Question

Hey, I'm not sure how I can take GST into consideration in MYOB for the transaction below; 3 Purchased 8 units Swish Phones from Pony

Hey,

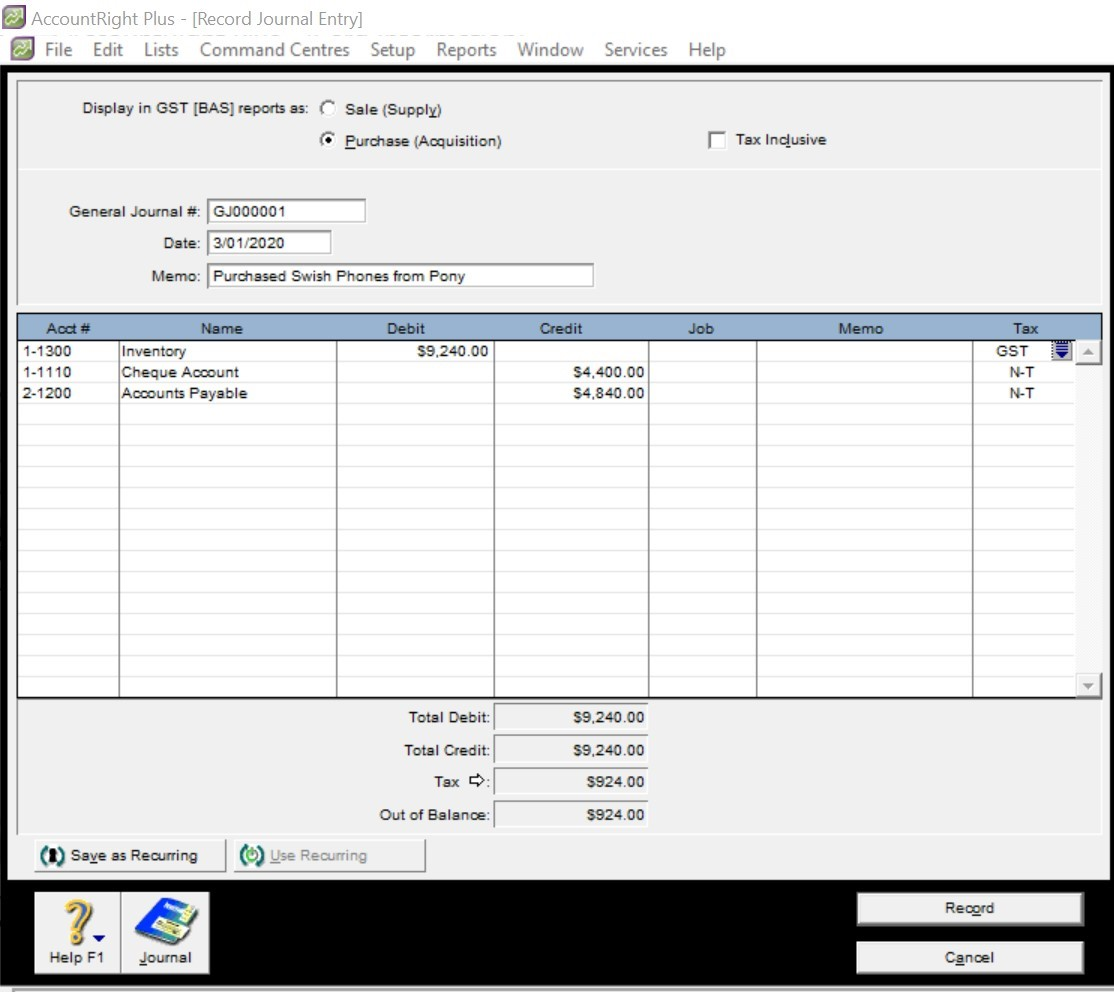

I'm not sure how I can take GST into consideration in MYOB for the transaction below;

| 3 | Purchased 8 units Swish Phones from Pony at $1,155 each (includes 10% GST), Purchase #350, Supplier Inv#492. Issued Cheque No. 4075 for $4,400 to this supplier for this particular invoice at the time of the purchase. |

In my solution, I decided to apply GST to the inventory number because it is GST receivable off the total cost of the phones. I did this by just selecting the tax code but I'm not sure if MYOB automatically applies the GST on the inventory to my GST receivable account. Please advise if I should just include the GST receivable account in my General Journal then debit it by $924 instead of what I have done below.

When I'm not using MYOB this is how I would journal this entry.

| Date | Acc# | Account Details | DR | CR |

|---|---|---|---|---|

| 3 | Inventory | xxxxx | ||

| GST Receivable | xxxx | |||

| Cheque Account | xxxxx | |||

| Accounts Payable | xxxxx |

PLEASE AND THANK YOU!!!!!

AccountRight Plus - [Record Journal Entry] File Edit Lists Command Centres Setup Reports Window Services Help Display in GST (BAS) reports as: Sale (Supply) Purchase (Acquisition) Tax Inclusive General Journal # GJ000001 Date: 3/01/2020 Memo: Purchased Swish Phones from Pony Credit Job Memo Debit $9,240.00 Acct # 1-1300 1-1110 2-1200 Name Inventory Cheque Account Accounts Payable Tax GST N-T N-T $4,400.00 $4,840.00 Total Debit: Total Credit: Tax Out of Balance ) Use Recurring $9,240.00 59,240.00 5924.00 5924.00 (1) Save as Recurring Record Help F1 Journal Cancel AccountRight Plus - [Record Journal Entry] File Edit Lists Command Centres Setup Reports Window Services Help Display in GST (BAS) reports as: Sale (Supply) Purchase (Acquisition) Tax Inclusive General Journal # GJ000001 Date: 3/01/2020 Memo: Purchased Swish Phones from Pony Credit Job Memo Debit $9,240.00 Acct # 1-1300 1-1110 2-1200 Name Inventory Cheque Account Accounts Payable Tax GST N-T N-T $4,400.00 $4,840.00 Total Debit: Total Credit: Tax Out of Balance ) Use Recurring $9,240.00 59,240.00 5924.00 5924.00 (1) Save as Recurring Record Help F1 Journal CancelStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started