Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hey i have done all the qiestions. can someone tell me if they're all correct? A firm has $50 million of common stock, $10 million

Hey i have done all the qiestions. can someone tell me if they're all correct?

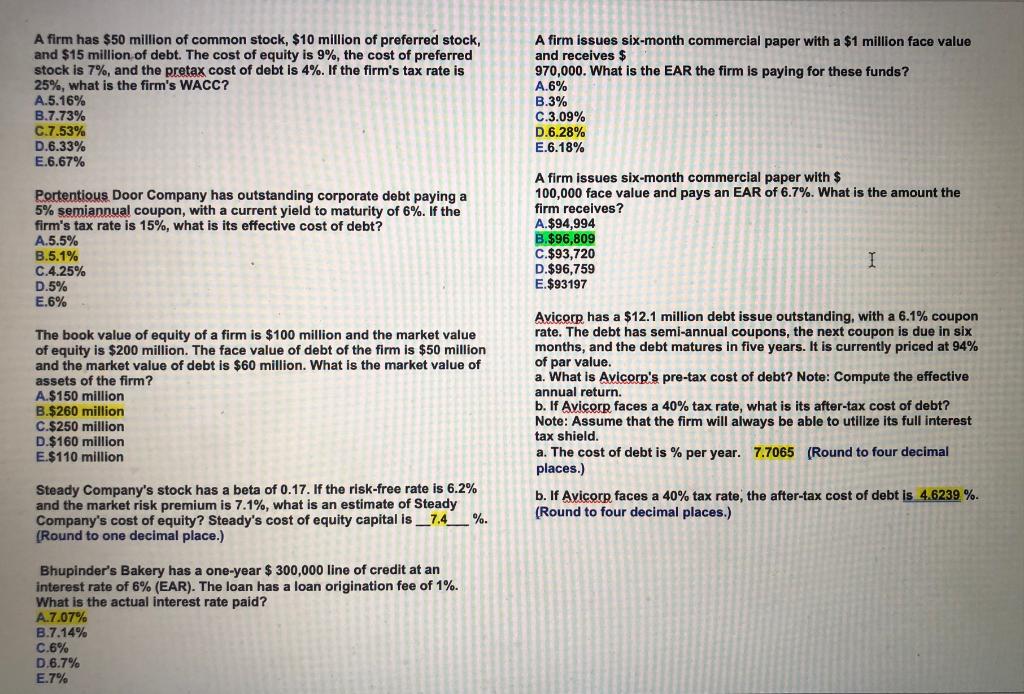

A firm has $50 million of common stock, $10 million of preferred stock, and $15 million of debt. The cost of equity is 9%, the cost of preferred stock is 7%, and the pretax cost of debt is 4%. If the firm's tax rate is 25%, what is the firm's WACC? A.5.16% B.7.73% C.7.53% D.6.33% E.6.67% A firm issues six-month commercial paper with a $1 million face value and receives $ 970,000. What is the EAR the firm is paying for these funds? A.6% B.3% C.3.09% D.6.28% E.6.18% Portentious Door Company has outstanding corporate debt paying a 5% semiannual coupon, with a current yield to maturity of 6%. If the firm's tax rate is 15%, what is its effective cost of debt? A.5.5% B.5.1% C.4.25% D.5% E.6% A firm issues six-month commercial paper with $ 100,000 face value and pays an EAR of 6.7%. What is the amount the firm receives? A.$94,994 B.$96,809 C.$93,720 I D.$96,759 E $93197 The book value of equity of a firm is $100 million and the market value of equity is $200 million. The face value of debt of the firm is $50 million and the market value of debt is $60 million. What is the market value of assets of the firm? A.$150 million B.$260 million C.$250 million D.$160 million E.$110 million Avicorp has a $12.1 million debt issue outstanding, with a 6.1% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 94% of par value. a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return. b. If Avicorp faces a 40% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. The cost of debt is % per year. 7.7065 (Round to four decimal places.) b. If Avicorp faces a 40% tax rate, the after-tax cost of debt is 4.6239 %. (Round to four decimal places.) Steady Company's stock has a beta of 0.17. If the risk-free rate is 6.2% and the market risk premium is 7.1%, what is an estimate of Steady Company's cost of equity? Steady's cost of equity capital is __7.4_ %. (Round to one decimal place.) Bhupinder's Bakery has a one-year $ 300,000 line of credit at an interest rate of 6% (EAR). The loan has a loan origination fee of 1%. What is the actual interest rate paid? A.7.07% B.7.14% C.6% D.6.7% E.7%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started