and M. Min $39,500 Lau & Min had a very disappointing fiscal year ended December 31, 2022, Before closing the Income Summary and Drawings accounts, the balance in the Income Summary account was a debit of $50,000. The poor results of the year are due to the recording of a loss from a lawsuit during the year. By the end of May, 2022, the partners determined that available cash in the business would be small, so they stopped withdrawing funds. As of May 31, 2022, L. thu had withdrawn $6,300 and M. Min had withdrawn $8,300. No other withdrawals were made for the remainder of the year. Once the judgement against the partnership was issued, additional cash had to be invested to make a payment on the settlement. On October 15, 2022, Lau and Min each invested $27.000 cash into the partnership The partnership agreement of Lau & Min provides for the division of any profit or loss using the following formula A salary allowance of $26,700 to Lau and $29,200 to Min. 2 An interest allowance of 5% on capital balances at the beginning of the year, 3 The remainder to be divided between Lau & Min on a 3.2 basis: 1. LAU & MIN Division of Loss Year Ended December 31, 2022 M. Min L Lau Loss $ Salary allowance L Lau 26700 M. Min 29200 Total i Deficiency remaining for allocation Interest allowance -105900 L La 2439 M. Min 1626 Total Deficiency remaining for allocation Fixed ratio -109965 L Lau 65979 M LAU & MIN Division of Loss Year Ended December 31, 2022 L Lau M. Min Total 50000 26700 29200 55900 allocation 105900 2439 1626 allocation 109945 659791 1 M. Min 29200 Total -105900 Decency remaining for allocation Interest allowance LLU M. Min 1626 Total Dehciency remaining for allocation 109965 Fixed ratio Lou 65979 M. Min 43956 Total O O Lots remaining for allocation Loss allocated to the partners 30000 20000 COOO -20000 $ 0000 hers 0 0 D Han 109695 1 1 43986 659791 109965 allocation 4065 1 991 1 10500 allocation CS 1 09062