Question: HEY I NEED ANSWER IN 20 MINS KINDLY HELP ME TO SOLVE THANKS I GIVE YOU THUMBS UP KINDLY ANSWER ALL A financial institution has

HEY I NEED ANSWER IN 20 MINS KINDLY HELP ME TO SOLVE THANKS I GIVE YOU THUMBS UP KINDLY ANSWER ALL

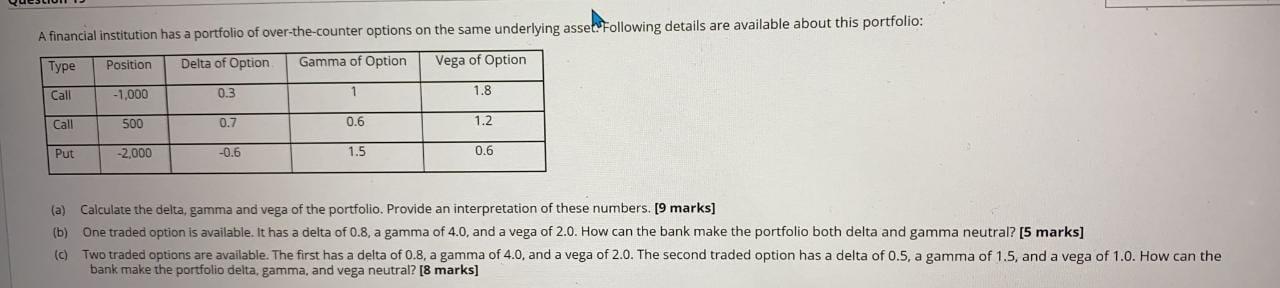

A financial institution has a portfolio of over-the-counter options on the same underlying asset. Following details are available about this portfolio: Type Position Delta of Option Gamma of Option Vega of Option -1,000 Call 0.3 1 1.8 Call 500 0.7 0.6 1.2 Put -2,000 -0.6 1.5 0.6 (a) Calculate the delta, gamma and vega of the portfolio. Provide an interpretation of these numbers. [9 marks] (b) One traded option is available. It has a delta of 0.8, a gamma of 4.0, and a vega of 2.0. How can the bank make the portfolio both delta and gamma neutral? (5 marks] (c) Two traded options are available. The first has a delta of 0.8, a gamma of 4.0, and a vega of 2.0. The second traded option has a delta of 0.5, a gamma of 1.5, and a vega of 1.0. How can the bank make the portfolio delta, gamma, and vega neutral? [8 marks] A financial institution has a portfolio of over-the-counter options on the same underlying asset. Following details are available about this portfolio: Type Position Delta of Option Gamma of Option Vega of Option -1,000 Call 0.3 1 1.8 Call 500 0.7 0.6 1.2 Put -2,000 -0.6 1.5 0.6 (a) Calculate the delta, gamma and vega of the portfolio. Provide an interpretation of these numbers. [9 marks] (b) One traded option is available. It has a delta of 0.8, a gamma of 4.0, and a vega of 2.0. How can the bank make the portfolio both delta and gamma neutral? (5 marks] (c) Two traded options are available. The first has a delta of 0.8, a gamma of 4.0, and a vega of 2.0. The second traded option has a delta of 0.5, a gamma of 1.5, and a vega of 1.0. How can the bank make the portfolio delta, gamma, and vega neutral? [8 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts