Hey! I really need with the questions below. I'm pretty sure I graphed it right. Would you mind double checking as well. Also, if you just explain how you figured the answers out that would be great. Thank you so much!

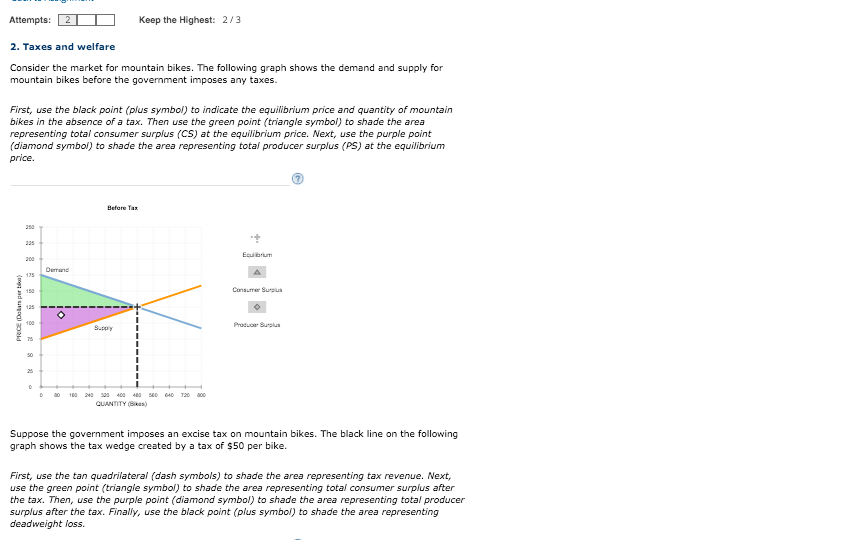

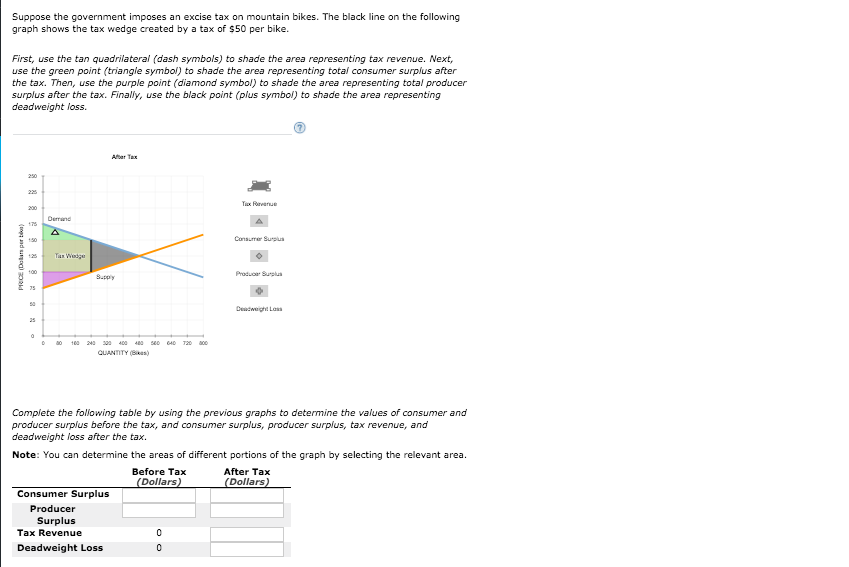

Attempts: 2 Keep the Highest: 2/3 2. Taxes and welfare Consider the market for mountain bikes. The following graph shows the demand and supply for mountain bikes before the government imposes any taxes. First, use the black point (plus symbol) to indicate the equilibrium price and quantity of mountain bikes in the absence of a tax. Then use the green point (triangle symbol) to shade the area representing total consumer surplus (CS) at the equilibrium price. Next, use the purple point (diamond symbol) to shade the area representing total producer surplus (PS) at the equilibrium price. 7 Before Tax Equilibrium 175 A Consumer Buplus 135 Producer Buplus 50 QUANTITY (Bikes) Suppose the government imposes an excise tax on mountain bikes. The black line on the following graph shows the tax wedge created by a tax of $50 per bike. First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer surplus after the tax. Finally, use the black point (plus symbol) to shade the area representing deadweight loss.Suppose the government imposes an excise tax on mountain bikes. The black line on the following graph shows the tax wedge created by a tax of $50 per bike. First, use the tan quadrilateral (dash symbols) to shade the area representing tax revenue. Next, use the green point (triangle symbol) to shade the area representing total consumer surplus after the tax. Then, use the purple point (diamond symbol) to shade the area representing total producer surplus after the tax. Finally, use the black point (plus symbol) to shade the area representing deadweight loss. Atbar Tex Place (Dolar per big A Consumer Surplus 100 Supply 75 Candwight Lama QUANTITY (BIS) Complete the following table by using the previous graphs to determine the values of consumer and producer surplus before the tax, and consumer surplus, producer surplus, tax revenue, and deadweight loss after the tax. Note: You can determine the areas of different portions of the graph by selecting the relevant area. Before Tax After Tax (Dollars) (Dollars) Consumer Surplus Producer Surplus Tax Revenue Deadweight Loss